How Data Can Be Used to Mislead: Compass' Results Told Three Ways

/“In God we trust; all others bring data.” The power of data in evidence-based research is critical, but even data -- used certain ways -- can mangle the truth. As a case study of how data can be manipulated to tell different stories, I examine Compass' recent financial results three different ways.

Method 1: The Annual, Single-Company View

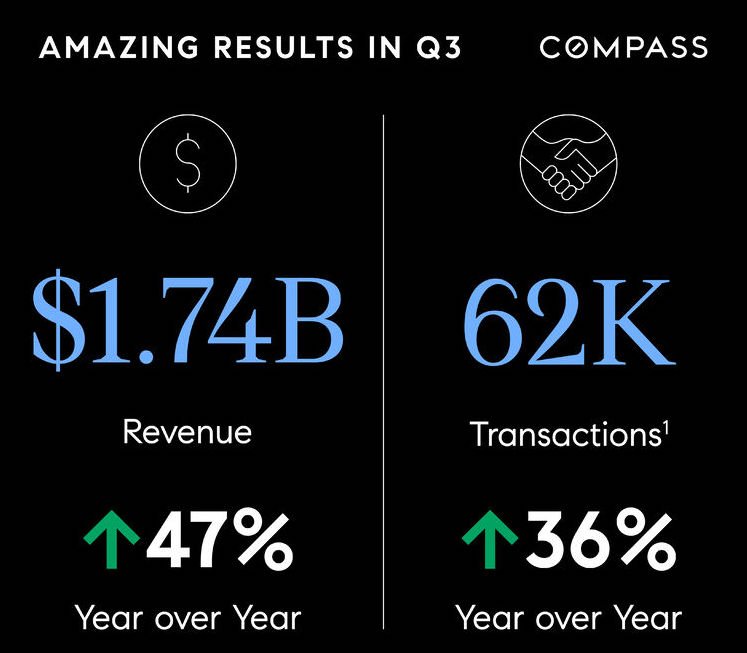

The first method, which is what Compass uses, compares key metrics to the corresponding period one year ago -- annual growth. Compared to Q3 2020 (and remember, 2020 was a pretty weird year), Compass experienced significant growth in revenue and transaction volumes -- up 47 percent and 36 percent respectively.

Compass' revenue growth was driven by more transactions, which in turn were driven by more agents (a 31 percent increase in Principle Agents). An annual comparison method accounts for seasonality in the business and is a great metric for companies in a relatively mature state, but falls short without important context.

Method 2: The Quarterly Single-Company View

An annual comparison is tricky for high-growth companies; the numbers are always huge. A granular look over time reveals deeper trends: Compared to the previous quarter, Compass' revenue actually declined, and its guidance for Q4 is a further decline.

Compass is subject to the same headwinds as any brokerage: inventory, seasonality, and agent recruitment & retention. It clearly hit a (seasonal?) peak in Q2, and now the business is slowing.

On a quarterly basis, Compass' losses are also stacking up. After approaching profitability last quarter, the company has returned to a net loss this quarter ($71 million of which is stock-based compensation expense).

A quarterly view over time introduces momentum and trends. It reveals that Compass's growth isn't steady (something that isn't clear with an annual comparison), and that the business appears to be slowing down -- with losses.

Method 3: The Quarterly & Annual Multi-Company View

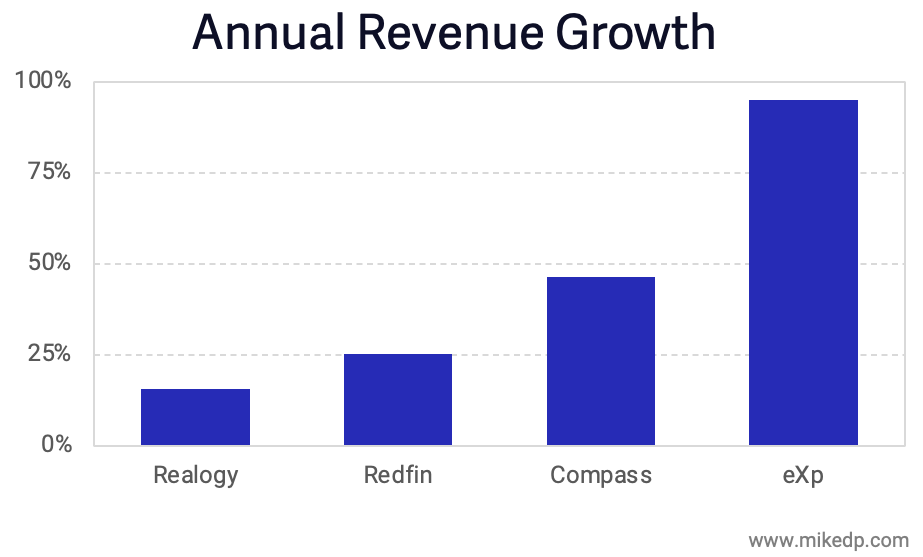

This method adds additional perspective with the context of Compass' publicly-listed peers. The numbers above lack context; is Compass under- or over-performing in the market?

It turns out that on an annual basis, revenue is growing at all of Compass' peers. Compass' growth rate is in the middle of the pack, larger than Realogy and Redfin, but lower than eXp Realty.

On a more granular basis (comparing to the previous quarter), Compass stands out with a revenue drop larger than its peers. As we saw above, something happened in Q3, and Compass' slowdown is more pronounced than any of its peers.

Finally, it's worth noting that Compass is materially less profitable -- unprofitable, in fact -- when compared to its brokerage peers. Realogy and eXp are generating significant net profits, while Compass continues to burn cash.

A peer comparison highlights key business model differences and provides another angle on the recent business slowdown. And while Realogy may be viewed as the less exciting, slow-growth industry incumbent, it runs a sustainable, durable, and profitable business model.

Strategic Implications

There's not one, right way to tell this story. But there's always different angles to consider, and multiple data points to triangulate the truth.

Exploring the complexity of real estate through evidence, context, and storytelling is a passion of mine. It's easy to manipulate the truth, or provide various versions of it, depending on the data presented. The truth is out there -- it just takes a critical eye to find it.

Zillow Exits iBuying — Five Key Takeaways

/Yesterday, Zillow announced that it is exiting its iBuyer business, Zillow Offers. After racking up over $1 billion in losses over 3.5 years, Zillow is closing the business down, a move that has significant implications for the real estate industry.

Zillow's Astronomical iBuyer Growth

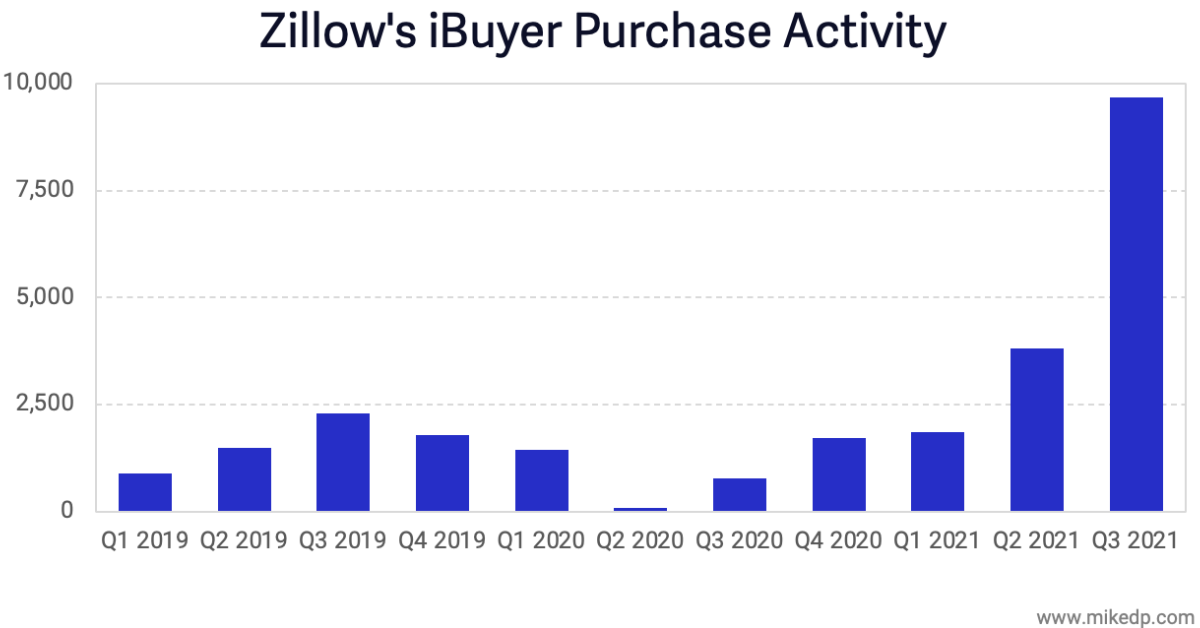

Zillow's iBuyer business grew so fast, so quickly, that it literally broke the company, forcing an abrupt shut down. In Q3 -- the three months that broke the business -- Zillow purchased more houses than in the previous 18 months combined.

This is the type of growth that can stress a business to its breaking point, which is exactly what happened.

This Was A Zillow Problem

Zillow's shareholder letter cites "higher-than-anticipated conversion rates" and "unintentionally purchasing homes at higher prices" as reasons for its failure. Both are execution issues that are critical ingredients to iBuying, and appear to be unique to Zillow.

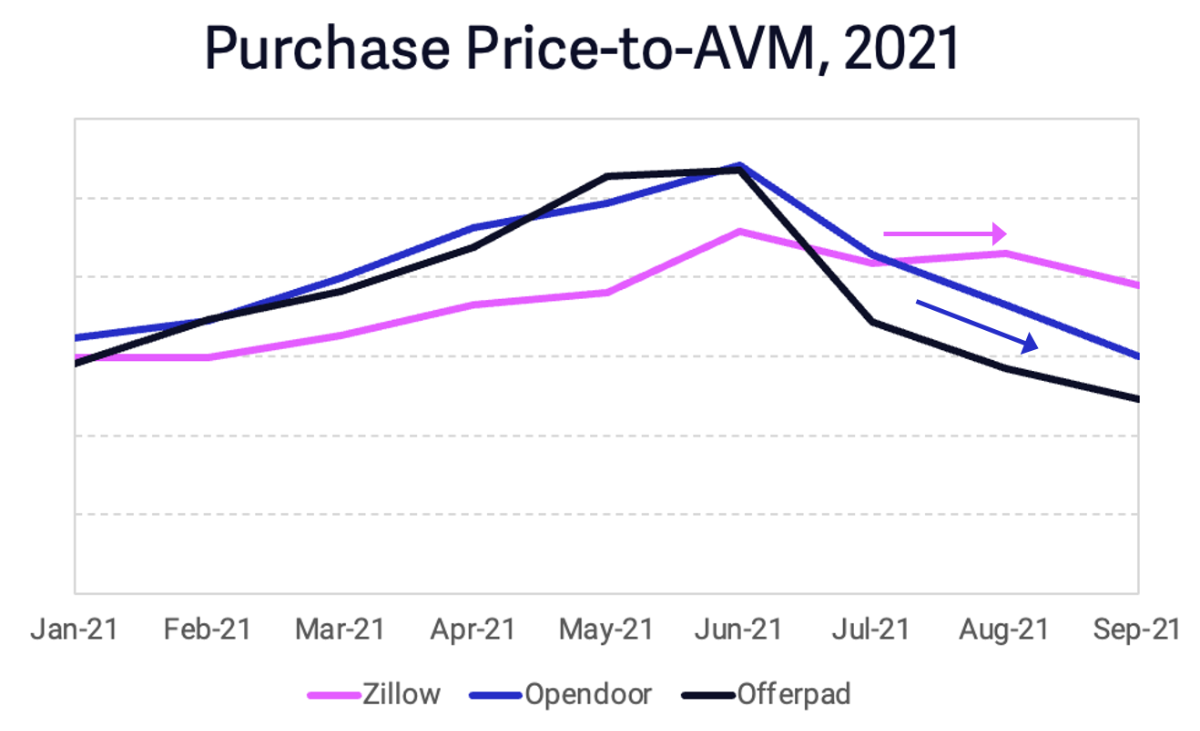

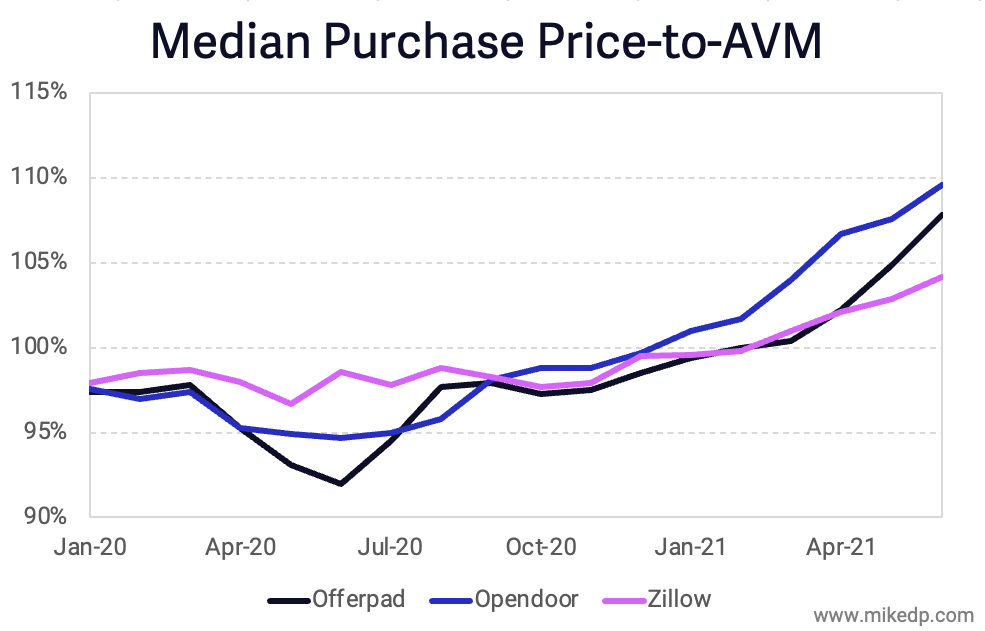

Zillow's unintentional purchase of homes at high prices contrasts nicely with Opendoor's intentional purchase of homes at lower prices. Beginning in July, as the market began to cool, Opendoor and Offerpad began paying less for homes, while Zillow continued to pay top dollar.

(I've removed the y-axis in the above chart to focus on what's really important: change over time, and the relative difference between iBuyers.)

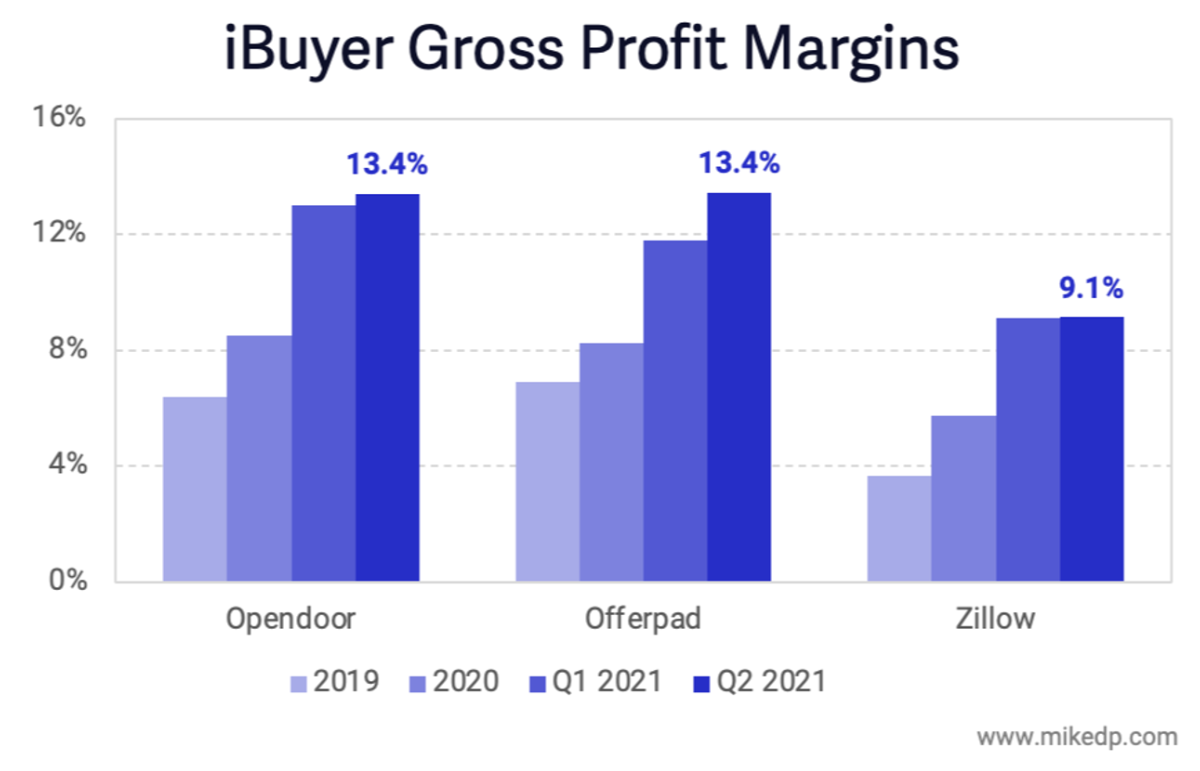

Since inception, Zillow has struggled to make structural operational improvements to its iBuying business. Zillow's gross margins -- which are a combination of purchase price, sale price, renovation costs, and service fee -- have consistently remained below its peers. Why? The others are just better at iBuying.

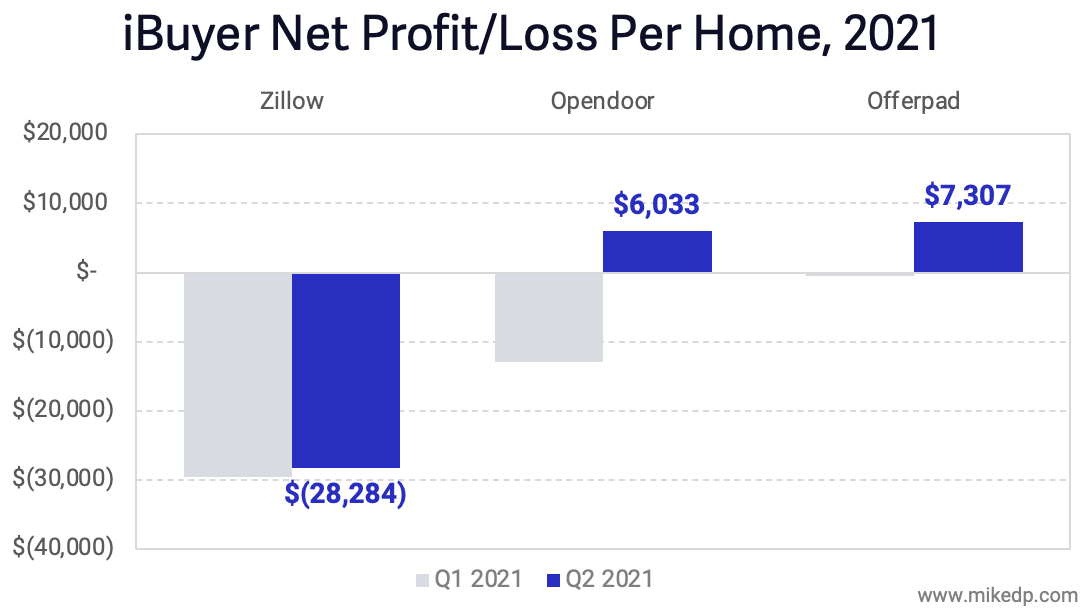

Earlier this year, when home price appreciation was at record highs and the other iBuyers flirted with profitability, Zillow continued posting massive losses.

iBuying is incredibly hard (it's real estate!). But while its peers managed incremental operational improvements over time, Zillow did not.

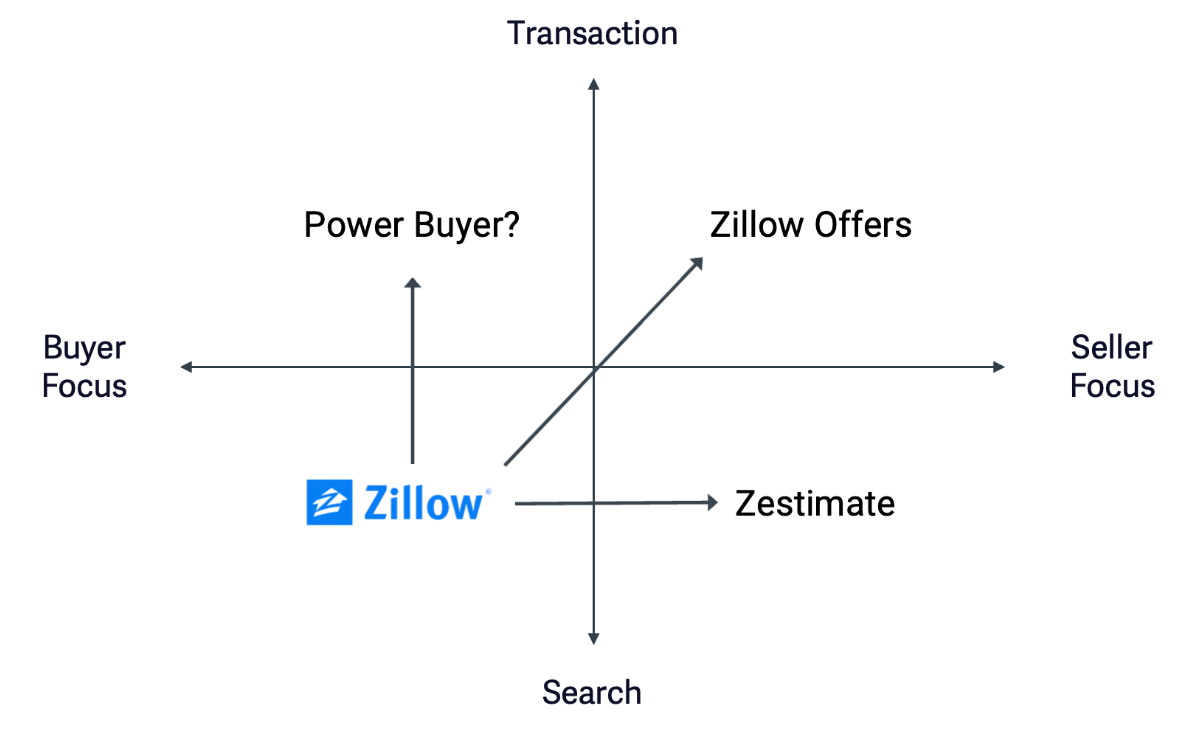

What's Next: Zillow 3.0

While Zillow 2.0 may have been a failed experiment in iBuying, what captures the imagination is the next iteration of the business. How will Zillow leverage its massive competitive advantage and its iBuyer learnings for Zillow 3.0?

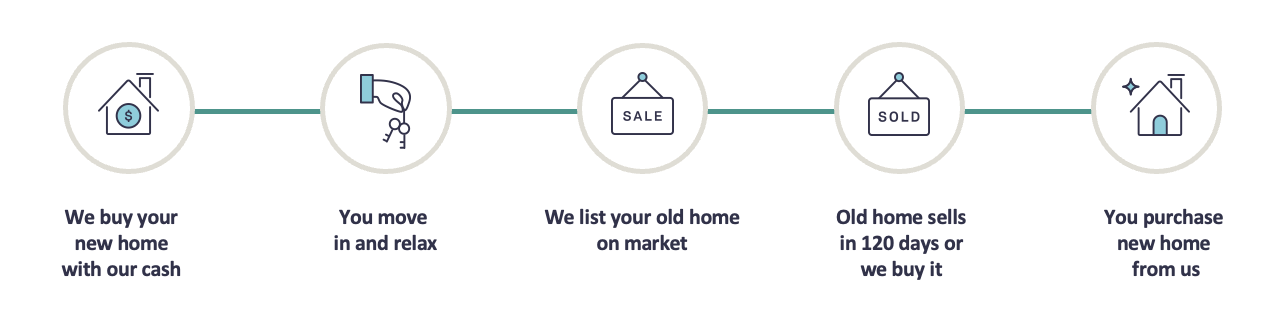

I wouldn't be surprised to see Zillow play deeper in the Power Buyer space, a model that is asset-light, easier to scale, less risky with better unit economics, and has a natural overlap with Zillow Home Loans (Opendoor diversified into Power Buying earlier this year).

Zillow as a Power Buyer -- either through organic development, partnership, or acquisition -- is a natural extension to its existing business of helping home buyers. The world of real estate has evolved significantly since 2018, and Zillow needs to stay relevant to those evolving consumer needs.

Opendoor's Pyrrhic Victory?

With Zillow's exit, Opendoor is left as the undisputed iBuying champion. But is it a battle worth winning? Zillow's exit is a mixed blessing for Opendoor, and puts the spotlight on Opendoor's path to profitability.

On the one hand, Zillow's absence from the market will relieve some competitive tension, allowing Opendoor to make slightly lower offers and charge slightly higher fees. There should be a small, positive effect on margins (which Opendoor needs more than ever).

But on the other hand, Opendoor is now going it alone, no longer able to piggyback off Zillow's consumer education efforts (advertising) in new and existing markets.

Opendoor has thrived in a high home price appreciation (HPA) market, driving gross margins to record highs. But with HPA dropping, what will happen to Opendoor's gross margins? Will it "make it up in volume," or will losses compound as it scales?

Black is the New Red

Zillow's decision to close its iBuying business is a victory for rationalists everywhere. For years, investment in real estate tech has frequently defied reason, prioritizing a company's ability to grow over profitability (watch my presentation, "How to Lose A Billion Dollars in Real Estate Tech"). Sustained unprofitability was the new competitive advantage and red was the new black.

But perhaps this is a turning point. For investors in Zillow, Opendoor, Compass, and a score of others, at some point enough is enough; a credible path to profitability is needed. For Zillow, this -- and losing a cool billion -- is that point.

I, for one, welcome the reintroduction of rational investment thought back into real estate. Let this be a welcome wake-up call for investors and the industry.

Priced to Sell: Zillow’s Inventory Problem

/In my previous analysis, iBuying is Hard: Zillow Pauses New Purchases, I suggested that iBuyers can get into trouble if they overpay for too many houses in a cooling market. This results in a growing inventory of overpriced houses that are difficult to sell, which is exactly the problem Zillow now faces.

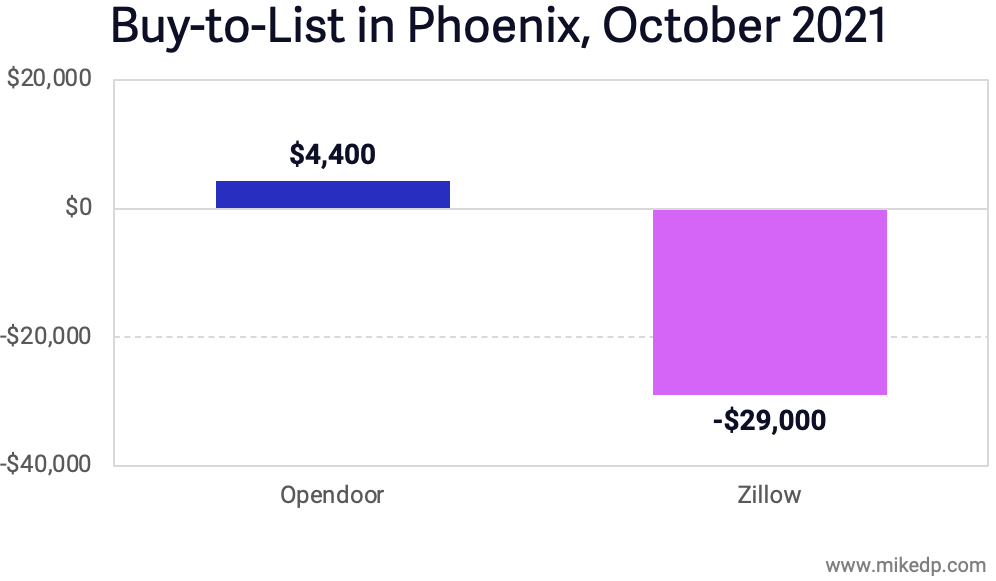

In Phoenix, Zillow's 250 current listings are priced at a median of 6.2 percent below what they were bought for (the "buy-to-list" metric).

(As a point of reference, iBuyer median home price appreciation -- buy-to-sell -- was around 8 percent earlier this year. In Phoenix, it was around 10 percent just a few months ago.)

Put another way, Zillow's Phoenix inventory is currently priced at a median of $29,000 less than the buy price. This is a direct result of price reductions on 182 listings of an average of $41k.

The trend is similar -- but not as bad -- in other markets. In Atlanta, Zillow's median buy-to-list is still positive, but down considerably from past months (and again worse when compared to Opendoor).

Buy-to-list is a metric that should be, and up until recently was, positive. On average, being able to sell a house for no less than it was bought for is table stakes for iBuying. A loss of $29k on each house -- before any other expenses are accounted for -- represents a catastrophic failure in pricing.

Perspective

There are a number of ways to read the situation. Yes, Zillow screwed up. Yes, Opendoor looks impressive in comparison. And yes, there are challenges with iBuying in a cooling market. In the microcosm of one iBuyer, in one market, in one month, the situation looks dire.

But it won't stop Zillow; the loss, relative to its total investment in iBuying, is small. Sold today, Zillow’s Phoenix listings would incur a loss of $7 million. That’s a fraction of Zillow’s total iBuying losses of this year and last.

This is a company that is willing and able to lose hundreds of millions of dollars to invest in and build a new business. A $7 million loss in one market during one month will be a distant memory by this time next year.

The iBuyer investment case for Zillow, Opendoor, and others is clear: this is an opportunity measured in trillions, not billions, of dollars. Within the context of long-term industry disruption, this may simply be an embarrassing detour on Zillow's inexorable march to transform real estate.

Special Thanks

The data collection for this analysis came together quickly with the help of several friends. Thank you to Rich Mackall, Oscar Castaneda, Sarah Perkins, and Divvy Homes!

iBuying is Hard: Zillow Pauses New Purchases

/Zillow announced that its iBuyer operation is paused for new business, and will not sign any additional contracts to buy homes through the end of the year.

Unprecendented Growth

Last quarter, the iBuyers purchased more houses than ever before. Preliminary market data -- which is so high I have to make note of how unusual it is -- shows another record-breaking quarter. In fact, if true, it would represent absolutely stunning growth to a scale the iBuyers have talked about but have yet to achieve.

If the public record data is accurate, Zillow purchased more than twice the number of houses in Q3 compared to Q2 (which itself was double Q1). This is the type of growth that can stress a business to its breaking point.

Missing the Signs

Aside from the massive human capital implications of scaling a business so quickly (real estate transactions are complex and people-dependent), the iBuyers can get into trouble if they pay above market for too many houses in a cooling market. This results in a growing inventory of over-priced houses that are difficult to sell.

Zeroing in on Phoenix offers a snapshot of the importance of reading and reacting to these changing market conditions. When Phoenix started to cool, Opendoor and Offerpad began to adjust by slowing down purchases. Zillow, however, did not.

As the market cooled between August and September, Opendoor and Offerpad purchased fewer houses, while Zillow purchased more.

Adjusting Prices

The iBuyers also adjusted to changing market conditions by paying less for houses. The median purchase price in Phoenix peaked in August. Opendoor and Offerpad's median purchase price also peaked in August before tracking the market and declining in September. But Zillow kept paying more and more.

Zillow continued to purchase homes well above the market median -- a full $65k higher in September. It continued to pay top dollar to fuel acquisitions at a time when the market was cooling and other iBuyers were pumping the brakes.

Strategic Implications

Growing pains. Off the rails. Ahead of your skis. Any of these phrases could apply to the situation at Zillow (or any number of other high-growth companies).

The iBuyers -- Zillow included -- experienced massive, transformational growth in 2021. And while Zillow stumbles, Opendoor appears to be firing on all cylinders and flexing its well-honed operational muscle as it reaches new highs.

The current problem seems to be unique to Zillow. The other iBuyers saw the signs and made strategic adjustments months in advance. Zillow either missed the signs, or decided to proceed despite them.

Which leads to the current situation: embarrassing, clearly not ideal, but also not the end of the world. A timely reminder that iBuying is an incredibly difficult business to scale, and when you move too fast, sometimes things break.

The Real Estate Disruptors Serious About Mortgage — A 10x Story

/Real estate tech disruptors are investing billions to build integrated brokerage and mortgage experiences. Some have more resources than others, but all have the same scaling bottlenecks. And in the end, the biggest disruptors -- and who is most at risk -- may come as a surprise.

The Bottlenecks to Scale

Each company employs licensed brokers -- Mortgage Loan Originators (MLOs) -- that occupy a critical position in securing or refinancing a mortgage. As with real estate, people remain a central component of the mortgage process, and no amount of technology, venture capital, or inspirational vision has yet to replace them.

MLOs are both a key component and a bottleneck for the iBuyers, Power Buyers, and others attempting to attach mortgage to their core services. The speed at which they hire MLOs, and the total number employed, is a reflection of how serious they are and their potential to grab market share.

Homeward and Knock, fresh off big funding rounds, are quickly growing. Newcomer Tomo is moving fast. Notably, the iBuyers remain relatively small. There is no outsize leader...until real estate portal Zillow is added into the mix.

Zillow has nearly 10x the MLOs of its smaller competitors, giving it significantly more scale and firepower for its integrated mortgage plans. Zillow is the top player...until pure play digital disrupter Better Mortgage is added into the mix.

Better Mortgage has raised nearly $1 billion in its quest to disrupt mortgage, and has nearly 10x the MLOs of Zillow. Significant firepower and scale, and clearly the top player...until industry behemoth Rocket Mortgage is added into the mix.

Ten MLOs to ten thousand MLOs. And: The number of MLOs roughly corresponds to closed loan volumes: $1.2 billion for Zillow, $14 billion for Better, and $65 billion for Rocket in Q1 2021.

Who's Disrupting Whom?

Both Rocket and Better recently announced they're hiring in-house real estate agents, which raises an interesting question about who's disrupting whom. Real estate tech companies are going after mortgage, but now mortgage is going after real estate.

These companies all have different approaches, but the destination is the same: an integrated real estate experience that seamlessly combines mortgage and brokerage. And the key execution trends are clear: in-house agents and MLOs, paired with deep discounts for consumers.

Perhaps the true takeaway is that those companies not included on the chart are the ones at risk. Whether it's being initiated from the real estate or mortgage side, both components are being smartly combined to provide an integrated, highly convenient consumer experience. The companies unable to provide that are the ones at risk.

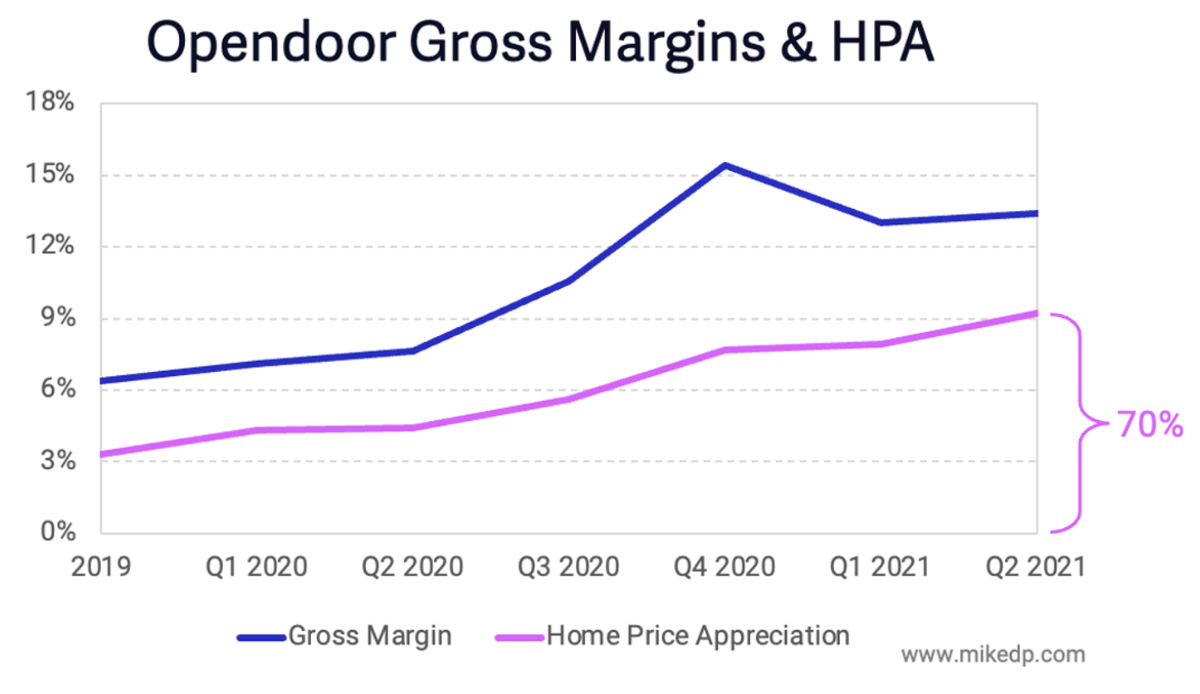

iBuyer Profits At Risk With Falling Home Price Appreciation

/U.S. iBuyers are closer than ever to profitability. Offerpad just posted a profitable quarter, and if stock-based compensation is excluded, so did Opendoor. But the overwhelming majority of profits are coming from record home price appreciation, which is temporary, and appears to be falling.

Home price appreciation (HPA) has always been a component of an iBuyer's gross profit; it is the spread between the purchase and resale price of a home. And it's significant: In Q2 2021, home price appreciation accounted for 70 percent of Opendoor's gross profit margin.

Over time, home price appreciation is becoming a larger component of Opendoor's gross profit margin -- rising from 50 percent in 2019 to 70 percent in Q2 2021.

What Goes Up Must Come Down?

Home price appreciation rates are beginning to cool in major markets across the U.S., including Phoenix, where the median iBuyer home price appreciation has fallen 50 percent since May. Opendoor's median home price appreciation for homes sold in August is just 2.7 percent, down a massive 75 percent from 10.7 percent in May.

The decline will certainly have a material impact on iBuyer gross profit margins, which have reached record highs during 2021.

Opendoor's gross margins have increased an impressive 700 basis points, from 6.4 percent to 13.4 percent, between 2019 and Q2 2021. But 84 percent of that improvement is from rising home price appreciation (3 percent → 9.2 percent).

Strategic Implications

Gross profit margin includes an iBuyer's service fees, home price appreciation, and repair costs (and in the case of Opendoor and Offerpad, also includes revenue from ancillary services like title insurance, mortgage, and brokerage services).

The iBuyers' recent profitability is being driven by record home price appreciation -- a temporary artifact of a hot housing market. As the market eases off its red hot highs, slowing price appreciation may have an adverse effect on iBuyer profit margins.

Thanks to Sarah Perkins of Lawyers Title (check out her real estate updates at theazmarket.com), for helping me dig through tax records.

Realtor.com Grows Agent Revenues Faster Than Zillow

/Top U.S. portals Zillow and realtor.com recently released their latest financial results. Historically, Zillow has maintained a consistent 2.5x agent revenue lead over realtor.com. But in the last quarter that lead has slipped, as realtor.com grew its agent revenues much more than Zillow.

Since the last quarter, Zillow increased its premier agent revenues by $14 million, or 4 percent, compared to an increase in realtor.com's real estate revenues of $24 million, or 18 percent. These are each company's agent lead gen programs, and don't include adjacencies like iBuying and mortgage.

That's a big jump and an outsize increase in realtor.com's agent lead gen revenues. The growth is potentially driven by the expansion of the Opcity referral program, which now makes up 30 percent of total revenues.

Strategic Implications

The decline in Zillow's revenue lead may be the start of a trend, or it may be a temporary blip (which has been seen before). Quarterly results from the past three years show that the companies are still within the normal bounds of fluctuations.

While the revenue dominance between Zillow and realtor.com has remained relatively static, the total spend from agents has not. Combined, Zillow and realtor.com have managed to increase agent revenues 55 percent over the past two years, from $327 million to $507 million -- seemingly fueled by the hot market.

So while Zillow and realtor.com have yet to consistently outperform each other, they're still managing to extract more revenue than ever before from their best customers: real estate agents.

Compass Nears Profitability as it Outperforms Incumbent Peers

/It's earnings season, which means press releases with huge numbers and big percentage gains, but light on helpful context. Compass posted big numbers; its quarterly growth is generally in line with its peers, while its record revenue is the result of continuous incremental outperformance.

Pandemic-Fueled Revenue Leap

Compass experienced a significant increase in revenue this past quarter -- a seasonal uplift fueled by a hot housing market. Compass has a history of large Q2 revenue jumps (delayed by a quarter in 2020 due to the pandemic).

When it comes to a global pandemic and real estate, a rising tide lifts all boats. Many of Compass' publicly-listed peers, including Realogy, eXp Realty, and Redfin, also experienced record breaking revenue growth. The quarterly growth rates follow a similar pattern.

They key is that Compass (and eXp) are outperforming their peers by a few percentage points each quarter -- the highs are higher and the lows not as low. That compounding effect adds up over time, and has resulted in Compass finally surpassing Realogy's brokerage revenue in Q2 2021: $1.95 billion vs. $1.77 billion.

Approaching Profitability (?!)

Compass also announced a net loss of only $7 million -- a huge improvement over past quarterly losses. The improvement was driven by Compass increasing its revenues and gross profit (by a lot) without a corresponding increase in expenses.

Future profitability hinges on more of the same: a favorable real estate market with a high volume of transactions, without a proportionate increase in expenses.

Strategic Implications

Like eXp Realty, Compass' revenue has increased exponentially over the past two years, driven by incredibly favorable market conditions that have benefited all real estate brokerages -- but some more than others.

Huge industry incumbents like Realogy have benefitted the least, while upstarts Compass and eXp have grown the most. Even tech-enabled Redfin, with so much going for it, pales in comparison to its peers.

The hot real estate market has fueled strong growth across the industry. Compass' growth is noteworthy, and demonstrates that while the industry moves slowly, some players move faster than others.

iBuyers: Paying Above Market and Reselling For More Upside

/With unprecedented demand and constrained supply, house prices are rising across the U.S. Consequently, the iBuyers -- led by Opendoor, Zillow, and Offerpad -- are paying record-high, above market values for the homes they’re purchasing from homeowners. But they're also reselling them for more money than ever before.

Purchase Price-to-AVM

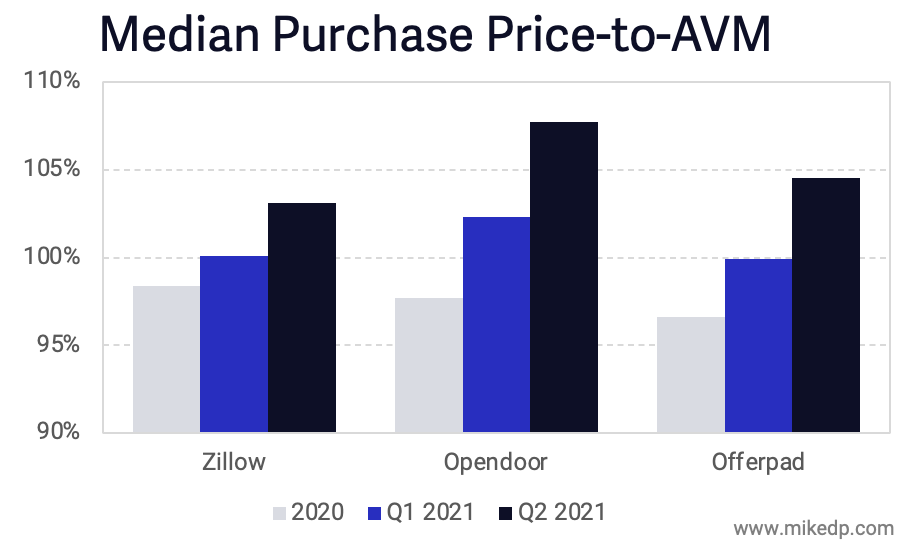

Purchase Price-to-AVM is a comparison of the price an iBuyer pays for a house compared to what an AVM (automated valuation model) determines the house is worth at the time of purchase. This study uses the ATTOM Data AVM.

Historically, iBuyers paid a point or two below “market value.” My previous research study, conducted in 2019, found a median Purchase Price-to-AVM of 98.6 percent for Opendoor and Zillow. But things have radically changed in 2021; the number is well over 100 percent, with Opendoor paying a median of 107.7 percent in Q2 2021.

To be fair, most of the market is paying above "market value" in the housing frenzy of 2021. And for iBuyers, this trend has accelerated over the past six months, led by Opendoor. As a newly-listed public company, Opendoor needs to demonstrate strong revenue growth, and the only way to do that is by buying and selling more houses.

This shift -- and Opendoor’s strategy -- is clearly visible when analyzing its Purchase Price-to-AVM distribution compared to Zillow. In 2020, both companies were nearly identical, with a median Purchase Price-to-AVM of around 98 percent.

But in the first half of 2021, Opendoor materially shifted to the right, paying, on average, significantly higher prices for houses.

Over the past 18 months, Opendoor has clearly shifted to paying more for homes, with a much looser price distribution than the past.

The above chart can be interpreted a number of ways: houses are getting more expensive (they are), Opendoor is paying more for houses (it is), and pricing is becoming harder to predict with an AVM. But there also appears to be a shift from the tight pricing discipline of 2020 to a free-for-all, acquire at any cost strategy.

The trends adhere to the fundamental principles of supply and demand: with housing in short supply, iBuyers need to increase the quality of their offers. But this doesn't negatively affect their margins; in fact, iBuyers are reselling homes for more money than ever before.

Rising Price Appreciation

Once an iBuyer purchases a house, they quickly spruce it up and resell it -- ideally for more than they bought it for. This difference, the spread between the purchase and resale price, is price appreciation.

In 2021, the median price appreciation for iBuyer transactions is 8.1 percent -- a record high -- up from 4.7 percent in 2020 and 3.3 percent for Opendoor and Zillow in 2019. And it continues to climb, with Opendoor hitting 9.2 percent in May 2021.

Combined with 2021's 40 percent increase in the median value of homes purchased by iBuyers, price appreciation approaching 10 percent is financially significant.

Consider: median price appreciation of 3.3 percent on a $250k home in 2019 is $8,250, compared to 9.2 percent (Opendoor's price appreciation in May 2021) on a $350k home, which is $32,000.

And the results vary by market. An analysis of 262 iBuyer transactions in Phoenix during May and June shows a median price appreciation of 11.5 percent, or $39,000, after a median of just nine days on the market (total hold time is about two months).

It's no wonder that iBuyers are happy to pay more for houses and abandon their tight price discipline; they're more than making up for it on the resale.

A Note on Data Sources

The data above is primarily sourced from national public property records, with some data from the Phoenix MLS. Price appreciation is calculated by taking the percentage difference between sale price to purchase price for matched properties, and then taking the median value of those transactions. It is based on over 20,000 transactions between January 2020 and May 2021. Thanks to my good friend Suhel Mangera for his assistance crunching the data.

For more, zavvie's recent Seller Preferences Report does a good job of tracking iBuyer offer quality, fees, concessions, and other data that's relevant for consumers.

iBuyers Are Back: Purchase Volumes and Prices Soar to Record Highs

/After a brief interlude last year, iBuyers are back in a big way. The iBuyers have bought more houses, at higher prices, in Q2 2021 than in any other quarter. Opendoor purchased more houses in the past three months than in all of 2020.

For anyone concerned that the iBuyer model wouldn't be popular in a seller's market, the evidence shows that it is resonating with consumers more than ever, and market conditions are in fact fueling its growth.

$350k is the new $250k

iBuyers are paying more for houses than ever before. The median purchase price of a home bought by Opendoor, Zillow, and Offerpad climbed to $350k in May, up from a steady-state median of $250k for the past several years (the iBuyer "sweet spot").

The iBuyers are still generally purchasing the same types of houses, they're just worth a lot more (+40%) due to the hot housing market. The median iBuyer purchase price closely tracks that of the overall U.S. market.

A more granular analysis shows dramatic shifts in price distribution. In the past 18 months, the percentage of homes purchased by iBuyers under $250k has plummeted from 55 to 13 percent, while the percentage of homes purchased for more than $500k has jumped from 3 to 24 percent.

This is a significant shift in the underlying economics of iBuying that affects revenues, gross profit, financing, inventory value, and more. For example, in Q1 2020 Opendoor sold around 5,000 homes. At an average of $250k each, that's around $1.2 billion in revenue. But at an average of $350k, revenue would be $1.7 billion -- a 40 percent increase driven by home values alone, and not volume.

The iBuyers will have blow-out quarters with record revenues, driven by high purchase and sale volumes and the rise in home values. iBuying is back in a big way.

A Note on Data Sources

The data above is sourced from national public property records. There is a timing delay, which means the June numbers may be slightly high or low. But the difference shouldn't take away from the major narrative of record volumes for the quarter.

Opendoor's Mortgage Attach Rate Jumps, But At What Cost?

/A key component of the long-term profitability of iBuyers is their ability to attach adjacent services such as mortgage and title insurance. Opendoor's mortgage attach rate in Arizona has recently shifted dramatically -- up from around two percent during the past 18 months, to nine percent in April and a record 12 percent in May.

While the improvement is significant, there are a few points worth clarifying:

While the percentage is high, the raw numbers are low. May's numbers equate to about 19 transactions where Opendoor sold a home and attached its Opendoor Home Loans product.

Attach rates and loan numbers in other markets remain low (roughly two percent attach in Texas). In May, there were five transactions attached to Opendoor Home Loans outside of Arizona.

As context, a 12 percent mortgage attach rate is an improvement, but still well-below industry averages and the Power Buyers.

The Cost of Gaining Market Share

Opendoor is making impressive gains in Arizona, but what's driving the momentum? It appears to come down to financial incentives: Opendoor is offering an additional two percent discount to buyers that use Opendoor Home Loans. As of writing, this promotion appears to be live in the Phoenix and Atlanta markets.

Opendoor offered the following table to prospective buyers (and their agents), showing the savings when using Opendoor Home Loans.

The challenge with these discounts is that Opendoor is giving away all of its margin to gain market share. In its investor presentation, Opendoor states a target margin of $5k on home loans -- which instantly disappears with a two percent back promotion.

Opendoor's rising mortgage attach rate in Arizona appears to be the result of significant financial incentives, or a "let's throw money at the problem" strategy.

Strategic Implications

There are two sides to Opendoor's "Throw Money At It" strategy. On the one hand, Opendoor effectively has unlimited access to capital, and is leveraging that competitive advantage by competing where it can win.

On the other hand, throwing money at the problem is a relatively unsophisticated, brute-force approach to gain traction and demonstrate top-line growth -- but at what cost? How valuable is a service if you need to pay people to use it?

Losing money on the core iBuyer transaction with hopes of making money on the mortgage (which is also losing money), doesn't balance out. Two loss leaders don't make a profit. For any company attempting to generate profits from adjacent services, and there are a lot, mortgage remains hard; it is no panacea for profitability.

The Rise of Power Buyers

/Following the rise of iBuyers during the past decade, 2021 has seen the emergence and rapid growth of Power Buyers -- companies empowering buyers with services like cash offers, bridge financing, and trade in programs. Like iBuyers, these companies are transaction-focused, but most critically, target buyers instead of sellers.

Power Buyers leverage their balance sheets to purchase homes on behalf of their customers (turning offers into all-cash offers, or as part of a trade in program).

The focus on buyers is achieving a high product/market fit: Orchard and Homeward saw 150%+ growth in 2020 and over 300%+ growth into 2021. With high demand for housing and low supply, buyers need products to stand out from the crowd. Cash offers and trade in programs are providing that advantage.

The Mortgage Advantage

Financial products aimed at home buyers give Power Buyers industry-leading mortgage attach rates. That is in stark contrast to the major iBuyers, who have struggled to attach mortgage.

When it comes to attaching mortgage, it appears to be more effective to target buyers earlier in the process. Which is why the iBuyers are evolving their model to offer cash offer and trade in programs (ex: Opendoor's cash-backed offer).

The shifting landscape is causing disruptors and incumbents to adjust their strategies. Many companies are responding to this shift in consumer demand by launching their own instant offer, cash offer, and trade in programs.

Digging Deeper into Power Buyers

There's a lot more to unpack in the world of Power Buyers. My latest free report goes into this topic in detail, and the following video provides a crisp overview.

The Impact of Compass' Declining Stock Price on Agents

/Compass' stock price has declined significantly since its IPO; it was the worst performing stock among its real estate peers over the past three months. And while stock prices certainly fluctuate, the decline has a significant, real world impact for the Compass agents that participated in its agent equity program.

A Bumpy IPO

Compass' stock has had a rough ride since its IPO on April 1, 2021. The company originally planned to price its shares between $23 and $26, valuing the company at $10 billion. With muted demand from investors, it revised down to $18 a share with a valuation of just over $7 billion for the IPO.

Compass Stock Price

Compass' stock has generally declined since its debut as a public company. It's currently trading at around $13.30 per share with a market cap of $5.2 billion -- significantly less than its last private valuation of $6.4 billion set by investors in July 2019.

Unlike any of its public real estate peers, Compass is worth less today than it was two years ago -- an outlier in the high-flying world of real estate tech stocks.

The Agent Equity Dilemma

Compass' stock price is especially relevant to agents that participated in its agent equity program, which allows agents to convert a portion of their commission into company shares. Compass agents invested $70 million into this program during 2018 and 2019 (the 2020 figure is unknown).

Any shares issued after July 2019 were valued at the company's valuation at that time: $6.4 billion or $154.26 per share ($15.42 per share after accounting for a stock split).

The point is that Compass stock is worth less today than it was in 2019, meaning agents that invested into the agent equity program since then have lost money on their investment (even accounting for a 10 percent company match).

Strategic Implications

Compass' growth story is impressive, and building a multi-billion dollar business is a noteworthy achievement. There are many individuals and organizations that made lot of money from the Compass IPO. But it's not a linear, upward trajectory to riches, and there are definitely winners and losers.

Stock option programs sound good on paper, but the reality varies. The post-IPO performance of Compass' stock highlights the primary issue with stock as a recruiting tool: it only pays if the stock goes up.

iBuyers Beginning to Target the Northeast Market

/The Northeast is the major population center of the U.S., but has remained untouched by disruptive new models in real estate -- until now. Opendoor, Zillow, Offerpad, RedfinNow, and Orchard are establishing the first footholds in this potentially lucrative market. Traditional agents and brokers have had years to prepare -- are they ready?

The strongest iBuyer markets are centered in the West, Southwest, and South -- basically everywhere except the Northeast and Midwest. These markets, with older housing stock and longer winters, are more difficult to crack.

Major iBuyer Markets

But it's no secret the iBuyers (and other models) plan to enter the Northeast. Opendoor's investor presentation clearly laid out the playbook and plan of attack, which includes expansion into the Midwest and Northeast corridor.

Opendoor's Target Markets

Based on a pair of recent job postings, it appears that Opendoor is starting in Washington D.C., Virginia, and Maryland -- a market that RedfinNow and "Power Buyer" Orchard also entered earlier this year.

In early 2021, RedfinNow was the first iBuyer to launch in Boston. Meanwhile, Offerpad is expanding through the Midwest, recently announcing a launch in Columbus. This sits alongside Zillow Offers' presence in Cincinnati, a market launched in 2020.

Strategic Implications

Traditional real estate agents located in the Northeast and Midwest have had years to watch and learn. Billion-dollar disruptors are coming, featuring new models like instant offers, cash offers, and buy before you sell programs.

The Northeast accounts for 17 percent of the U.S. population, and local realtors can be zero percent forgiven for ignoring the coming disruption. Change is happening (slowly) and smart agents are adapting to that change. No market is immune. What's your plan? (Hint: Compete Where You Can Win).

Offerpad and Its More Profitable Flavor of iBuying

/The Offerpad story presents the clearest signal yet that iBuying can become profitable. Its latest Q1 2021 numbers show a business only losing $230 per home bought and sold -- a breathtaking achievement compared to losses of tens of thousands of dollars per home at Opendoor and Zillow.

All up, on a GAAP basis, Offerpad's Q1 net loss was just $233k, compared to $58 million for Zillow Offers and $270 million for Opendoor. Staggering differences.

Background

Following Opendoor, Offerpad was the second iBuyer to launch in the middle of the last decade. In terms of size, it was eclipsed by Opendoor but has maintained parity with Zillow, buying and selling more than 4,000 homes per year.

Offerpad's version of iBuying stands out because it is losing radically less money than its peers. Offerpad's overall net loss per home is significantly lower than Zillow and Opendoor -- $5,400 compared to Opendoor's $29,000 in 2020. And it's overall net loss in 2020 was $23 million, twelve times smaller than Opendoor's $286 million.

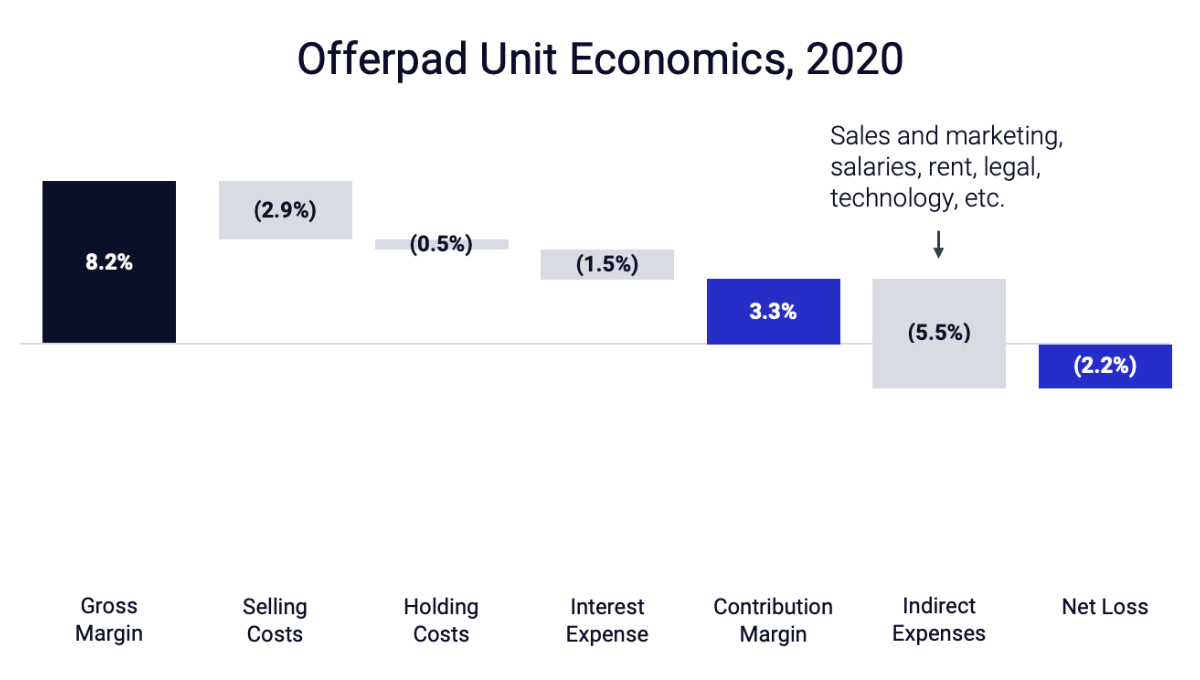

Comparing Unit Economics

Financially, there are two possible explanations for this difference: either Offerpad is generating more revenue, or it is incurring less expense, per home bought and sold.

On the first point, the evidence suggests nearly identical revenue generation at Offerpad and Opendoor, as measured by gross margins (this accounts for purchase price, sale price, renovations, and ancillary services).

Both companies are tracking above Zillow, with all iBuyers seeing significant gross margin gains in Q1 2021 due to higher home price appreciation in the current market (and Opendoor is almost certainly benefiting from withholding new listings in 2020).

Offerpad and Opendoor have very similar direct costs as well (as measured by selling costs, holding costs, and interest expense in the charts below). The primary difference appears to be in each company's indirect expenses.

The unit economics between the two companies are nearly identical. But as a percentage of revenue, Offerpad's indirect expenses were 5.5 percent in 2020, compared to Opendoor's 14.6 percent (and Zillow's 17.5 percent). This is the key difference driving profitability.

Indirect Expenses

Each company has three main expense lines:

Sales, marketing and operating

General and administrative

Technology and development

Sales, marketing and operating generally scales with volume; it includes selling costs, holding costs, and other costs directly involved in the transaction. General and administrative consists of corporate overhead like executive and admin salaries and rent, while technology and development includes all tech costs, including headcount.

The iBuyers have vastly different approaches to their technology investment; Opendoor is spending about eight times more on technology and development than Offerpad (and both companies are dwarfed by Zillow -- but given Zillow's wider technology ecosystem, I'm going to focus on an Opendoor comparison).

Since 2018, Opendoor has invested over $150 million into technology, compared to just over $20 million at Offerpad.

Offerpad's General and Administrative (G&A) expense -- think of it as general corporate overhead -- is also well below its peers. Again, Opendoor is outspending Offerpad by a factor of eight.

The differences in investment aren't explained by volume. In 2019, Opendoor sold about 4x the houses as Offerpad, but its overhead and tech costs were about 7x higher. In 2020, Opendoor sold about 2x the houses as Offerpad, and its overhead and tech costs were about 8x higher (a trend that continues into 2021).

Certainly each company has slight variations on how it accounts for expenses, but the overall narrative is clear: In aggregate and on a per unit basis, Offerpad is spending a fraction of what Opendoor is on technology and corporate overhead, resulting in significantly lower indirect costs.

The Impact of Technology

How does Opendoor's $150 million technology investment compare to Offerpad's $20 million? Looking at the bottom line, the results show a negligible difference and no competitive operating advantage.

I would expect technology development to allow iBuyers to more accurately price homes, improve operational efficiency, or reduce expenses -- but Offerpad and Opendoor have nearly identical unit economics and direct selling costs (Opendoor's gross margin advantage is being driven by home price appreciation, which is a gravy train that won't last forever).

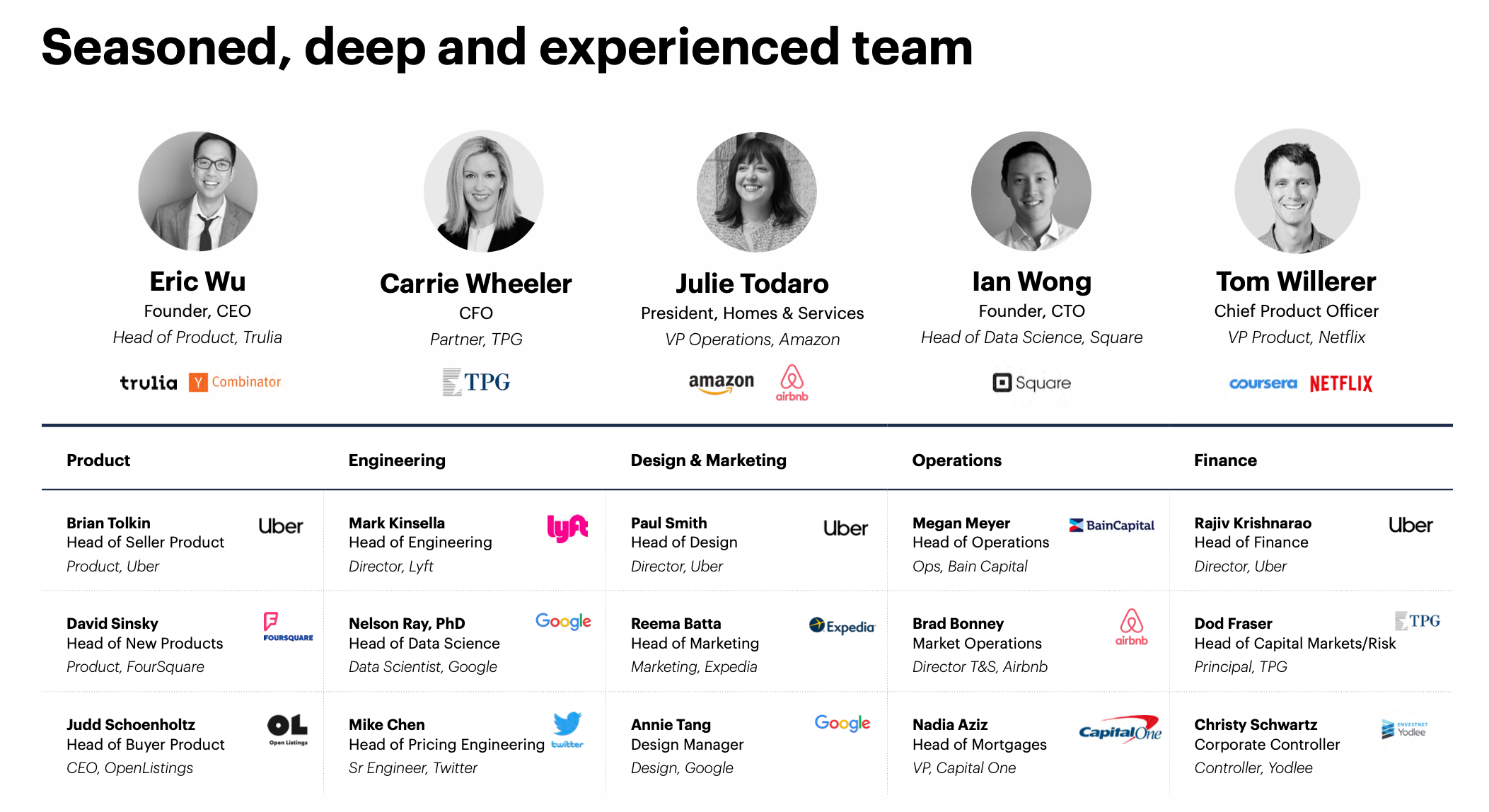

Two Teams, Two Approaches

Offerpad and Opendoor are illustrating two different approaches to iBuying specifically, and venture-fueled disruption more generally.

Each company raised radically different amounts of venture capital before becoming public companies. At $1.3 billion, Opendoor had nearly 10x the capital to grow the business compared to Offerpad. The amount of capital raised is a direct result of differing growth mindsets, and has enabled two different growth strategies.

A look at each company's management team is illuminating. Nearly half of Offerpad's team come from a real estate background, including a co-founder (not pictured) that also co-founded single family rental behemoth Invitation Homes.

Contrast this with Opendoor, where not one single person listed has a real estate background. It appears that all of its executives come from venture-funded technology businesses.

The end result is two completely different teams with completely different approaches -- one centered in real estate, and the other centered in technology.

Strategic Implications

Offerpad's latest financials strongly suggest that a less venture-funded, less tech-enabled, more real estate focused, and less breakneck version of iBuying can be (almost) profitable.

And while Offerpad is nearly profitable on a small scale, perhaps it also suggests that Opendoor and Zillow can become profitable on a large scale -- not at 4,000, but at 40,000 houses per year -- once sales volumes catch up with overhead expenses.

Finally, the Offerpad story raises questions around the true value of technology in real estate. Like Compass' massive investment in technology (and WeWork before it), Opendoor is over-investing in tech with little to show for it on the bottom line. Technology helps create a great story, but at the end of the day, real estate is still...real estate.

Compete Where You Can Win

/In the fast moving world of real estate, it’s never been more important to define a crisp and effective strategy. A portion of my work consists of strategic consulting for a range of real estate tech businesses. That experience has taught me a lot, and I can sum up what I believe to be the single most important concept in strategy: Compete where you can win.

A three minute video of me talking about "Compete Where You Can Win."

Find Your Sustainable Competitive Advantage

All of my strategy work — from multi-billion dollar organizations to scrappy start-ups — starts with a somewhat cliche business school phrase: sustainable competitive advantage. This is what sets a company apart from others; the collection of unique attributes that allow an organization to outperform its competition.

In the world of real estate tech, Zillow has its massive consumer audience, Compass has its deep pockets, Keller Williams has its scale, and Realogy has its brands.

Clearly identifying a sustainable competitive advantage — a company’s strengths — is an important first step in an effective strategy. The critical second step is leveraging that competitive advantage directly against a competitor’s weakness or a market opportunity — competing where it can win.

Case Study: Compass

Perhaps the best case study is Compass. Its competitive advantage was capital ($1.5 billion in VC funding), which it used to gobble up market share.

The competitive weakness that Compass exploited was a traditional brokerage’s inability to compete on capital. Competitors couldn’t match Compass’ commission splits, signing bonuses, or marketing support. Unlike its competitors, Compass didn’t need to worry about being profitable, and the company leaned heavily into this strategy to recruit agents and grow its market share. Compass played a game that it, and it alone, could win.

Compete Where You Can Win

What truly sets yourself or your business apart from others? What can you offer that no one else can, and how can you leverage it against your competitor's weak points? It’s senseless to go up against your competitors where they are strongest (although many still try).

Anyone in real estate, from disruptor to incumbent, behemoth to startup, tech company to individual agent, can effectively compete in today's quickly changing market. It all comes down to being smart about understanding your strengths and competing where you can win.

Zillow, Power Buyers, and the Challenge of Attaching Mortgage

/In 2018, Zillow set itself lofty goals when it entered the mortgage business. Three years later, Zillow's actual performance is far, far below its predictions, highlighting how difficult the mortgage space is, not just for Zillow, but for every real estate tech company targeting mortgage as a lever for growth.

Setting High Expectations

Zillow's 2018 Annual Report, released after Mr. Barton assumed the CEO role, clearly set out the company's 3–5 year goals in mortgage:

Mortgages Segment

Zillow Home Loans achieves a 33 percent attach rate to Zillow Offers, up from zero in 2018.

Zillow Home Loans originates more than 3,000 loans per month, up from nearly 4,000 MLOA loan originations in all of 2018.

The 33 percent attach rate to Zillow Offers is down from the lofty 75 percent attach rate quoted earlier by Mr. Rascoff in Zillow's 2018 second quarter earnings call:

"So for anybody who is wondering why we just bought a mortgage lender, just to hit some of those numbers again, at a mere 10,000 homes sold a month from Zillow Offers, a 75% attach rate gets to over $800 million a year of revenue opportunity for mortgage origination.”

Three years and over 10,000 homes bought and sold later, the reality is a mortgage attach rate to Zillow Offers of less than 1 percent.

(Zillow and Opendoor's attach rate is based on the markets where the service is live.)

Zillow's goal of originating 3,000 loans per month, or 36,000 in a year, remains highly aspirational. Loan originations actually took a step backwards in 2019 before rebounding in 2020 due to the pandemic and record low interest rates -- but are still less than 20 percent of Zillow's original goal.

It's worth noting that proportionally, Zillow's purchase volume (versus refinance) has steadily declined from 97 percent in 2018 to 31 percent in 2020 (and down to 10 percent in Q1 2021). The growth in Zillow Home Loans is being fueled by refi.

The Rise of Power Buyers

Ironically, Zillow is attaching more mortgages to Opendoor-owned homes than it is to Zillow-owned homes. Just let that sink in.

This bizarre fact underscores how difficult it is to attach mortgage to an iBuyer home for sale; most prospective buyers are already pre-approved. It's too late in the buyer journey to introduce and attach a new financing option.

Which is why the smart money is on companies -- I call them Power Buyers -- focused exclusively on attracting buyers earlier in the process with products like cash offer and buy before you sell. Examples include Homeward, Orchard, and Knock, and initiatives like Opendoor's Cash Offer and Zillow's video tease of it helping a Zillow Offers seller secure financing for their next purchase.

There are a multitude of companies attempting to sell mortgage and other adjacent services to their customers in an effort to increase profits. For the time being, the Power Buyers are in the lead with mortgage attach rates approaching 80%, with the iBuyers pivoting their models to catch up. Zillow's experience shows that it's a long, slow road, requiring big investment, patience, and a smart, consumer-first approach.

Compass Agents: You Are The Customer

/As a newly public company, Compass faces a challenge to reach profitability. Its latest numbers reveal a noticeable drop in agent commission splits, a reminder that Compass’ path to profitability lies directly through -- and may come at the expense of -- its own agents.

Compass incurred losses of $212 million in its first quarter as a public company, compared to the $270 million it lost in all of 2020. Meanwhile, Compass’ peers managed to turn a profit during some of their best quarters ever.

The $212 million loss includes a one-time expense of $149 million of stock based compensation. Looking at Adjusted EBITDA, where each company backs out various expenses to provide a more favorable accounting of the business, still reveals significant losses -- compared to the healthy profits at eXp and Realogy.

The data reveals a brokerage continuing to lose money, especially compared to its peers, during a booming real estate market. But now that Compass is public, the spotlight is turning towards profitability and leading to an obvious source of additional profit: its agents.

The Agent is the Customer

In the first quarter of 2021, Compass’ agents generated $1.1 billion in revenue and were paid $900 million in commissions (including stock). But the effective agent commission split of 80.8 percent is a noticeable drop from the past year. While its brokerage peers paid proportionally more money to their agents, Compass paid less.

In its public filings, Compass attributes this “favorable decrease” (their words, not mine) to “the change in mix of the commission arrangements we have with our agents” and “changes in geographic mix.” The agent economics are changing in Compass' favor, and Compass is retaining more of the commission.

This dynamic is not unique to Compass, but it highlights the natural tension between brokerage and agent when less money being paid to agents is seen as “favorable” and “an improvement.”

For Compass, a reduction of its effective agent commission -- through a combination of changes in commission arrangements, geographic mix, and increasing technology fees -- of just 3 percent results in immediate profitability.

It's highly unlikely that Compass will drop its agent commissions 3 percent and survive as a business. Agents would simply pack up and leave. But the gap isn't too far and, combined with rising technology fees, represents the fastest path to sustained profitability.

Compass' effective agent commission drop in Q1 2021 is the largest seen in two years. It may be an outlier or it may be the start of a trend, but it remains a key metric to watch going forward. And if you're a real estate agent, this is a gentle reminder to never forget that you are the customer.

A note on data: When calculating Compass' effective agent commission splits, I've included stock-based compensation. For Q1 2021, I've backed out the one-time acceleration of stock-based compensation expense of $41.7 million in connection with the IPO.