Observations on the U.S. Market Recovery

/The U.S. real estate market is in the midst of a recovery. Important lead indicators are up from their lows of the past several months, and nearly every graph is moving up and to the right. But a high-level snapshot does not paint an accurate picture; a deeper look reveals the varied nature of the recovery rollercoaster.

A National Look

Redfin does an excellent job of presenting an up-to-date and accurate picture of the U.S. market. Starting at the top of the funnel -- new listings -- the recovery is clearly visible. New listings coming to market are swiftly rising, and are currently down only 18 percent compared to the same time last year (and yes, it looks like a checkmark).

Pending home sales took a big hit in April and May, but are recovering just as quickly as new listings, a sign of strong buyer demand (likely driven by low mortgage rates). Pending sales are nearly at the same level they were last year.

Home sales lag all other indicators -- it can take one to three months between a new listing coming to market and a home being sold. Transaction volumes will recover, but it may take many months.

National data paints a straightforward, if over-simplistic, picture of a real estate market in recovery. A market-by-market analysis shows the varied nature of recovery.

Market-Specific Analysis

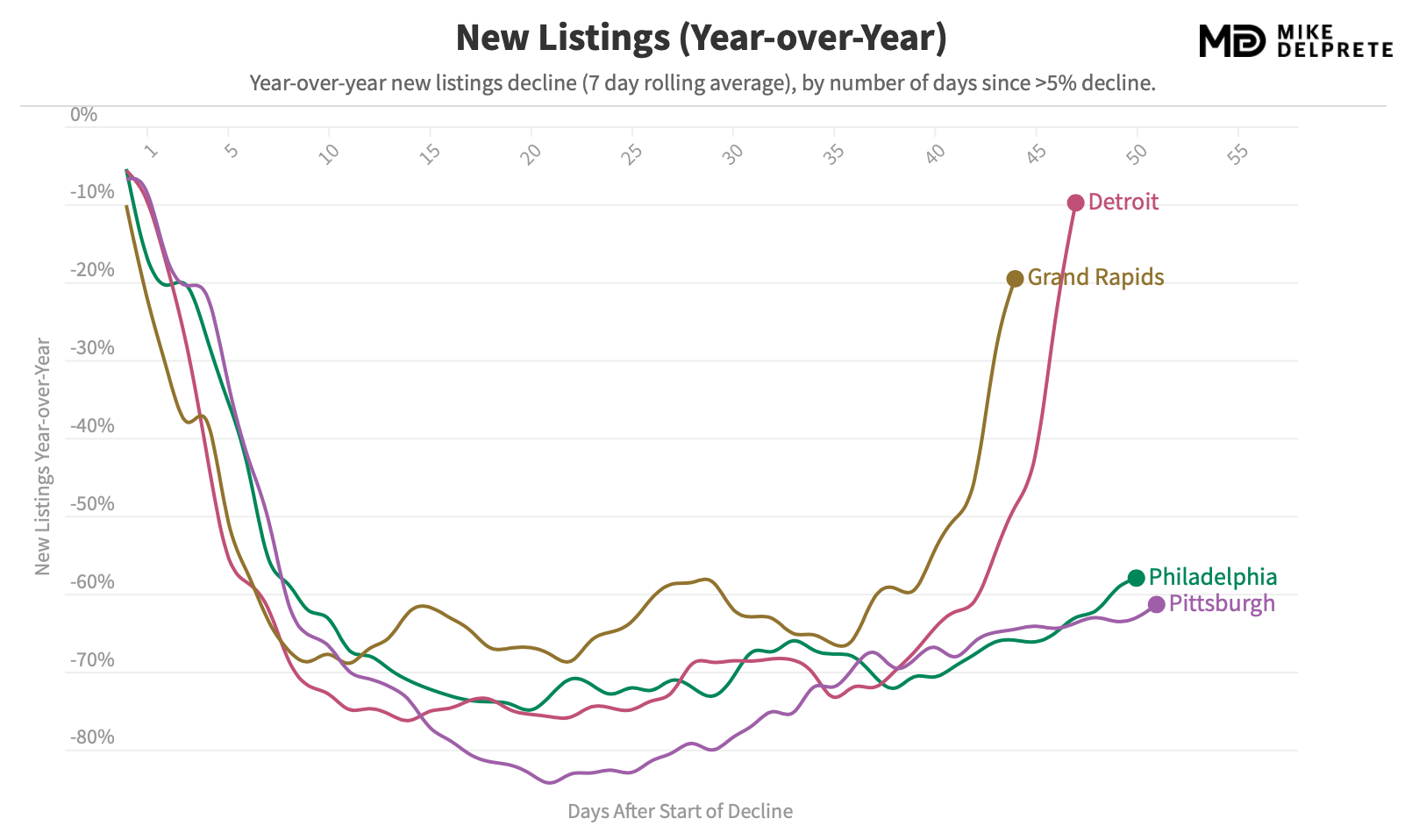

There are many different markets in the U.S., and each is recovering differently. Utilizing my Real Estate Market Tracker (which is an interactive tool; give it a spin), it's clear that all markets are seeing an uptick in pending sales, but at different rates.

Looking at the data on a year over year basis reveals an interesting trend: Half the markets surveyed are up compared to last year, while half are down significantly.

For example: Pending home sales in Austin and Tampa are up 30–40 percent after a quick recovery, reflecting very strong buyer demand. In the major coastal cities like L.A. and NYC, pending sales are still down 30–60 percent compared to last year.

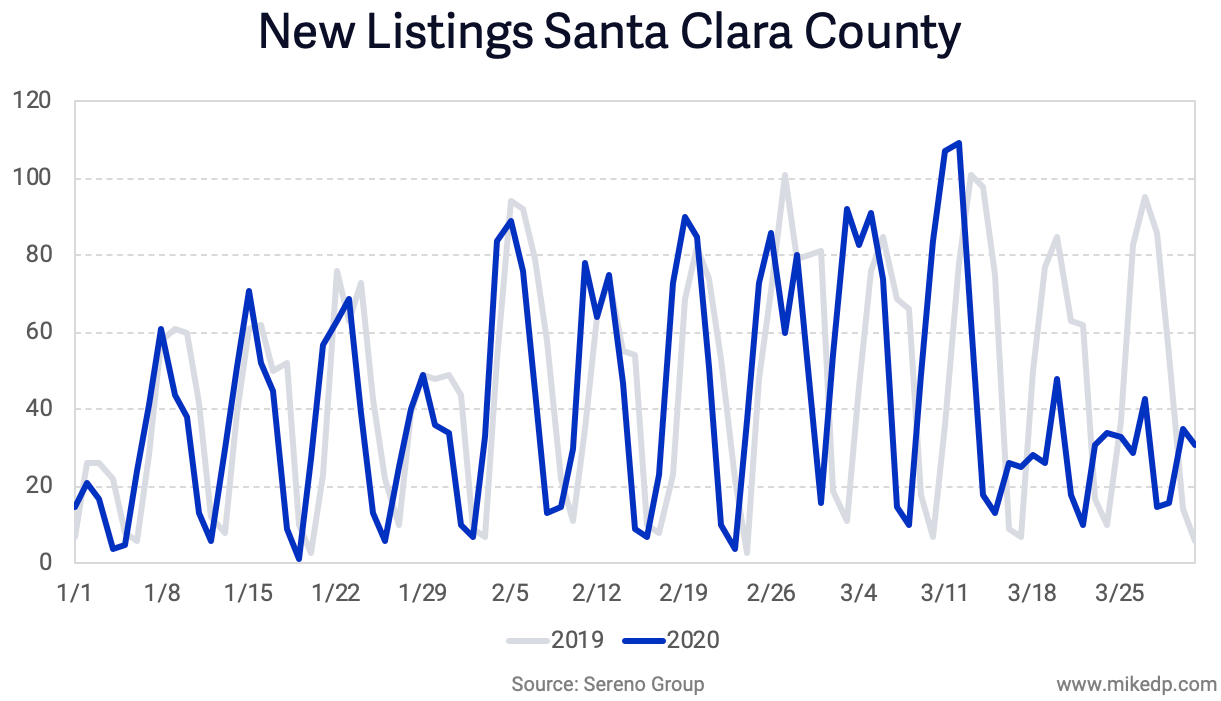

The picture of recovery in King County, Washington (Seattle) is common in many markets: Gradual. New listings coming to market, which were down 50 percent in March, have slowly increased over the span of three months, and are still not at historical levels.

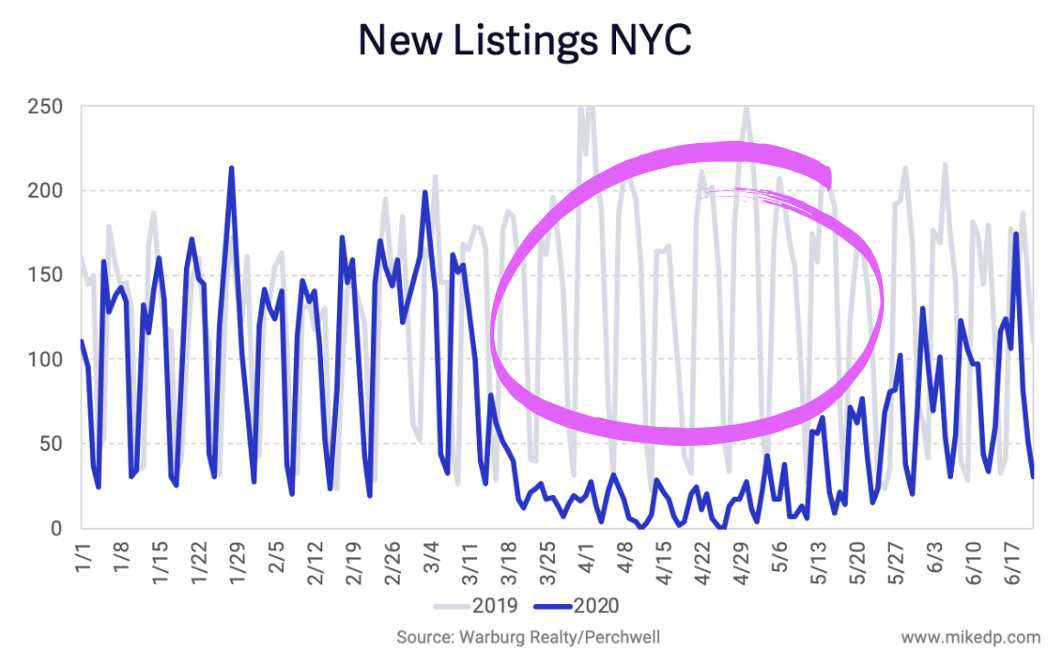

New York City saw the most severe drop in new listings -- down 85 percent -- and is finally seeing an uptick (call it a surge?) in new listing volumes after three months of real estate lockdown.

But the big question for NYC is: What happens to the missing three months of new listings? It's a massive volume. Will they come to market now, over the next few months, or will it remain a giant hole in 2020 transaction volumes?

The Key Takeaway

Looking at only the national numbers paints an over-simplified version of the U.S. market recovery. It looks like a smooth, predictable rollercoaster that has gone down and is steadily heading back up. In reality, there are ten thousand different rollercoasters moving independently of each other, all at different speeds and at different points on different tracks. Not all markets will recover the same.

If you enjoy data as much as I do, give the Real Estate Market Tracker a spin. Compare any number of markets in the U.S. I also highly recommend visiting Redfin's Data Center and Zillow’s Weekly Market Report for national and market-specific data.