Predators and Prey

/The real estate industry is in the midst of a massive financial reckoning: public company valuations down by billions, widespread layoffs, and a rush for venture-funded disruptors to conserve cash and demonstrate sustainable business models.

Why it matters: Amidst this turmoil, the industry is bifurcating into predators and prey -- companies that have the resources to expand through acquisition, and those burning cash that are vulnerable to takeover.

Companies with dwindling cash balances and high cash burn will be forced to raise funds or face insolvency (for example, Reali closing operations).

The predators have the financial resources -- namely, vast amounts of cash -- to take advantage of the current market situation and acquire vulnerable businesses.

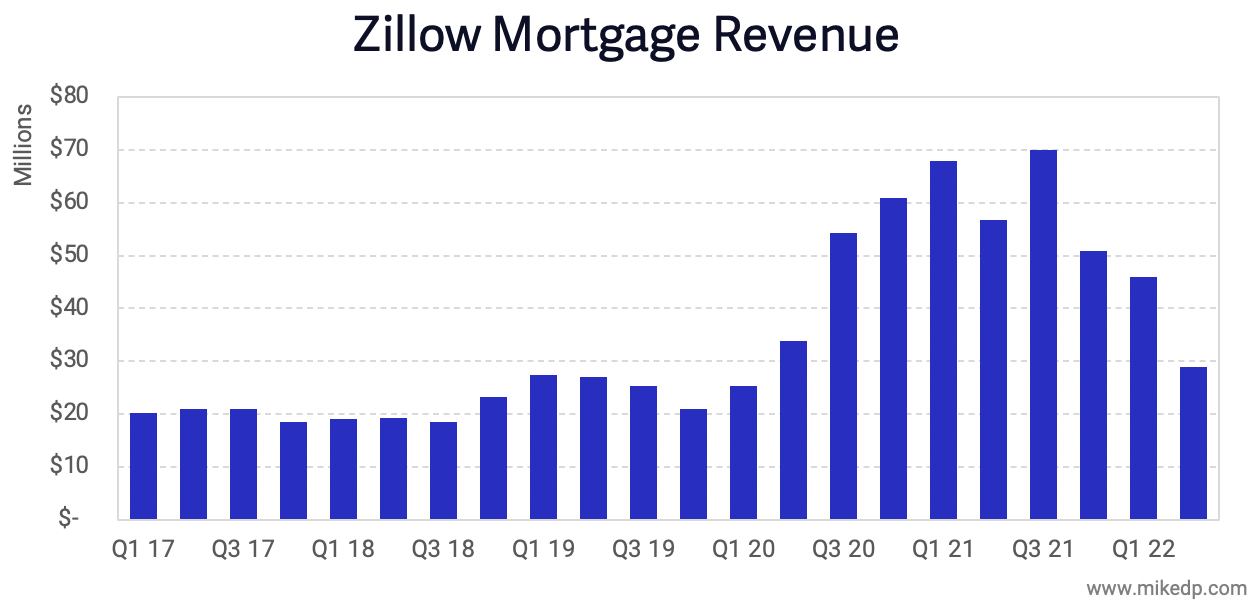

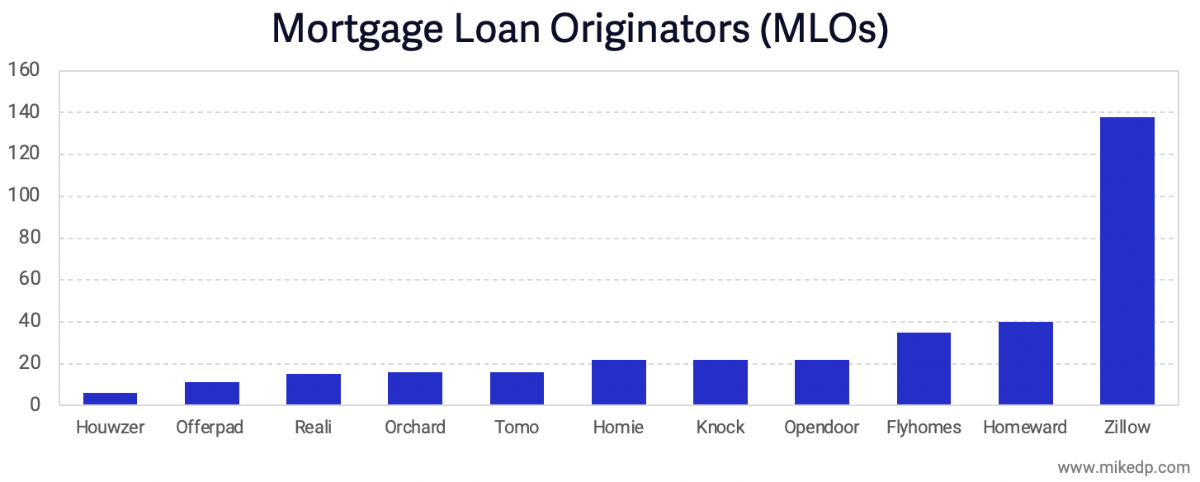

Companies like Zillow, CoStar, and Rocket are certainly predators: flush with cash and opportunistically acquisitive in their outlook.

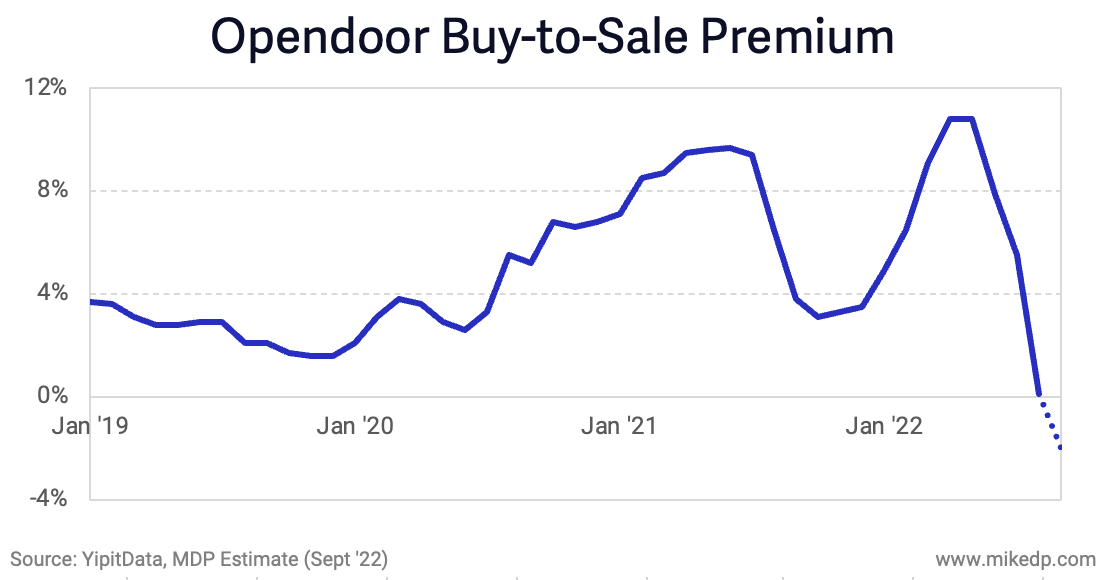

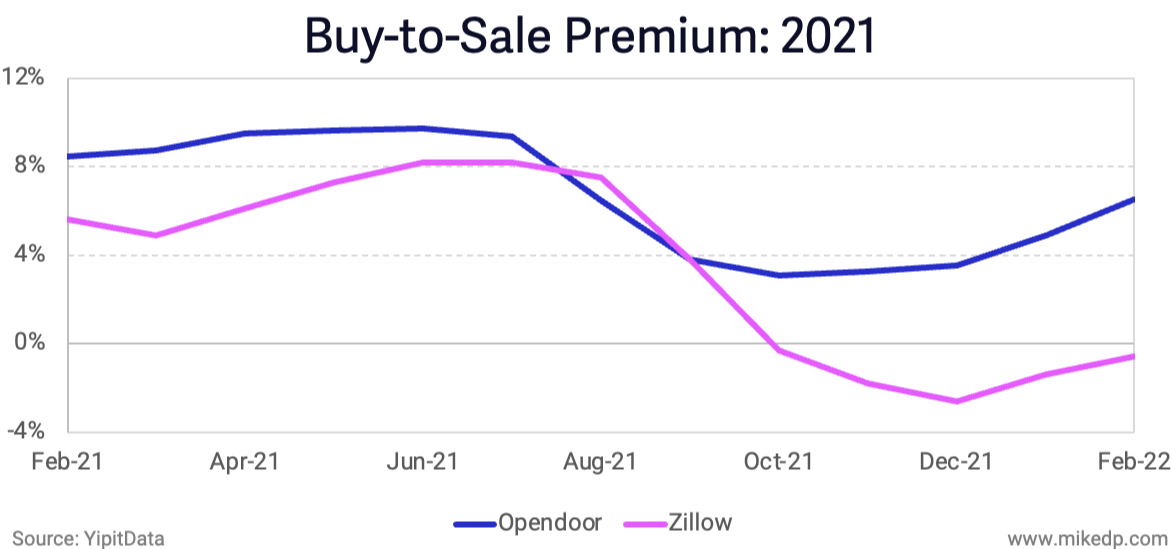

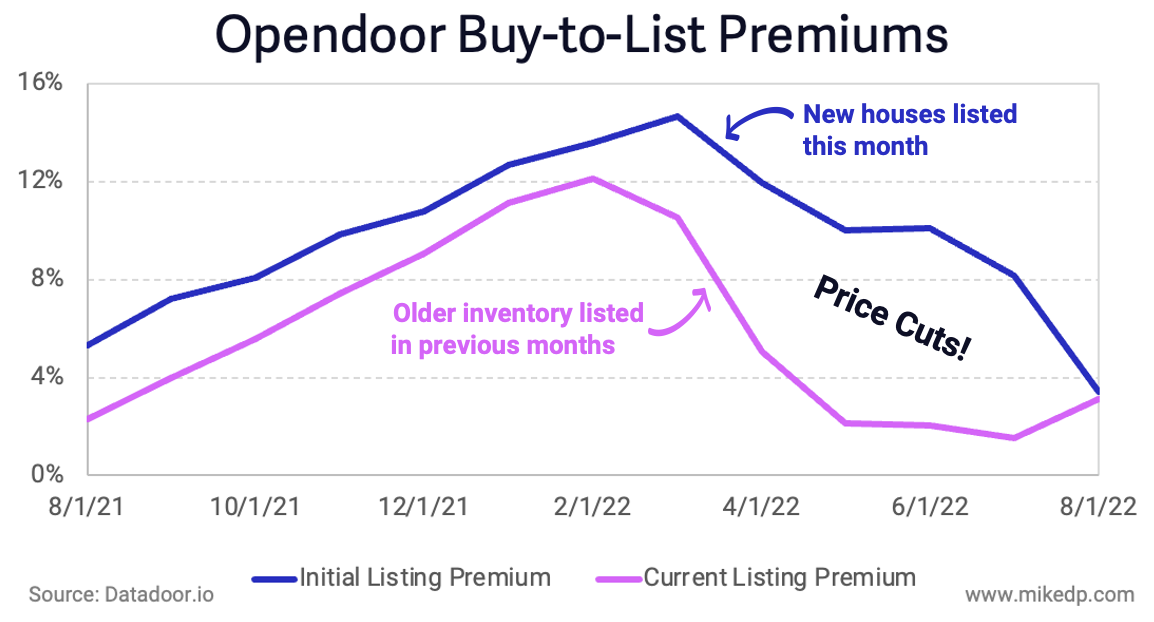

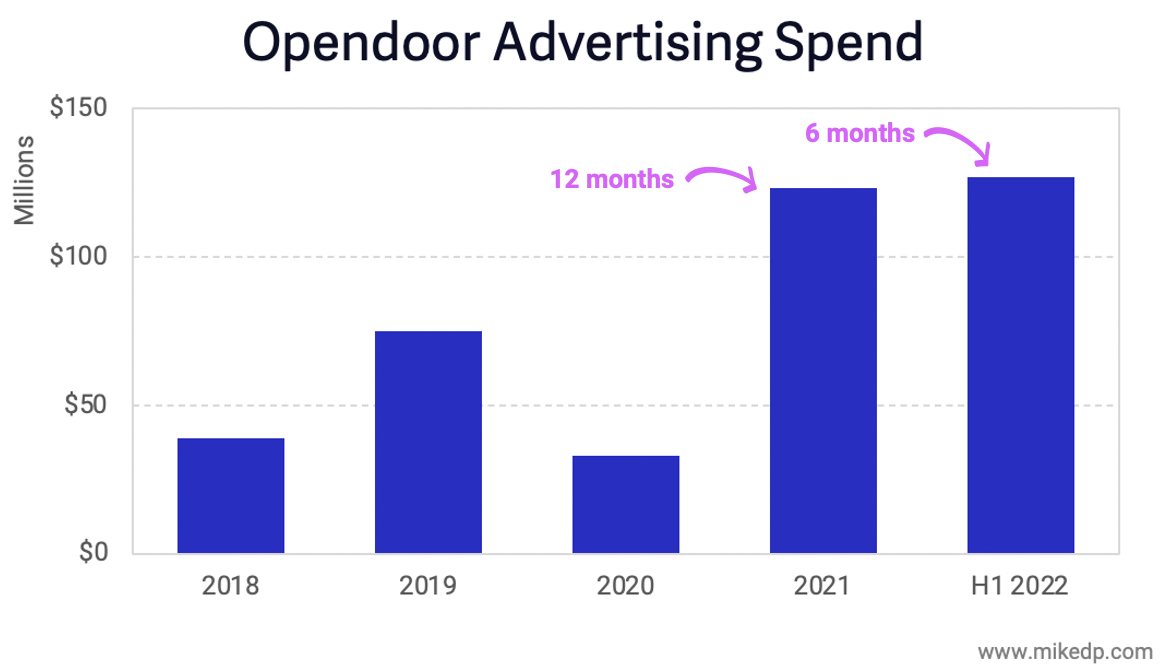

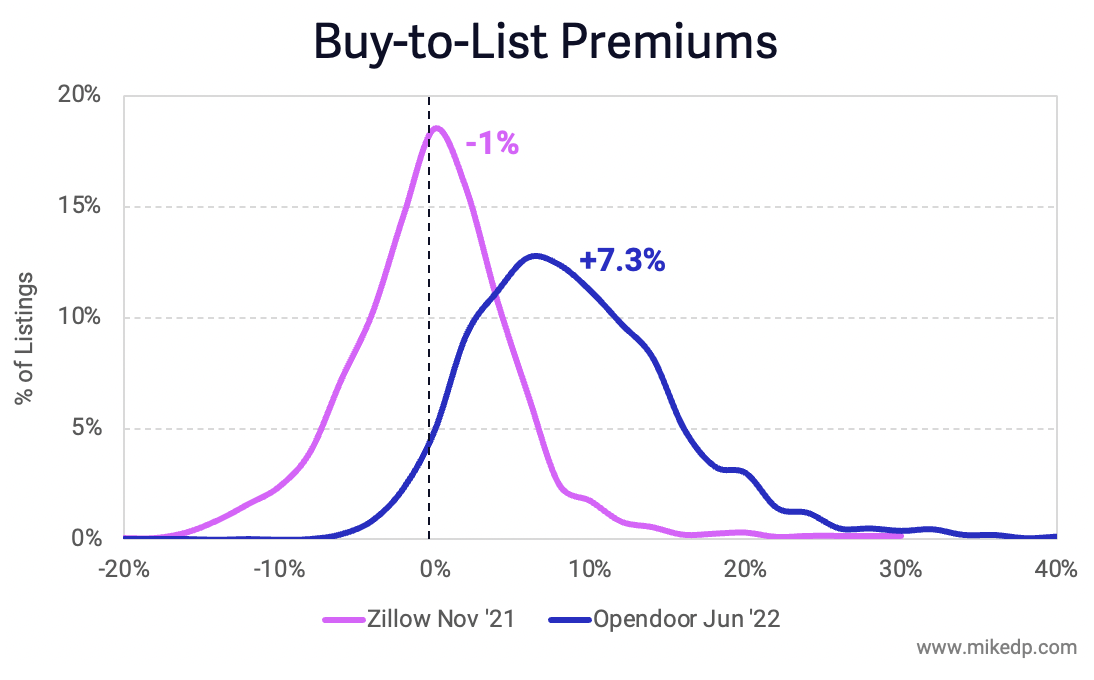

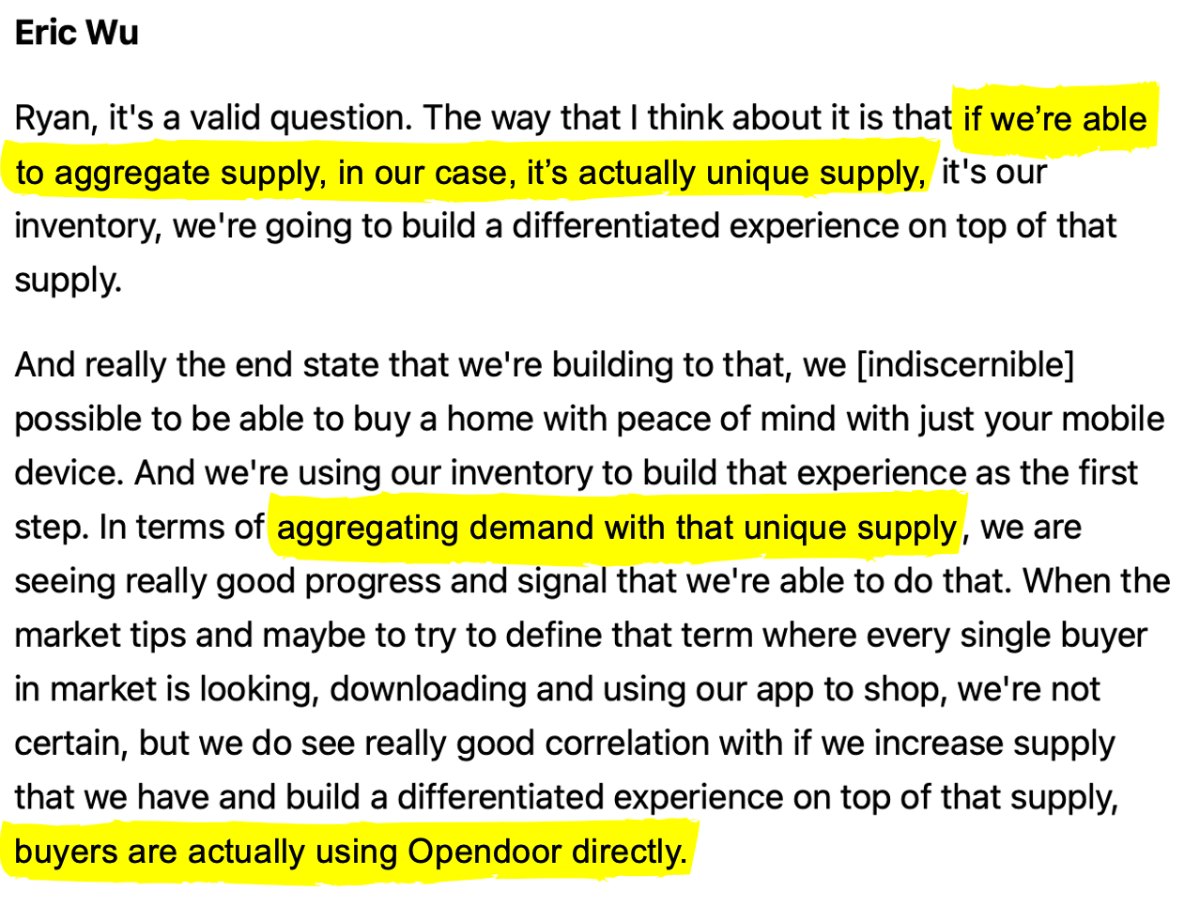

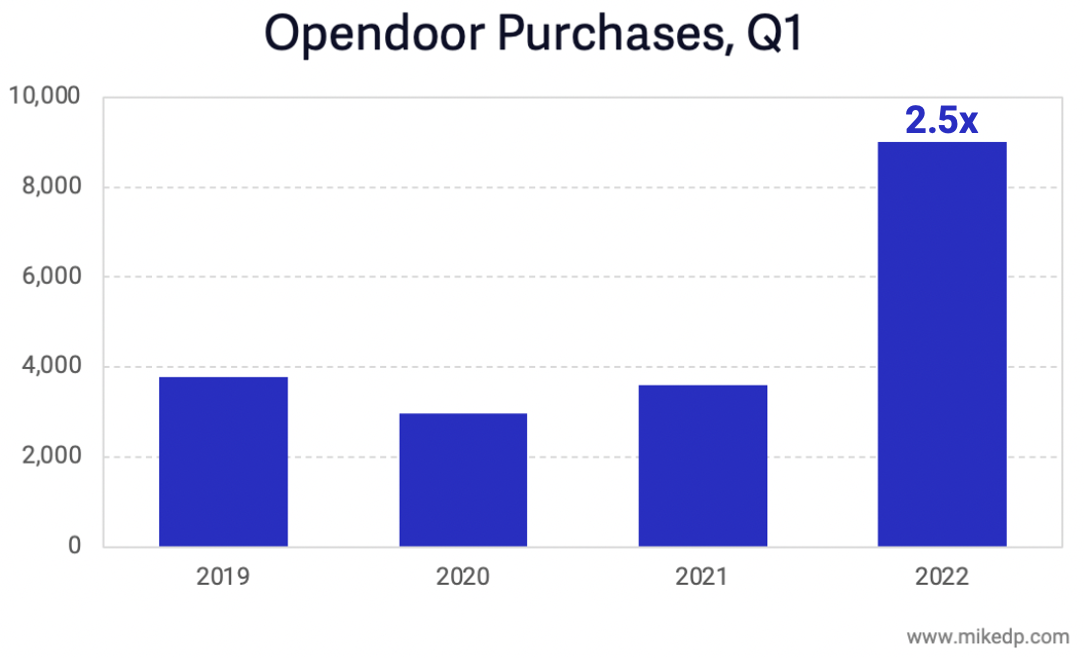

Opendoor is the outlier; although it has plenty of cash on hand, it’s about to enter (at least) two quarters of massive financial losses.

Private equity firms with plenty of cash to deploy are the other opportunistic predators.

The prey are the businesses that are vulnerable -- diminishing cash balances with high cash burn. In other words, a typical real estate tech disruptor.

With its cash burn problem, Compass is a prime example (and noteworthy because it was in the predator camp for years).

While the specific players surrounding the rumor of Vista Equity Partners taking Compass private may be incorrect, the overall theme is spot on.

The majority of prey are the hundreds of private companies whose financials are not publicly available.

The severity of their situation depends on when they last raised money, how quickly they're spending it, and how much they have in the bank.

If a company doesn't have at least 12 months of runway, they're prey.

What to watch: The name of the game for the next 6–18 months is VUCA -- volatile, uncertain, complex and ambiguous.

Expect to see a larger amount of mergers, acquisitions, consolidation, and liquidation.

The bottom line: Cash is king. In today's market, a company’s cash flow determines if it is in control of its own destiny.

If a company is burning cash and needs to raise additional funds, it will be forced to do so on someone else’s terms.

But, if a company is cash flow positive with a solid balance sheet, a VUCA environment presents incredible opportunity.

"Only when the tide goes out do you discover who's been swimming naked."

- Warren Buffet