Purplebricks targets mid-market America (finally)

/Purplebricks launches in Phoenix and Las Vegas this week. This is on the back of its previous launches in Southern California and the New York metro area, and is the latest step in its U.S. expansion.

Why it matters: This is Purplebricks' first foray into mid-market America, the true sweet spot of its business model.

Picking the right target market

Purplebricks’ U.S. launch strategy is markedly different in terms of target markets. In the U.K. and Australia, evidence shows that the typical Purplebricks customer is at the mid-end of the market. However, the U.S. launch targeted high-end markets and customers.

In June of last year, Purplebricks CEO Michael Bruce said the average Purplebricks customer in the U.K. sold for around £240k (data on tens-of-thousands of transactions backs this up). The average house price in the UK is around £230k.

To use Mr. Bruce’s own words, Purplebricks' success is down to "a higher concentration in the heart of the market rather than the top end where it has been extremely tough."

The story is similar in Australia. An analysis I conducted in 2017 shows similar trends in Victoria and Queensland. My analysis shows an average sale price of $415k AUD in H1 2018, below the overall market median home value.

Then we come to the U.S. According to Zillow, as of January 2018 the median home price was $229k.

Los Angeles County, Purplebricks’ launch market in the U.S., has a median home price of $583k. San Diego County, one of the next launch markets, has a median home price of $540k. And Purplebricks’ latest launch market, the New York Metro area, has a median home price of $374k.

An analysis of 150 Purplebricks listings in the U.S. shows a median listing price of $552k. All of these numbers are significantly higher than the national average (in some cases, over twice as much).

Purplebricks decided to launch in U.S. markets where the median home value is more than double the national average. That’s a completely different launch strategy than its successful international markets.

It’s like taking a budget airline that caters to price-conscious families and launching a New York-to-London route for business travelers. It might not be the right fit. And for a business very much reliant on marketing spend to generate leads, it picked two of the most expensive advertising markets.

The Purplebricks proposition challenge

Purplebricks is clearly the low cost option when compared to alternatives in the U.K. But in the U.S., that's not the case.

In the U.K., the cost savings versus using a traditional estate agent are clear: on average, a home seller saves around £2,000 (outside of London and using national median home sale prices). And yes, this fee is paid upfront regardless of an eventual sale or not.

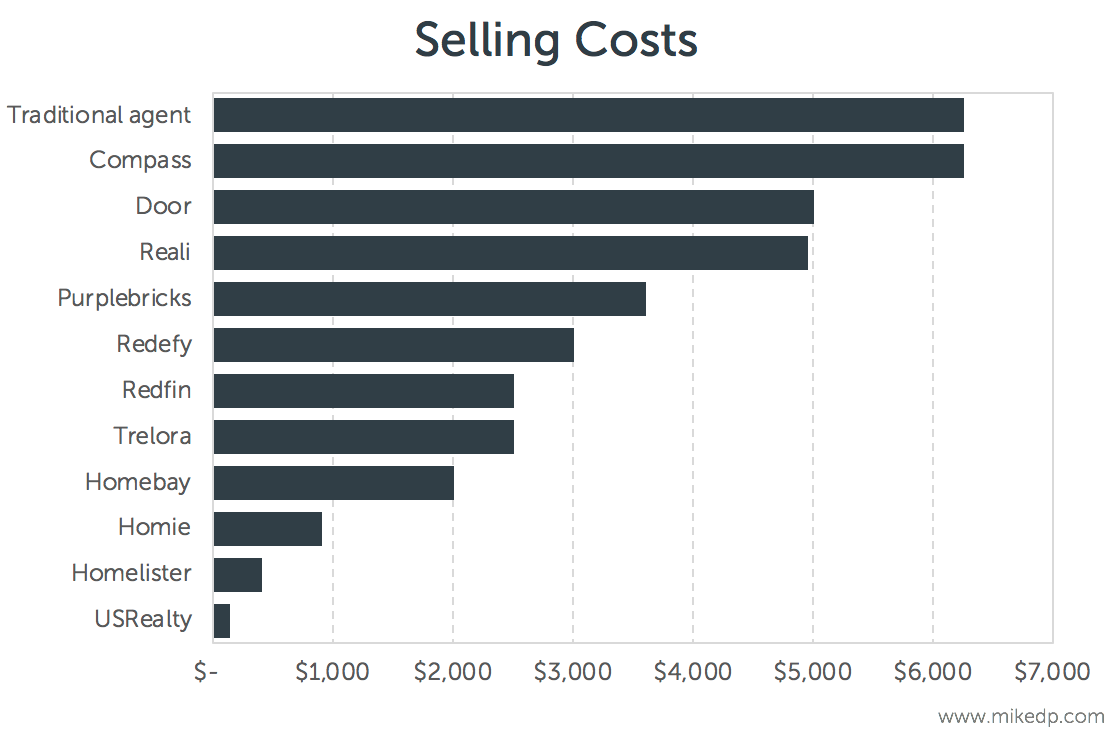

In the U.S., however, Purplebricks’ price-point puts it right in the middle of a crowded pack (and it just raised its fee from $3,200 to $3,600). It’s less expensive than a traditional listing agent. It’s slightly less or slightly more than Redfin depending on a 1 percent or 1.5 percent Redfin fee, and it’s slightly more expensive than other fixed-fee providers like Redefy and Trelora.

And that’s just the listing fee, which is paid regardless of the house selling or not. A homeseller still needs to pay a typical buyer’s agent fee of 2.5–3 percent.

In short, Purplebricks is not the clear low-price leader that it is in the U.K. There are a number of alternatives, Redfin being the biggest. And the competitive field is big, leaving Purplebricks with a relatively undifferentiated product in a crowded field (this is also true in the U.K., but the difference is that Purplebricks is already #1 in that market).

Strategic implications

There are a number of key points to consider in Purplebricks' U.S. expansion:

- Its U.S. launch markets were not in its "sweet spot." Phoenix and Las Vegas are, which begins the true test in the U.S.

- Advertising in L.A. and New York is expensive. Expect Purplebricks to get more bang for the buck for its advertising dollar in mid-range markets like Phoenix.

- Purplebricks is operating in a crowded marketplace of low-cost and fixed-fee alternatives. It is not the least expensive option, and Redfin is a sizable competitor.