Portal War ‘24: Traffic is a Non-Zero-Sum Game

/Homes.com appears to have solidified its place as the #2 portal in the U.S. market, without a corresponding decline in traffic at any other portal.

Why it matters: Portal traffic appears to be a non-zero-sum game – traffic gained by one portal is additive and not coming at the expense of other portals.

Dig deeper: In the first quarter of 2023, the big three real estate portals – Zillow, realtor.com, and Redfin – had a combined 334 million average monthly unique visitors.

Fast forward to the first quarter of 2024 and those same portals have a combined 338 million average monthly uniques – no change – with Homes.com growing to an additional 94 million average monthly uniques.

And that’s just for Homes.com – if you include CoStar’s entire residential network, which includes Apartments.com, the scale is even greater.

It's a valid comparison; the other portals also include traffic from a larger network of sites, including rentals.

The result is that CoStar’s resi network has nearly double the traffic of realtor.com.

CoStar’s traffic reporting hasn’t been consistent – it has fluctuated between Homes.com and the entire residential network, and sometimes includes quarterly averages and other times specific months.

CoStar’s inconsistent reporting runs the risk of reducing trust in its traffic numbers, even when the underlying results are impressively real.

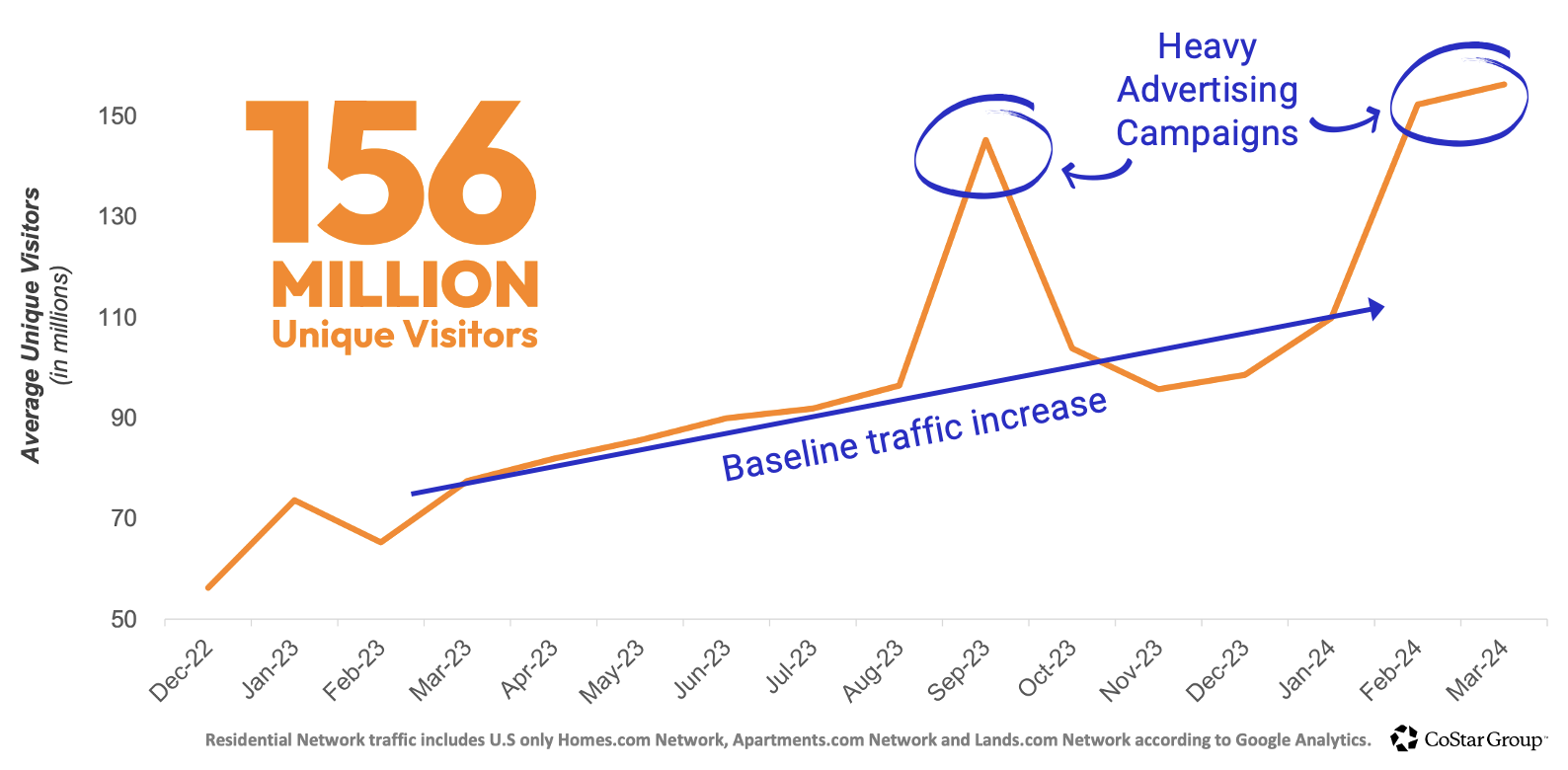

But traffic has unequivocally increased over the past year, punctuated by two periods of heavy advertising.

CoStar’s advertising spend reached an all-time high in Q1 2024 – which directly corresponds to the recent traffic surge in February and March.

The bottom line: While Homes.com’s traffic increase is additive to the market and not affecting other portals’ traffic, that’s not to say it won’t affect their businesses.

Unlike website visits, there is a finite amount of transactions, commission dollars, and agents willing to spend money online; that’s a zero-sum game.

Note on data: Collecting traffic data for Homes.com and CoStar’s residential network relies on a combination of assembling clues, triangulation, and making a few assumptions. The numbers above are estimates based on public information.