The Race to Cut Costs

/Across the real estate industry, companies are racing to cut costs in the face of a significant market slowdown.

Why it matters: With dropping revenues, cost control is one of the only levers in a company’s control – and is the key to a sustainable, profitable business.

The need to cut costs – and the depth of those cuts – are a function of a company’s overall financial health and business model efficiency.

Some companies, like eXp, have the advantage of a more efficient business model with lower operating expenses (OpEx).

Compared to its peers, eXp is servicing a disproportionately high number of transactions with relatively modest operating expenses.

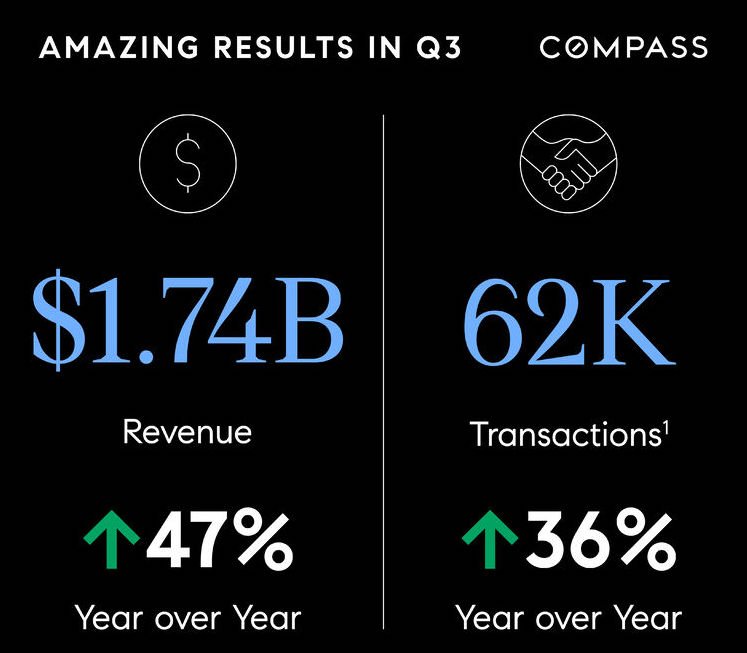

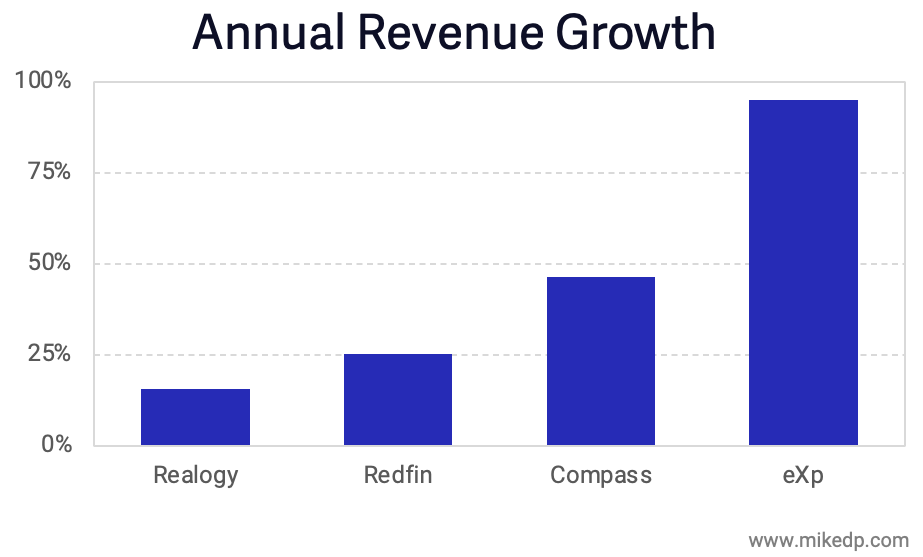

The more traditional industry behemoths, Anywhere and Compass, have a less efficient model with a much higher cost basis (and thus need to cut faster and deeper).

Dig deeper: Another measure of business model efficiency is the amount of revenue generated per $1 spent in operating expenses.

Based on this metric, eXp was about three times more efficient in Q3 2022 than its publicly-listed brokerage peers (who are all in the $3–4 range).

Compass has been racing to cut its operating expenses as quickly as possible (it also recently announced a third round of layoffs).

Compass is driving to cut its non-GAAP operating expenses by 40 percent, or around $600 million annually.

Layoffs are the most visible way that real estate tech companies are cutting costs.

Since June of 2022, Compass has shed around 1,700 employees (40 percent), while Redfin has also cut deep with 2,000 fewer employees (26 percent).

Many other real estate tech companies have also enacted significant layoffs to cut costs (and in some cases, in order to survive).

What to watch: Among the big brokerages, Anywhere, Compass, and Redfin have already made significant cost reductions, while eXp and Douglas Elliman are under less pressure to cut costs.

Cost reductions limit a company’s ability to invest in future growth opportunities (ex: Compass has "paused all expansion into new markets” and Anywhere shut down its cash buying program).

The bottom line: The market downturn is forcing all real estate tech companies to cut their expenses in order to achieve, or maintain, profitability.

Unprofitable companies with high cash burn and high fixed costs have no choice but to cut, and cut deep, to survive.

While other companies operating more efficient, low-cost operating models are under less pressure to make big cuts – and may be better placed to invest in future growth.