Learning From A New Generation of Brokerages

/Behind the hype of year-end press releases and the incomprehensible density of financial metrics, clarity is emerging on the shifting brokerage landscape.

Why it matters: The industry is changing – a new generation of brokerage businesses is rising, attracting more agents and operating more efficiently than their legacy peers.

Context: Overall transactions were down 19 percent in 2023 compared to the previous year – a significant market slowdown.

eXp Realty, Compass, and Keller Williams outperformed the market, with smaller transaction declines, while the big legacy firms HomeServices of America (HSoA) and Anywhere were on par with the overall market.

The notable outliers are Redfin, which underperformed the market by a wider margin, and the Real Brokerage, which grew its transaction volumes a whopping 78 percent.

Transaction volumes over the past seven years paint a fascinating picture of disruption.

During that time we’ve seen the exponential growth of eXp Realty and Compass, moving from effectively zero to top spots in transaction and sales volume.

At the same time, the two incumbent leaders (Anywhere and HSoA) went from total dominance to being usurped by these two disruptive start-ups.

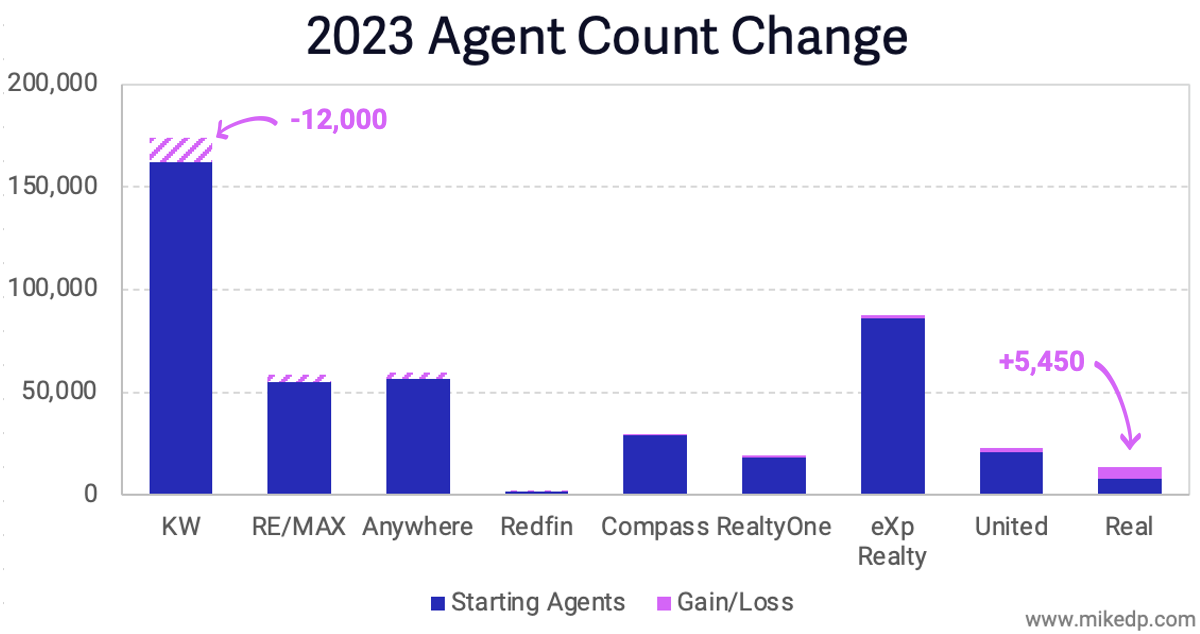

Agent migratory patterns continued at pace with agents streaming out of the big legacy brands for lower-fee models (and Compass).

In the current downturn, the lure of the low-fee brokerage is simple: agents can keep more of their commission.

Which comes at the expense of the large, legacy brands including RE/MAX, HomeServices of America, Anywhere, and Keller Williams, who collectively lost over 19,000 agents in 2023.

Here’s another way to look at the same data that helps show perspective relative to each firm's size.

Zooming in to agent movement between Keller Williams, RE/MAX and eXp Realty highlights this continuing flow of agents.

According to 3rd party data from hundreds (but not all) MLSs, 1,627 agents moved from eXp to KW during 2023, while 3,099 agents moved in the opposite direction -- for a net gain of 1,472 agents in eXp's favor.

Similarly, 388 agents moved from eXp to RE/MAX during the year, while 897 moved in the opposite direction – for a net gain of 509 agents in eXp’s favor.

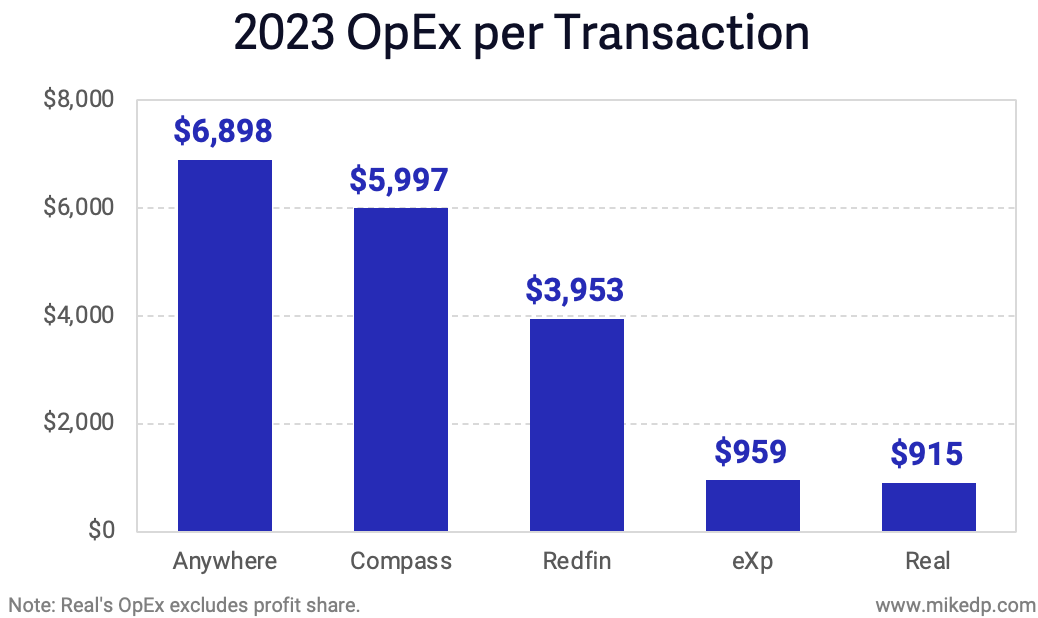

Alongside the shifts in transaction and agent count, there is an underlying shift in brokerage business model efficiency.

Keeping in mind that eXp is the largest brokerage based on transaction volume, its operating expenses (OpEx) per transaction is one-fifth its brokerage peers.

Even Redfin, which has exemplified an efficient, tech-driven brokerage model, has a cost structure closer to an incumbent than a disruptor.

What to watch: The results bring to mind an out-of-context but still relevant Gary Keller quote: “We’re losing so slowly we think we’re winning.”

But it’s not as simple as winners and losers, and each number tells a part of, but not the entire, story.

For example, although Keller Williams lost the most agents in 2023, it still outperformed the market -- so context is key.

The bottom line: In a recent Inman presentation, I unpacked what a Netflix vs. Blockbuster moment in real estate would look like, and how a receding tide reveals business model resiliency and clues about future growth.

The key message here is less about winners and losers, and more about learning.

It’s a transformative time in the industry, and now is an opportunity to pause, step back, critically evaluate, and use the moment to get smarter – what can you learn?