Google Enters the Portal Wars

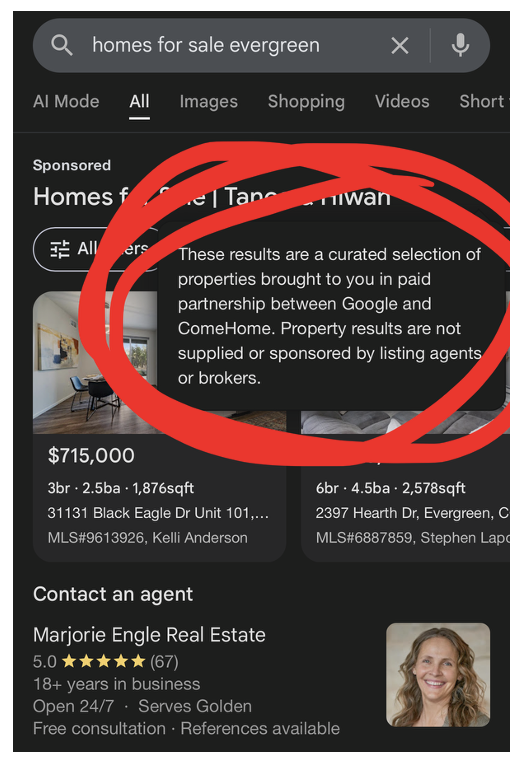

/Sometimes a picture is worth a thousand words, and I think this might be one of those times.

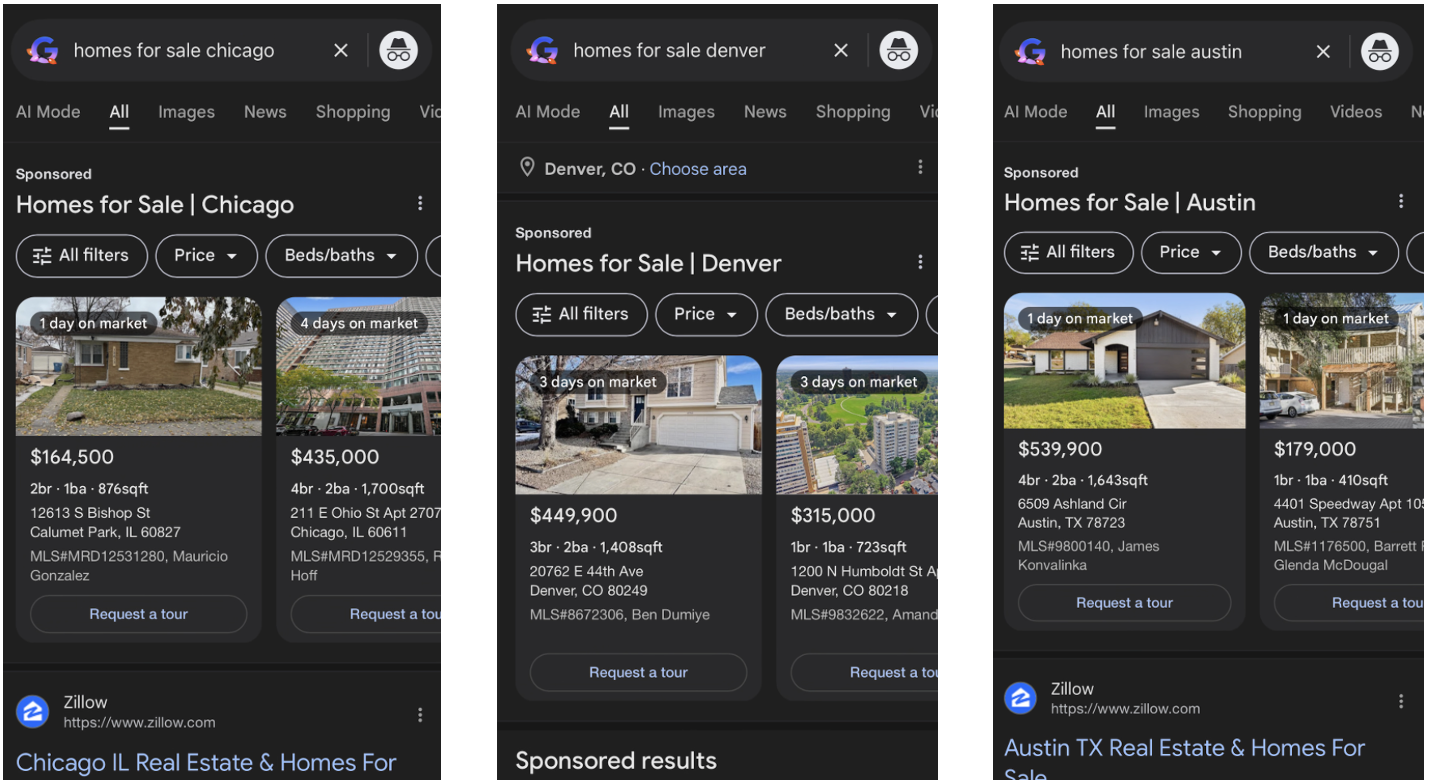

Why it matters: Google putting for sale listings directly into search results — even if it's a test — is a big deal.

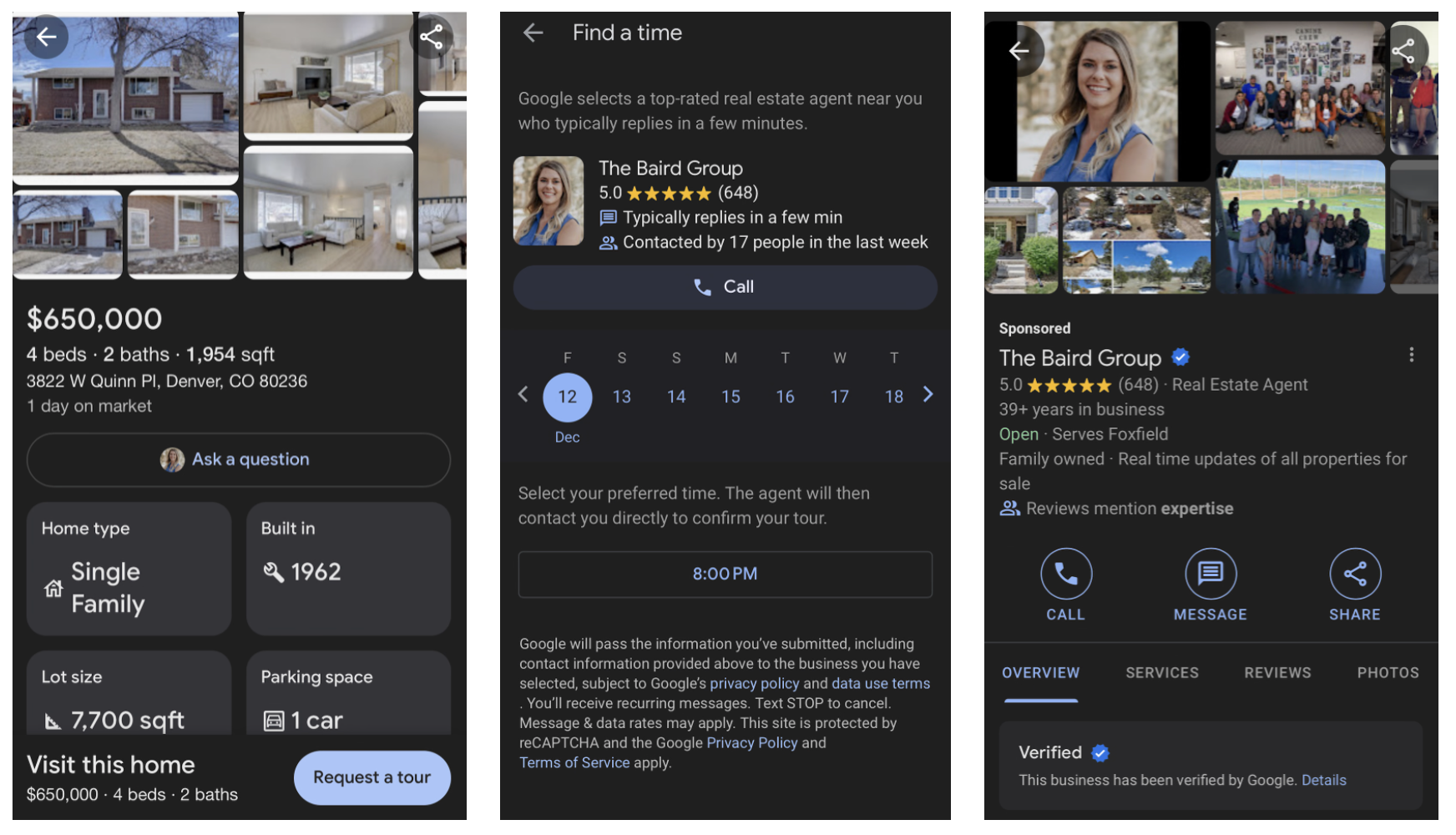

The functionality includes full property detail pages, links to request a tour, and contact an agent — you know, the core business model of real estate portals.

This appears to be a test, live in a limited number of markets and only on mobile.

It appears this is a partnership with ComeHome by HouseCanary, and property results are "not supplied or sponsored by listing agents or brokers."

The bottom line: There are a lot of potential implications here, from the incumbent portals to exclusive listings to AI and international, but for now it's all speculation.

Let's wait and see how this plays out.

If you thought 2025 was interesting, 2026 is shaping up to be a zinger!