Visualizing Existing Home Sales

/A collaboration between Mike DelPrete and Aziz Sunderji

There is an abundance of data about the U.S. housing market – and for every metric, there are an infinite number of ways of slicing and dicing the data.

Why it matters: What’s needed is a way of simplifying the data – ultimately, data should tell a story and provide meaning.

This week I am teaming up with real estate data visualization specialist Aziz Sunderji of Home Economics to contextualize yesterday's existing home sales report.

401,000 homes were sold across the country in August, and we think the best way to contextualize the data is to compare these figures to the same month in prior years. By this measure, home sales last month were the lowest since August 2010.

Sales in the West have declined against the long-run average more than in other regions (though the Northeast is not far behind). Transactions are holding up better in the Midwest and in the South.

Momentum in home sales over the past six months has been sluggish, and well below historical averages.

And sales are consistently falling below the historical average, especially during the past five months -- although August was a slight improvement over July.

The current downturn shows signs of similarity to past housing downturns, both in velocity and duration.

Our ask: Use these charts! Include them in your own research and use them to educate consumers, board members, and peers.

The more we collectively understand the data – and make meaning from it – the better decisions we’ll make to move forward with clarity.

Zillow Still Crazy About Mortgages

/In a down market with historically high interest rates, Zillow continues to invest in its mortgage business – Zillow Home Loans – and is the only company among its peers that is adding mortgage loan originators (MLOs) to its headcount.

Why it matters: While other real estate tech companies are shedding mortgage headcount, cutting expenses, and closing their mortgage operations, Zillow’s investment is a clear sign of strategic intent and a reflection of its ability to invest for the long-term.

Zillow’s real estate peers, including iBuyers, Power Buyers, digital brokerages, and mortgage start-ups, have all shed MLOs over the past 18 months.

Some companies, like Opendoor, have shut down their entire mortgage operations, while others have cut MLO headcount by half (or more).

The number of Zillow’s MLOs has fluctuated over time, but there has been a sustained and noticeable increase throughout 2023.

Zillow’s MLO headcount is up around 40 percent since February ‘23.

Better Mortgage, which recently went public via a SPAC, presents a very different story of MLO headcount.

Zillow Home Loans is still relatively small compared to industry peers, including Redfin’s Bay Equity and Prosperity Home Mortgage (a subsidiary of mega-broker HomeServices of America).

Zoom out: And as I’ve written in the past, these companies are a drop in the bucket compared to mortgage industry behemoth Rocket Mortgage.

Remember: Zillow’s recent financial reporting changes have removed an informative layer of transparency from its business.

After six years of losses, it’s no longer possible to track the profitability and operating expenses of the mortgage business unit.

The bottom line: The number and growth of MLOs is an important leading indicator of a company's firepower and strategic intent.

With continued struggles around profitability and uncertainty around adoption, Zillow Home Loans is far from an unequivocal success story – but the company continues its heavy investment.

The depth of investment stands out by going against the grain of other mortgage companies, real estate tech disruptors, and the overall market – which highlights the importance of mortgage for Zillow.

Industry Evolution Continues During a Receding Tide

/At the close of the first half of 2023, key metrics – agent count, transaction volumes, and overall profitability – highlight a brokerage industry evolving along two paths.

Why it matters: In my recent Inman presentation, I unpacked what a Netflix vs. Blockbuster moment in real estate would look like, and how a receding tide reveals business model resiliency and clues about future growth.

Earlier this year, I suggested that “to identify the brokerage business models of the future, one simply needs to follow the agents.” (Read more: Agent Migratory Patterns.)

There is a clear split between the low-fee brokerage models that are attracting agents, and the legacy brokerages that are shedding agents – a trend that continues in Q2.

The notable change is Compass, which once again grew its agent count after shedding around 400 agents during Q1 – putting the company back on the growth side of the ledger.

The net change in agents is correlated to brokerage transaction volume; in general, more agents yield more transactions.

The overall market was up 37 percent in Q2 compared to the previous quarter, which can be attributed to seasonal growth.

The most notable outliers of the past quarter are Real and Compass, which both significantly outperformed the market.

And transaction volumes directly correlate to brokerage revenue.

Overall brokerage revenues are depressed in 2023, and continue to follow seasonal trends.

Compass has maintained its revenue leadership position, with eXp making significant gains over the past two years (while industry incumbent Anywhere has lost its top spot).

Overall brokerage profitability, a function of revenue and a company’s operating expenses, is clearly split into two camps.

The legacy brokerages had a much better Q2 (including Compass being cash flow positive), but are still unprofitable at a Net Income level for the first half of the year.

With significantly lower fixed costs and operational overhead, the low-fee brokerage models continue to have a structural advantage, and are operating much more profitably than legacy brokerages in the down market.

The bottom line: In my recent Inman presentation, I outlined what a Netflix vs. Blockbuster moment in residential real estate would look like.

Incumbents would have a stagnant market share with high fixed costs and a limited ability to evolve, while disruptors would be exponentially gaining market share with an easy to define unfair advantage.

The shifting market – the receding tide – is revealing these changes across the industry, leading to a bifurcation of business models with key differences in market share, growth, and profitability.

The Last Mile Problem

/Real estate has a last mile problem. Despite advances in online lead generation, tech platforms, emerging AI assistants, and disruptive new models -- an agent is still the necessary bridge to a consumer. Watch a clip of me outlining this phenomenon during my Inman Connect keynote below.

The last mile problem is a concept that comes from logistics and transportation.

Getting goods from a factory to a warehouse, and from a warehouse to a distribution center, is the easy part.

The difficulty comes with the final delivery -- the last mile -- where the experience is uncertain, complex, and expensive.

Real estate's last mile problem is similar -- you can buy thousands of online leads, invest millions into building a tech platform, and use predictive analytics to score how likely a lead is to transact.

But you still need an agent to pick up the phone, make a call, and build a relationship with a consumer.

And that's why the biggest players in real estate are working with agents, and not trying to disintermediate them.

Zillow's Premier Agent and Flex programs keep high-quality agents at the center of the transaction.

And now Opendoor is pivoting back to agents with a significant marketing and partnership campaign.

Online real estate companies probably wish agents weren't necessary and that they could go directly to consumers -- and agents probably wish the online disruptors would just go away.

But both forces operate in a tentative equilibrium, not necessarily liking each other, but able to work together to achieve a common outcome.

Which leaves real estate agents as the last mile solution -- the unavoidable, indisputable, and irreplaceable central part of the transaction.

Watch my enitre keynote, Pandemonium, to hear more about the industry's Netflix vs. Blockbuster moment and what a receding tide reveals about business models and true intentions. Enjoy!

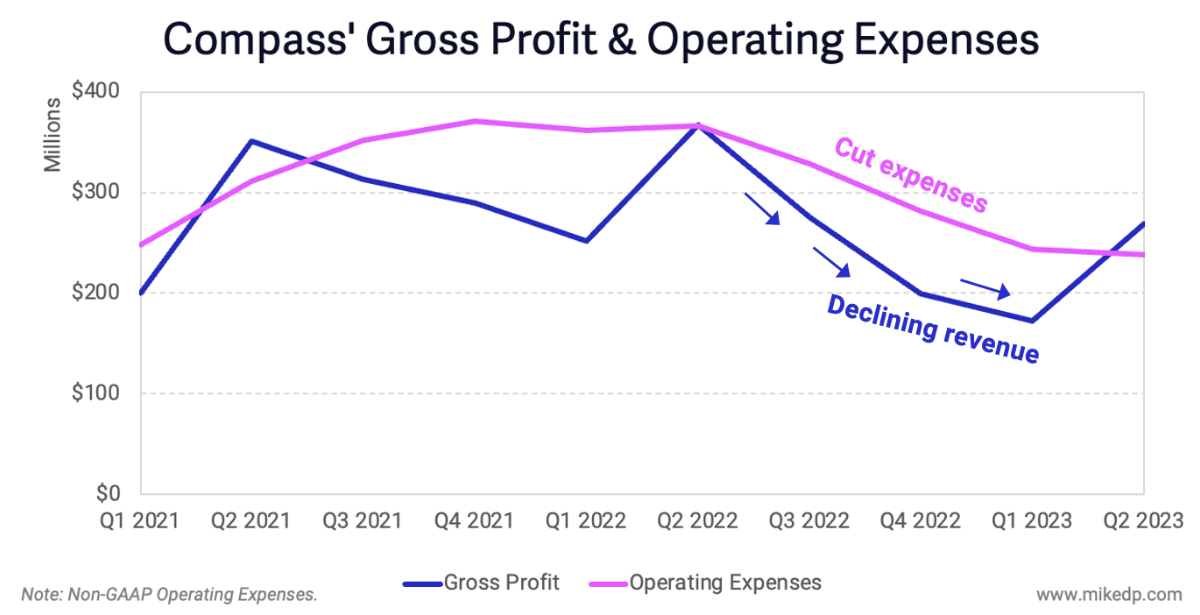

Compass’ Cash Crisis Closes

/After 15 months of cost cutting, Compass is free cash flow positive, making more money than it spent in Q2 2023.

Why it matters: With a high cost base and dwindling cash reserves, Compass was forced to cut operating expenses as it pivoted to a profitable, sustainable operation – which it has done.

Dig deeper: I first wrote about Compass' cash burn problem in May 2022, and it's been a busy 15 months.

Over the past year, the company has cut expenses by about 35 percent – or $500 million – through three rounds of layoffs.

Compass’ annual operating expenses have dropped from $1.45 billion to $950 million, with a goal of getting down to $900 million by the end of the year.

A declining market is an especially challenging time to achieve profitability.

As of Q2 2023, Compass’ trailing 12 month revenue was $5 billion – down from $6.7 billion a year ago.

Which means cost control is the only realistic option available to get cash flow positive.

Compass’ cash balance has stabilized at $335 million – and, in fact, has increased for the first time in years.

Management clearly has confidence in the business: in July, it repaid the outstanding $150 million draw from its revolving credit facility.

What to watch: Compass isn’t entirely out of the woods yet, but it’s on a much more solid foundation.

This past quarter is the high-water mark for revenue; from here seasonality kicks in with progressively lower revenue for the next nine months.

It’s likely that cash flow will remain relatively flat for the rest of the year – the question is whether it will limit the company’s ability to invest for future growth (M&A and organic).

The bottom line: Compass’ turnaround has been an instructive case study in managing a business through a turbulent market.

Like many businesses, the company was caught flat-footed last year when the market changed, but it executed a necessary turnaround to sustainability.

The broader lesson is around adaptability – it matters less how you got to where you are, and more how quickly you can adapt to a rapidly changing environment.

Brokerage Profitability

/A common response to my previous analysis, Agent Compensation at the Top U.S. Brokerages, is that the brokerages paying the most out to agents couldn’t be profitable or sustainable – but, perhaps counterintuitively, the evidence suggests otherwise.

Why it matters: In a shifting market, the low-fee brokerage models are structurally designed to thrive, and are operating much more profitably than legacy brokerages.

To recap, the low-fee models are paying out a significantly higher percentage of their revenue to agents than legacy brokerages.

Those same low-fee brokerages are also profitable or closest to profitability: eXp Realty, United, Real, and Fathom (RealtyONE declined to share this information with me).

The only companies that were profitable in Q1 2023 were eXp Realty and United Real Estate, and the largest legacy brokerages were really unprofitable.

Note: This analysis uses Adjusted EBITDA (think of it as Adjusted Earnings) as the metric of profitability – it allows a company to portray its earnings in the best possible light by backing out expenses like stock-based compensation, one-off legal or restructuring charges, and other non-cash expenses.

To account for variations in brokerage scale, we can look at Adjusted EBITDA per transaction, which yields similarly revealing results.

It’s worth directly comparing the two fastest-growing models of the past five years, Compass and eXp: in Q1 2023, Compass lost $1,900 per transaction, while eXp generated a profit of $130 per transaction – quite the difference.

The outlier is Douglas Elliman, which has a much smaller transaction volume (4,600 in Q1 '23, compared to 36,000 at Compass), so its loss per transaction is much higher than its peers.

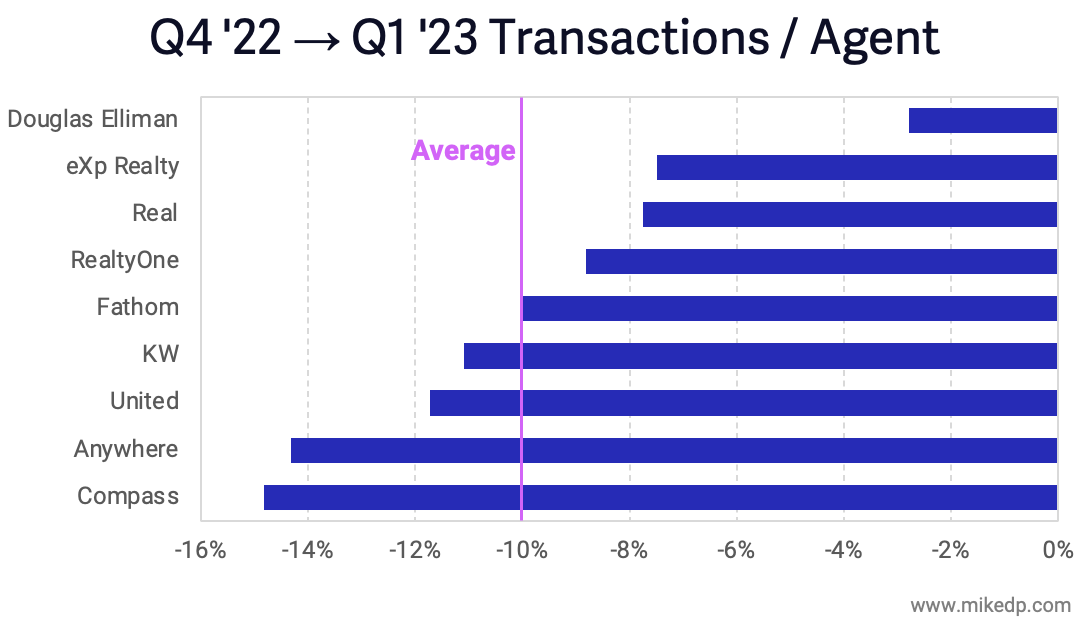

The next most common response to this analysis asserts that the low-fee models don’t provide as much support to their agents.

Therefore, while agents are able to “make more money,” they’re on their own and, without brokerage support, are less productive.

Once again, the evidence suggests otherwise.

Across the nine brokerages in this analysis, the average production was one transaction per agent in Q1 2023.

The average for the legacy brokerages (Compass, Anywhere, Keller Williams, and Douglas Elliman) was 1.03 transactions per agent, while the average for the low-fee brokerages (eXp, Real, RealtyONE, United, and Fathom) was 0.98 transactions per agent – effectively the same.

In aggregate, agents at low-fee brokerages, with “less support,” were just as productive as agents at the legacy brokerages with “lots of support.”

Variability in the number of transactions per agent over time provides further evidence: between Q4 2022 and Q1 2023, the average number of transactions per agent dropped 10 percent across the same nine brokerages.

Four low-fee brokerages (eXp, Real, Fathom, and RealtyONE) were at or below that average – meaning that their agents saw less of a decline in transaction volume than agents at legacy brokerages.

Support or not, agents at low-fee brokerages were more resilient and saw less variability in production during a changing market.

Yes, but: These are averages, and as with all averages, there will be overs, unders, and outliers.

Not all low-fee brokerages and legacy brokerages perform similarly.

Furthermore, inside of each organization, there is significant variability in individual agent performance and compensation.

The bottom line: The dual hypotheses that low-fee brokerages aren’t sustainable, and that their agents are less productive due to less support, are false.

Low-fee brokerages are in fact more profitable than the legacy brokerages, even after paying out a significantly higher proportion of their revenue out to agents.

This is classic Innovator’s Dilemma: while the legacy brokerages are racing to cut costs, the low-fee models – built from the ground up with a lower cost operating model – are taking market share and competing where they can win.

Agent Compensation at the Top U.S. Brokerages

/Agent compensation structures at U.S. real estate brokerages vary, with some firms paying out a significantly higher percentage of their revenue to agents than others.

Why it matters: Commission and fee structure is foundational when it comes to agent loyalty and recruitment; as agents seek to maximize their earnings, they're naturally drawn to brokerages offering higher splits and lower fees.

Dig deeper: Brokerages generate revenue from the commission on the sale of a house.

The brokerage and agent then effectively split the commission, through a varied combination of commission splits, fees, and revenue sharing.

Once added up, the result is a percentage of total brokerage revenue that is paid out to agents – ranging from 77 to 96 percent in this analysis.

The low-fee / high-split brokerages like eXp Realty, Real, RealtyONE, Fathom, and United end up paying significantly more of the commission out to agents.

Compass, which famously offered agents high commission splits as a recruitment incentive, is, on aggregate, closer to traditional industry stalwart Anywhere (home of Coldwell Banker and Sotheby's) than the others.

Compass is paying its agents less over time, through a combination of reducing existing agent splits, recruiting new agents with lower splits, and higher fees.

The one percent reduction in revenue paid out to agents over the last two years represents about $9.5 million retained by Compass and not paid out to agents in Q1 2023.

Compass highlights this achievement, which it is clearly proud of, in its quarterly earnings, declaring that its “commissions expense as a percentage of revenue” is “improving.”

In fact, Compass is so pleased with this achievement that it is the first data point in its earnings press release and the second financial highlight, behind total revenue, in its investor presentation.

Enjoy it while you can; after this article, I doubt Compass will be highlighting these numbers so strongly in the future – and it certainly won’t kick off its agent gatherings with the same metrics.

Agents like to make money, so it’s unsurprising that as natural entrepreneurs they flock to brokerages where they can maximize their earning potential.

It’s no coincidence that the top 5 brokerages that grew agent count over the past quarter are the exact same brokerages that paid the most out to agents: eXp, Real, Fathom, RealtyONE, and United.

The bottom line: It’s a simple equation: More money attracts more agents, and more agents sell more houses.

Brokerages paying a smaller proportion of revenue to agents is an effective strategy to improve short-term financials, but the long-term implications around agent recruitment and retention are significant.

In a period of fewer transactions and overall belt-tightening, it's more important than ever for agents to carefully consider commission splits when deciding where to work.

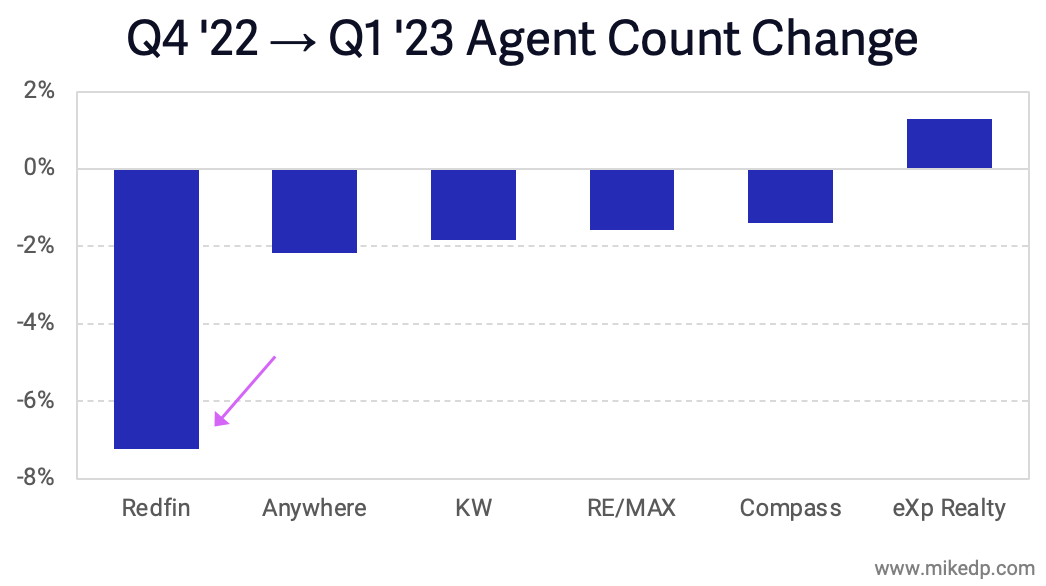

Agent Migratory Patterns

/The first quarter of 2023 saw a variety of winners and losers in terms of brokerage agent count – the numerical manifestation of agent recruitment and retention.

Why it matters: As I’ve previously asserted, agents are central to the real estate transaction; growth in transaction volumes goes hand in hand with growth in agent count, because agents sell houses.

Dig deeper: Disruptive, low-fee brokerages like eXp Realty, Real Brokerage, United Real Estate, and RealtyOne all added agents during the first three months of the year.

Meanwhile, some of the largest incumbent brokerages and franchises – Keller Williams, RE/MAX, and Anywhere – all lost agents.

The five largest brokerages and franchises in this list – Anywhere, Keller Williams, RE/MAX, Compass, and eXp Realty – account for over 427,000 agents, down 1.1 percent from the previous quarter.

Among them, only eXp Realty grew its agent count from the last quarter.

Redfin, with less than 2,000 salaried principle agents, is the downside outlier after three rounds of layoffs.

Real Brokerage is the clear upside outlier, growing its agent count over 20 percent – to 10,000 agents – from the previous quarter.

10,000 agents is considerably fewer than Anywhere’s 58,000 or RE/MAX’s 82,000, but Real is catching up to Compass’ 28,000 agents.

Speaking of Compass, Q1 2023 was the first time that the brokerage’s agent count decreased.

Context is important: many brokerages lost agents!

But Compass is no longer in the ranks of “fast growing brokerages,” a category it dominated over the past three years – that mantle now passes to eXp Realty and Real (and several other low-fee brokerage models).

What to watch: Agent migration patterns are a significant leading indicator of future brokerage growth.

In a period of belt-tightening and fewer transactions, agents are moving away from traditional brands and flocking to relatively newer models where they're able to keep more of their commission.

The bottom line: Agents – and not AI, machine learning, a sophisticated CRM, a one-click transaction, nor any other tech buzzwords – sell houses.

This period of market scarcity reveals the brokerage business models able to thrive in a downturn, as well as those facing more fundamental challenges.

To identify the brokerage business models of the future, one simply needs to follow the agents.

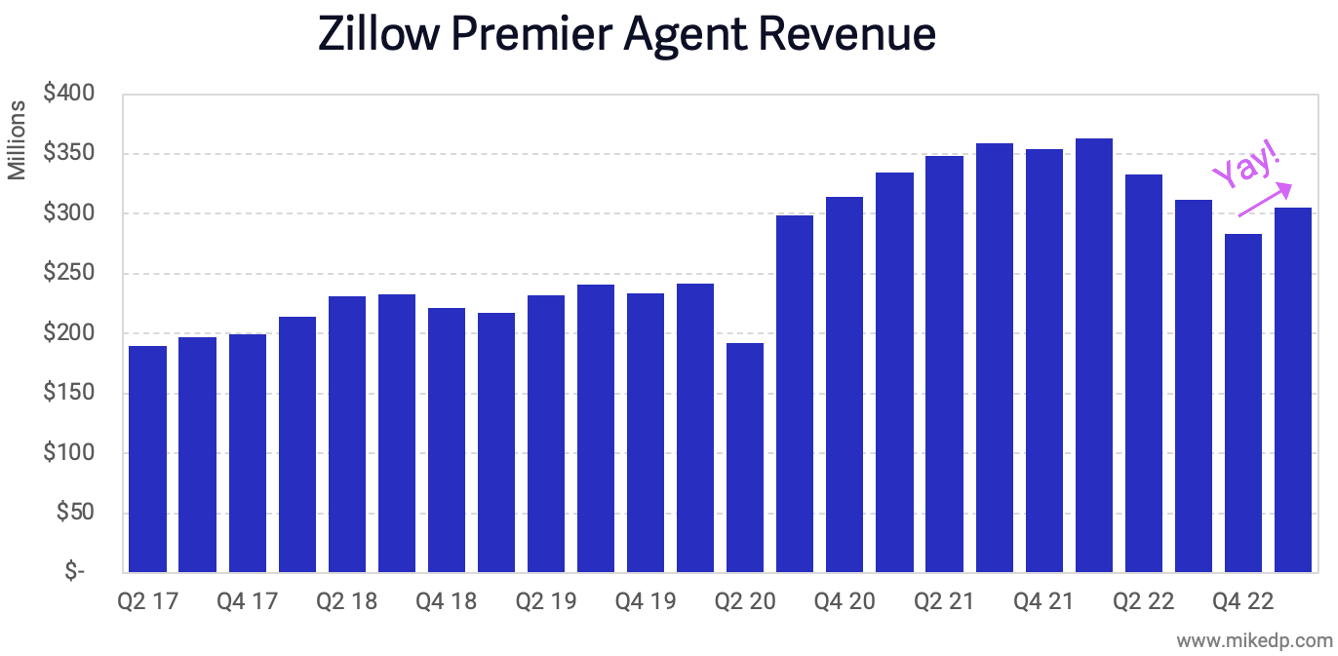

Zillow 3.0: Is It Working?

/Zillow’s latest earnings reveal growth in its core Premier Agent business after nine months of decline – the longest in the company’s history – a promising result of Zillow’s new strategy.

Why it matters: The next iteration of Zillow revolves around a back to basics strategy of generating more leads and monetizing those leads through an integrated consumer experience (a super app).

But a change in financial reporting will make it more difficult to track the various components of the business on its journey to building that super app.

Zillow’s Premier Agent revenue increased during the first quarter of the year, breaking a nine-month losing streak – the longest consistent revenue decline in the company’s recent history.

Premier Agent revenue was up 8 percent from Q4 2022 (but still down 16 percent from the heady days of early 2022, when the market was at its peak).

Comparatively, Zillow had a strong quarter – its Premier Agent business outperformed the market year-over-year and quarter-over-quarter.

Compared to the same period last year, overall transactions in the market were down 26 percent, compared to a 16 percent decline in Premier Agent revenue.

And compared to last quarter, market transactions were down 14 percent while Zillow managed to grow its Premier Agent revenue 8 percent – a noteworthy achievement!

Zillow’s ability to outperform the market comes down to two activities: capturing a higher percentage of leads in the market, and generating more revenue per lead.

Zillow’s stated goal is to double its share of customer transactions from 3 to 6 percent by the end of 2025.

ShowingTime and Flex are both designed to engage more consumers and increase conversion rates, resulting in more leads and more revenue per lead.

Zillow Home Loans is another source of revenue growth, and the company continues to invest in it.

The segment saw an increase in revenue during the latest quarter, but the change in financial reporting means we’ll no longer be able to see profitability for the segment – after six years of losses and two years of me writing about those losses.

Losses aside, Zillow continues to invest in its mortgage business and is hiring more mortgage loan officers (MLOs) to handle an increase in volume.

This is a good reminder that mortgage is very much a people business and not a scalable technology business.

The bottom line: Zillow’s path forward is dependent on its ability to capture more leads, further monetize those leads, and attach ancillary services like mortgage – a super app leading to super revenue.

But Zillow’s change in financial reporting will make it more difficult to track, with any degree of granularity, which pieces of the puzzle are working well and which are struggling.

Still, the numbers (while they last) don’t lie – the company’s recent performance relative to the market underscores the powerful position Zillow occupies at the top of the consumer funnel and its ability to affect change for consumers, agents, and the entire industry.

The Rise of Real

/A relative newcomer to the industry, the Real Brokerage is growing fast and is one of the few brokerages to materially grow its transaction count in 2022.

Why it matters: In a notoriously slow moving industry, it’s worth tracking the fast movers.

Dig deeper: Real was a big winner in 2022, with its transaction count increasing by 181 percent – 24,000 units – compared to an overall industry decline of 18 percent.

On a unit basis, Real was second only to eXp Realty in terms of its growth.

Like other growing brokerages, the surge was fueled by agent recruitment: Real’s agent count increased 113 percent to 8,200 agents in 2022 (and has since exceeded 10k).

Agent count is the most reliable indicator that correlates to transaction count growth.

Cash flow: There is chatter about Real’s profitability and ability to sustain itself.

During 2022, Real’s cash balance fell from $29 million to $18 million – but that drop includes $10 million in acquisition-related expenses.

Outside of acquisitions, the company appears to be close to cash-flow positive.

What to watch: As we’ve seen with other brokerages, the momentum of Real’s agent recruitment will likely propel the business to continued growth in 2023.

The bottom line: It’s difficult to look at Real and not think of eXp Realty – both companies have similarly favorable agent commission splits and multi-level revenue share schemes.

And while future performance is uncertain, Real appears to be in the early stages of an exponential growth phase, driven by strong agent recruitment.

A receding tide reveals winners and losers in the brokerage space: The Real Brokerage is on the winning side of the ledger, growing quickly and at an increasingly meaningful scale.

Note: I’ve had coffee with Real’s CTO, but I have no financial stake nor association with Real Brokerage. I’m just looking at the data – and it’s difficult to ignore a fast-moving business in a slow-moving industry.

Incentive Splits and Agent Retention

/Brokerages are employing a variety of incentives in the ever-expanding battle to win over the hearts and minds of real estate agents, including an innovative golden handcuff known as “Incentive Splits.”

Why it matters: Incentive Splits create an ever-increasing bill that an agent must repay if they leave a brokerage – which can effectively lock an agent into staying even when they want to leave.

This analysis focuses on Compass, where there is the most evidence, but the company is not alone in employing the practice.

Incentive Splits, a term included in some Compass agent agreements, are bonus commissions that range from 2–10 percent.

These commissions accumulate over time, creating an ever-growing balance that an agent must repay if they want to leave Compass.

The contract language states that if an agent leaves within two years of receiving any incentive, including an Incentive Split from a home transaction, the agent must repay all Incentives back to Compass.

In reviewing several contracts, this timeframe has ranged from one to three years.

The bill can add up quickly, especially for top performing agents that wish to leave: the invoice below (which may not be representative of the average Compass agent) includes over $72,000 in Incentive Splits, payable back to Compass.

Yes, but: It’s not clear how widespread this practice is – I’ve seen Incentive Splits included in the contracts of around 20 current and former Compass agents.

A Compass spokesperson told me that since the company stopped offering cash incentives to agents in 2022, this only impacts a small group of agents.

Compass is not alone: the invoice below from Corcoran includes a $43k bill for “Split Overpayments,” which is the same as an Incentive Split.

The incentive to agents is clear – extra cash in their pockets – but the mechanics are designed as golden handcuffs: financial incentives given to employees and contractors to discourage them from leaving a company.

But unlike other golden handcuffs, Incentive Splits don’t expire or vest after a certain amount of time.

The bottom line: Incentive Splits appear to be an inventive mechanism to incentivize agents to stay with their brokerage – by creating an ever-growing bill that must be repaid if they want to leave.

Putting aside effectiveness and intention, the key takeaway for agents is clear: read the fine print.

Perhaps at the “brokerage of the future,” agents will stay because they want to, not because they have to.

Brokerage Winners and Losers

/The market crunch is on, with 1,096,000, or 18 percent, fewer residential real estate transactions in 2022 compared to 2021.

Why it matters: It's said that a rising tide lifts all boats – but a receding tide affects boats differently, once again highlighting important differences across the brokerage landscape.

Context: According to the latest data from RealTrends, the top 20 brokerages by transaction count in 2022 (and the sample set for this analysis) were led by eXp Realty, Anywhere, HomeServices of America, Compass, and Howard Hanna.

To maintain an apples-to-apples comparison, I typically exclude franchise operations like Keller Williams, RE/MAX, and Anywhere’s franchise group because the business model is substantially different.

But last time I got a lot of questions about Keller Williams, so for comparison here is where KW – and its hundreds of U.S. franchisees combined – ranks (#1).

As the tide recedes, it reveals a collection of winners and losers in terms of transaction growth and decline.

The big winners are eXp Realty and Real Brokerage, which added 65,000 transactions, while industry incumbents Anywhere and HomeServices of America lost a combined 150,000 transactions.

When Keller Williams is added to the list, we see that it lost 190,000 transactions in 2022 compared to 2021 – more than Anywhere, HomeServices of America, and Compass combined.

As a percentage, KW’s 15 percent decline outperformed an overall market decline of 18 percent, but on a unit basis (revenue comes from units, not percentages) the 190k decline is substantial.

What to watch: It’s tempting – and imperative! – to draw conclusions about brokerage models from the data.

The winners – eXp, Real, Fathom, Realty ONE, and United Real Estate – have one thing in common: they all offer high agent splits, per-transaction fees, or 100 percent commission models.

Meanwhile, the biggest losers are typically seen as traditional industry incumbents (but somehow also include Compass and Redfin).

The bottom line: A rising tide may lift all boats, but a receding tide slams some boats against the shore.

In a year of belt-tightening and fewer transactions, agents – and their transactions – appear to be flocking to relatively newer models where they keep more of their commission.

Market Shift Highlights Brokerage Fundamentals

/2022 was a tumultuous year: the real estate market turned, transactions dropped, and the largest U.S. brokerages were all forced to chart new courses.

Why it matters: Agent count, transaction volumes, and the relative growth and decline of brokerages in 2022 are all powerful predictors of future performance.

Agent count continues to fuel the business of the major U.S. real estate brokerages.

eXp Realty is the clear stand-out, with an exponential increase in the number of its U.S. agents – which now eclipses industry incumbents Anywhere and HomeServices of America (HSoA).

Overall growth slowed across the board in 2022, and Anywhere has seen a recent uptick in agent count, which has yet to translate into a corresponding uptick in transaction count.

Transaction volumes and brokerage performance are directly correlated to agent count (MDP: “Technology doesn’t sell houses, agents do.”)

Among its peers, eXp Realty once again outperformed the market, growing its transactions by 12 percent in 2022, compared to an overall market decline of 18 percent.

eXp’s large brokerage peers all transacted less in 2022 than the year before, while Compass, also buoyed by recent agent count gains, experienced less of a decline than the traditional incumbents (and Redfin).

The declining market has forced companies across the industry, brokerages included, to cut costs.

But those cuts are unequal among peers – cash flow and profitability dictate the speed and severity of cuts.

Throughout the year, Anywhere and Compass, which have the highest operating expenses, have been forced to cut the deepest, while eXp and Douglas Elliman have increased their operating expenses (from a smaller base).

What to watch: Agent count growth and transaction volumes will remain sluggish in 2023.

A further slowing of the market will force some companies to cut even deeper.

It’s a numbers game: less transactions will go to fewer agents – so brokerages with strong agent count growth will outperform the market (just look at eXp).

The bottom line: The market correction is a great equalizer – and it’s accentuating the differences between brokerage business models.

In a market of musical chairs with fewer chairs available, companies with sustainable models, lower overheads, and strong recruiting are more likely to succeed.

Cash Burn Continues as Compass Navigates to Breakeven

/The results are in and Compass burned $143 million in cash during Q4 2022, leaving the company with a cash balance of $362 million.

Why it matters: With a clearly articulated goal of reaching breakeven after billions in losses, 2023 is Compass’ seminal make-or-break year.

Despite another quarter of high cash burn, the company appears to be positioned to achieve breakeven in 2023 after massive cuts made over the previous 12 months.

Even in a much softer market, Compass’ Q4 2022 cash burn is less than a year ago, a reflection of the cuts already made to the business.

Compass started 2023 with a cash balance of $362 million – which includes a $150 million drawdown from its revolving credit facility

Without that additional loan, Compass’ cash balance would have been $212 million – dangerously low for a company that just burned $143 million in a quarter.

The key to breakeven is Compass’ ability to reduce its non-GAAP operating expenses (OpEx), primarily achieved through layoffs.

OpEx has dropped significantly over the past six months, and is on track to drop further through the rest of the year.

It appears that Compass is aiming for OpEx of around $950 million for 2023, down about 30 percent from $1.35 billion in 2022.

It’s fair to say that any brokerage, Compass included, falls apart if it’s unable to recruit or retain agents.

For the first time, Compass’ agent count has gone flat, reflecting the challenging market and environment for agents (less transactions = less agents).

Yes, but: It takes several data points to create a trend, and most brokerages are seeing a similar slowdown in agent count growth.

Analysis time: Assuming Compass’ national market share and revenue per transaction remain consistent with 2022, we can see what needs to be believed for the company to reach breakeven in 2023.

Compass’ current non-GAAP operating expense target of $950 million suggests that 4.5 million transactions in the national market are necessary to give Compass the revenue and gross profit necessary to break even for the year.

A bear case of 4 million transactions would require Compass to cut an additional $100 million of operating expenses to reach breakeven.

Please note: these are back-of-the-envelope calculations that provide directionality, not certainty.

What to watch: Like other brokerages, Compass only has so many levers to pull to reach breakeven.

On the revenue side, the company is considering franchising as a less-expensive growth strategy, and will be trying to accelerate its mortgage joint venture.

If the market remains soft and revenue drops, the only option is to cut even more costs out of the business.

The bottom line: Compass is not alone in needing to cut costs during a significant market downturn – its future depends on it.

The company dipped into its “emergency reserve” last quarter – $150 million from its revolving credit facility – for the home stretch to profitability.

It appears that Compass has made the deep cuts necessary to achieve breakeven this year, as long as nothing else unexpectedly goes wrong.

2 Key Learnings from a Purplebricks Retrospective

/U.K.-based Purplebricks remains one of the best examples in the world of a real estate disruptor going from zero to one.

Why it matters: It’s a complex growth story revealing two key learnings that apply to all real estate tech disruptors: the adoption ceiling and reversion to the mean.

The adoption ceiling is the phenomenon where a disruptor's market share stops growing and plateaus (also called market saturation).

This is common across many new models, but especially prevalent in real estate due to its highly fragmented, non-differentiated nature.

Purplebricks hit its adoption ceiling in 2019; there were only so many early adopters willing to try its substantially new model (pay a lower fixed-fee up front instead of a commission upon sale of a home).

The Covid-19 pandemic and the growth of similar models contributed to an erosion in new listings (called instructions) -- and market share -- beginning in 2020.

Hand-in-hand with a plateauing market share are rising customer acquisition costs (CAC); with scale, it becomes more expensive to acquire each new customer.

Opendoor, the U.S.-based iBuyer, has experienced the same phenomenon as it scales, with customer acquisition costs substantially higher in 2022 compared to past years.

Reversion to the mean is the tendency of real estate disruptors, over time, to look more and more like the incumbents they are trying to disrupt.

Purplebricks has steadily increased its once-low fees, has adopted a "pay later" option, and made its agents full-time employees -- putting it much closer to the traditional estate agent model.

Meanwhile across the industry, iBuyers have launched traditional, agent-led sales options, leading portals have bought traditional mortgage businesses, anti-MLS disruptors have started listing on the MLS, and over time Compass looks less like a tech company and more like a brokerage.

The bottom line: Like so many real estate tech disruptors, Purplebricks is a "cautionary tale" about overreach and setting unrealistic expectations.

Back in 2018, I was quoted in The Financial Times about this exact topic. Not much has changed.

The power -- the gravitational pull -- of the traditional real estate industry is incredibly strong.

Over time, even the most well-funded, aggressive start-ups have a tendency to be assimilated into the traditional industry.

The Race to Cut Costs

/Across the real estate industry, companies are racing to cut costs in the face of a significant market slowdown.

Why it matters: With dropping revenues, cost control is one of the only levers in a company’s control – and is the key to a sustainable, profitable business.

The need to cut costs – and the depth of those cuts – are a function of a company’s overall financial health and business model efficiency.

Some companies, like eXp, have the advantage of a more efficient business model with lower operating expenses (OpEx).

Compared to its peers, eXp is servicing a disproportionately high number of transactions with relatively modest operating expenses.

The more traditional industry behemoths, Anywhere and Compass, have a less efficient model with a much higher cost basis (and thus need to cut faster and deeper).

Dig deeper: Another measure of business model efficiency is the amount of revenue generated per $1 spent in operating expenses.

Based on this metric, eXp was about three times more efficient in Q3 2022 than its publicly-listed brokerage peers (who are all in the $3–4 range).

Compass has been racing to cut its operating expenses as quickly as possible (it also recently announced a third round of layoffs).

Compass is driving to cut its non-GAAP operating expenses by 40 percent, or around $600 million annually.

Layoffs are the most visible way that real estate tech companies are cutting costs.

Since June of 2022, Compass has shed around 1,700 employees (40 percent), while Redfin has also cut deep with 2,000 fewer employees (26 percent).

Many other real estate tech companies have also enacted significant layoffs to cut costs (and in some cases, in order to survive).

What to watch: Among the big brokerages, Anywhere, Compass, and Redfin have already made significant cost reductions, while eXp and Douglas Elliman are under less pressure to cut costs.

Cost reductions limit a company’s ability to invest in future growth opportunities (ex: Compass has "paused all expansion into new markets” and Anywhere shut down its cash buying program).

The bottom line: The market downturn is forcing all real estate tech companies to cut their expenses in order to achieve, or maintain, profitability.

Unprofitable companies with high cash burn and high fixed costs have no choice but to cut, and cut deep, to survive.

While other companies operating more efficient, low-cost operating models are under less pressure to make big cuts – and may be better placed to invest in future growth.

Two Key Charts to Contextualize the U.S. Housing Market

/Media headlines are focused on a crashing U.S. real estate market, but the truth is more nuanced with less hyperbole.

Context matters: The reality is that the market is down, but simple comparisons to a sky-high 2021 are amplifying the scale of the decline.

Arm yourself with the right data -- two key charts -- to understand and contextualize this dynamic market.

Monthly home sales are collected and published by the National Association of Realtors (NAR), but historical data beyond 2021 is not easily accessible and rarely included in analyses.

With help from NAR, I've published this data in the past -- and now I'm publishing a direct link to a live chart: U.S. Existing Home Sales.

While existing home sales are down in the second half of 2022, the deviation from historical averages is not nearly as extreme as the drop from last year.

Looking forward: A leading indicator for the future housing market is consumer demand for mortgage loans (specifically purchase loans).

This mortgage application data, alongside average mortgage rates, is published weekly by the Mortgage Bankers Association.

The mortgage demand index shows that purchase demand is at record lows -- but just barely (compared to 2014).

Furthermore, there is a recent uptick in demand that corresponds to dropping mortgage rates.

The bottom line: The last six months of 2022 have been challenging, and it appears likely that low volumes will continue well into 2023.

But it's not as bleak as the news headlines may lead you to believe.

Do your own research and make your own conclusions -- with the right data: U.S. Existing Homes Sales and Purchase Mortgage Demand are a great start.