Rightmove's slowing growth: same problem as Zillow, different strategy

/Rightmove, the U.K.'s top portal, announced its full-year 2018 results last week.

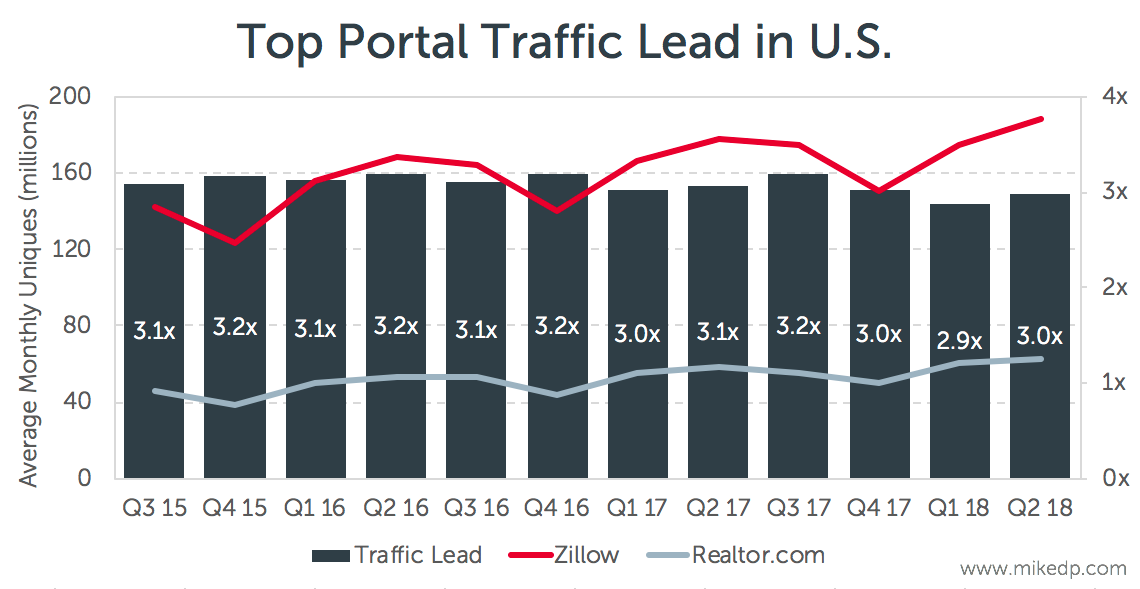

Why it matters: Not unlike Zillow, the growth in Rightmove's core advertising business continues to slow. The slowdown in velocity reveals the limits and highlights the challenges the business will need to overcome as it looks for new growth opportunities.

Overall revenue grows and slows

Overall revenue at Rightmove grew 10 percent last year -- respectable, double-digit growth, but also the lowest number recorded in its history.

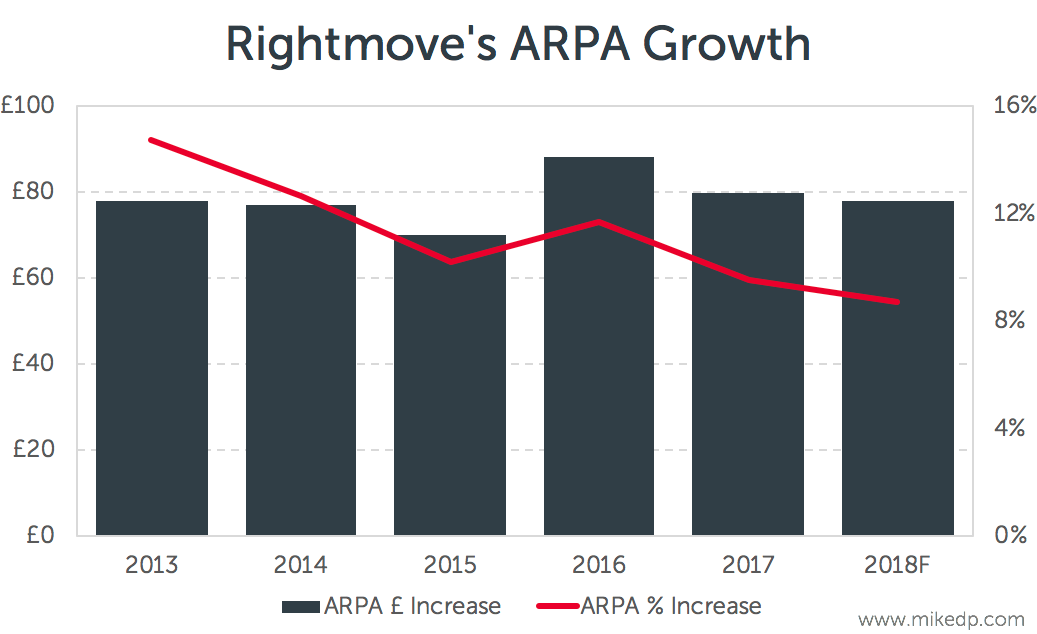

Rightmove's core revenue driver is its Agency business, which accounts for over 75 percent of total revenue (concentration risk!). Annual growth continues to slide over time. The 8.7 percent growth is the lowest number recorded, and reflects the growing difficulty the business has in charging its customers more money for the same service.

Nearly all of Rightmove's growth is coming from price increases (average revenue per advertiser, or ARPA), as opposed to new customers. The amount that Rightmove is able to squeeze out of its existing customers is slowing over time.

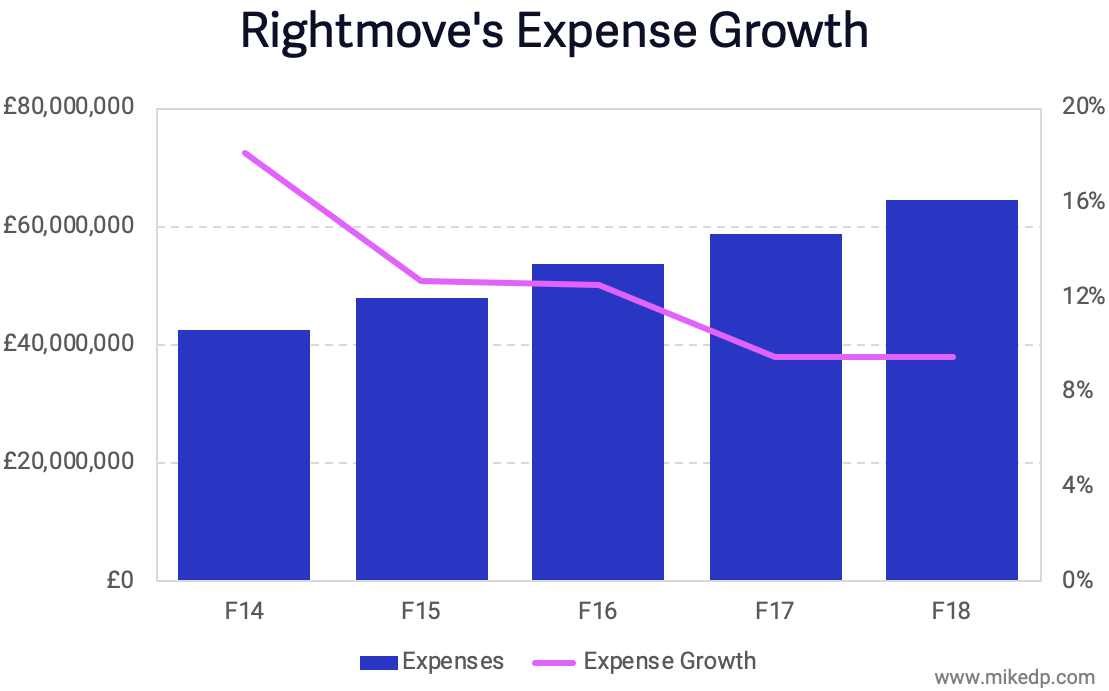

Controlling expenses

Historically, Rightmove has demonstrated incredibly disciplined cost control. By managing its expenses, Rightmove is able to maintain its phenomenal 76 percent profit margins.

But while good for the bottom line, controlling expenses too much can limit the ability of a business to invest in future revenue streams.

One way Rightmove maintains its margins is limited headcount growth. In 2017 (which was a transition year when revenue growth slowed considerably as new pricing was rolled out), the business only added ten new hires. In 2018, Rightmove added sixteen new hires.

Strategic implications

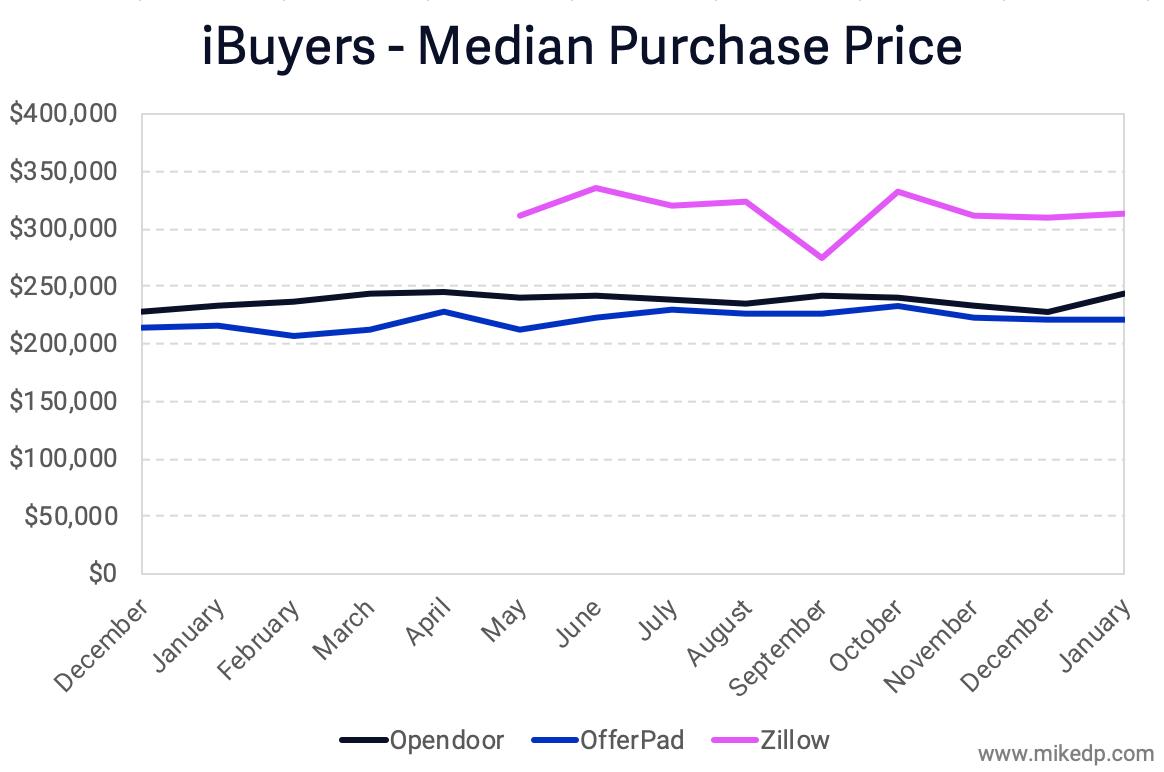

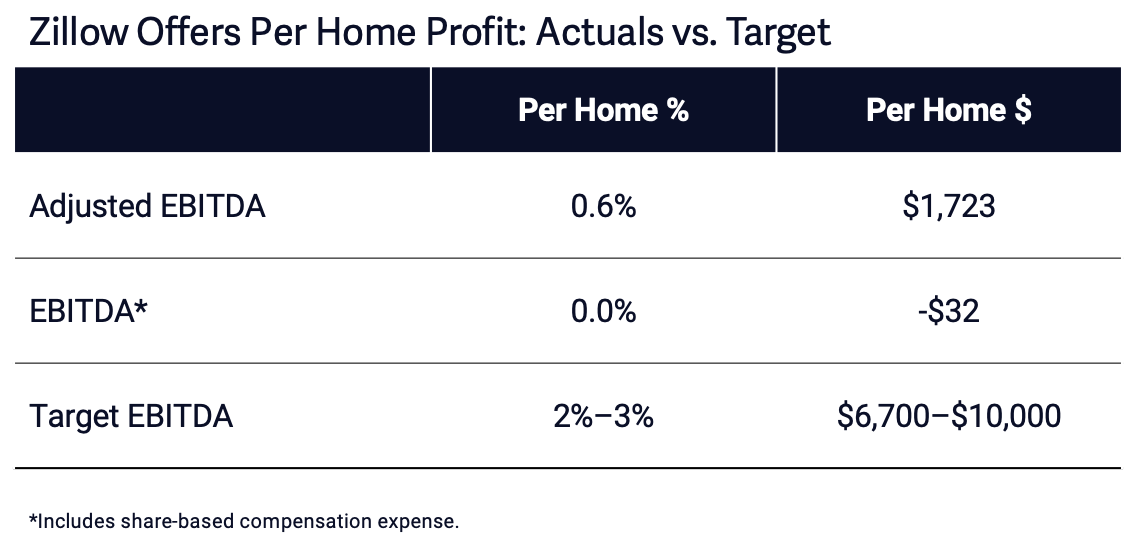

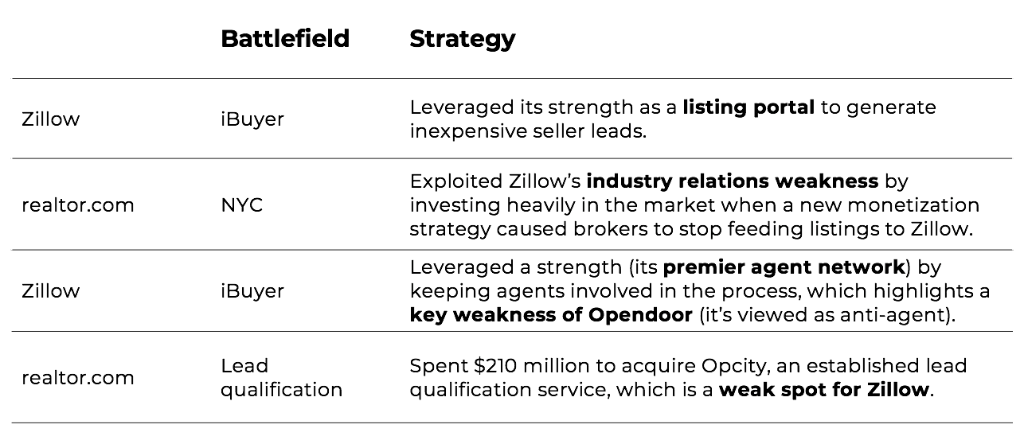

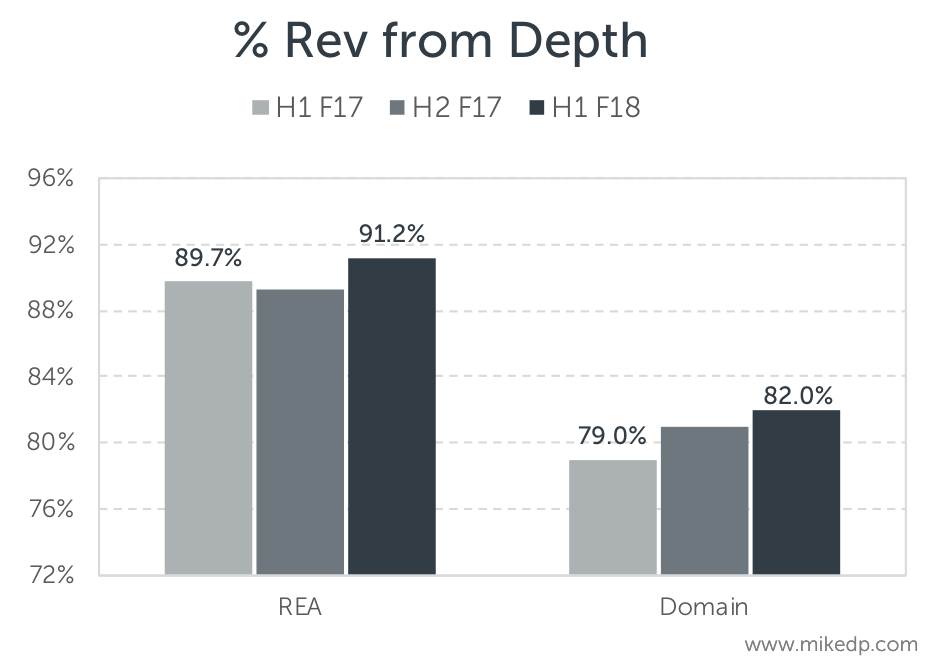

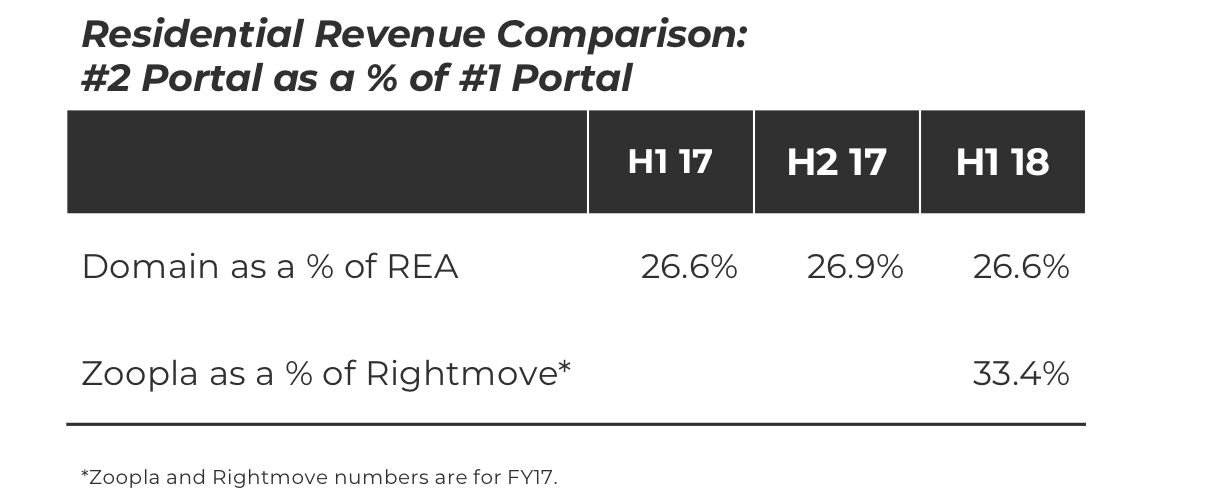

While facing similar challenges, Rightmove's strategy stands in stark contrast to nearly every other major real estate portal around the globe. Zillow and REA Group spent tens-of-millions of dollars to acquire mortgage businesses, Scout24 acquired a finance comparison business for over $300 million, realtor.com acquired Opcity for $210 million, and Zoopla acquired a range of adjacent businesses for half-a-billion pounds.

The real estate portal business is evolving, moving closer to and getting involved in more parts of the transaction. But Rightmove has remained steadfast and stationary in its solitary focus (more on this in my Future of Real Estate Portals Report and 2018 Global Real Estate Portal Report).

Rightmove's revenue growth slowdown may sound similar to Zillow (as I wrote about last week), although the slowdown is less pronounced and immediate. But the trend and concern is the same.

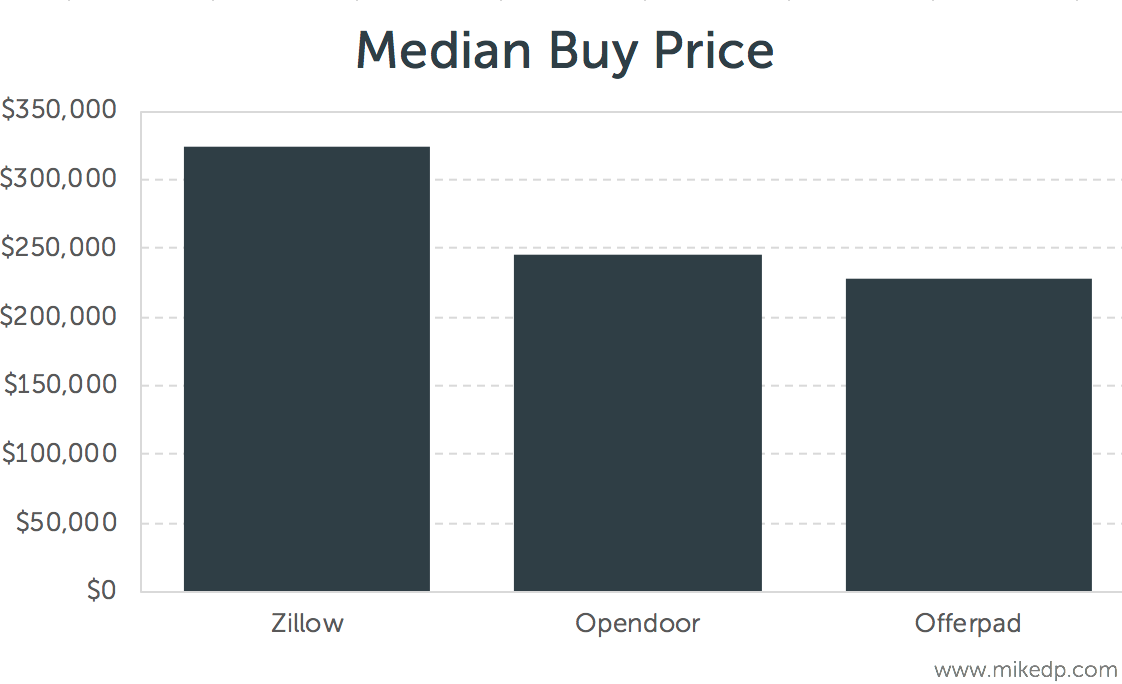

Both portals are facing slowing growth in their core businesses. Zillow has invested heavily in new business lines (mortgage, rentals, Zillow Offers, and lead qualification to name a few) and appointed a new CEO, while Rightmove hasn't -- its eggs are still in the same basket.