A Comparative Study of Real Estate Portal Revenue Growth

/With the books closed on 2022, the largest real estate portals around the world have demonstrated another year in a long line of consistent revenue growth.

Why it matters: The varied revenue growth between portals highlights business model differences, market share penetration, and hints at future prospects – all while reinforcing the strong position that leading real estate portals have in their respective markets.

The standouts are Rightmove (U.K.), Hemnet (Sweden), and Zillow (U.S.), all for a variety of reasons.

The change in revenue between 2021 (boom market) and 2022 (contracting market) highlights differing market dynamics and varied portal business models.

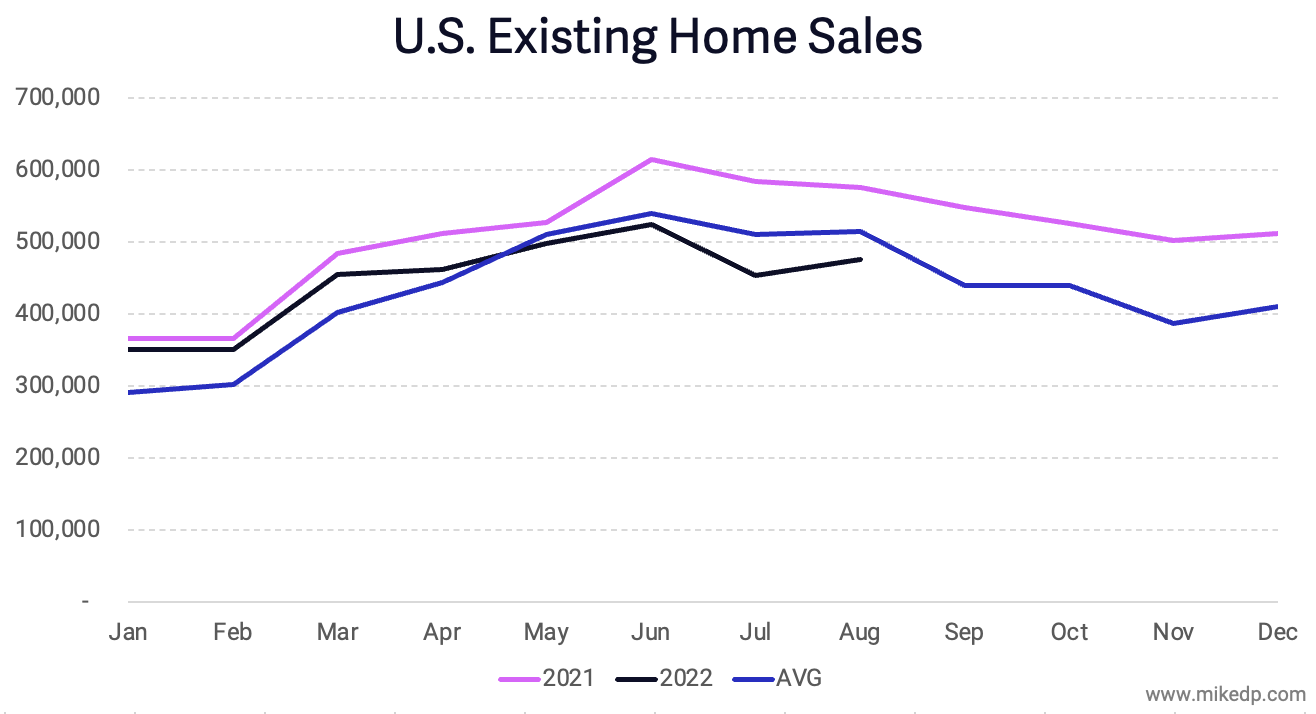

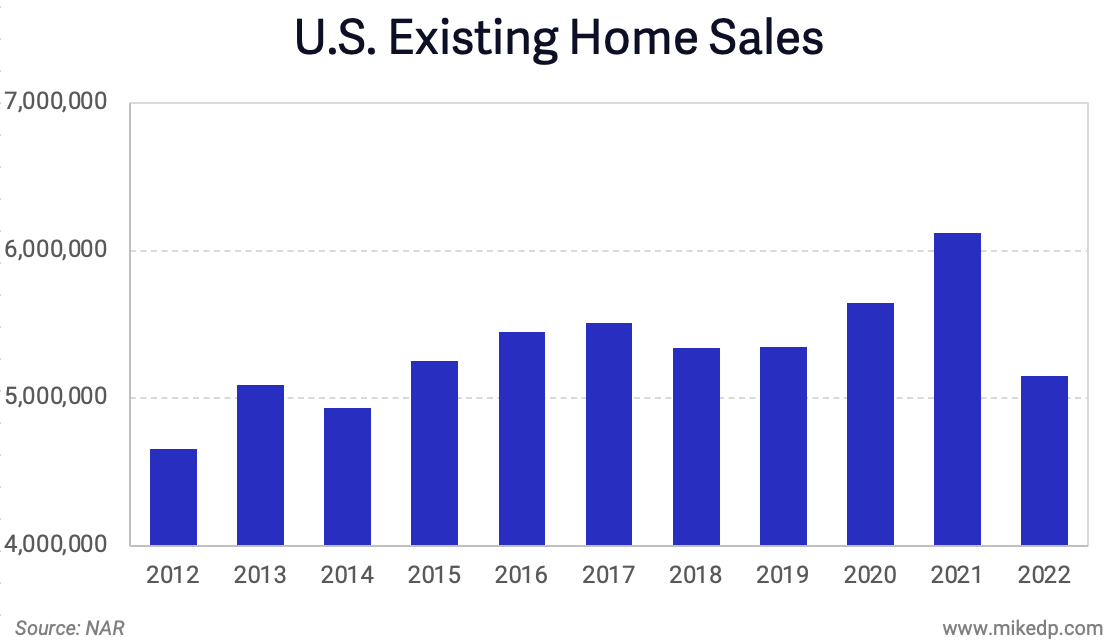

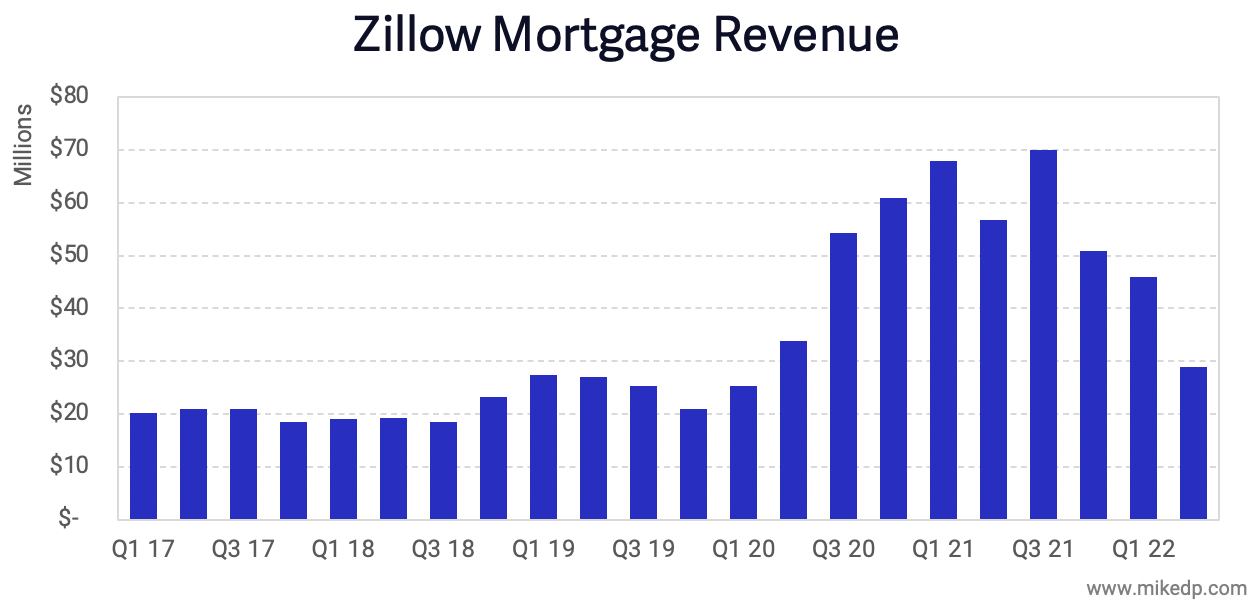

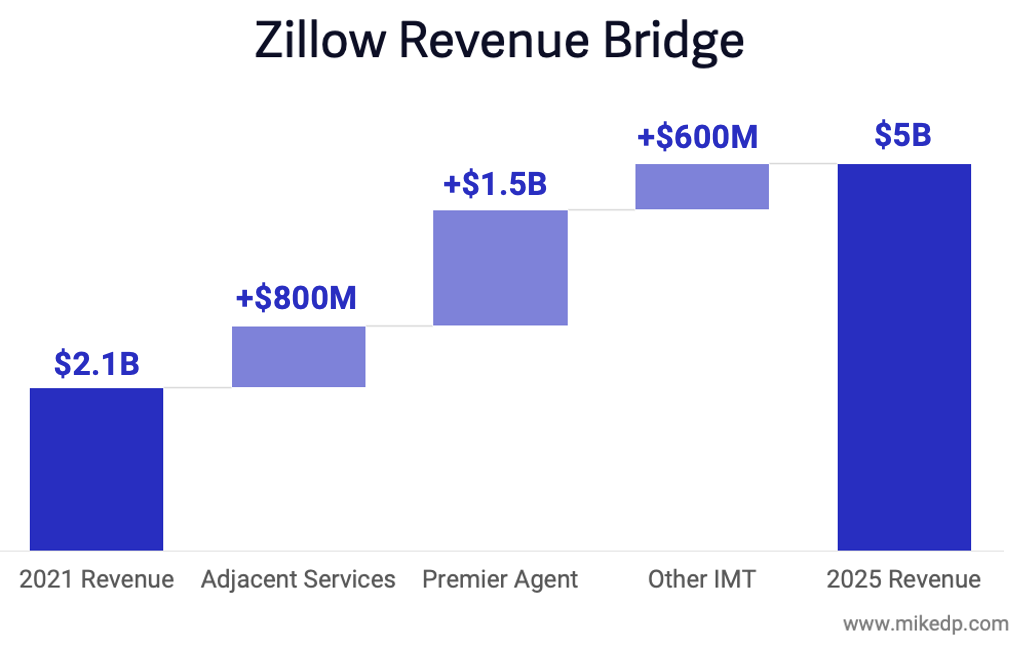

The U.S. housing market experienced higher highs in 2021 and lower lows in 2022 compared to many international markets – leading to revenue declines in 2022.

In Sweden (Hemnet) and Australia (REA Group and Domain), the homeowner pays the portal listing fee – making it easier for portals to increase prices on a fragmented audience that transacts infrequently.

Hemnet is the clear standout in terms of revenue growth over the past four years.

General Atlantic, a growth equity firm, acquired a majority stake in Hemnet in 2016 – and since then the business has accelerated its growth in a remarkable way.

Dig deeper: Hemnet’s revenue growth has come from increasing its average revenue per listing, with the major driver being price increases (in addition to new premium products).

As the only major portal in Sweden – far above any competitors – Hemnet has incredible pricing power.

On the opposite end of the spectrum, Rightmove has the slowest growth of its peers.

Rightmove is the dominant portal in the U.K. and its competitive position hasn’t changed in years, but the company has a more conservative growth model and tends to “stick to its knitting” more than its peers.

It’s also reached market saturation and is only able to raise prices so much each year.

The bottom line: Real estate portals are strong businesses that typically demonstrate consistent revenue growth.

But across the world, not all portals are created equal: markets, business models, relative pricing power, and competitive tension all factor into growth potential.

And with an asset class as financially and as psychologically valuable as real estate, customers – real estate agents and homeowners – are willing to pay more and more each year, fueling the perpetual revenue growth machine.