Real Estate Portals See Up to 40% Drop in Traffic, Leads

/The spread of the coronavirus -- and associated lockdowns, quarantines, and travel restrictions -- have caused a dramatic drop in traffic and leads at the world’s top real estate portals. These metrics are critical indicators of a top of the funnel slowdown in the real estate market.

A Global Overview

The data below is from a handful of leading real estate portals around the world: SeLoger in France, Zoopla in the U.K., Funda in The Netherlands, Zillow in the U.S., and a European portal and a U.S. portal that wish to remain anonymous. The evidence is clear: on average, portals are seeing around a 30 percent drop in traffic (as a weekly moving average) as a result of the pandemic.

The data shows a similar, although slightly higher, decline in the number of leads being generated by the portals -- ranging from 28 to 50 percent, with an average of 33 percent.

The spreading pandemic is clearly affecting the world’s top portals. They are generating less traffic and considerably less leads, which is a reflection of a slowing property market.

U.K. Snapshot: Zoopla

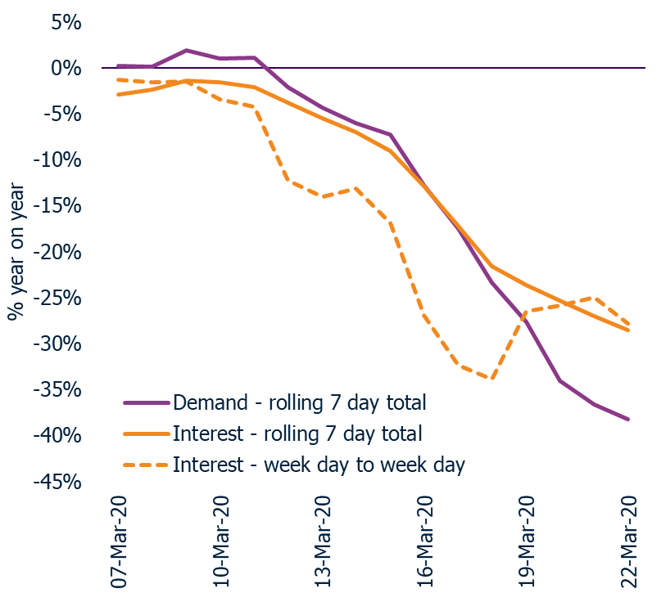

Zoopla is the U.K.’s second-largest portal by traffic, and is on the front lines of up-to-date data analysis. Over the course of March, it has seen a 30 percent drop in traffic (interest) and a 40 percent drop in demand (leads generated through the system).

Interestingly, Zoopla is seeing a slight rebound in traffic over the past few days -- likely as consumers adapt to their new reality, shut themselves indoors, and turn to the portal as a form of browsing entertainment. The trend is similar in The Netherlands, where leading portal Funda reports that traffic is slowly growing back to normal levels.

U.S. Snapshot: Zillow

During an earlier conference call, Zillow stated its traffic was down 20 percent from last year. Considering its traffic was up 10 percent annually in the previous quarter, the weekly decline is closer to 30 percent -- which matches the stated decline in connection requests, or leads, through the system.

Another large U.S. real estate portal (not a publicly traded company) was willing to anonymously share its traffic and lead statistics. The 30 percent traffic drop in March is clear (and most likely reflective of the other U.S. portals).

This same portal reports a corresponding drop in leads of 28 percent, closely matching the drop in traffic, and nearly identical to category leader Zillow.

True Discounts

Earlier this week I conducted an analysis of how the top real estate portals around the world were reacting to Covid-19, primarily by offering customer discounts. For agent and broker customers of these portals, it’s worth understanding that a reduction in fees comes along with a reduction in leads.

For example, Zillow is offering its premier agent customers a 50 percent discount, but for 30 percent fewer leads.

Assuming a hypothetical situation where a customer was spending $10,000 for 100 leads, that customer is now spending $5,000 for 70 leads -- the true discount is closer to 29 percent.

Top of the Funnel

A drop in portal traffic -- and the associated leads generated through the system -- is the ultimate, top of the funnel measure of a slowdown in real estate transactions. Consumers are reducing their visits to real estate portals, which is a more passive interaction with the market, and significantly reducing the number of lead forms filled out to inquire about a property, which is a more active measure of intent.

A drop in leads will ripple through the entire real estate ecosystem. Less leads for agents means less business, and less business means less transactions. The key questions to watch in the coming weeks (and months) are: Does the drop in leads go any lower, how long does the decline last, and how long will the recovery be before we’re back to normal levels?

Further Reading and Thanks

I've published several analyses of the massive changes occurring in the real estate industry since the COVID-19 pandemic:

Survival of the Fittest: The Real Estate Pandemic Survival Guide

Unintended Advantages: iBuying in a World of Social Distancing

I have deep gratitude for the portals that shared their data for this analysis -- either publicly or directly with me. Making this information available helps us replace uncertainty and fear with a growing certainty and resiliency. Thank you!