For First Time, Opendoor Selling Homes for a Loss

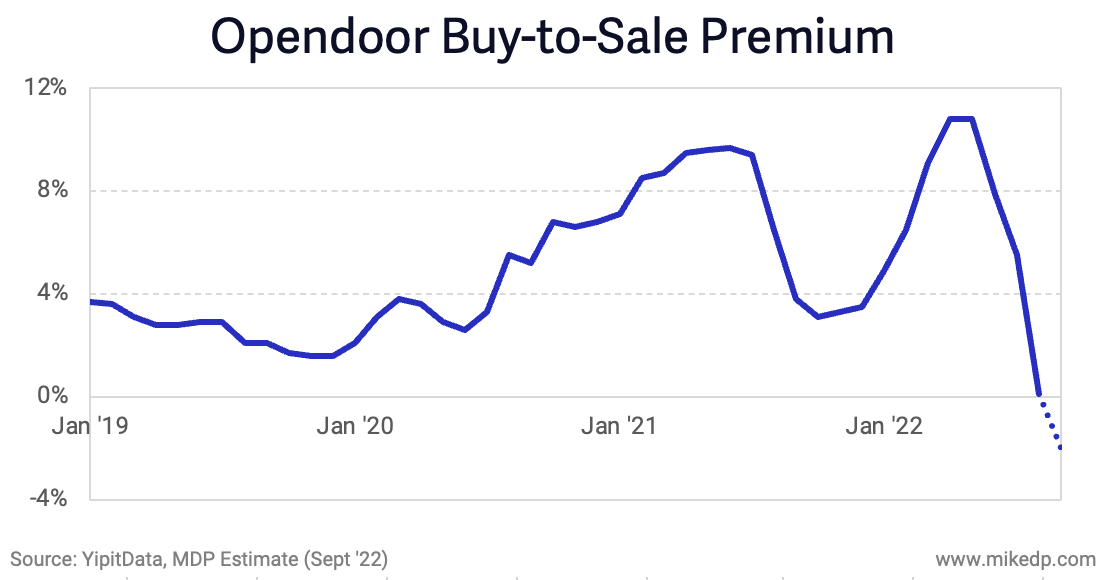

/Opendoor's buy-to-sale premium -- the difference between the purchase and resale price of its homes -- has reached a record, negative low.

Why it matters: For the first time in its existence, Opendoor is entering territory, where, in aggregate, it is selling homes for less than their purchase price.

This certainly puts the company (and business model) under pressure, and is reminiscent of the situation faced by Zillow last year.

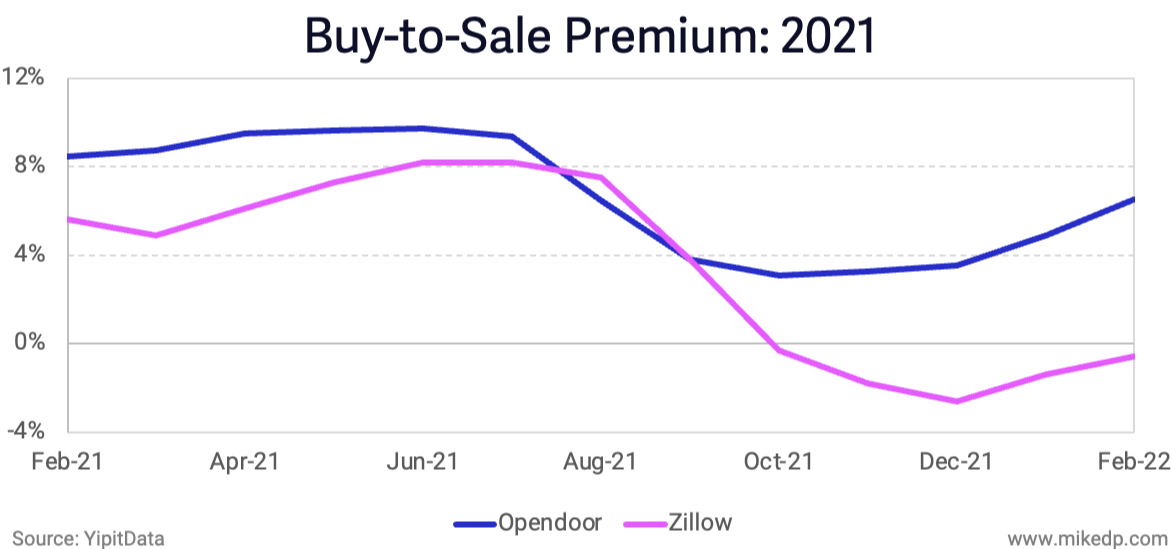

Go back: Opendoor outperformed Zillow during the dark days of 2021 (when Zillow Offers imploded); its buy-to-sale premium never dipped below zero percent.

At the time, this demonstrated that Opendoor's pricing operation was a powerful competitive advantage.

But 2022 is different; transposing Zillow's performance in 2021 to Opendoor in 2022 shows a similar deterioration in the buy-to-sale premium.

Even Opendoor's pricing operation can't keep up with the rapidly changing market (or perhaps this was a calculated risk Opendoor was willing to take).

(I've estimated a negative two percent buy-to-sale premium in September, but it's still too early to know where the month will land.)

While Opendoor's buy-to-sale premium is approaching the same negative levels that sunk Zillow last year, it doesn't mean the result will be the same.

Zillow experienced a system-wide iBuying failure, and exited because it was unwilling to accept the risks to its entire business going forward.

Opendoor, built from the ground up as an iBuyer and willing to accept those same risks, is vigorously managing the current situation.

Opendoor's buy-to-list premium, a leading indicator of future profitability, appears more optimized than Zillow's in 2021; the distribution is less concentrated with more potential resale upside.

It would be fair to say Opendoor's pricing operation is more nuanced and sophisticated.

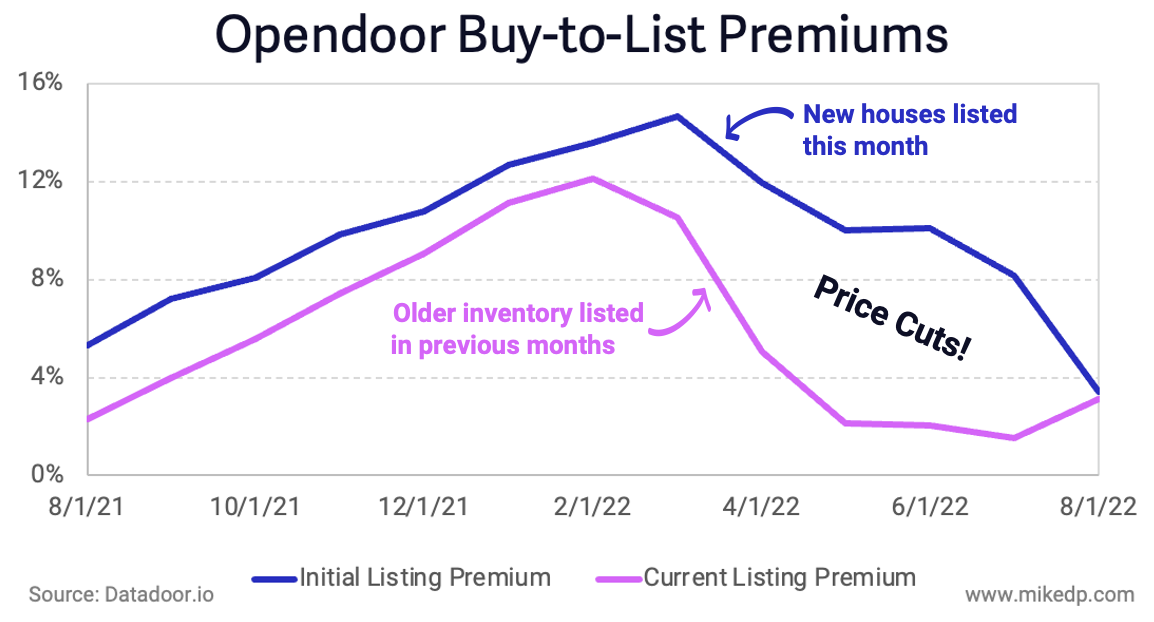

Opendoor is also leveraging aggressive price cuts.

The initial buy-to-list premium (blue line) represents new houses listed in a current month, while the current buy-to-list premium (pink line) includes houses listed in previous months.

The difference is price cuts; Opendoor cutting the initial listing price down to the current listing price -- which it is doing energetically across its markets.

Some perspective: Opendoor is selling around 2,000 houses per month with an average sale price of $400,000. A buy-to-sale loss of two percent amounts to a $16 million loss.

Yes, and: Opendoor is racking up other expenses, including $3,500 buyer agent commission bonuses and seller concessions, to previously unseen levels.

The result is going to be a pretty tough Q3.

The bottom line: This is market whiplash -- just six months ago I was talking about how Opendoor was going to make record profits from home price appreciation.

You can't have highs without the lows -- this is the nature of iBuying, and now is Opendoor's chance to prove its model works during a significant downturn.

Thank you to my friends at Datadoor.io, Yipit Data, and Max Mitchell for their help with data for this analysis. "In God we trust; all others bring data."