Signal vs. Noise: Unpacking the “Portal Wars”

/The first quarter of 2023 saw a seasonal increase in traffic for all U.S. real estate portals and, despite the hype, the competitive landscape remains unchanged.

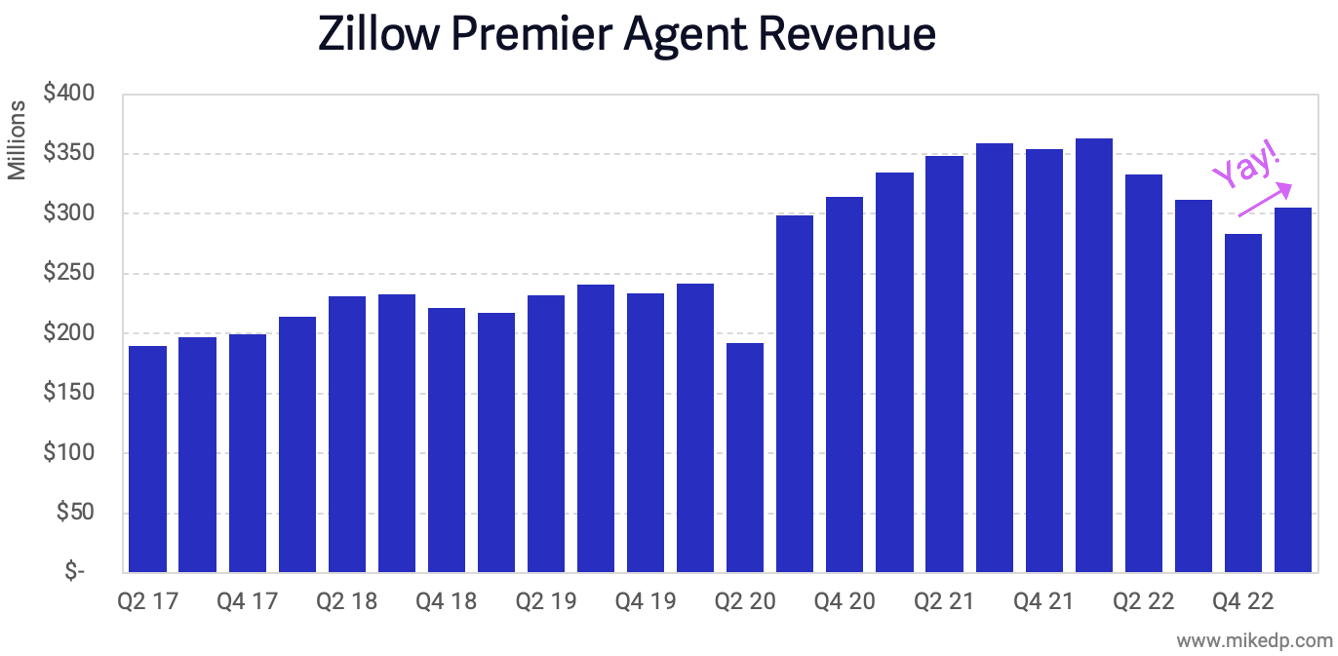

Why it matters: For real estate portals like Zillow, traffic – consumer eyeballs – remains the lifeblood of their strategic and unrivaled power across the industry.

Zillow added twice the amount of monthly unique users than any other portal during the quarter.

Absolute users are more important than percentage gains; users turn into leads, and leads turn into money.

The number of users also increases the total audience size, which is THE most important metric for an advertising platform.

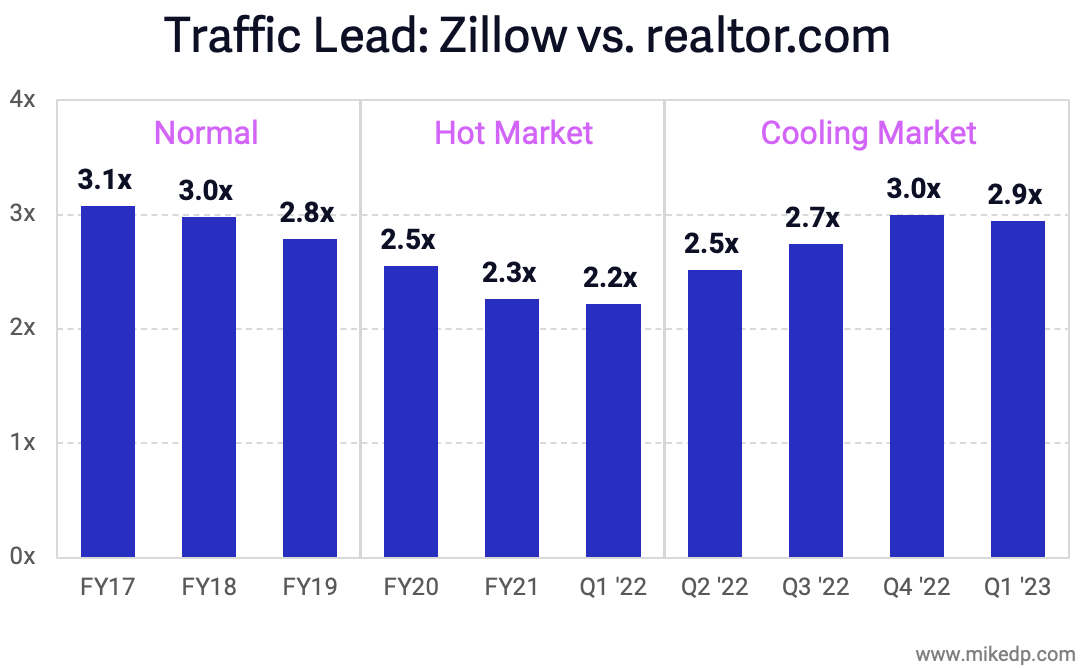

Zillow has increased its commanding lead over realtor.com during the previous year.

This is a reflection of the overall real estate market and a change in consumer behavior, rather than anything within Zillow or realtor.com’s direct control.

During a hot housing market with limited inventory, consumers spent more time on multiple portals, but in a cooling market with significantly less people moving, consumers are simplifying their casual searches on just one portal.

The new entrant is CoStar’s Homes.com, which was acquired in May 2021. With deep pockets, CoStar is known for its heavy advertising campaigns.

Homes.com’s Q1 growth of 7 million monthly uniques did not come cheap; CoStar spent $112 million across all of its consumer properties during the quarter, including an increase of $55 million “primarily for SEM advertising of our residential brands.”

SEM (search engine marketing) is buying traffic.

What’s playing out in the U.S. portal space is not unique, but the latest example of network effects and the dominant position of leading portals.

In Australia, the top real estate portal (REA Group) maintains a similar lead over its closest rival, Domain Group.

For more on real estate portals and the power of network effects, check out Millions More Buyers: A Real Estate Portal’s Competitive Advantage.

The bottom line: Once the signal is separated from the noise, Zillow’s commanding position becomes clear, despite heavy investment from competitors.

The hype may suggest that the portal wars are heating up, but the evidence suggests no meaningful change – in fact, Zillow’s position has become even more dominant.

Furthermore, it’s not even a war; Zillow already won.