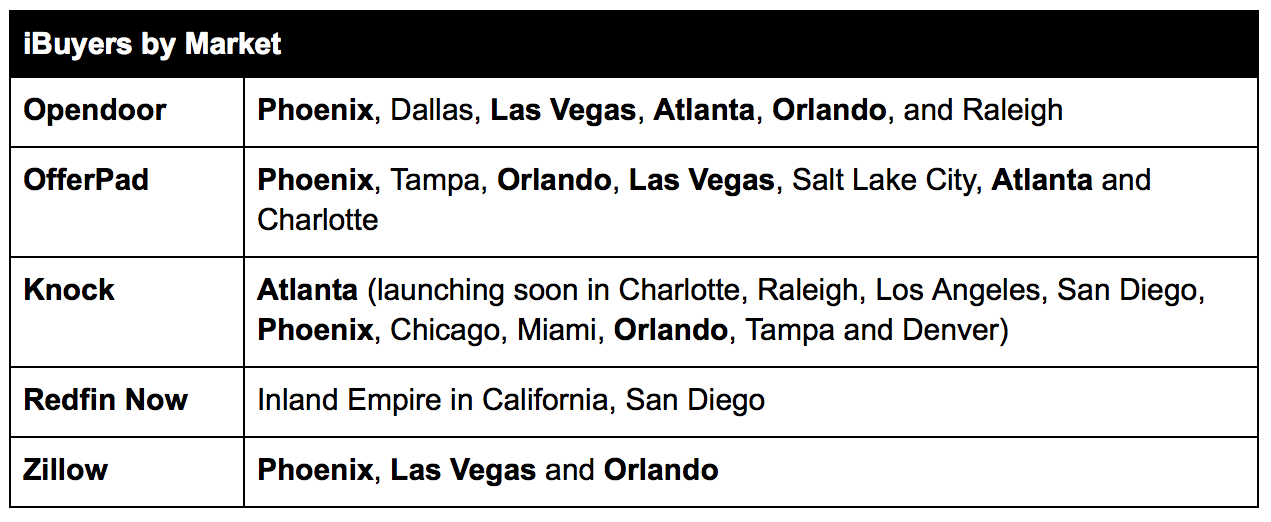

I would expect to see more competitors launch in 2018. The market is going to get very crowded very fast. And that forms part of the paradox: the more successful Opendoor and its model becomes, the more competitors will enter the space to get a piece of the action.

The real competitive threat: incumbents

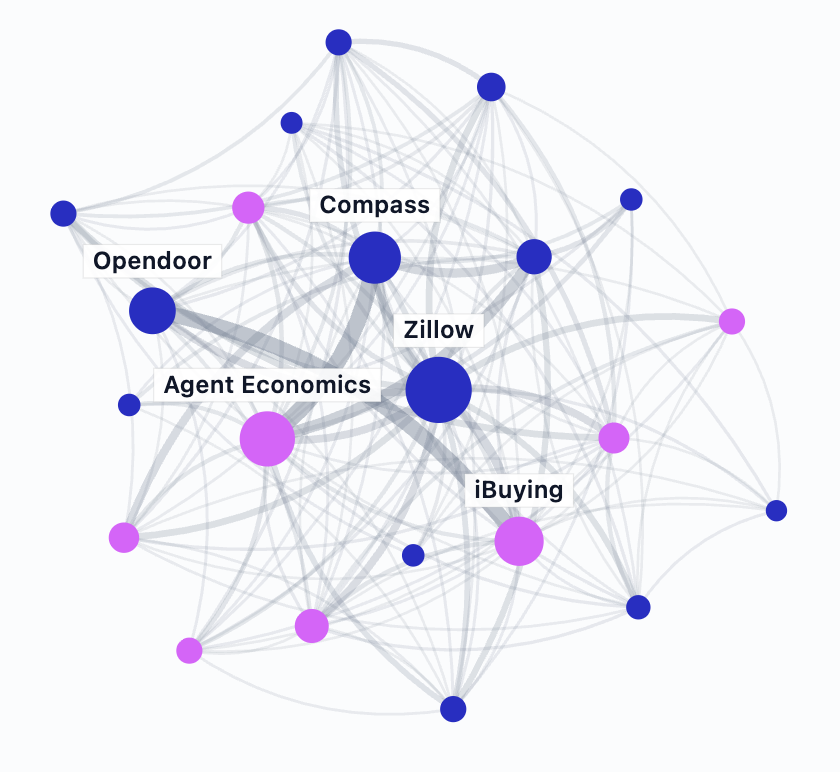

While the various iBuyers might beat each other up through tough competition in each market, that’s not the biggest competitive threat they face. The top competitive threat is the massive real estate incumbents themselves.

This forms the next part of the paradox: the more successful Opendoor becomes, the more of a threat they become to industry incumbents, which forces them to respond. The most logical response from a major player such as Realogy or Keller Williams would be to launch their own iBuyer program.

This is what Redfin has done with Redfin Now. Redfin was able to spin this test up quickly and is now able to adopt a “me too” proposition when attracting new customers. For a small amount of effort, incumbents can blunt the iBuyer proposition.

It’s a simple extension: If a consumer decides to sell their home with an incumbent, they can choose the traditional agent services for a commission, or they can sell it instantly for a fixed offer and certainty.

Make no mistake, the offer and the experience from the incumbent is going to be bad. They’re simply not set up to provide the same quality of service as Opendoor, and most likely will lowball the seller to protect their margins. But the offer will be present and it will appeal to some sellers.

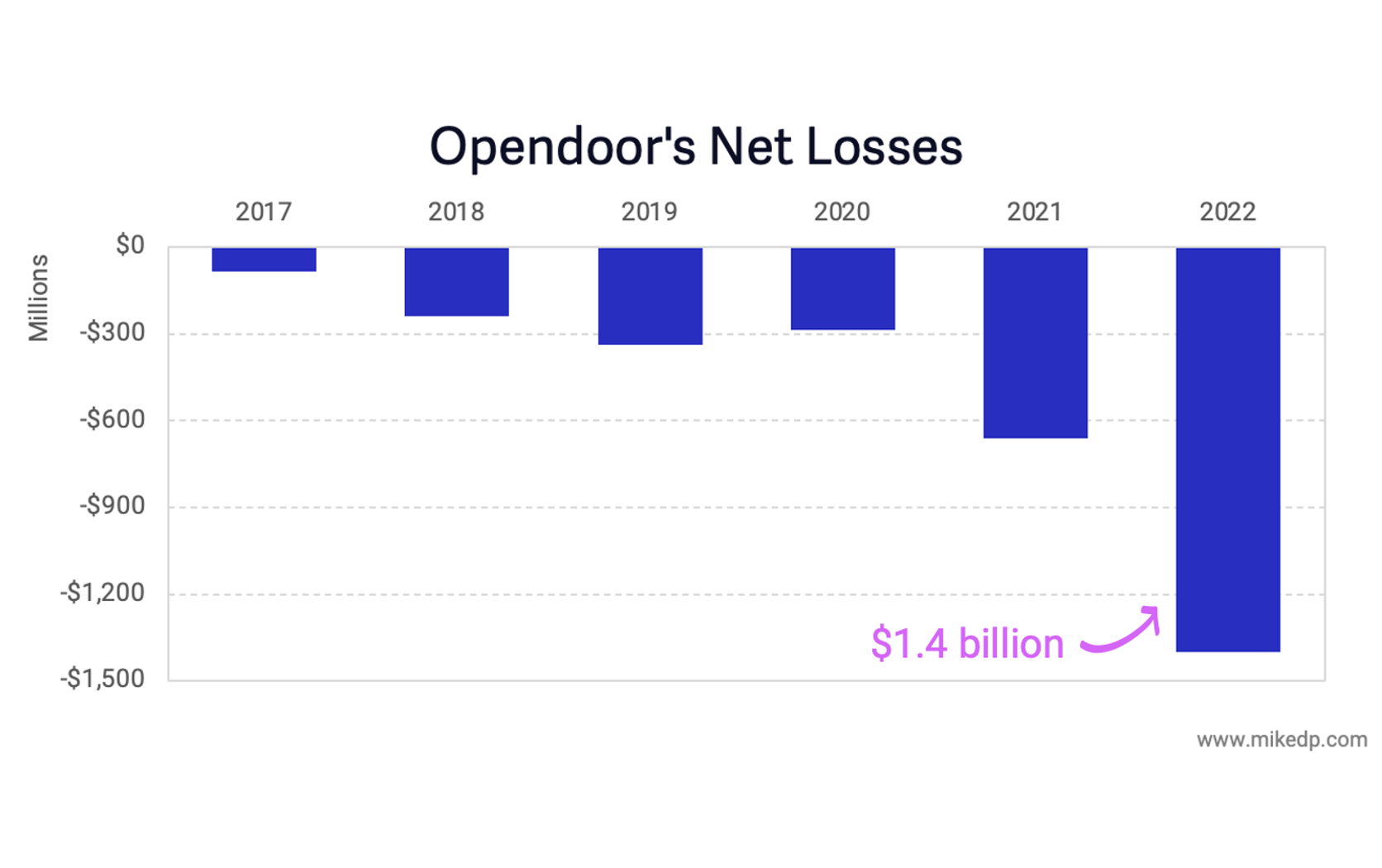

The proposition from the incumbents will be poor, but it will be enough to soak up a portion of the demand in the market and take momentum away from Opendoor and other iBuyers. And if Opendoor can’t scale or if it becomes too expensive to attract new customers, it’s game over.

The more successful Opendoor becomes, the more incumbents will be forced to react, and when they do it will harm Opendoor’s growth and profitability.

Scaling challenges

Opendoor faces a number of challenges over the next 12 months. The most pressing of which is how the business scales nationally.

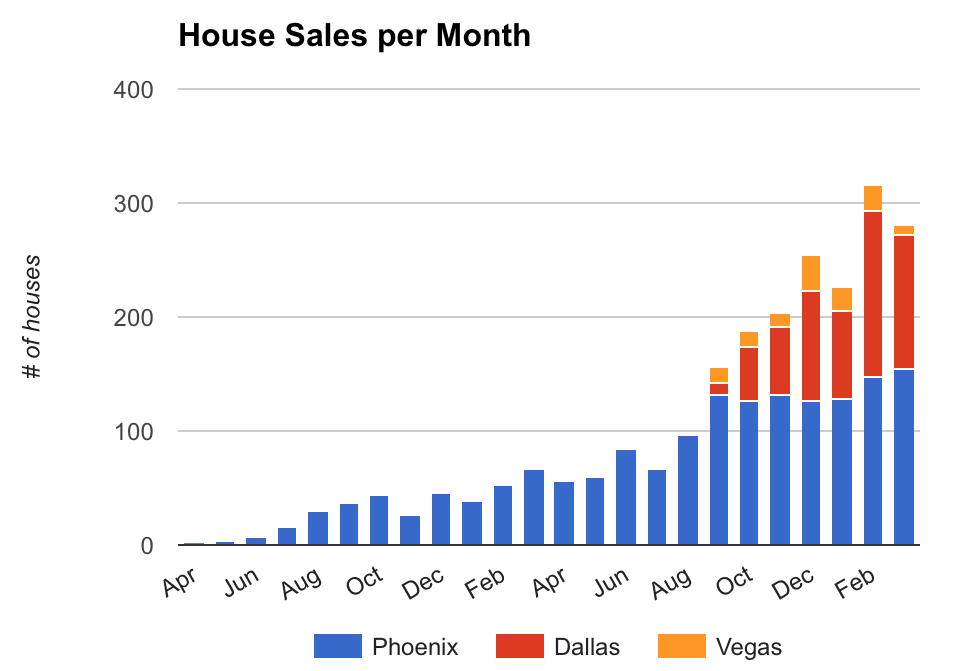

The previous two years have been spent proving out the model. Opendoor has been refining its processes in its two core markets, Phoenix and Dallas, trying a partnership model in Las Vegas, and just recently launched in Atlanta, Orlando, and Raleigh.

But 2018 is the big test: going national. I expect Opendoor to meaningfully be in ten markets this year. This will put a tremendous amount of pressure on the business, the management team, and the well-refined processes to see if they can all truly scale. It’s like NASA going to the moon after conducting tests in Earth’s orbit (which is exactly what they did). It’s a big step.

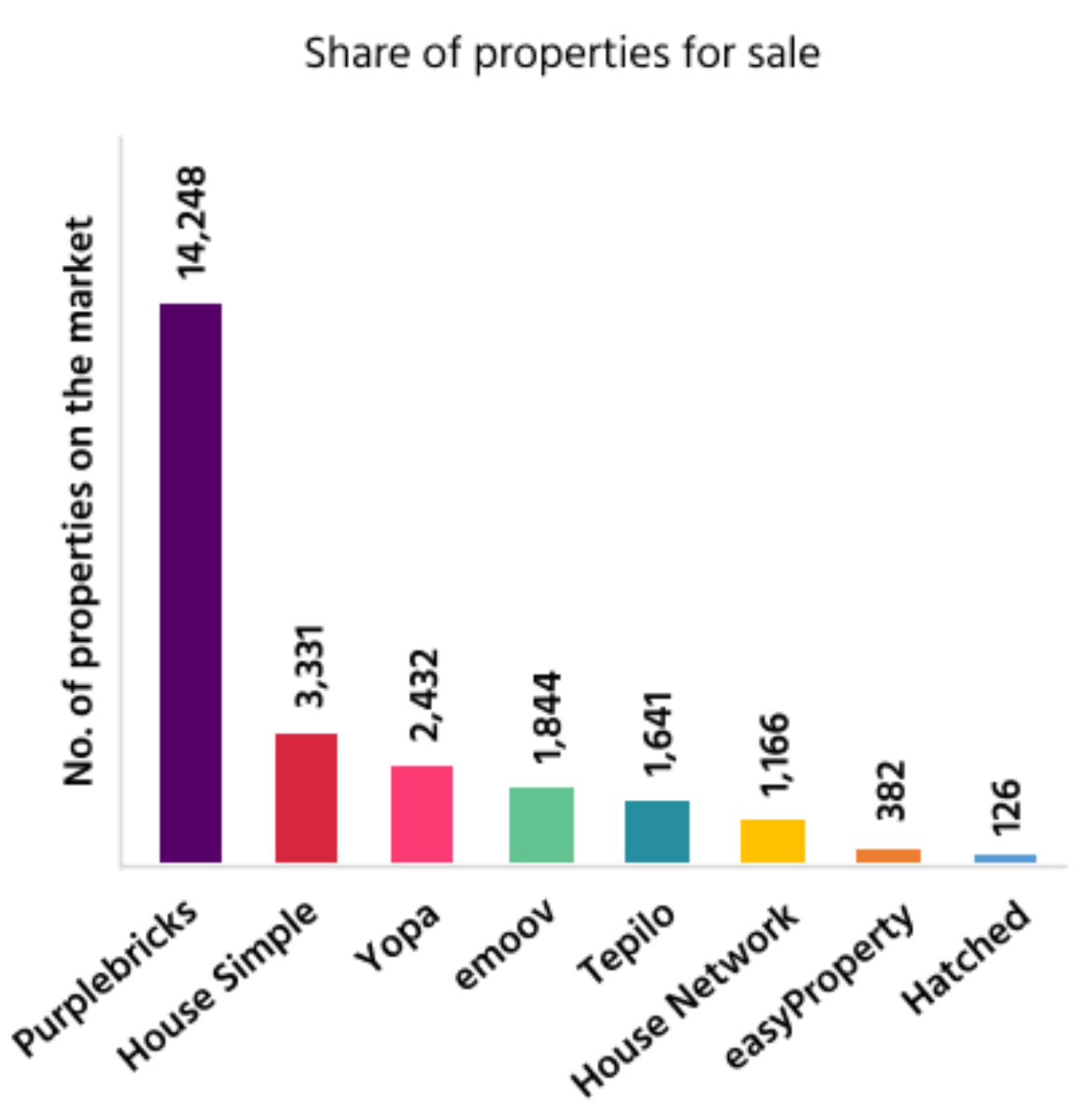

It will also be interesting to see how Opendoor approaches advertising. In the U.K., Purplebricks ran a national above-the-line advertising campaign (TV and radio) to build brand. That will be expensive in the U.S., but it’s a critical component to scaling the business, especially long-term customer acquisition costs. It’s also necessary to start building a moat between itself and its iBuyer competitors.

Opendoor will also face a significant challenge as it scales its people. As I mentioned above, scaling the business is resource intensive and is people dependent.

To win, Opendoor needs to provide exceptional customer service and needs to hire exceptional people. The more markets it expands to, the more people it will need. And the more people it hires, the more effort it will take to find exceptional people.

This contributes to the paradox. The larger Opendoor gets, the more difficult it will become to find quality people and maintain a high level of quality across a growing employee base -- all critical ingredients in delivering a superior customer experience.

The question of fees

Opendoor -- and its peers -- will also face ongoing challenges around its fees, both clearly explaining them to consumers and reducing them.

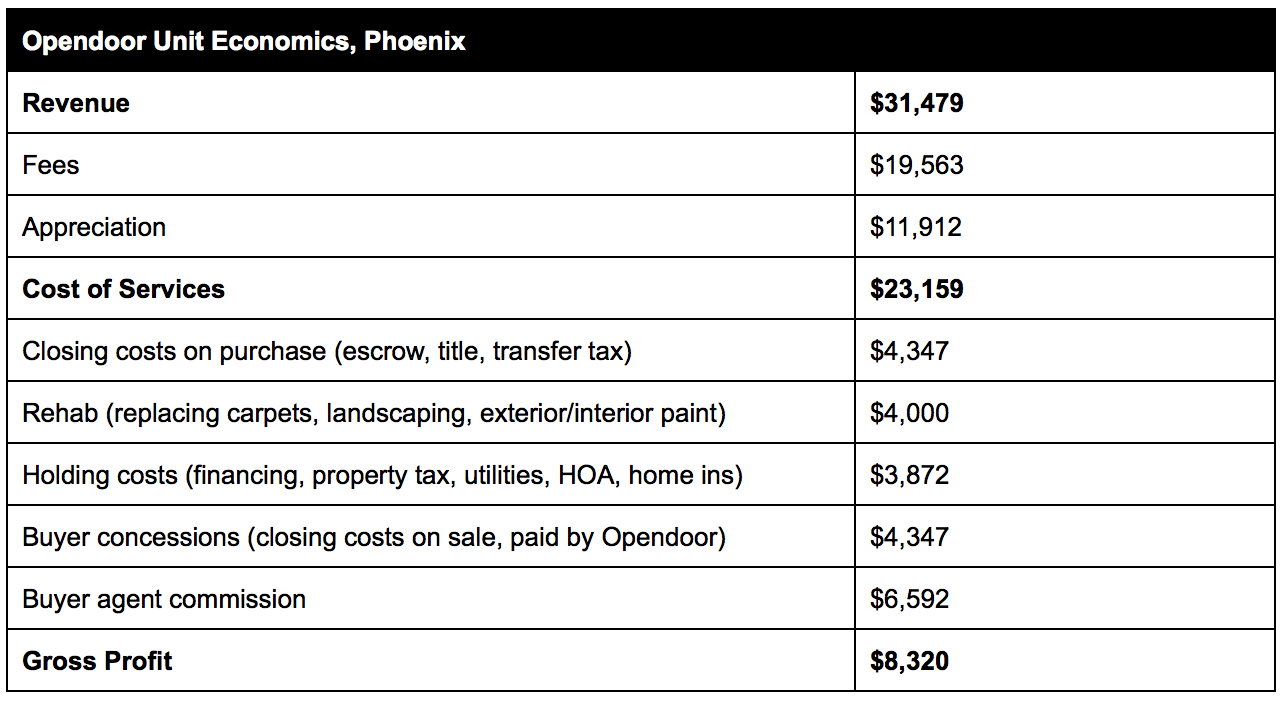

Opendoor needs to be price competitive with traditional real estate agents to succeed. The lower it can drop its fees, the more customers will flock its way. From the outside looking in, it appears to be doing this with the current fee structure, which happens to coincide with a noticeable uptick in activity in Q4 2017.