Massive iBuyer Financial Losses Continue

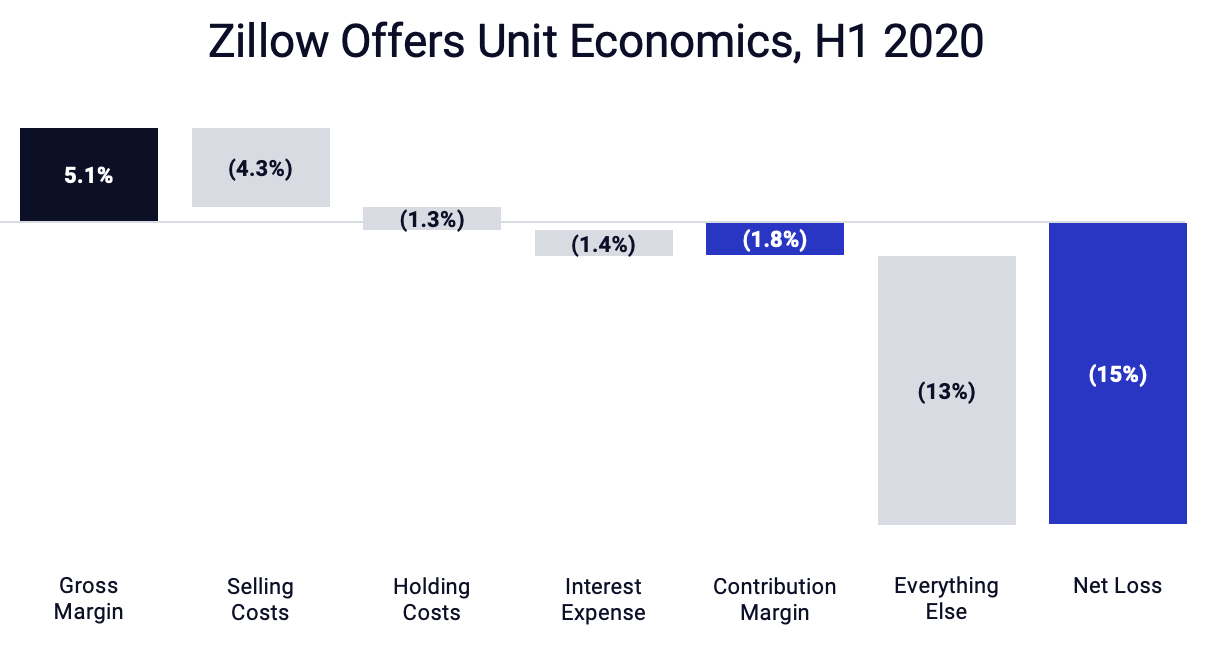

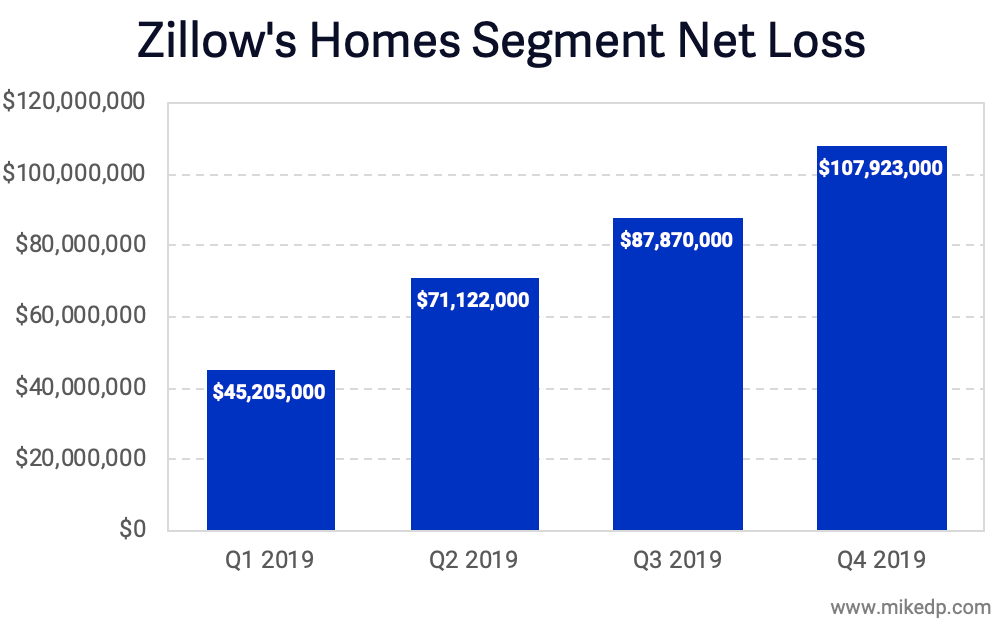

/The “Reinvention of Real Estate” comes with a staggering price tag. In 2020, the two largest iBuyers, Opendoor and Zillow, lost a total of $607 million buying and selling houses. That’s a loss of about $40,000 on each home bought and resold, about $1.6 million every single day, or about $1,100 per minute in 2020.

And that $607 million is on top of the $650 million lost in 2019 — well over $1.2 billion in the past two years.

Opendoor's Challenging 2020

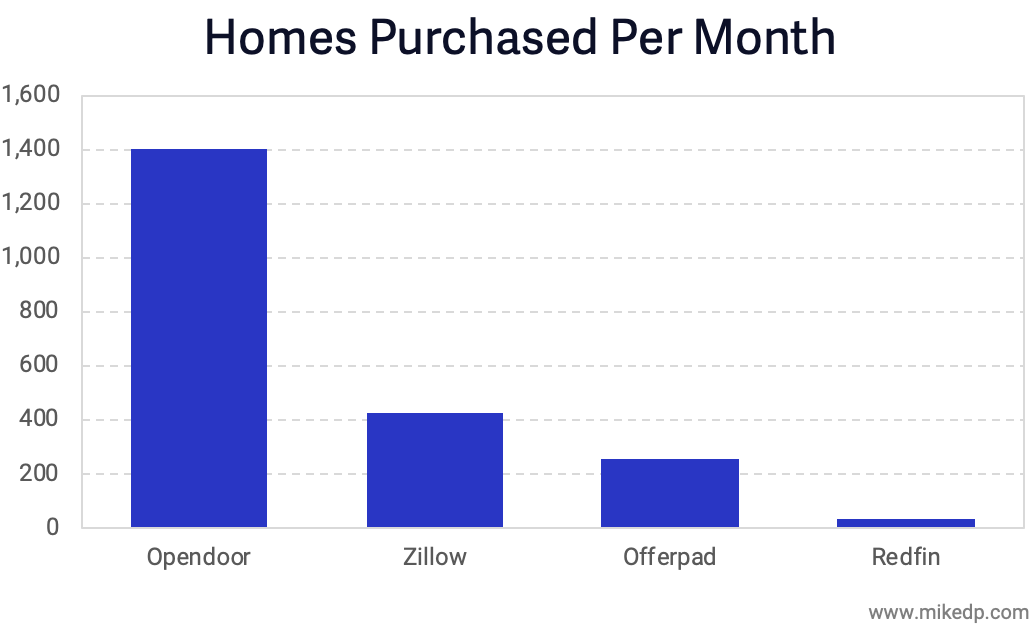

Opendoor accumulated losses at a quickening pace during a challenging 2020. Like Zillow, it stopped buying houses earlier in the year, and its recovery since has been slow. This has corresponded to a striking decline in the number of homes sold throughout the year, especially compared to last year.

As expected, Opendoor’s decision to pause listing new homes for sale in late 2020 led to a dramatic drop in home sales in Q4 2020. Without a corresponding drop in corporate overhead expenses, Opendoor’s financial metrics reached a new milestone: a net loss of over $100k per home.

But it's almost certainly a temporary setback. On the plus side for Opendoor, and as a result of building up inventory in late 2020, it's going to have a blowout Q1 2021.

A Revealing Fourth Quarter

The key financial drivers for each iBuyer were quite different in the last quarter of 2020. Opendoor managed to blow Zillow away with a gross margin of 15.4 percent — which is a combination of service fees, price appreciation, renovation expenses, and ancillary revenue streams. Opendoor was better able to monetize the transaction.

The subsequent cost drivers show an equally revealing story. Especially Opendoor’s record-low selling costs of 2.1 percent. The bulk of this fee is brokerage commissions. The drop from 3 percent earlier in the year is notable, and is likely the result of Opendoor continuing to push down the buyer agent commissions offered on its houses.

Holding costs and interest expense are also lower — by about half — from earlier in the year, and both iBuyers appear evenly matched (aside from a slight interest expense advantage to Opendoor).

Good for Consumers

Despite their staggering financial losses, the evidence suggests that Zillow and Opendoor remain staunchly pro-consumer. Both businesses are determined to pass a financial benefit on to consumers alongside a streamlined experience:

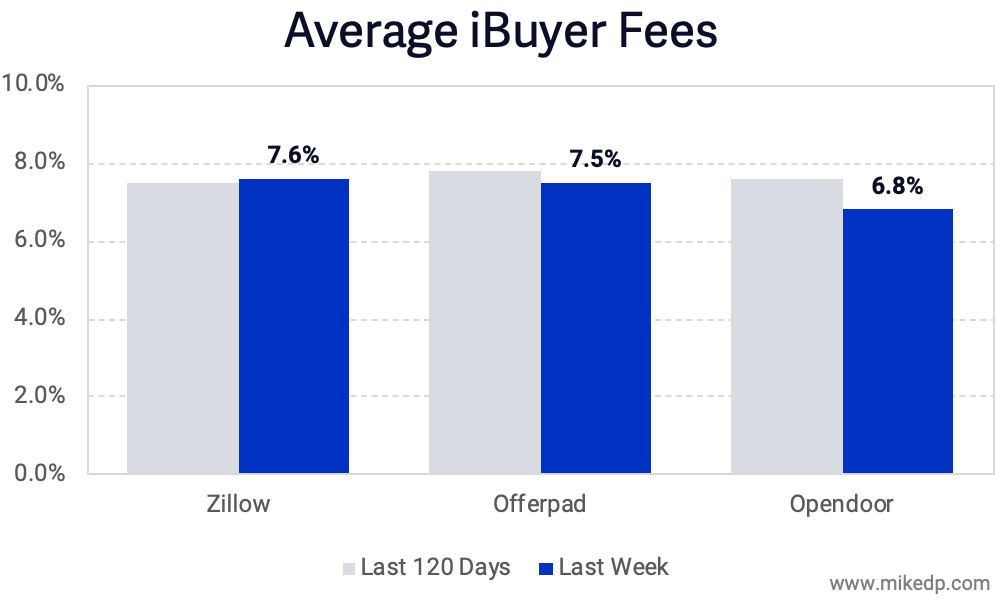

Opendoor lowering its service fee for homeowners, now down to 5 percent.

Zillow Rewards offers savings when consumers bundle its services together.

Opendoor offering savings when using its in-house services.

Both iBuyers paying very close to fair market value.

Contrast this with another real estate tech disruptor, Compass, which is self-admittedly obsessed with agents (and not consumers). The difference shows. Compass’ strategy of gaining market share and promoting exclusive listings available only on its platform is good for business, but not for consumers.