Zillow Pressures Flex Teams to Perform

/Zillow continues to double down on its mortgage business, this time by compelling Flex teams to send back leads that have expressed interest in learning more about Zillow Home Loans – or risk getting kicked out of the program.

Why it matters: Zillow is leveraging its immense market power and forcing its partner ecosystem to change behavior, all in an effort to meet its revenue goals.

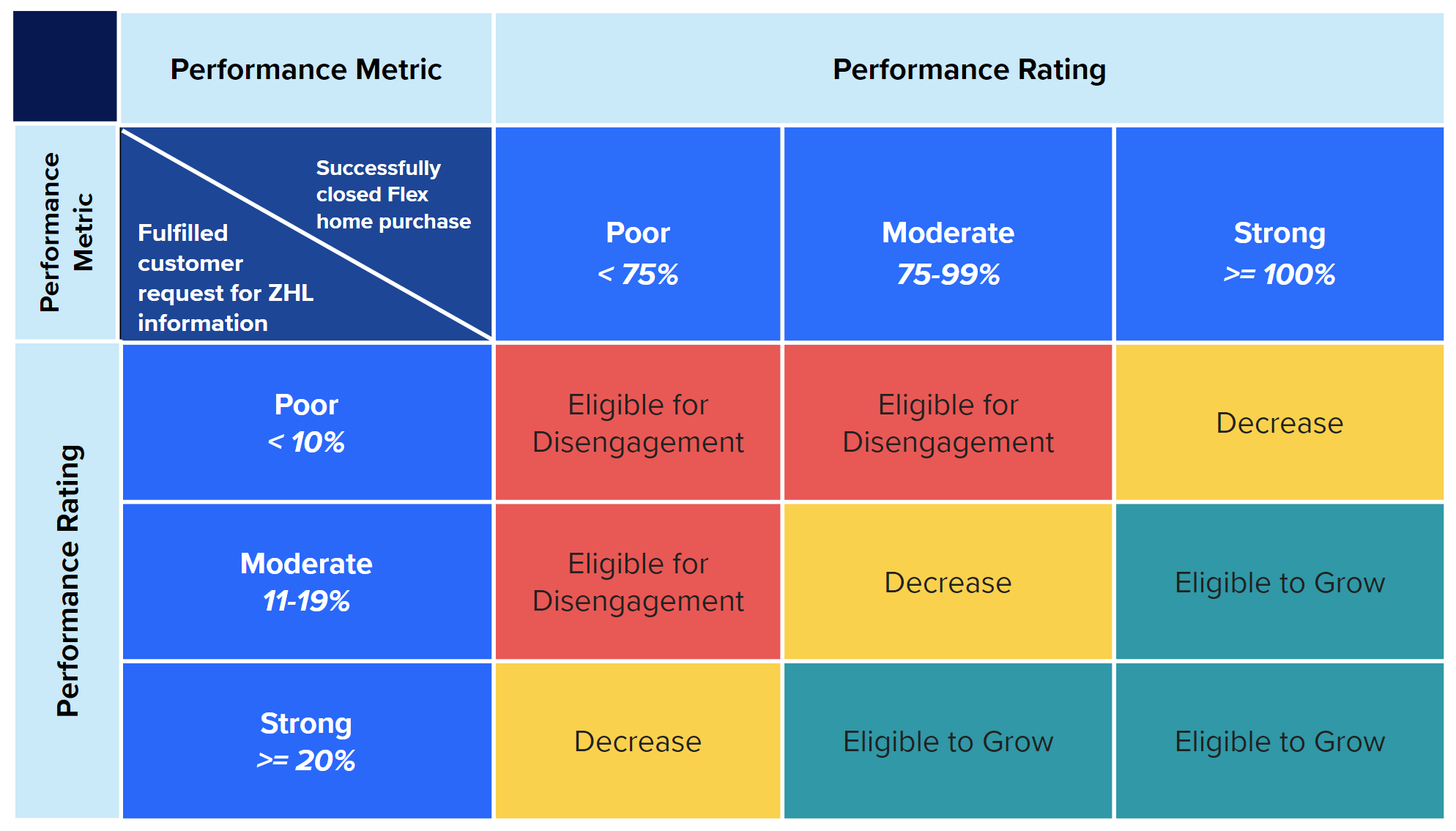

The following chart, provided by Zillow to its Flex partners, clearly outlines its performance expectations.

Underperformance, in terms of not converting buyer leads or not sending leads back to Zillow Home Loans, can result in “disengagement” – no more leads.

While Flex teams that convert leads and send customers back to Zillow Home Loans are eligible to get more leads.

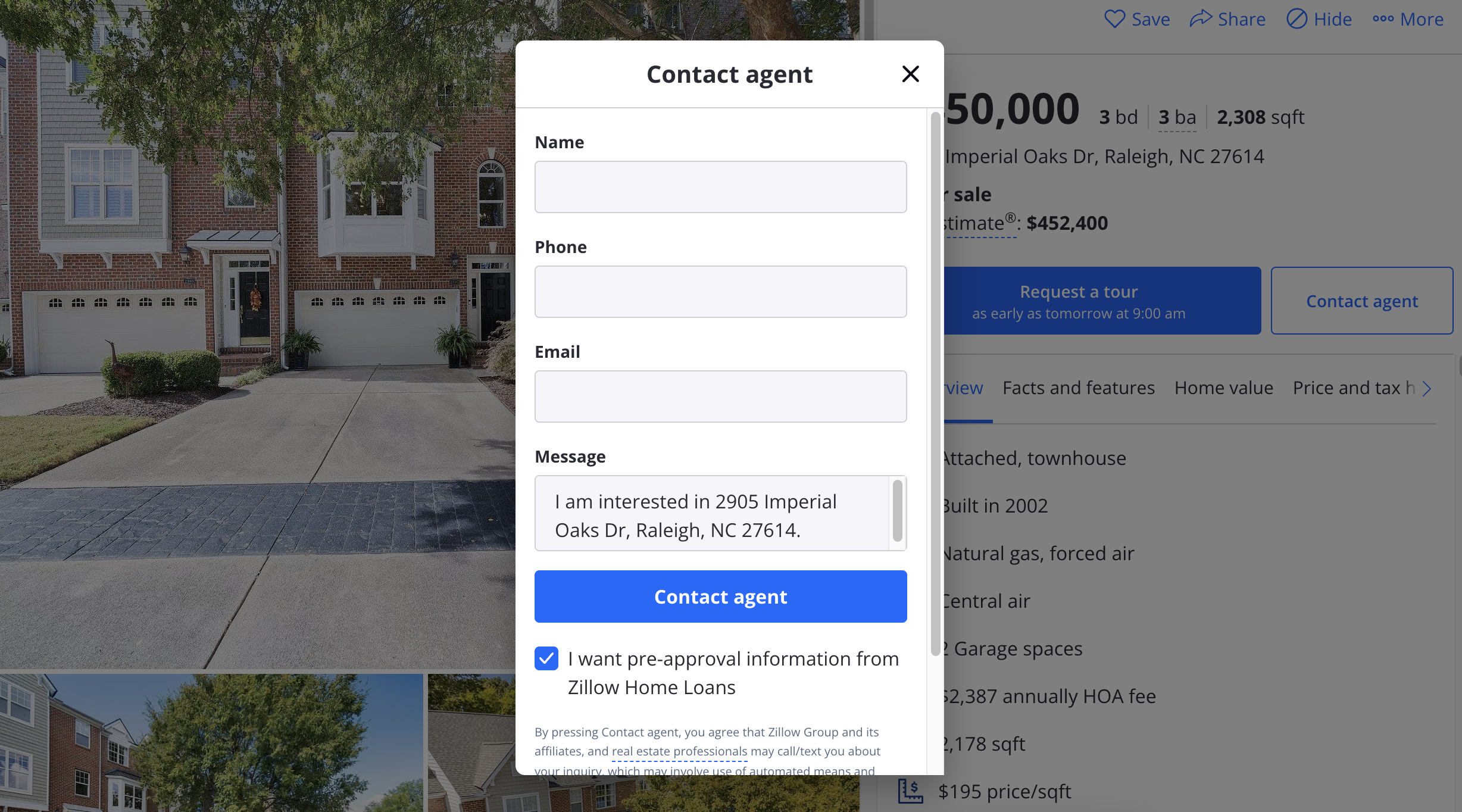

Zillow asks Flex agents to send back leads that have expressed interest in learning more about Zillow Home Loans.

Consumers “express interest” through a checkbox on the initial contact form, which is checked by default – so it’s really an option to opt-out rather than opt-in.

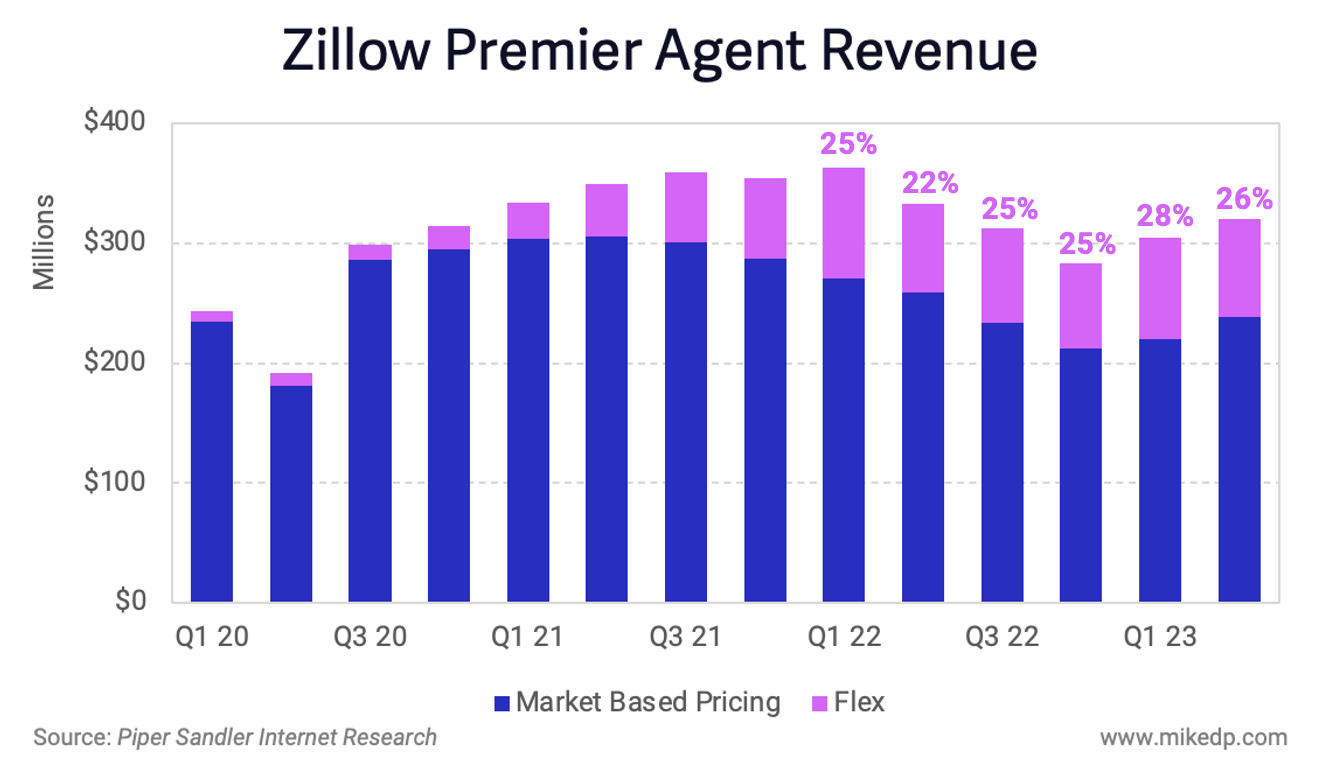

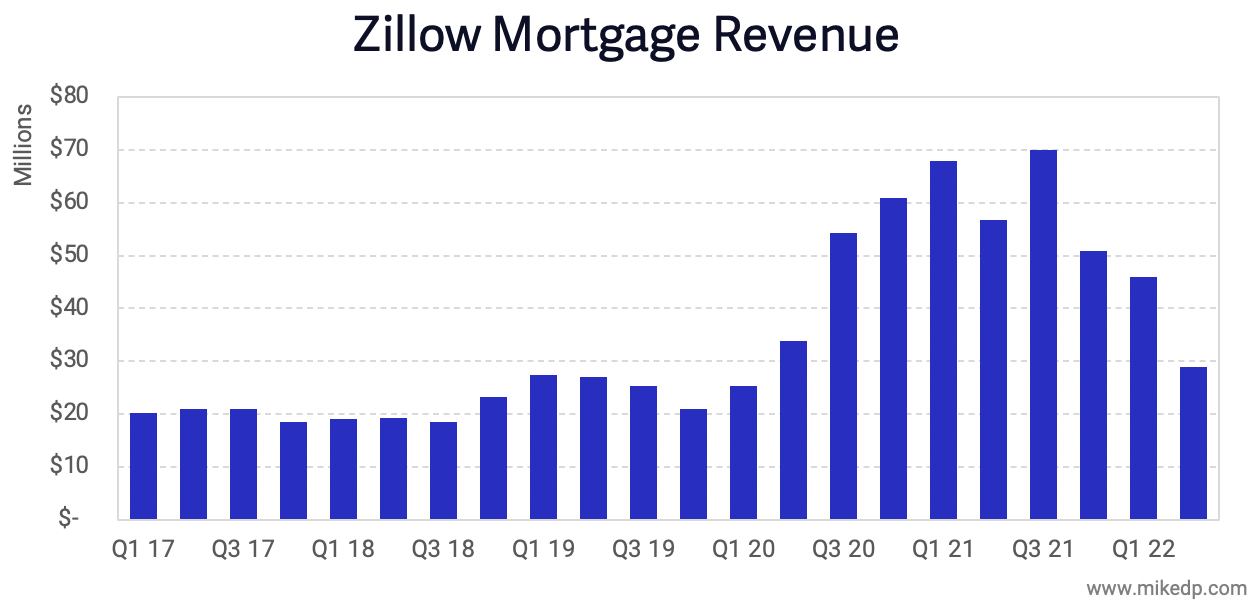

This is another clear signal of the critical importance of Zillow Home Loans to Zillow’s long-term strategic plan to double revenue.

Zillow continues to invest in its mortgage business and is the only company among its peers that is adding mortgage loan originators to its headcount.

Zillow is also raising its Flex success fee to 40 percent across a number of markets.

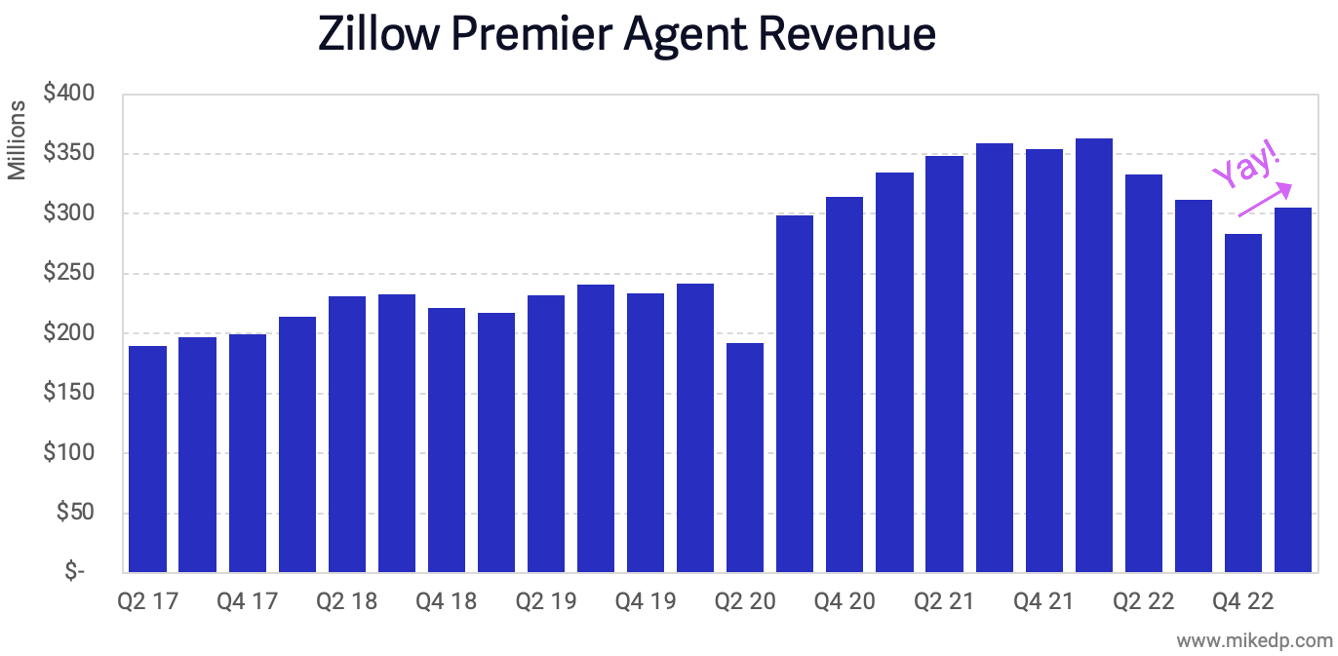

Perspective: While Zillow is strongly leveraging its power on the market, it only affects a very small percentage of agents and transactions.

Less than five percent of the U.S. real estate agent population works with Zillow (with far fewer Flex agents), and Zillow only touches around three percent of U.S. real estate transactions.

The bottom line: Zillow is curating a small, exclusive ecosystem of agents that are willing to play by its rules, which now includes tight integration with Zillow Home Loans.

Zillow continues to lean heavily into mortgage as part of its broader strategy, even though Zillow Home Loans has lost $283 million since 2017.

At the end of the day, there is only so much Zillow itself can do; it is reliant on its agent partners, and Zillow is exerting immense pressure on those partners to achieve its goals.