Opendoor Set to Cash In from Record Home Price Appreciation

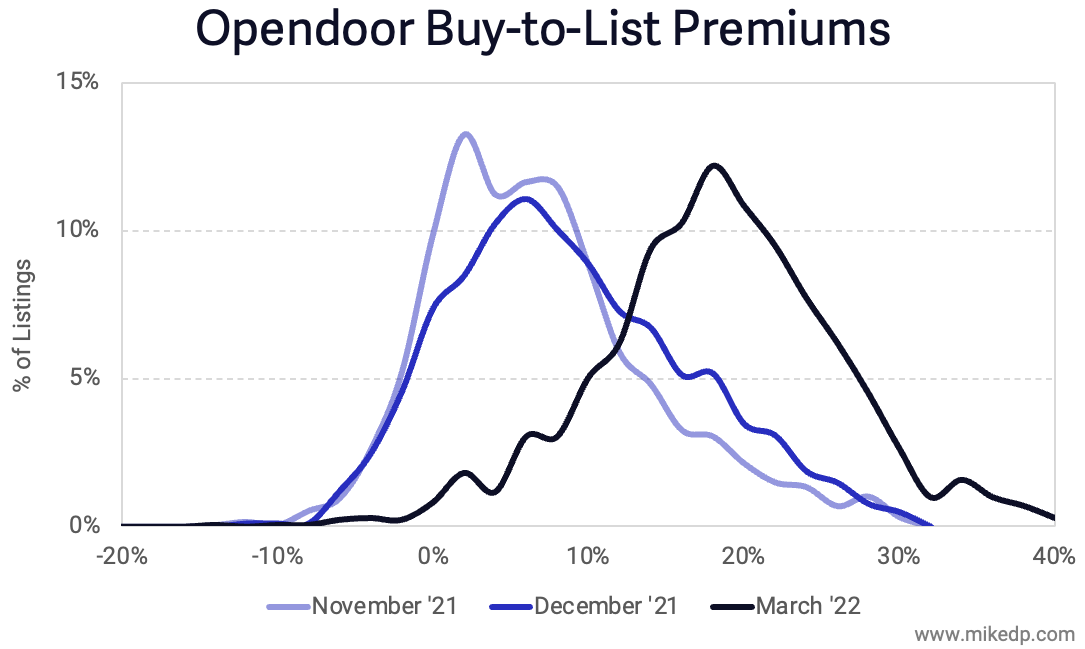

/Home price appreciation is through the roof again, and Opendoor's buy-to-list premium (the difference between the purchase price and current listing price of a home) is at record highs.

Why it matters: Opendoor is going to make a lot of money in the first half of 2022.

Dig deeper: Opendoor's houses are currently listed for a median of 17 percent -- or $60k -- higher than what they were purchased for, on average, 72 days earlier.

This is based on 1,700 listings as of March 15, 2022 (excluding Texas), and according to YipitData's historical analysis through February, is an all-time high.

The distribution across listings shows a significant improvement from the end of 2021 -- and is pushing so high I had to adjust the chart's x-axis.

Buy-to-list is a good leading indicator of iBuyer profitability, and is usually a few percentage points higher than the eventual sales price.

Buy-to-list in one quarter generally affects the following quarter: Opendoor's low buy-to-list in Q3 2021 resulted in a low buy-to-sale premium and contribution margin in Q4 2021 (3.3 percent).

Opendoor is going to have a blockbuster Q2 2022 -- contribution margin is on track to exceed 2021's highs of 10 percent.

Yes, but: If Opendoor is the winner here, who is the loser?

Opendoor is no different than any other home seller in the market. If the home seller is the winner, the loser must then be home buyers -- scant inventory and rocketing home prices are making homes less affordable.

Opendoor is simply riding the market wave, and riding it really well (remember Zillow Offers?).

What's next: What goes up must come down; home price appreciation will slow, and Opendoor will once again need to deftly read the market and adjust its purchasing activity.

These extreme market risks are a big reason Zillow exited iBuying.

The bottom line: Opendoor (and Offerpad) are going to benefit tremendously from rising home price appreciation in the first half of 2022.

It's worth noting that this key financial driver isn't within Opendoor's control. Wildly rising home price appreciation isn't a business strategy, it's the market.

Big Tech Coming After Agent Commissions in a Big Way

/The biggest real estate tech companies — Zillow, Compass, and Opendoor — have set their sights on agent commissions as a source of revenue and profit growth.

Why it matters: Agents remain the backbone of the industry, generating around $100 billion in commissions annually.

That commission pool is a rich target for big tech companies to tap into.

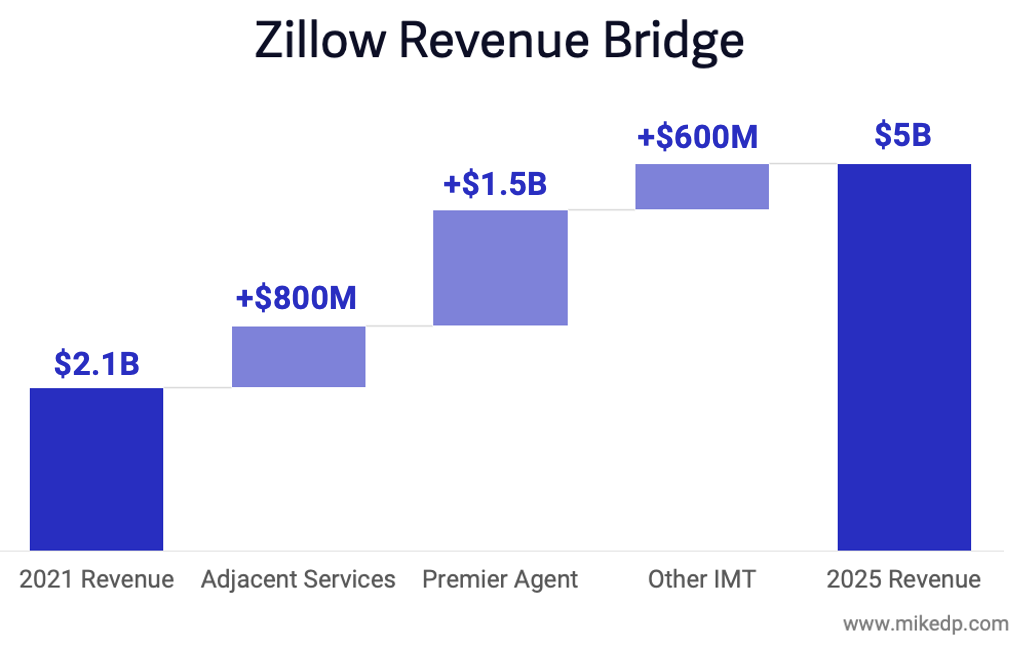

Zillow's new strategy (Zillow 3.0: Back to Basics) is centered on extracting an additional $1.5 billion from agents by 2025, for a total of $2.9 billion annually.

Compass wants to pay agents less. In its own words, Compass has a demonstrated track record of "improving economics with agents" of one percent per year.

Compass provides multiple slides that highlight its plans and ability to reduce commission splits paid to its agents over time.

In other words, if you're a Compass agent, the company's plan for profitability hinges on reducing your commission split over time. Sorry!

Opendoor continues to use its scale to push buyer agent commissions -- one of its biggest expenses -- lower.

In Atlanta, Opendoor has experimented with buyer agent commissions ranging from 1.5 to 3 percent, having finally settled on 2.25 percent.

Interestingly (and I don't think I can take credit for this), Opendoor dropped its lowest 1.5 percent buyer agent commission ten days after I published about the iBuyer War on Real Estate Commissions.

Some perspective:

Opendoor sold 20,000 houses in 2021. A 0.75 percent savings in buyer agent commissions is about $53 million annually.

Compass's medium term goal of a 2.5 percent commission split improvement on its 2021 revenues is $160 million annually.

Zillow wants to generate an additional $250–$300 million from agents per year.

Yes, but: These companies aren't simply raising prices; they're offering increased value to agents.

Opendoor promises partner agents increased deal flow and less time spent on each transaction.

Compass promises its agents increased deal flow and efficiency from its brand and tech platform.

Zillow provides agents with exclusive access to pre-qualified buyer leads.

The bottom line: Big Tech has big plans to extract hundreds of millions of dollars from real estate agents in the coming years.

Amidst a landscape of new models, disruptors, tech innovation and "super apps," there remains one consistent way to make money in real estate: commissions.

Can Opendoor Scale?

/Opendoor, the original iBuyer and undisputed category leader, is laser-focused on scaling nationally and proving that it has a winning model.

Why it matters: Opendoor needs to demonstrate to investors that it has a credible path to profitability, and that as it grows it isn't just losing money faster. It needs economies of scale.

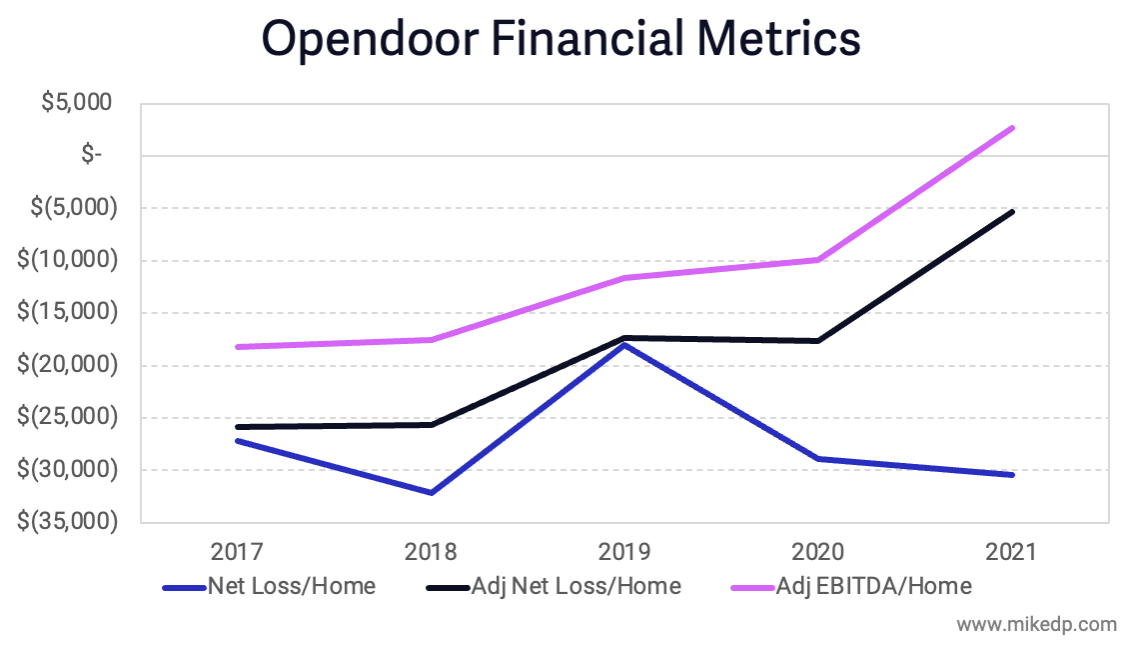

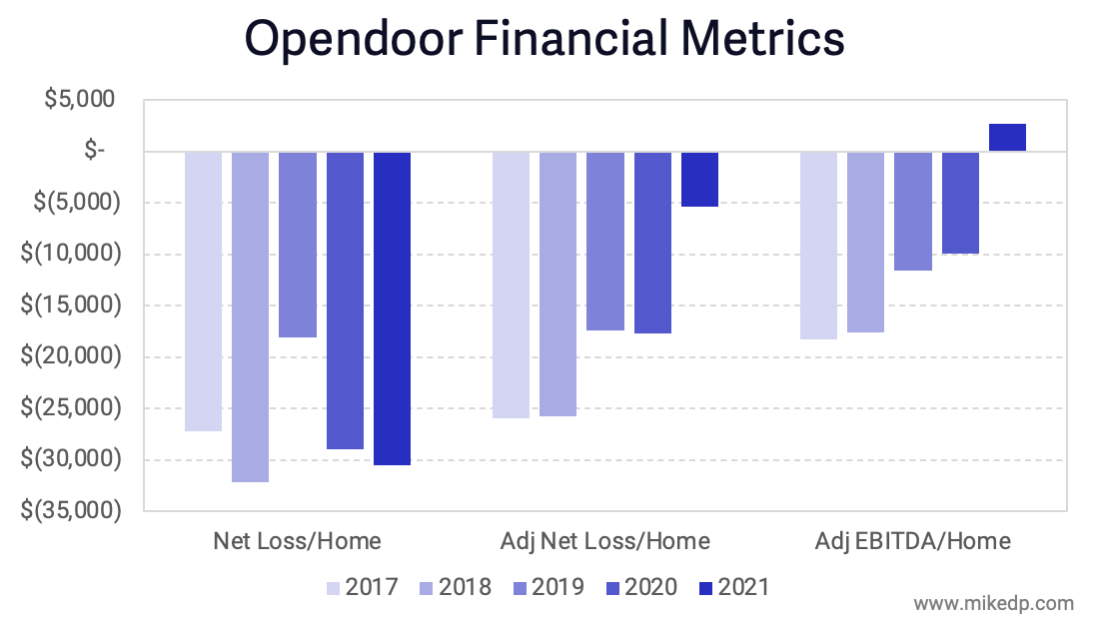

Opendoor reports a variety of financial metrics:

Net Loss is the total GAAP loss for the business.

Adjusted Net Loss backs out stock-based compensation expense ($536 million in 2021).

Adjusted EBITDA additionally backs out interest expense related to the purchase of homes ($140 million in 2021).

Now is not the time to debate the validity of each metric; let's consider all three. And to best illustrate economies of scale, let's divide each by the total number of homes sold in a period of time.

Improvement over time is clear. The key years are 2019 and 2021, when Opendoor sold a similar amount of homes: 19,000 in 2019 and 21,000 in 2021.

Opendoor's key metrics improved significantly between 2019 and 2021, with Adjusted EBITDA positive for the first time ever.

The exception is Net Loss, which bloated from $536 million of stock-based compensation expense related to its IPO.

Yes, but: Opendoor benefited from record-setting home price appreciation in 2021, resulting in unusually high gross profits and contribution margin.

Let's consider an alternate reality, where contribution margin in 2021 was a slightly more modest five percent (instead of 6.5 percent).

The result is still an improvement from 2019, an important sign of Opendoor's ability to lose less money per home as it scales.

But it's still losing money. While economies of scale are improving, the business remains unprofitable.

The bottom line: The evidence suggests that Opendoor can scale, both operationally through a challenging market, and economically as it realizes efficiency gains.

If durable profitability is the goal, reaching it depends on further economies of scale, attaching adjacent services, and a favorable macro environment -- all of which are uncertain and only some within Opendoor's control.

Coming Soon: The 2022 iBuyer Report. I'm putting together a new, ~200 slide, evidence-based look at the evolving world of instant home buyers. Pre-order today and save 10%.

Growth Machines: Compass, eXp, and the Future of Brokerage

/The major, publicly-listed brokerages all posted impressive revenue, transaction, and agent count growth in 2021.

Why it matters: In a notoriously slow-moving industry, these are eye-catching gains. Revenue at Compass beat out Realogy's owned brokerage group for the first time.

eXp Realty doubled its U.S. revenue in 2021. For a business already operating at scale, this is a very impressive feat.

By the numbers: eXp Realty rocketed past industry incumbent Realogy in an accelerating growth curve, topping 400,000 transactions in 2021.

Agent counts are driving this growth. Despite promises of disintermediation, disruption and technological efficiency, the agent is still central to the transaction.

Compared to its peers, agent growth at eXp Realty has been jaw-dropping. eXp added more new agents in 2021 than Compass has in total.

The big picture: Amidst the hyperbole of disruption, the future of brokerage is still being shaped by real estate agents.

Brokerages are growing by recruiting more agents. The more agents a brokerage adds, the more that transactions grow.

Agent recruitment is a key competitive advantage for brokerages; Compass and eXp's growth has been propelled by generous financial incentives offered to agents.

Be smart: Perhaps consider Compass' technology platform through the lens of agent recruitment and retention, and its level of investment is understandable.

A note on eXp Realty: The numbers above are estimated for the U.S. market. eXp reports global figures, but also gives the percentage of revenue generated outside of the U.S. I've used that to estimate U.S. agent count, transaction volume, and revenue.

iBuyer Sales to Investors Soar

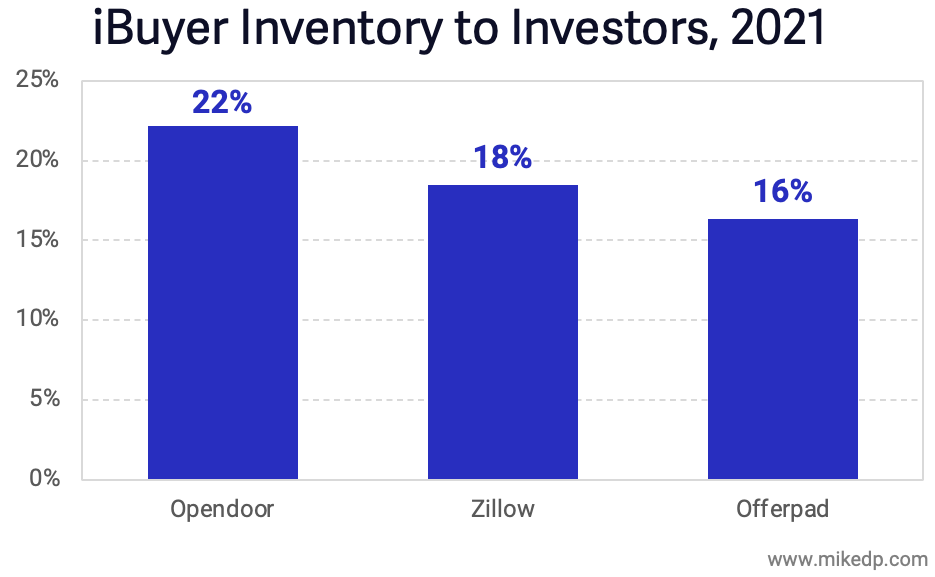

/The major iBuyers sold approximately 20 percent of their inventory directly to investors in 2021, more than double the previous high in 2019.

Why it matters: These sales -- a growing part of the iBuyer business model -- mainly occur off market, meaning traditional home buyers never see them. And most of them are subsequently turned into rental properties.

By the numbers: This amounts to nearly 8,000 sales in 2021, a relatively small number, but one that has quadrupled since 2019.

Even though the number is small, it still matters -- especially to the thousands of families that missed out on the opportunity of homeownership.

All three of the major iBuyers sold significant portions of their inventory to institutional investors in 2021, with Opendoor leading the pack.

The big picture: Investors bought a record number of homes in 2021, and not just from iBuyers.

"Last year, investors bought nearly one in seven homes sold in America’s top metropolitan areas, the most in at least two decades," according to a Washington Post analysis.

"Those purchases come at a time when would-be buyers across the country are seeing wildly escalating prices, raising the question of what impact investors are having on prices for everyone else."

Fast forward: Opendoor's IPO documents set a goal of buying and selling upwards of 140,000 houses a year. Selling 20 percent to investors amounts to nearly 30,000 houses each year.

Taking inventory off the market, turning them into rentals, and reducing home ownership opportunities aren't part of the iBuyer narrative, but that's what's happening.

Selling to investors may be a sound business decision, but there are real world implications that directly affect thousands of American families.

Zillow 3.0: Back to Basics

/Zillow's new strategy has the company going back to its roots, doubling down on agent lead gen, and extracting more revenue from real estate commissions.

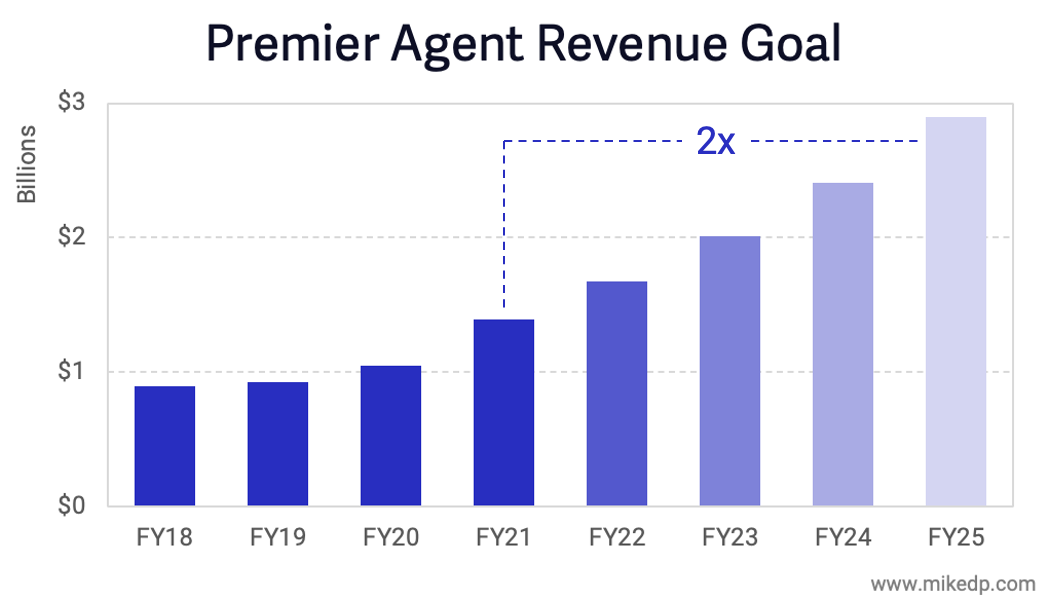

Go deeper: The biggest growth driver is Zillow's premier agent business, which it plans to double by 2025. That's an additional $1.5 billion paid by real estate agents to Zillow.

These are aggressive targets and a step-change from past growth rates, which reflect the audaciousness of the strategy -- and a clear signal of intent.

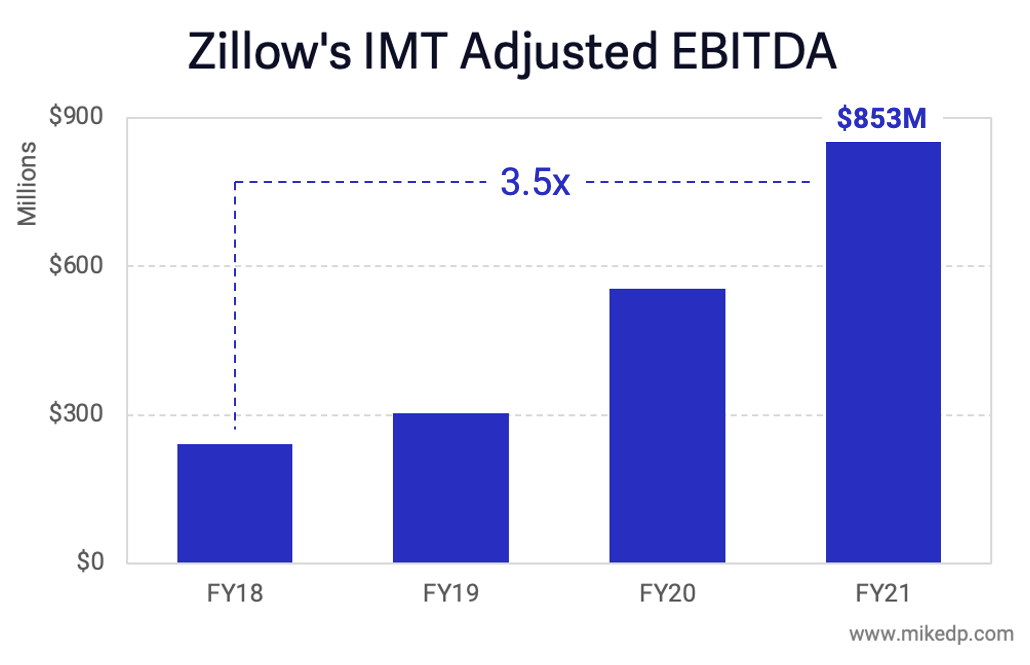

By the numbers: Zillow's core business is stronger, and more profitable, than ever, giving the company a rock-solid foundation and plenty of cash for future growth.

Earnings in Zillow's IMT business, which includes premier agent, more than tripled over the past three years. It's the profitable engine room of Zillow 3.0.

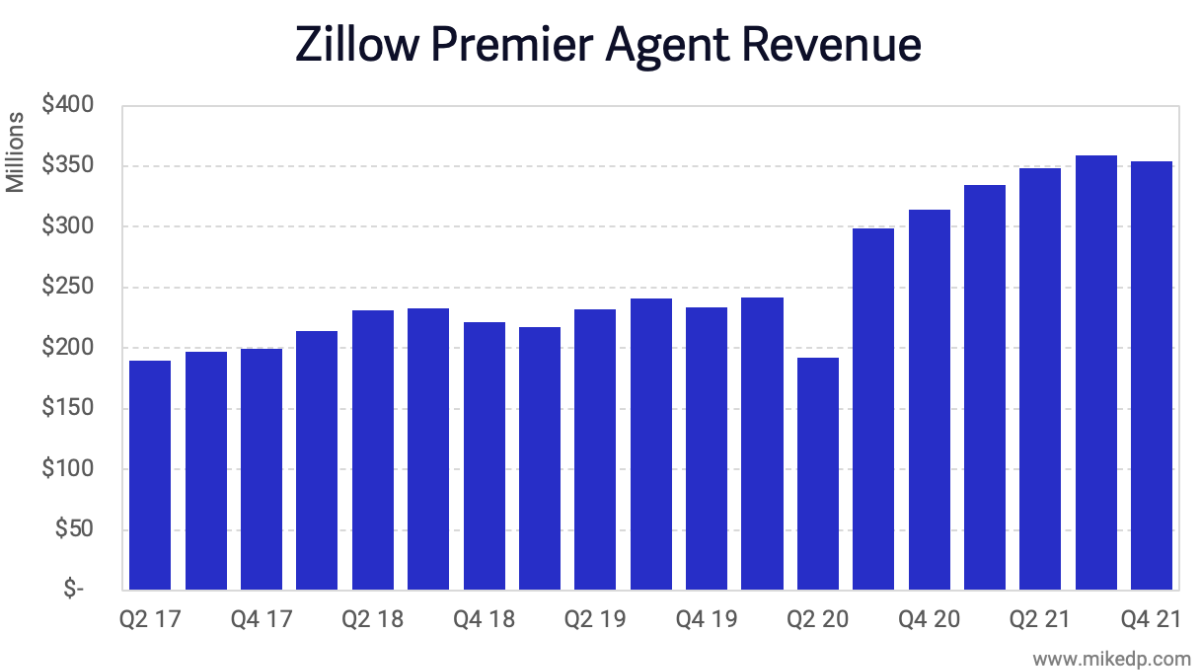

Premier Agent saw an acceleration in revenue growth driven by unprecedented demand during the pandemic.

But quarterly revenue growth just dropped for the first time in 18 months. The pandemic bump won't continue indefinitely.

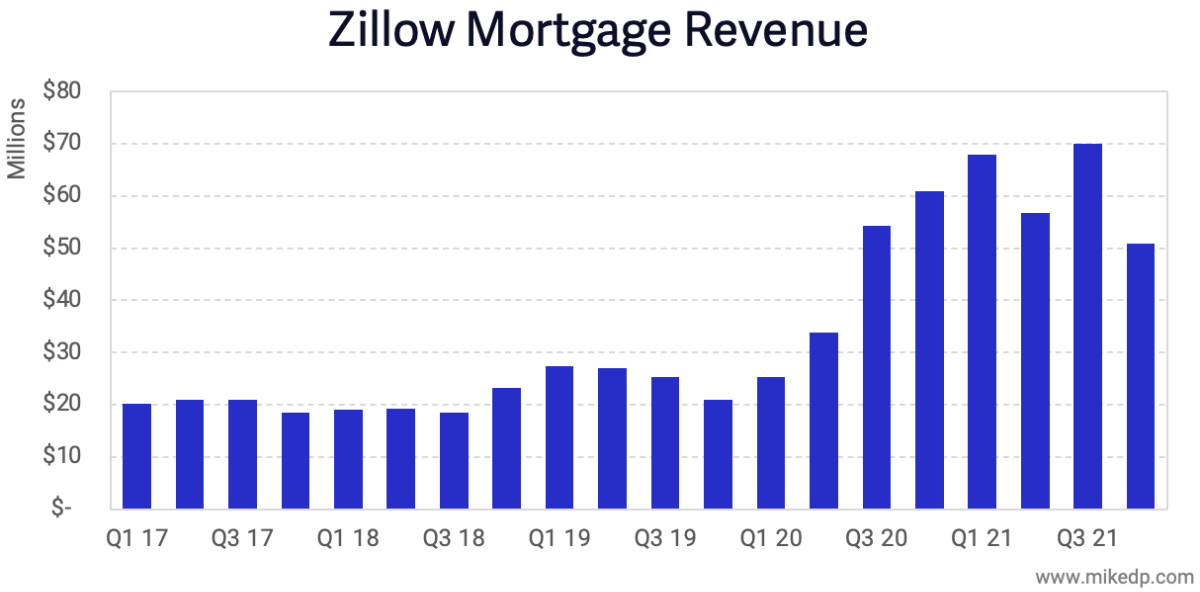

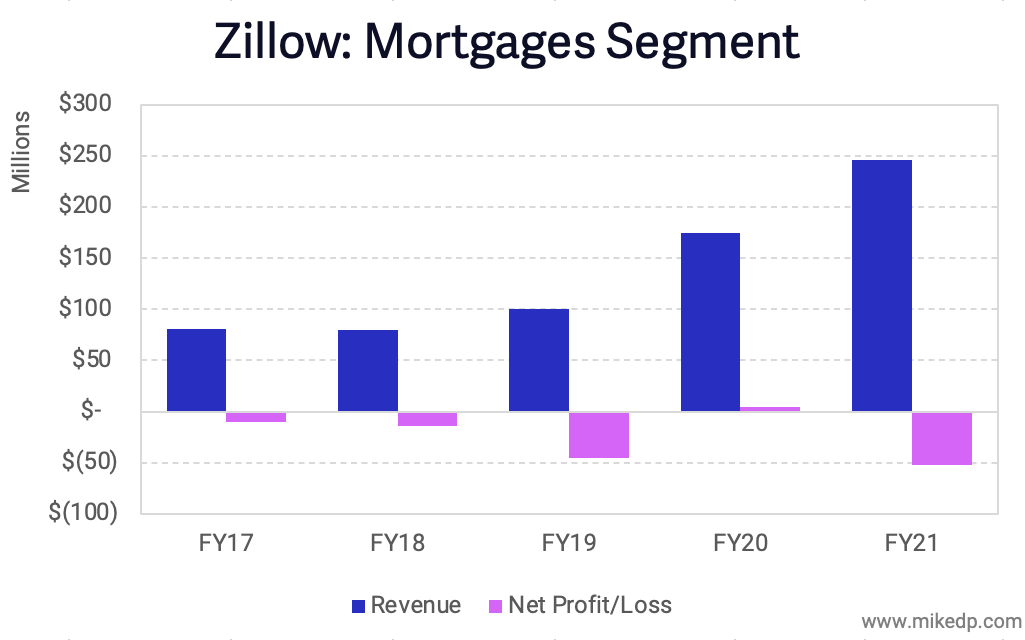

Zillow Home Loans, its mortgage play, is another key component of Zillow 3.0.

Like Premier Agent, revenue surged during the pandemic, but has slowed down significantly in the most recent quarter.

The pressing issue is that Zillow Home Loans is consistently unprofitable (net loss of $50 million in FY21).

Zillow is managing to lose a lot of money in a business that others can operate quite profitably.

The best case is that Zillow is smartly investing for the future. The worst case is that Zillow Home Loans is another Zillow Offers, beset by executional issues and overextension.

The bottom line: Zillow's 3.0 plan is centered around creating more transactions for premier agents and selling consumers adjacent services (mortgage and title).

Creating more transactions comes down to connecting consumers and agents in such a way that Zillow earns a commission.

That's a huge inflow of new business for premier agents, and it comes at the expense of non-premier agents.

Momentum Builds in Mortgage Disruption

/Significant changes continue in the mortgage space as portals, iBuyers, Power Buyers, and brokers invest in building end-to-end real estate ecosystems.

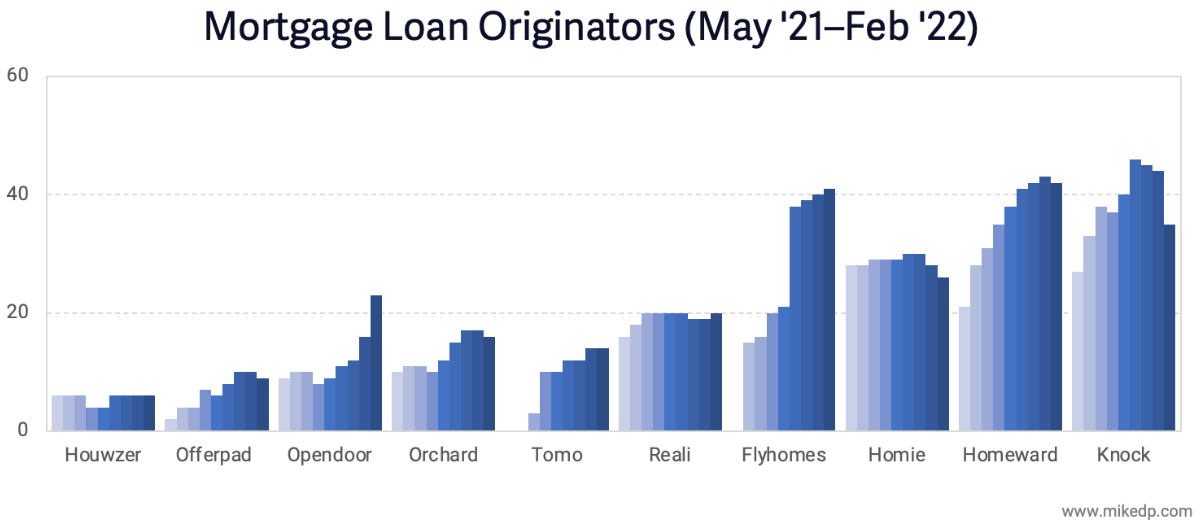

Why it matters: Real estate tech disruptors are investing billions to build integrated brokerage and mortgage experiences. These companies employ licensed brokers -- Mortgage Loan Originators (MLOs) -- that occupy a critical position in securing or refinancing a mortgage.

The number and growth of MLOs is an important leading indicator of a company's firepower and strategic intent.

Big picture: Of the venture-backed disruptor pack, the companies with the most MLOs are those attempting to develop a complete ecosystem play anchored around mortgage: Power Buyers.

Homeward, Knock, and Flyhomes are good examples, while Orchard lags due to a slower-growth employee agent business model.

Notable growth in MLOs occurred at Opendoor and Flyhomes, sending a strong signal of intent.

In November 2021, Opendoor acquired RedDoor, a digital-first mortgage brokerage, with 10 MLOs.

In Q4 2021, Flyhomes accelerated its hiring of MLOs to meet current and expected demand.

Comparatively, Zillow has more firepower but has been shedding MLOs since May 2021, with a significant drop in January.

Knock, a Power Buyer, also saw a significant decline in MLOs during January.

Redfin made a huge move in January, acquiring Bay Equity Home Loans for $135 million, adding 485 MLOs to its roster.

This positions Redfin well ahead of Zillow in terms of underwriting capacity -- and is a strong signal of future intent in the space.

Yes, but: All of these companies pale in comparison to the behemoths of the mortgage industry.

Rocket Mortgage (12k MLOs) and Better Mortgage (1.5k MLOs) have both announced plans of their own to expand into the brokerage space.

The bottom line: Mortgage lies directly on the path of brokers, portals, and disruptors attempting to build an end-to-end real estate ecosystem.

Opendoor is clearly ramping up its mortgage resources and ambitions, while Redfin has made a big investment in the space.

Tracking the number of MLOs over time reveals how serious these companies are and their potential to grab market share.

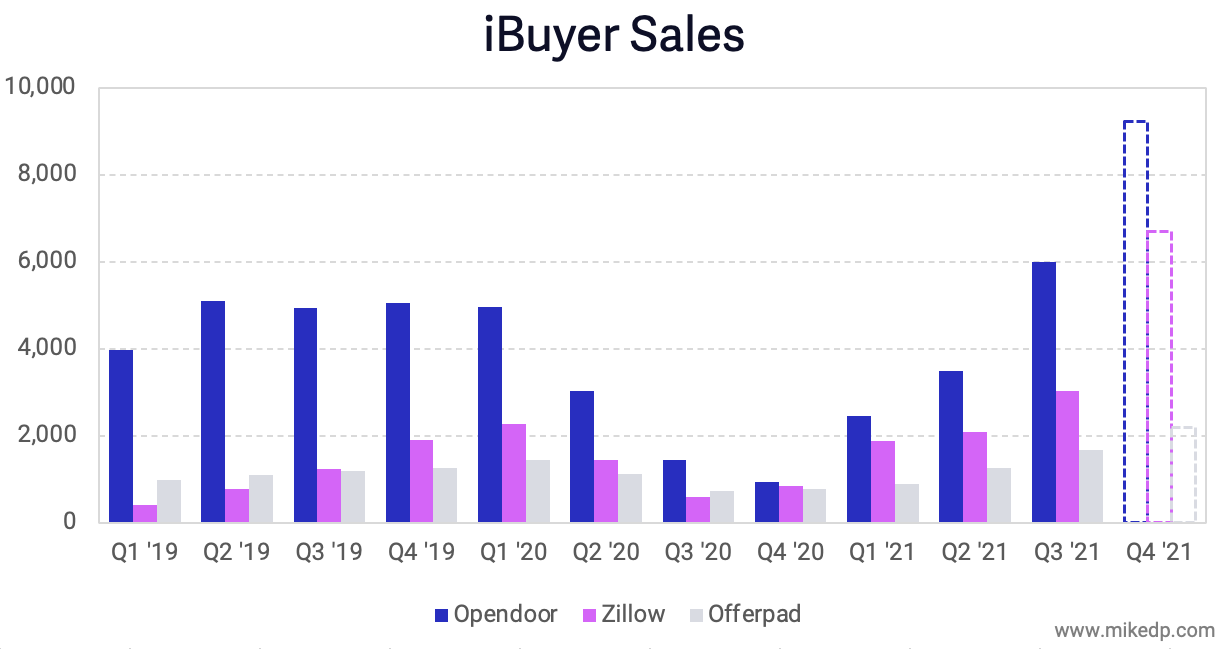

iBuyer Market Share Soars in 2021

/2021 was a transformative and record-breaking year for iBuyers. More houses were bought and sold by iBuyers than ever before.

Why it matters: iBuyers are one of the leading disruptive models in real estate. Their ability to grow, in all types of markets, is an important signal as to what degree the traditional real estate transaction can be disrupted.

But while 2021 saw record-high iBuyer transactions, it also saw the implosion of Zillow Offers after the business grew too quickly.

Big picture: iBuyer national market share of home purchases hit an all-time high of 1.3 percent -- around 70,000 houses -- in 2021.

iBuyer purchases remained robust as 2021 came to a close.

Even though Zillow stopped new purchases, it was on the hook to complete purchases that were already under contract.

Seasonality kicked in for Opendoor as it smartly slowed purchases after a massive acquisition spree in Q3.

Note: Q4 numbers are preliminary and subject to change.

iBuyer sales set new records in Q4, with more houses sold than ever before.

Opendoor consistently sold more houses each month, demonstrating an expanding operational capacity to repair and sell houses at scale.

This is a critical metric to watch. Buying houses is the (comparatively) easy part; selling at scale is difficult.

Note: Q4 numbers are preliminary and subject to change.

What's next: 2022 is all about profitability. Opendoor and Offerpad need to demonstrate that they can achieve consistently positive unit economics at scale.

With Zillow out of the picture, there will be less competitive pressure on fees and acquisition prices.

But Opendoor faces increasing competition from big incumbents, Power Buyers, and smaller brokerages, which have all launched similar products.

The bottom line: 2021 was a massive year for iBuyers. In particular, Opendoor is approaching the scale it promised during its IPO. If its economics fall into line, the company is poised to be a significant force in real estate.

Opendoor vs. Zillow: A Tale of Two Pricing Models

/A catastrophic pricing failure sunk Zillow's iBuyer business. Clearly, home price appreciation is a key factor of the housing market in 2021 and beyond. And being able to accurately predict house prices -- not only today, but into the future -- is a non-negotiable prerequisite for iBuyers.

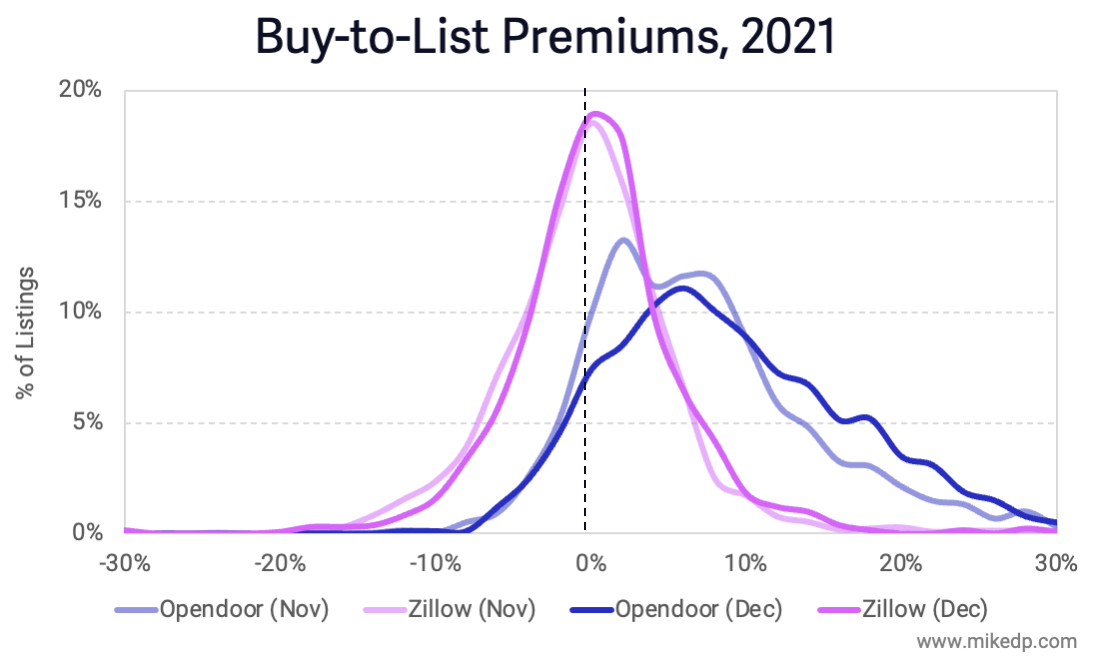

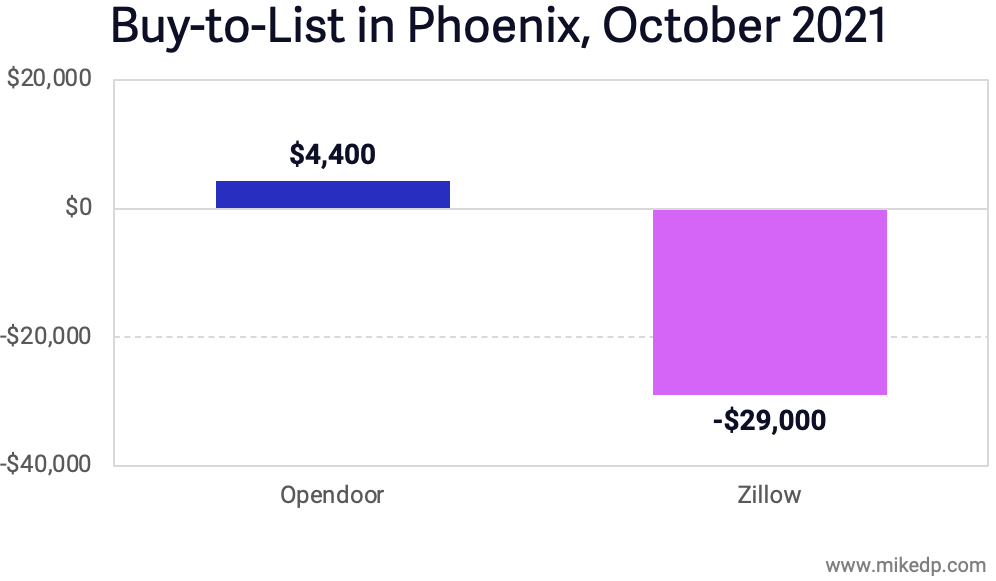

The best leading indicator of effective and accurate pricing is the buy-to-list premium; the difference between the purchase price and current listing price of a home. Unlike Opendoor, Zillow overpaid for the homes it acquired and is selling them for a loss; a negative buy-to-list premium, and a big problem.

Opendoor's median buy-to-list premium is rising once again, a sign of a healthy pricing and resale operation that is successfully reading the market.

While Opendoor's median buy-to-list premium is higher than Zillow's, the magic is in the distribution curve. Opendoor has a wide distribution of premiums that skews higher, leading to higher gross profits.

The finesse of Opendoor's pricing curve has been refined and improved over the past month. Not only has its median buy-to-list premium increased, but the percentage of listings with higher premiums has increased; the curve has shifted to the right.

A Matter of Timing

The buy-to-list premium is a leading indicator and a predictor of what is to come. The price a home sells for (buy-to-sale) is typically, but not always, a few percentage points lower than the listing price.

Even though Opendoor's buy-to-list premium is rising in Q4, its home price appreciation will be quite low for the quarter due to the intense pricing pressure of the previous quarter.

Strategic Implications

A comparison of Zillow Offers and Opendoor highlights the critical importance of pricing in iBuying. There's an understated elegance in the detail; it's not just buying low and selling high. A successful pricing operation -- not just an algorithm, but people! -- needs to work at scale, needs to improve over time, and needs to be more nuanced than a brute-force bell curve.

As the Zillow Offers collapse has demonstrated, pricing is a true potential competitive advantage for iBuyers. Getting it right is a prerequisite for success, while getting it wrong can lead to catastrophic failures.

Next Gen Lead Gen

/Next generation lead generation is the most significant business model shift for real estate portals since their birth. It is the evolution towards delivering fully qualified leads with a commission share model, and it accounts for an increasing percentage of portal lead gen revenues -- while bringing them closer to the transaction.

An Emerging Global Trend

The evolution is occurring globally and targets both buyer and seller leads. The key themes include lead qualification and a commission share model (aka success fee).

Leading real estate portals around the world have made significant investments into next gen lead gen, including several large acquisitions.

The U.S. portals focus on monetizing buyer leads, while international portals like ImmoScout24 and MeilleursAgents focus on seller leads. The most effective way to reach prospective sellers is with property valuations: “What is my home worth?”

A key element of this model is that leads are qualified before being handed off to a partner agent. Leads are called directly by the portal, typically within minutes of submitting a form.

The second key element of next gen lead gen is the use of a commission share, or success fee, model. If a lead transacts, the agent pays a percentage of their commission back to the portal.

The commission share varies by market, but is generally around a third of an agent's commission. And this source of revenue accounts for an increasing share of portal revenue; realtor.com generates about a third of its lead gen revenue from the commission share model, as does ImmoScout24.

A Win for Consumers, Portals, and (some) Agents

Next gen lead gen lays the groundwork for a triple win: the promise of a better consumer experience, less wasted time for agents, and a more valuable product for portals.

The potential downside of next gen lead gen programs lie in their exclusive nature. It's not for everyone; agent networks consist of a small and exclusive group of the total agent pool.

Over the long term, the agents not participating in these programs will receive fewer online leads, and may be at a significant competitive disadvantage in the race to acquire customers. Next gen lead gen is revolutionizing the portal lead gen business model, but it only works for the agents that jump on board.

Next Gen Lead Gen is a major trend discussed in my Real Estate Portal Strategy Handbook.

Check out the free preview of the report.

iBuyer Market Share Rockets to New High

/Before Zillow's meltdown, national iBuyer market share surged to another all-time high, blowing past all previous records by a wide margin. In Q3 2021, iBuyers accounted for 1.6 percent of all homes purchased in the U.S. That's around 28,000 homes, nearly double the 15,000 homes purchased by iBuyers in Q2.

The situation will certainly change with Zillow exiting the market and seasonality kicking in during Q4 2021. But for the time being, iBuyers have never been bigger, and Opendoor is now left as the undisputed category leader.

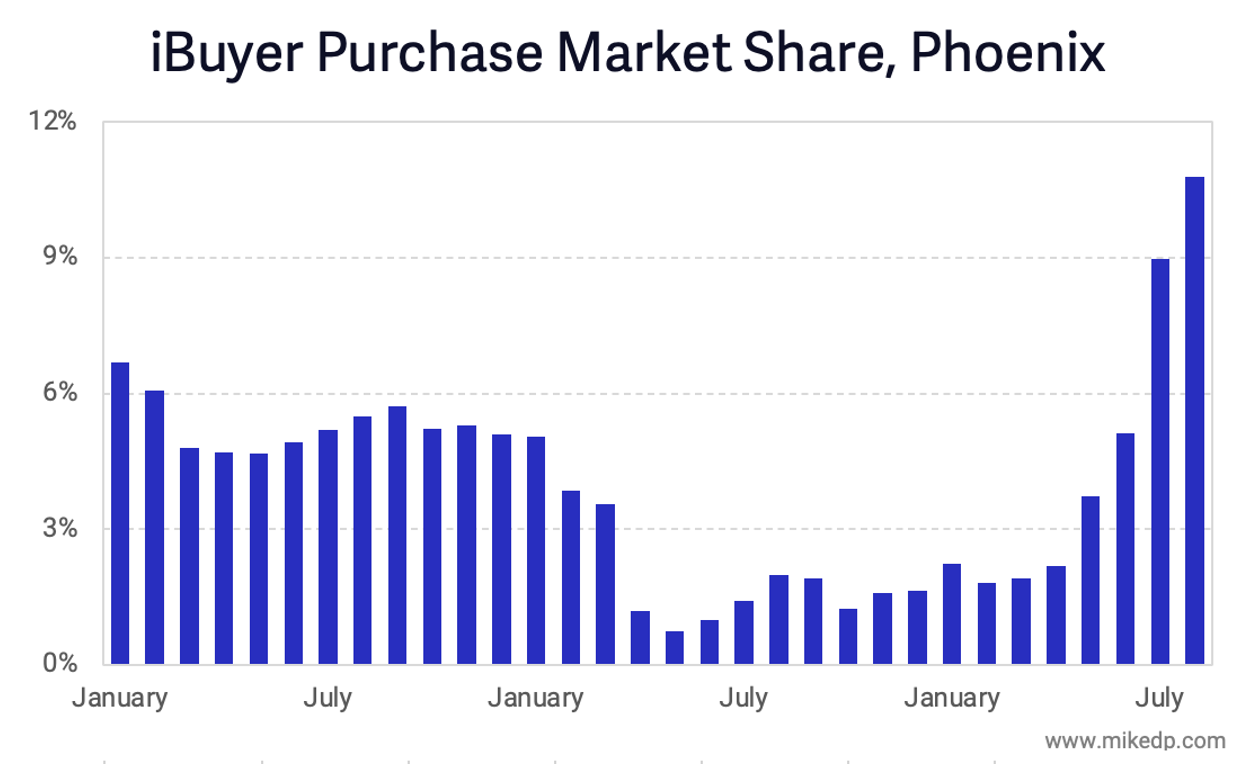

Also noteworthy: iBuyer Market share in Phoenix, the largest iBuyer market, peaked to a new high of 10.8 percent. This is the first time iBuyers have exceeded 10 percent market share in a major market -- a significant, if temporary, achievement.

Opendoor's Earnings: Painfully Normal

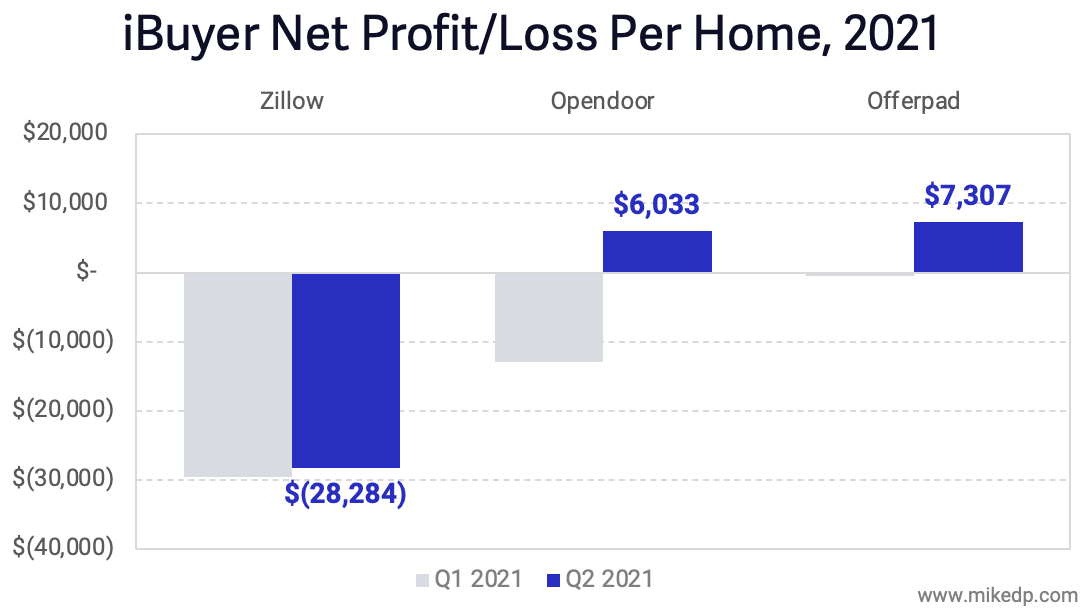

Both Opendoor and Zillow scaled their iBuying operations tremendously in Q3, but while Zillow's business spectacularly imploded, Opendoor demonstrated critical economies of scale. As it grows, its net loss per home is improving.

These charts show net profit/loss based on simple math: total net profit/loss for the business divided by the number of houses sold (excluding stock-based compensation expense). The result is a benchmark of business model efficiency.

While Opendoor and Offerpad improved their net profit/loss in 2021 (benefiting from record home price appreciation), Zillow's just got worse (and that's excluding the $304M inventory writedown) -- another reason Zillow Offers just wasn't working out.

As it scales, Opendoor's revenue (and gross profits) are increasing faster than fixed and variable costs. That's a positive sign, and something critically important to Opendoor's growth and profitability narrative.

How Data Can Be Used to Mislead: Compass' Results Told Three Ways

/“In God we trust; all others bring data.” The power of data in evidence-based research is critical, but even data -- used certain ways -- can mangle the truth. As a case study of how data can be manipulated to tell different stories, I examine Compass' recent financial results three different ways.

Method 1: The Annual, Single-Company View

The first method, which is what Compass uses, compares key metrics to the corresponding period one year ago -- annual growth. Compared to Q3 2020 (and remember, 2020 was a pretty weird year), Compass experienced significant growth in revenue and transaction volumes -- up 47 percent and 36 percent respectively.

Compass' revenue growth was driven by more transactions, which in turn were driven by more agents (a 31 percent increase in Principle Agents). An annual comparison method accounts for seasonality in the business and is a great metric for companies in a relatively mature state, but falls short without important context.

Method 2: The Quarterly Single-Company View

An annual comparison is tricky for high-growth companies; the numbers are always huge. A granular look over time reveals deeper trends: Compared to the previous quarter, Compass' revenue actually declined, and its guidance for Q4 is a further decline.

Compass is subject to the same headwinds as any brokerage: inventory, seasonality, and agent recruitment & retention. It clearly hit a (seasonal?) peak in Q2, and now the business is slowing.

On a quarterly basis, Compass' losses are also stacking up. After approaching profitability last quarter, the company has returned to a net loss this quarter ($71 million of which is stock-based compensation expense).

A quarterly view over time introduces momentum and trends. It reveals that Compass's growth isn't steady (something that isn't clear with an annual comparison), and that the business appears to be slowing down -- with losses.

Method 3: The Quarterly & Annual Multi-Company View

This method adds additional perspective with the context of Compass' publicly-listed peers. The numbers above lack context; is Compass under- or over-performing in the market?

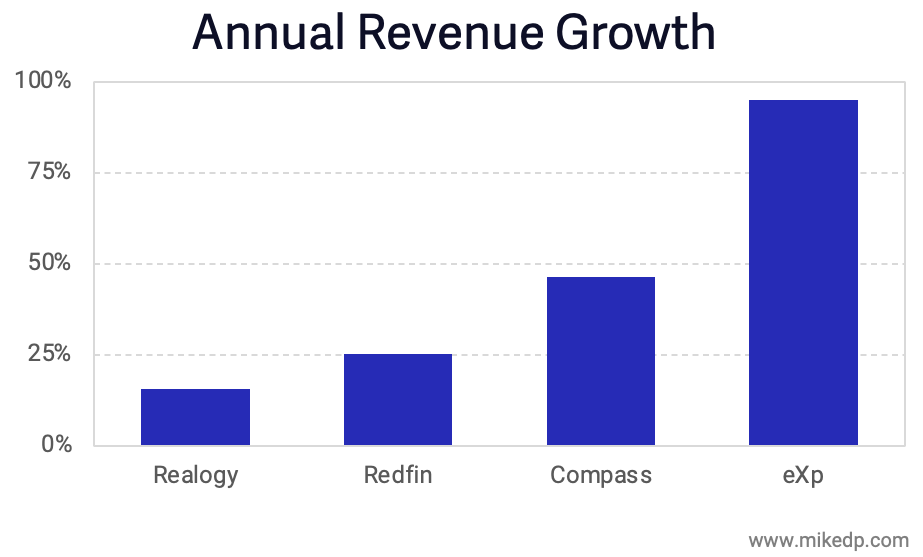

It turns out that on an annual basis, revenue is growing at all of Compass' peers. Compass' growth rate is in the middle of the pack, larger than Realogy and Redfin, but lower than eXp Realty.

On a more granular basis (comparing to the previous quarter), Compass stands out with a revenue drop larger than its peers. As we saw above, something happened in Q3, and Compass' slowdown is more pronounced than any of its peers.

Finally, it's worth noting that Compass is materially less profitable -- unprofitable, in fact -- when compared to its brokerage peers. Realogy and eXp are generating significant net profits, while Compass continues to burn cash.

A peer comparison highlights key business model differences and provides another angle on the recent business slowdown. And while Realogy may be viewed as the less exciting, slow-growth industry incumbent, it runs a sustainable, durable, and profitable business model.

Strategic Implications

There's not one, right way to tell this story. But there's always different angles to consider, and multiple data points to triangulate the truth.

Exploring the complexity of real estate through evidence, context, and storytelling is a passion of mine. It's easy to manipulate the truth, or provide various versions of it, depending on the data presented. The truth is out there -- it just takes a critical eye to find it.

Zillow Exits iBuying — Five Key Takeaways

/Yesterday, Zillow announced that it is exiting its iBuyer business, Zillow Offers. After racking up over $1 billion in losses over 3.5 years, Zillow is closing the business down, a move that has significant implications for the real estate industry.

Zillow's Astronomical iBuyer Growth

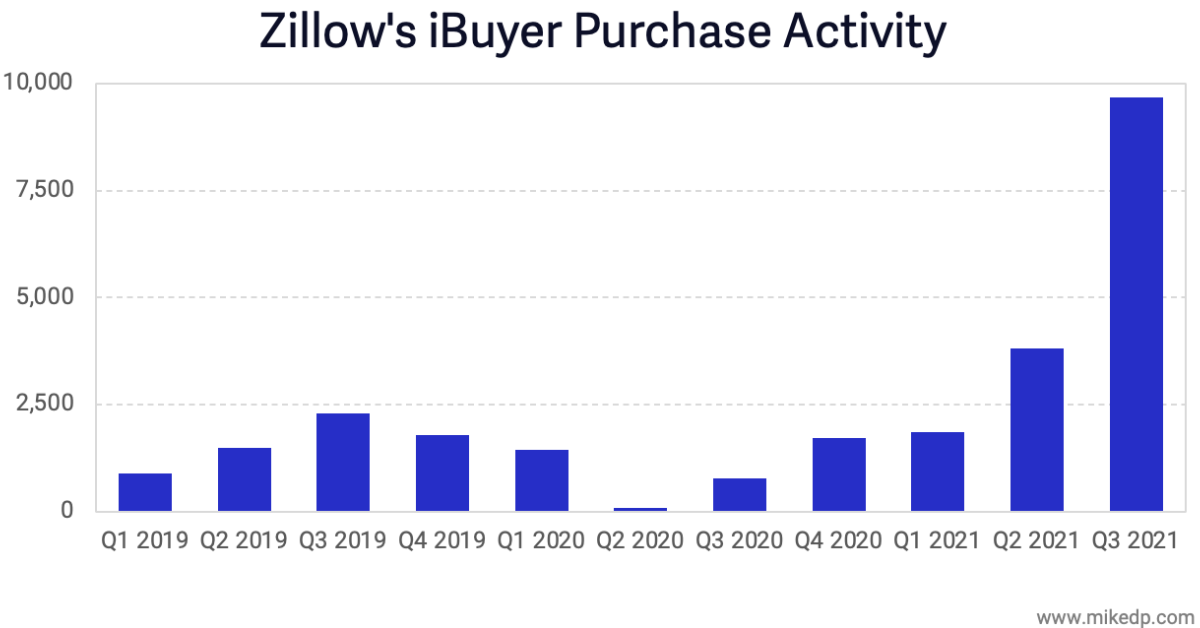

Zillow's iBuyer business grew so fast, so quickly, that it literally broke the company, forcing an abrupt shut down. In Q3 -- the three months that broke the business -- Zillow purchased more houses than in the previous 18 months combined.

This is the type of growth that can stress a business to its breaking point, which is exactly what happened.

This Was A Zillow Problem

Zillow's shareholder letter cites "higher-than-anticipated conversion rates" and "unintentionally purchasing homes at higher prices" as reasons for its failure. Both are execution issues that are critical ingredients to iBuying, and appear to be unique to Zillow.

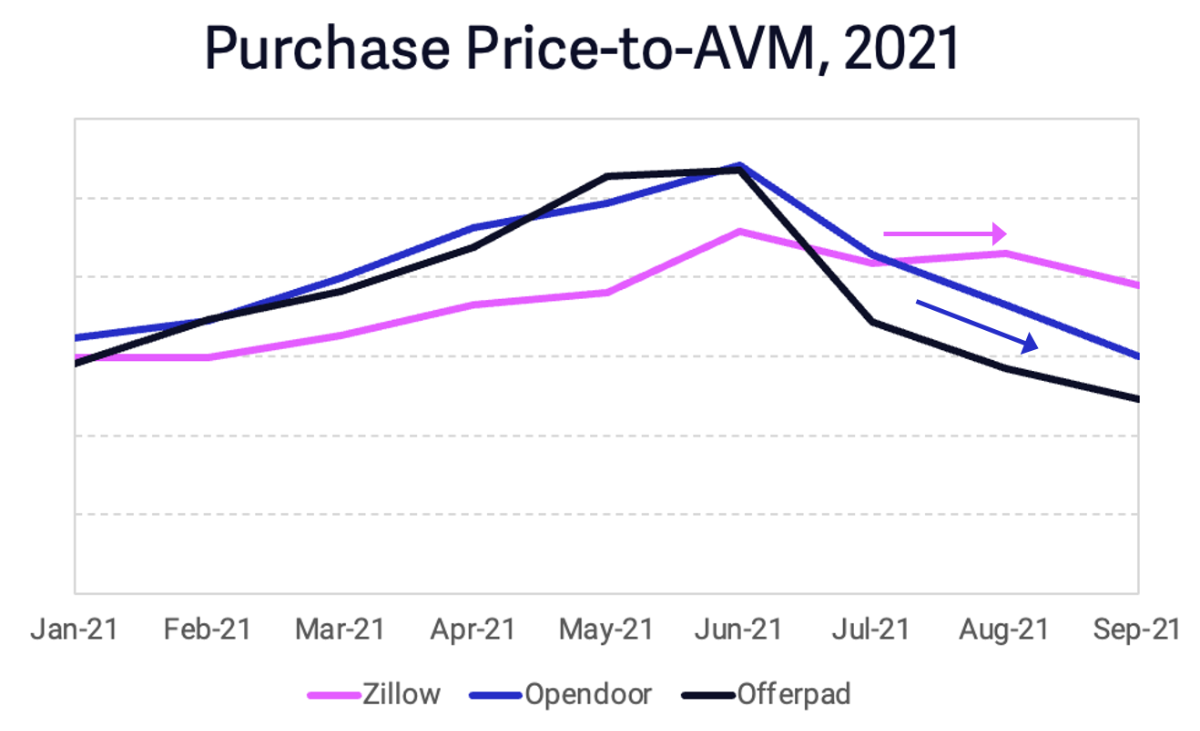

Zillow's unintentional purchase of homes at high prices contrasts nicely with Opendoor's intentional purchase of homes at lower prices. Beginning in July, as the market began to cool, Opendoor and Offerpad began paying less for homes, while Zillow continued to pay top dollar.

(I've removed the y-axis in the above chart to focus on what's really important: change over time, and the relative difference between iBuyers.)

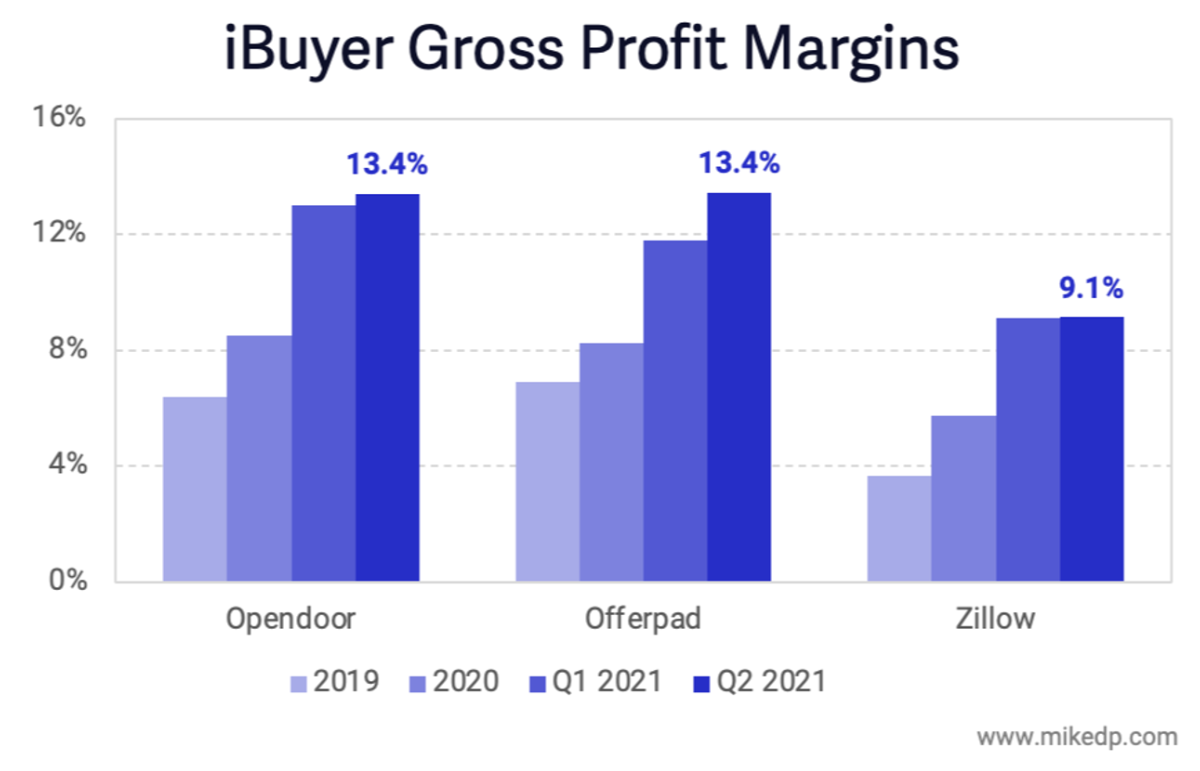

Since inception, Zillow has struggled to make structural operational improvements to its iBuying business. Zillow's gross margins -- which are a combination of purchase price, sale price, renovation costs, and service fee -- have consistently remained below its peers. Why? The others are just better at iBuying.

Earlier this year, when home price appreciation was at record highs and the other iBuyers flirted with profitability, Zillow continued posting massive losses.

iBuying is incredibly hard (it's real estate!). But while its peers managed incremental operational improvements over time, Zillow did not.

What's Next: Zillow 3.0

While Zillow 2.0 may have been a failed experiment in iBuying, what captures the imagination is the next iteration of the business. How will Zillow leverage its massive competitive advantage and its iBuyer learnings for Zillow 3.0?

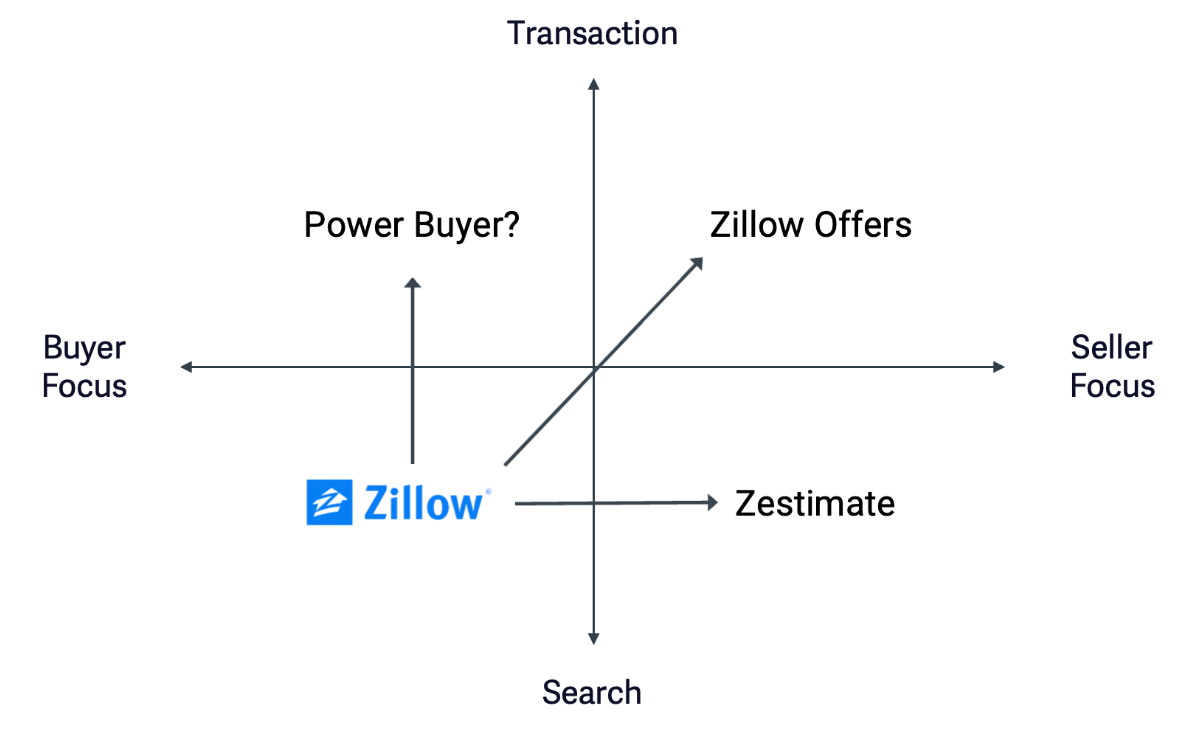

I wouldn't be surprised to see Zillow play deeper in the Power Buyer space, a model that is asset-light, easier to scale, less risky with better unit economics, and has a natural overlap with Zillow Home Loans (Opendoor diversified into Power Buying earlier this year).

Zillow as a Power Buyer -- either through organic development, partnership, or acquisition -- is a natural extension to its existing business of helping home buyers. The world of real estate has evolved significantly since 2018, and Zillow needs to stay relevant to those evolving consumer needs.

Opendoor's Pyrrhic Victory?

With Zillow's exit, Opendoor is left as the undisputed iBuying champion. But is it a battle worth winning? Zillow's exit is a mixed blessing for Opendoor, and puts the spotlight on Opendoor's path to profitability.

On the one hand, Zillow's absence from the market will relieve some competitive tension, allowing Opendoor to make slightly lower offers and charge slightly higher fees. There should be a small, positive effect on margins (which Opendoor needs more than ever).

But on the other hand, Opendoor is now going it alone, no longer able to piggyback off Zillow's consumer education efforts (advertising) in new and existing markets.

Opendoor has thrived in a high home price appreciation (HPA) market, driving gross margins to record highs. But with HPA dropping, what will happen to Opendoor's gross margins? Will it "make it up in volume," or will losses compound as it scales?

Black is the New Red

Zillow's decision to close its iBuying business is a victory for rationalists everywhere. For years, investment in real estate tech has frequently defied reason, prioritizing a company's ability to grow over profitability (watch my presentation, "How to Lose A Billion Dollars in Real Estate Tech"). Sustained unprofitability was the new competitive advantage and red was the new black.

But perhaps this is a turning point. For investors in Zillow, Opendoor, Compass, and a score of others, at some point enough is enough; a credible path to profitability is needed. For Zillow, this -- and losing a cool billion -- is that point.

I, for one, welcome the reintroduction of rational investment thought back into real estate. Let this be a welcome wake-up call for investors and the industry.

Priced to Sell: Zillow’s Inventory Problem

/In my previous analysis, iBuying is Hard: Zillow Pauses New Purchases, I suggested that iBuyers can get into trouble if they overpay for too many houses in a cooling market. This results in a growing inventory of overpriced houses that are difficult to sell, which is exactly the problem Zillow now faces.

In Phoenix, Zillow's 250 current listings are priced at a median of 6.2 percent below what they were bought for (the "buy-to-list" metric).

(As a point of reference, iBuyer median home price appreciation -- buy-to-sell -- was around 8 percent earlier this year. In Phoenix, it was around 10 percent just a few months ago.)

Put another way, Zillow's Phoenix inventory is currently priced at a median of $29,000 less than the buy price. This is a direct result of price reductions on 182 listings of an average of $41k.

The trend is similar -- but not as bad -- in other markets. In Atlanta, Zillow's median buy-to-list is still positive, but down considerably from past months (and again worse when compared to Opendoor).

Buy-to-list is a metric that should be, and up until recently was, positive. On average, being able to sell a house for no less than it was bought for is table stakes for iBuying. A loss of $29k on each house -- before any other expenses are accounted for -- represents a catastrophic failure in pricing.

Perspective

There are a number of ways to read the situation. Yes, Zillow screwed up. Yes, Opendoor looks impressive in comparison. And yes, there are challenges with iBuying in a cooling market. In the microcosm of one iBuyer, in one market, in one month, the situation looks dire.

But it won't stop Zillow; the loss, relative to its total investment in iBuying, is small. Sold today, Zillow’s Phoenix listings would incur a loss of $7 million. That’s a fraction of Zillow’s total iBuying losses of this year and last.

This is a company that is willing and able to lose hundreds of millions of dollars to invest in and build a new business. A $7 million loss in one market during one month will be a distant memory by this time next year.

The iBuyer investment case for Zillow, Opendoor, and others is clear: this is an opportunity measured in trillions, not billions, of dollars. Within the context of long-term industry disruption, this may simply be an embarrassing detour on Zillow's inexorable march to transform real estate.

Special Thanks

The data collection for this analysis came together quickly with the help of several friends. Thank you to Rich Mackall, Oscar Castaneda, Sarah Perkins, and Divvy Homes!

iBuying is Hard: Zillow Pauses New Purchases

/Zillow announced that its iBuyer operation is paused for new business, and will not sign any additional contracts to buy homes through the end of the year.

Unprecendented Growth

Last quarter, the iBuyers purchased more houses than ever before. Preliminary market data -- which is so high I have to make note of how unusual it is -- shows another record-breaking quarter. In fact, if true, it would represent absolutely stunning growth to a scale the iBuyers have talked about but have yet to achieve.

If the public record data is accurate, Zillow purchased more than twice the number of houses in Q3 compared to Q2 (which itself was double Q1). This is the type of growth that can stress a business to its breaking point.

Missing the Signs

Aside from the massive human capital implications of scaling a business so quickly (real estate transactions are complex and people-dependent), the iBuyers can get into trouble if they pay above market for too many houses in a cooling market. This results in a growing inventory of over-priced houses that are difficult to sell.

Zeroing in on Phoenix offers a snapshot of the importance of reading and reacting to these changing market conditions. When Phoenix started to cool, Opendoor and Offerpad began to adjust by slowing down purchases. Zillow, however, did not.

As the market cooled between August and September, Opendoor and Offerpad purchased fewer houses, while Zillow purchased more.

Adjusting Prices

The iBuyers also adjusted to changing market conditions by paying less for houses. The median purchase price in Phoenix peaked in August. Opendoor and Offerpad's median purchase price also peaked in August before tracking the market and declining in September. But Zillow kept paying more and more.

Zillow continued to purchase homes well above the market median -- a full $65k higher in September. It continued to pay top dollar to fuel acquisitions at a time when the market was cooling and other iBuyers were pumping the brakes.

Strategic Implications

Growing pains. Off the rails. Ahead of your skis. Any of these phrases could apply to the situation at Zillow (or any number of other high-growth companies).

The iBuyers -- Zillow included -- experienced massive, transformational growth in 2021. And while Zillow stumbles, Opendoor appears to be firing on all cylinders and flexing its well-honed operational muscle as it reaches new highs.

The current problem seems to be unique to Zillow. The other iBuyers saw the signs and made strategic adjustments months in advance. Zillow either missed the signs, or decided to proceed despite them.

Which leads to the current situation: embarrassing, clearly not ideal, but also not the end of the world. A timely reminder that iBuying is an incredibly difficult business to scale, and when you move too fast, sometimes things break.

The Real Estate Disruptors Serious About Mortgage — A 10x Story

/Real estate tech disruptors are investing billions to build integrated brokerage and mortgage experiences. Some have more resources than others, but all have the same scaling bottlenecks. And in the end, the biggest disruptors -- and who is most at risk -- may come as a surprise.

The Bottlenecks to Scale

Each company employs licensed brokers -- Mortgage Loan Originators (MLOs) -- that occupy a critical position in securing or refinancing a mortgage. As with real estate, people remain a central component of the mortgage process, and no amount of technology, venture capital, or inspirational vision has yet to replace them.

MLOs are both a key component and a bottleneck for the iBuyers, Power Buyers, and others attempting to attach mortgage to their core services. The speed at which they hire MLOs, and the total number employed, is a reflection of how serious they are and their potential to grab market share.

Homeward and Knock, fresh off big funding rounds, are quickly growing. Newcomer Tomo is moving fast. Notably, the iBuyers remain relatively small. There is no outsize leader...until real estate portal Zillow is added into the mix.

Zillow has nearly 10x the MLOs of its smaller competitors, giving it significantly more scale and firepower for its integrated mortgage plans. Zillow is the top player...until pure play digital disrupter Better Mortgage is added into the mix.

Better Mortgage has raised nearly $1 billion in its quest to disrupt mortgage, and has nearly 10x the MLOs of Zillow. Significant firepower and scale, and clearly the top player...until industry behemoth Rocket Mortgage is added into the mix.

Ten MLOs to ten thousand MLOs. And: The number of MLOs roughly corresponds to closed loan volumes: $1.2 billion for Zillow, $14 billion for Better, and $65 billion for Rocket in Q1 2021.

Who's Disrupting Whom?

Both Rocket and Better recently announced they're hiring in-house real estate agents, which raises an interesting question about who's disrupting whom. Real estate tech companies are going after mortgage, but now mortgage is going after real estate.

These companies all have different approaches, but the destination is the same: an integrated real estate experience that seamlessly combines mortgage and brokerage. And the key execution trends are clear: in-house agents and MLOs, paired with deep discounts for consumers.

Perhaps the true takeaway is that those companies not included on the chart are the ones at risk. Whether it's being initiated from the real estate or mortgage side, both components are being smartly combined to provide an integrated, highly convenient consumer experience. The companies unable to provide that are the ones at risk.

iBuyer Profits At Risk With Falling Home Price Appreciation

/U.S. iBuyers are closer than ever to profitability. Offerpad just posted a profitable quarter, and if stock-based compensation is excluded, so did Opendoor. But the overwhelming majority of profits are coming from record home price appreciation, which is temporary, and appears to be falling.

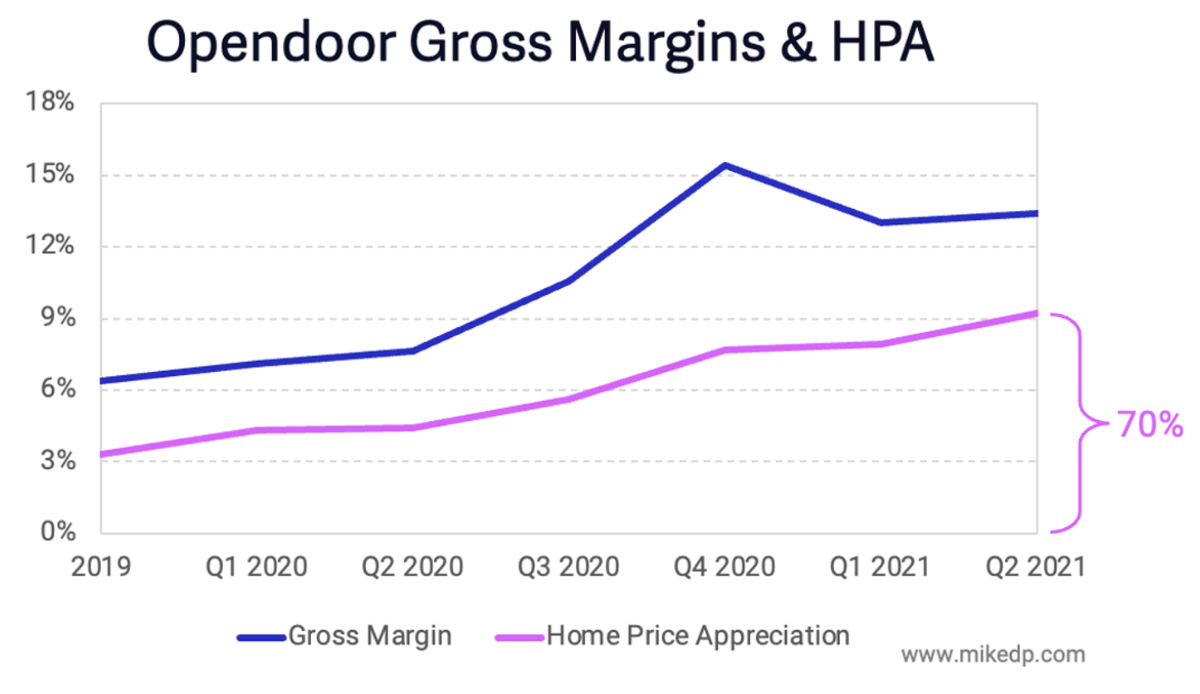

Home price appreciation (HPA) has always been a component of an iBuyer's gross profit; it is the spread between the purchase and resale price of a home. And it's significant: In Q2 2021, home price appreciation accounted for 70 percent of Opendoor's gross profit margin.

Over time, home price appreciation is becoming a larger component of Opendoor's gross profit margin -- rising from 50 percent in 2019 to 70 percent in Q2 2021.

What Goes Up Must Come Down?

Home price appreciation rates are beginning to cool in major markets across the U.S., including Phoenix, where the median iBuyer home price appreciation has fallen 50 percent since May. Opendoor's median home price appreciation for homes sold in August is just 2.7 percent, down a massive 75 percent from 10.7 percent in May.

The decline will certainly have a material impact on iBuyer gross profit margins, which have reached record highs during 2021.

Opendoor's gross margins have increased an impressive 700 basis points, from 6.4 percent to 13.4 percent, between 2019 and Q2 2021. But 84 percent of that improvement is from rising home price appreciation (3 percent → 9.2 percent).

Strategic Implications

Gross profit margin includes an iBuyer's service fees, home price appreciation, and repair costs (and in the case of Opendoor and Offerpad, also includes revenue from ancillary services like title insurance, mortgage, and brokerage services).

The iBuyers' recent profitability is being driven by record home price appreciation -- a temporary artifact of a hot housing market. As the market eases off its red hot highs, slowing price appreciation may have an adverse effect on iBuyer profit margins.

Thanks to Sarah Perkins of Lawyers Title (check out her real estate updates at theazmarket.com), for helping me dig through tax records.

Realtor.com Grows Agent Revenues Faster Than Zillow

/Top U.S. portals Zillow and realtor.com recently released their latest financial results. Historically, Zillow has maintained a consistent 2.5x agent revenue lead over realtor.com. But in the last quarter that lead has slipped, as realtor.com grew its agent revenues much more than Zillow.

Since the last quarter, Zillow increased its premier agent revenues by $14 million, or 4 percent, compared to an increase in realtor.com's real estate revenues of $24 million, or 18 percent. These are each company's agent lead gen programs, and don't include adjacencies like iBuying and mortgage.

That's a big jump and an outsize increase in realtor.com's agent lead gen revenues. The growth is potentially driven by the expansion of the Opcity referral program, which now makes up 30 percent of total revenues.

Strategic Implications

The decline in Zillow's revenue lead may be the start of a trend, or it may be a temporary blip (which has been seen before). Quarterly results from the past three years show that the companies are still within the normal bounds of fluctuations.

While the revenue dominance between Zillow and realtor.com has remained relatively static, the total spend from agents has not. Combined, Zillow and realtor.com have managed to increase agent revenues 55 percent over the past two years, from $327 million to $507 million -- seemingly fueled by the hot market.

So while Zillow and realtor.com have yet to consistently outperform each other, they're still managing to extract more revenue than ever before from their best customers: real estate agents.