Portal Wars: CoStar vs. Zillow, Boomin vs. Rightmove

/Across the globe, there are efforts underway to unseat leading real estate portals. In the U.S., commercial real estate behemoth CoStar has spent over $400 million to acquire residential listing portals Homes.com and Homesnap. And in the U.K., start-up Boomin is raising an additional £25 million to directly compete with Rightmove.

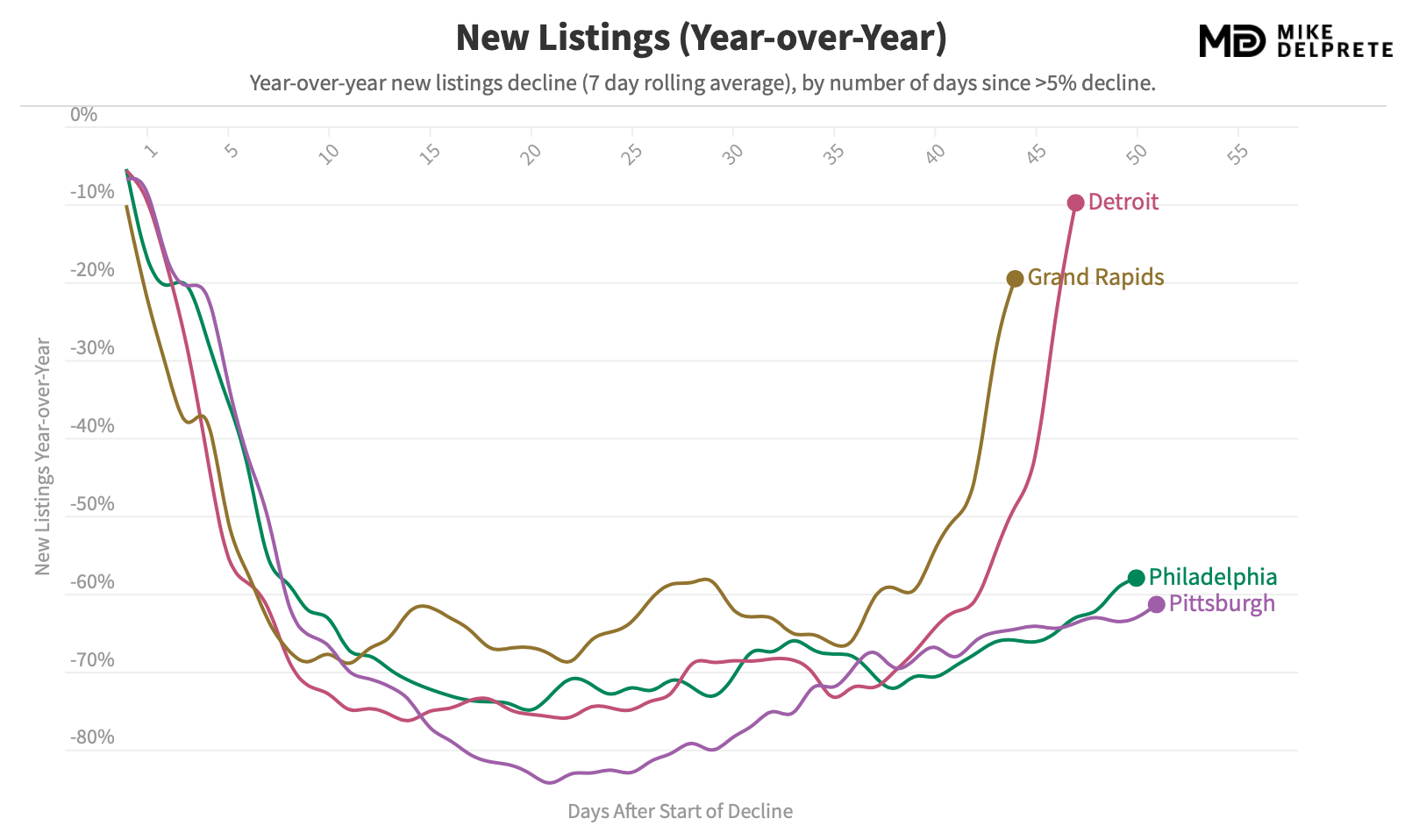

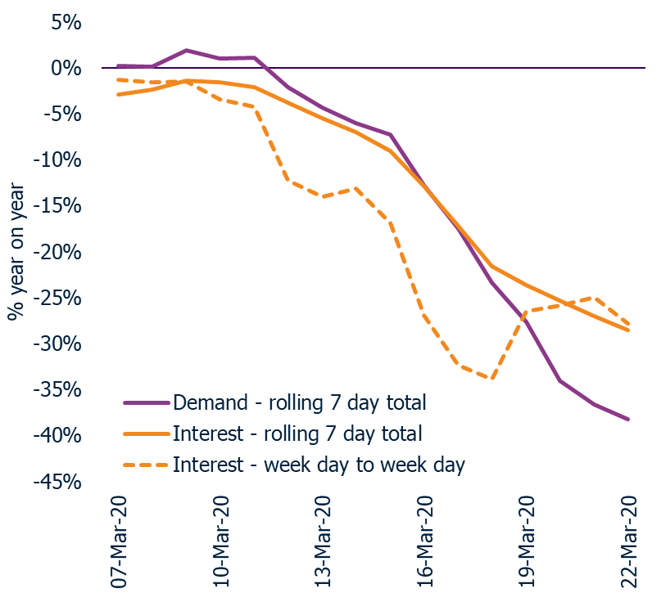

The primary value a real estate portal provides its customers is exposure to the most potential homebuyers and homesellers. In the U.S., Zillow's traffic lead over CoStar's recent acquisitions is astronomical.

Homeowners want to advertise their biggest asset in the one place buyers will definitely look. Zillow is that place: From a traffic standpoint, Zillow has a reach 23 times larger than Homes.com, making it exponentially more effective and valuable.

Attempting to directly compete with market-leading real estate portals is an incredibly difficult proposition, with success unlikely. The unique challenges include:

Incremental gains in market share don't equate to incremental gains in value.

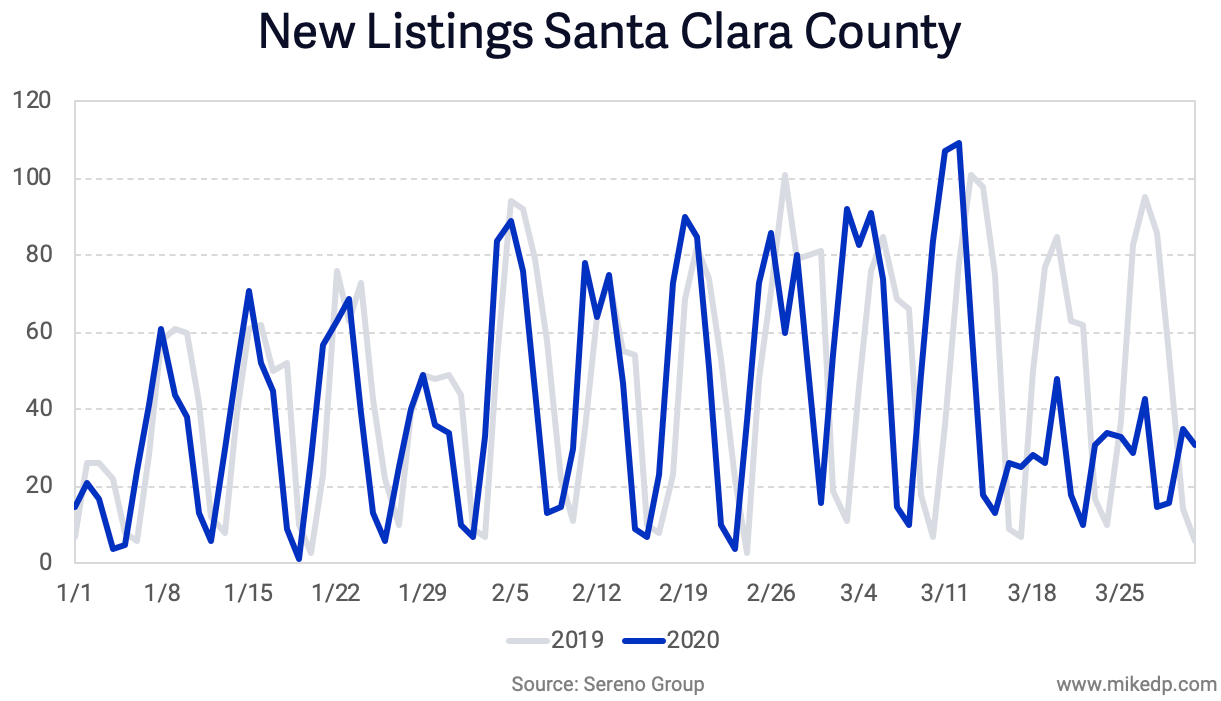

Getting listings is the easy part. Building traffic is hard.

Product differentiation means little. The main value to users is reach.

The CoStar Strategy

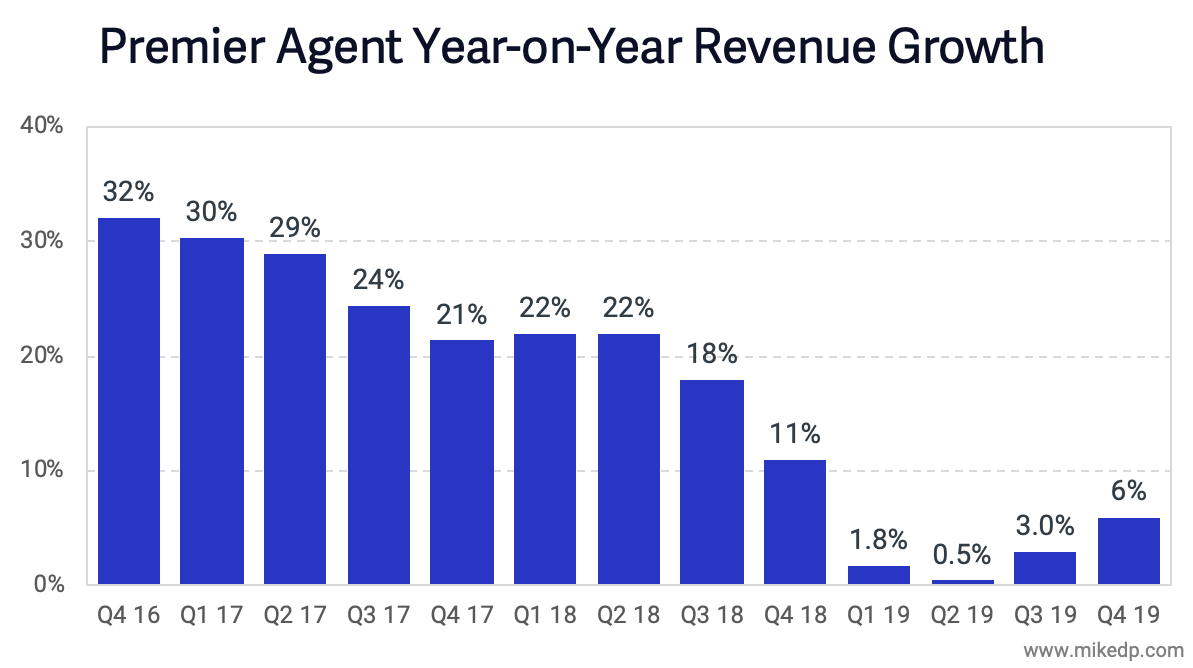

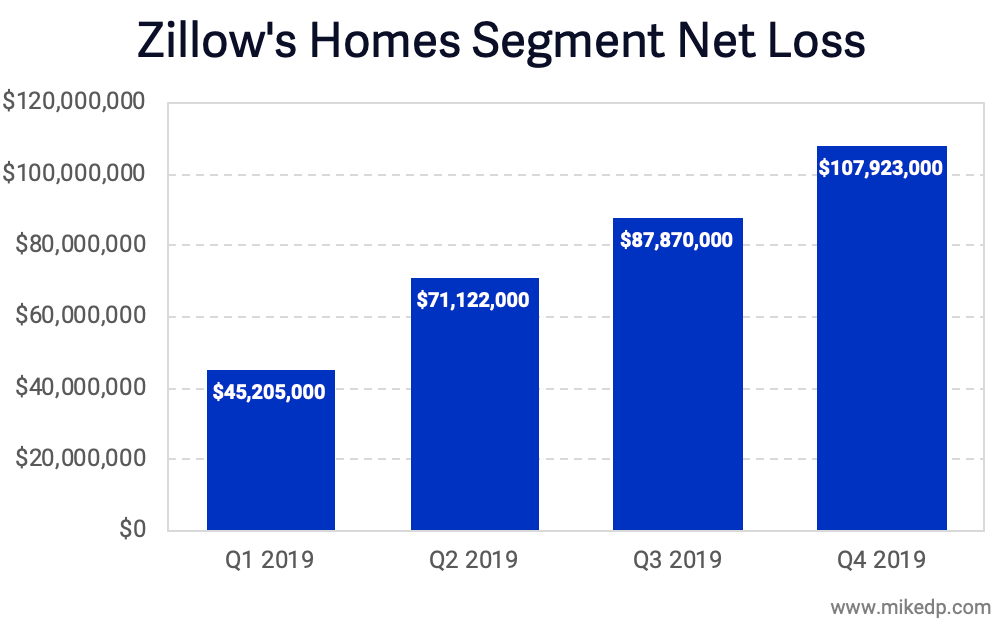

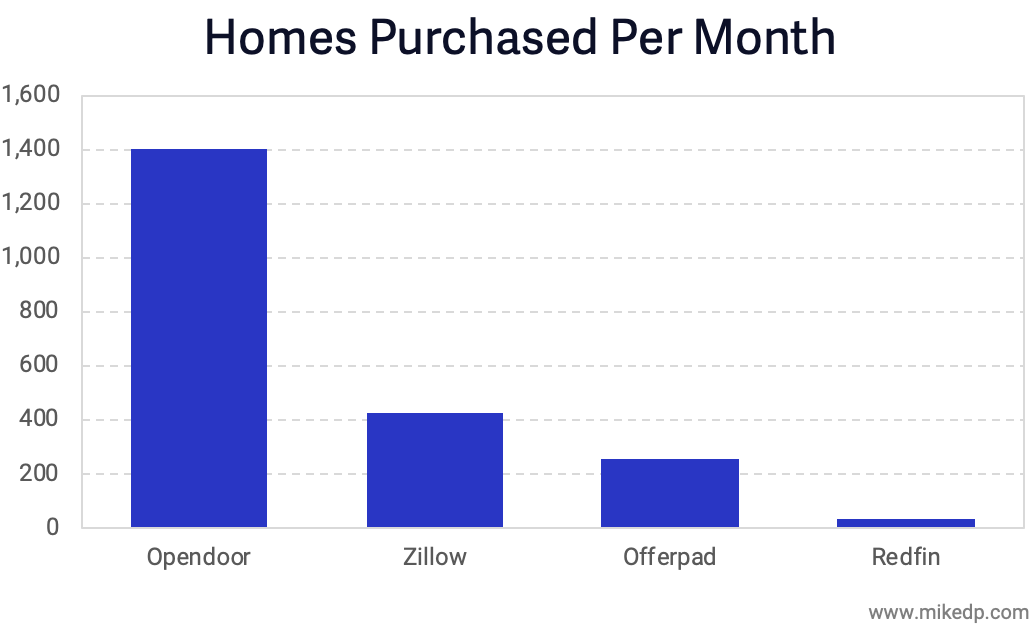

CoStar doesn't need to unseat Zillow to build a valuable business. Zillow's customers are real estate agents -- premier agents -- that pay Zillow for leads. However, Zillow only works with about five percent of real estate agents in the U.S., leaving a large addressable market for CoStar to tap into.

The narrative that CoStar is attempting to compete directly with Zillow is simply that: a story designed to rile up agents and generate buzz. The actual battle isn't about consumer eyeballs; it's about a real estate agent's wallet.

Strategic Implications

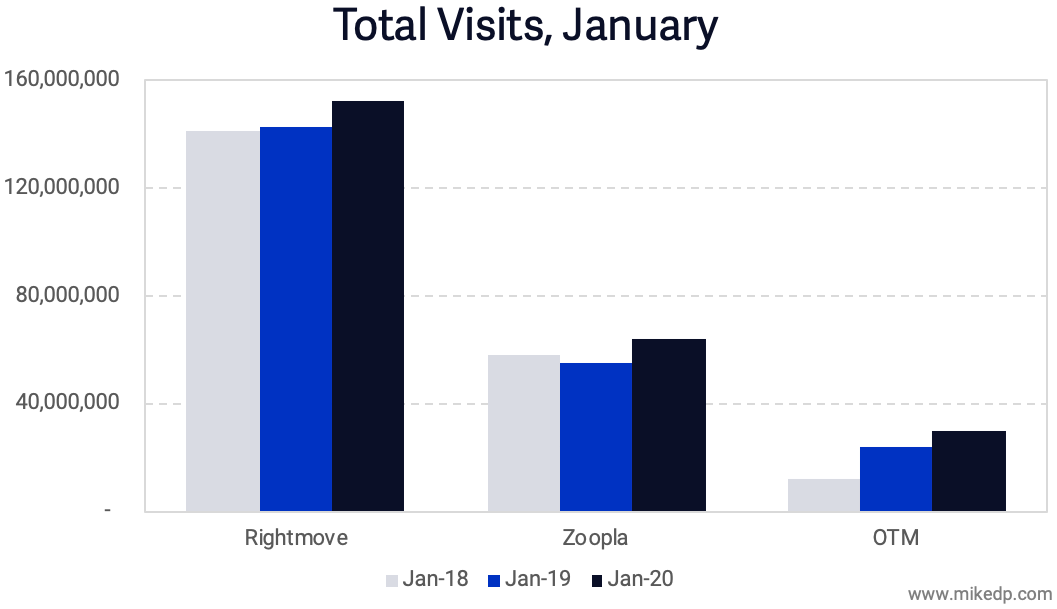

The challenger portals are succeeding with the easy bit: securing listings. Traffic is the hard part.

Through the years, the top portals have maintained their lead against billion-dollar, multinational media organizations (Zillow vs. realtor.com, IS24 vs. Immoweb), industry-backed, publicly listed upstarts (OnTheMarket vs. Rightmove), private-equity backed #2's (Zoopla vs. Rightmove), and publicly listed competitors (Domain vs. REA Group). Hundreds of millions of dollars have been thrown against the top portals for years with no effect on their dominant position whatsoever.

Past evidence shows that it is exceedingly unlikely that this new batch of challengers will dethrone the top portals. The smart challengers understand this game and how it’s played; not trying to overtake the leaders, but instead building a viable business on its own merits.

A Deeper Dive

Check out the articles below to dive deeper into the massive advantages that incumbent portals possess and the challenges around trying to disrupt them.