Momentum Builds in Mortgage Disruption

/Significant changes continue in the mortgage space as portals, iBuyers, Power Buyers, and brokers invest in building end-to-end real estate ecosystems.

Why it matters: Real estate tech disruptors are investing billions to build integrated brokerage and mortgage experiences. These companies employ licensed brokers -- Mortgage Loan Originators (MLOs) -- that occupy a critical position in securing or refinancing a mortgage.

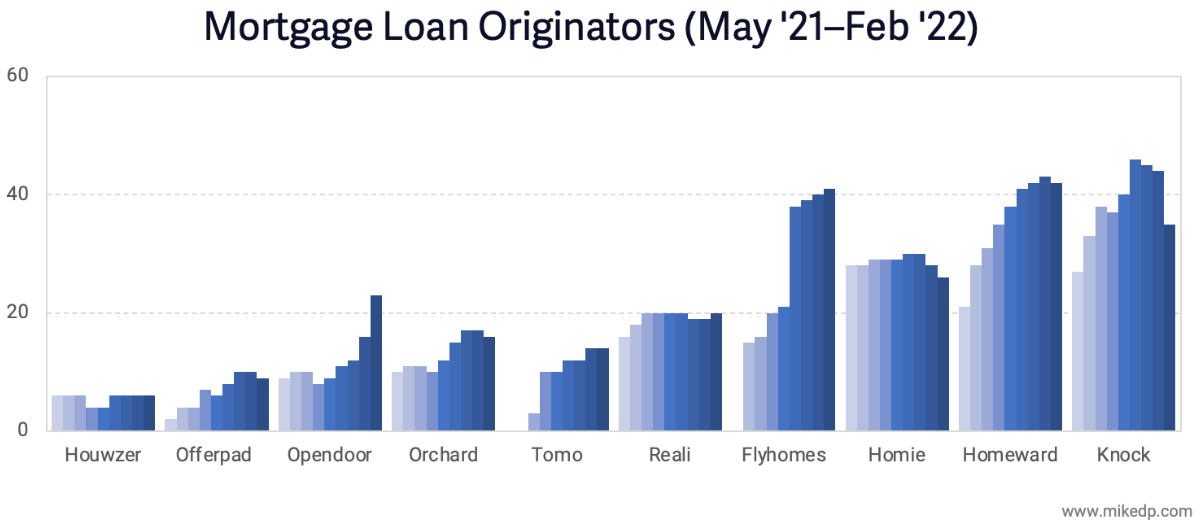

The number and growth of MLOs is an important leading indicator of a company's firepower and strategic intent.

Big picture: Of the venture-backed disruptor pack, the companies with the most MLOs are those attempting to develop a complete ecosystem play anchored around mortgage: Power Buyers.

Homeward, Knock, and Flyhomes are good examples, while Orchard lags due to a slower-growth employee agent business model.

Notable growth in MLOs occurred at Opendoor and Flyhomes, sending a strong signal of intent.

In November 2021, Opendoor acquired RedDoor, a digital-first mortgage brokerage, with 10 MLOs.

In Q4 2021, Flyhomes accelerated its hiring of MLOs to meet current and expected demand.

Comparatively, Zillow has more firepower but has been shedding MLOs since May 2021, with a significant drop in January.

Knock, a Power Buyer, also saw a significant decline in MLOs during January.

Redfin made a huge move in January, acquiring Bay Equity Home Loans for $135 million, adding 485 MLOs to its roster.

This positions Redfin well ahead of Zillow in terms of underwriting capacity -- and is a strong signal of future intent in the space.

Yes, but: All of these companies pale in comparison to the behemoths of the mortgage industry.

Rocket Mortgage (12k MLOs) and Better Mortgage (1.5k MLOs) have both announced plans of their own to expand into the brokerage space.

The bottom line: Mortgage lies directly on the path of brokers, portals, and disruptors attempting to build an end-to-end real estate ecosystem.

Opendoor is clearly ramping up its mortgage resources and ambitions, while Redfin has made a big investment in the space.

Tracking the number of MLOs over time reveals how serious these companies are and their potential to grab market share.