Trade Me's private equity adventure

/In recent weeks, Trade Me, New Zealand's leading classifieds and marketplace portal, has received two, multi-billion-dollar buy-out offers from private equity firms.

Why it matters: There is a growing trend of private equity getting involved in portals around the world, which allows these businesses more freedom of action as private companies -- but with significant change.

Private equity and portals

Trade Me is New Zealand's leading portal, with property, automotive, and jobs classifieds and a general marketplace business. I worked there as head of strategy between 2012 and 2016.

British firm Apax Partners and American firm Hellman & Friedman have both offered around $2.5 billion NZD for the business, a 25 percent premium to the existing share price.

This news follows several other examples of private equity getting into the (property) portal business:

General Atlantic acquires a majority stake in Hemnet, December 2016.

Silver Lake acquires Zoopla for £2.2 billion, May 2018.

General Atlantic invests $120 million in Property Finder, November 2018.

Slowing growth

Since its public debut eight years ago, Trade Me has grown revenues 100 percent and net profit 39 percent.

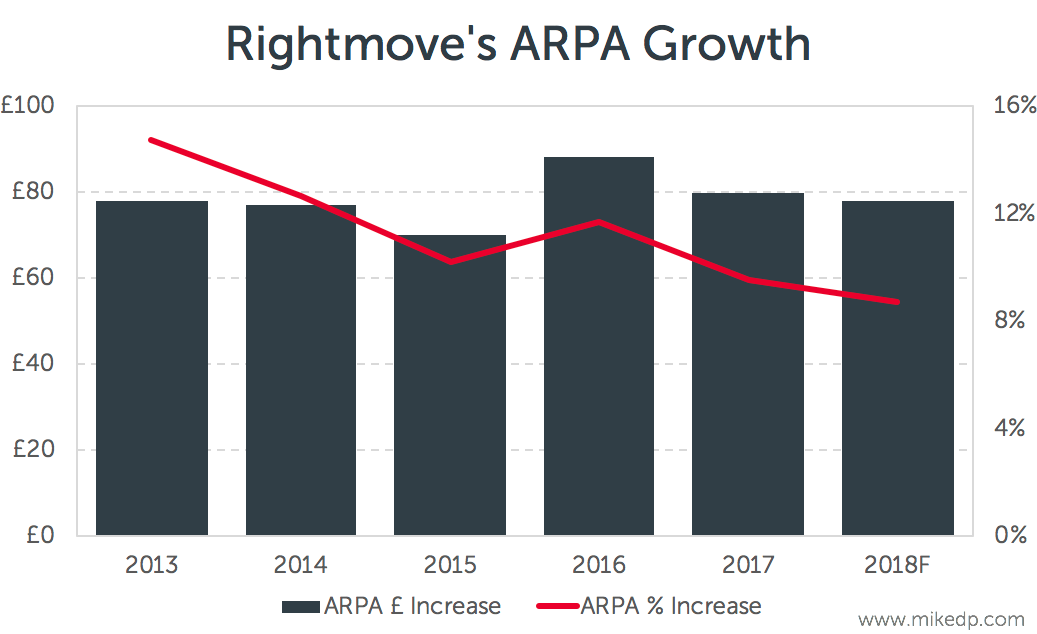

Revenue growth has slowed over the years, especially recently, in a story reminiscent of Rightmove's growth dilemma.

The stock price has seen a steady rise with its ups and downs, but has been relatively flat since 2017.

In August of 2018, Trade Me announced a special dividend to return $100 million in capital to investors. This comes on top of the normal dividend, which represents around 80 percent of profits. Returning capital at that scale can be a signal that the company has run out of ideas.

Many businesses believe it is more beneficial to reinvest profits to improve efficiency, expand reach, create new products and services as well as improve existing ones, and further separate themselves from competitors.

Like Rightmove, Trade Me is in a difficult position. With growth slowing, it is less likely to make big investments for fear of depressing earnings and upsetting investors. It's a delicate, public-company balance. Enter private equity...

Upside potential, with change

Private equity invests in businesses for one and only reason: to make money. It's clear that these P.E. firms have evaluated Trade Me's business and believe there is significant upside potential under new ownership and management.

But significant growth comes with significant change. When Silver Lake acquired Zoopla in the U.K., nearly the entire executive team was let go as part of the restructuring. It's the same story in Sweden, when General Atlantic appointed a new management team after acquiring a majority stake in Hemnet.

Strategic implications

If consummated, a private equity takeover of Trade Me would have a number of implications for the business, competitors, and the entire online ecosystem:

A private ownership structure will allow Trade Me to be more aggressive, focus on longer-term opportunities, and be less sensitive to a stock price that focuses on short-term earnings growth.

Private equity firms demand a return on their investment, and this transaction will be no exception. Expect costs to be trimmed, earnings maximized, and a more aggressive posture on pricing and monetization.

If you're competing with Trade Me, expect a dramatically different business to emerge that's tougher, less conservative, and more willing to throw its weight around.

Trade Me has long had a friendly, home-grown feel in New Zealand. New owners -- and new demands on the business -- may change the equation.