Observations on Zillow's 2016 results and the U.S. market

/Hey, Zillow! Thanks for reporting your full year financial results for 2016. It provides a great opportunity to update my international property portal analysis and draw out a few observations on the U.S. market.

Let’s start with EBITDA

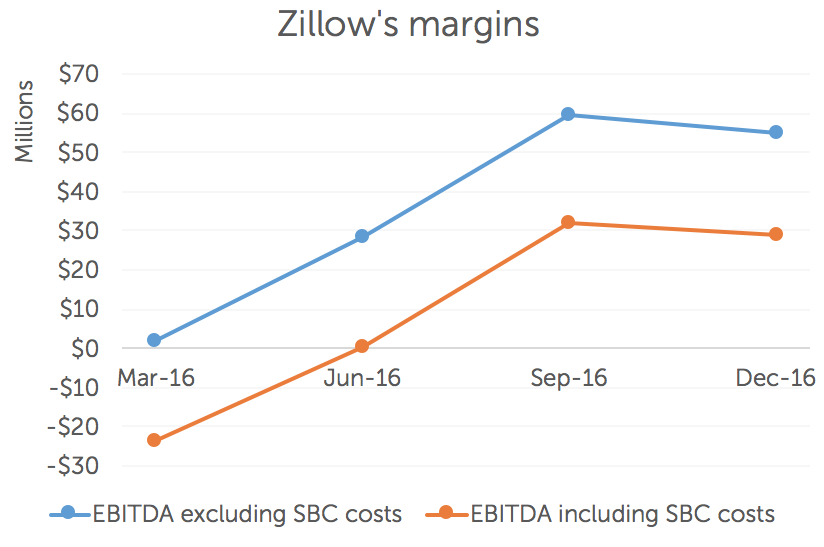

The first thing we need to understand when talking about Zillow is its EBITDA. As I have written in the past, Zillow reports non-GAAP “Adjusted EBITDA” numbers, which exclude stock-based compensation (SBC) costs. Many large U.S. tech companies now include SBC costs in their numbers, which is the generally accepted part of GAAP (generally accepted accounting principles). It’s also necessary to do this for an apples-to-apples comparison to international property portals.

Zillow’s 2016 Adjusted EBITDA is $144.8 million. Once we include SBC costs of $106 million, that drops down to $37.9 million. If we then include the negative impact of the $130 million litigation settlement with News Corp, we arrive safely in negative territory. But for comparison purposes, we’re going to stick with an EBITDA of $37.9 million; the litigation settlement was truly a one-off.

With 2016 revenues of $846 million and EBITDA of $37.9 million, Zillow has an EBITDA margin of 4.5% (far less than its reported 17% using Adjusted EBITDA numbers). As you can see below, that margin is well-below international peers.

Zillow claims that it can reach 40% EBITDA margins “at scale,” which is on par with its international peers. I suspect that number is using Adjusted EBITDA figures, which would not be an apples-to-apples comparison with the peers above.

I highly doubt that Zillow can go from an EBITDA margin of 4.5%

to an EBITDA margin of 40%.

Zillow is projecting 2017’s revenues to crack $1 billion with Adjusted EBITDA of around $200 million. Assuming stock-based compensation costs of $110 million, that implies an EBITDA of $90 million and EBITDA margins of 8.7% -- nearly double 2016’s levels.

The chart below shows Zillow’s Adjusted EBITDA and EBITDA margins over the past 4 quarters. There was a big jump into profitability in the third quarter of 2016, which has subsequently levelled off in the fourth quarter.

A $200 million Adjusted EBITDA in 2017 looks pretty similar to extending the last two quarters out for the entire fiscal year (the blue line in the chart above), with around $50 million of Adjusted EBITDA per quarter. That implies a relatively flat trajectory when it comes to earnings (in other words, expenses will track higher with revenues).

But does it scale?

I’m interested in understanding how well the Zillow business model scales. When I think about scaling, I think hockey stick curves where revenue grows at a faster pace than expenses. Making more money by spending the same amount – that’s scaling. (For more on scaling in real estate, see Purplebricks results show promising trends written by yours truly.)

The chart below shows historical revenue and expense growth. In 2016, revenue and expenses both grew at 31%. I’ve forecasted 2017 below based on Zillow’s revenue and Adjusted EBITDA guidance, which implies revenue growth of 23% and expense growth of 13%.

If Zillow can pull that off, it shows the business model has the ability to scale. But judging its historical numbers only, the graph is pretty clear – it’s not scaling; expense growth is keeping pace with revenue growth.

If we look at the previous seven quarters, we see another story of revenue growth. There is no accelerating upward trajectory; in fact, growth is slowing down.

Going macro

I find it helpful to look at revenue potential from a macro level. How much more room is there to grow revenues in the U.S. market?

Let’s look at the average monthly revenue per advertiser (ARPA). The chart below highlights Zillow compared to international peers and suggests a nice uptick in ARPA, placing Zillow in the middle of the international pack. But it also suggests incremental, rather than exponential, room for growth.

Zillow is again middle of the pack when it comes to revenue per employee. This suggests a limited ability for Zillow to monetize on a radically different expense base (in other words, it probably can’t extract much more revenue without adding more expensive headcount).

At a high level, 2016’s results have moved Zillow up in the pack when it comes to overall monetization relative to population size. In the chart below, REA Group, Domain, and Trade Me Property all operate in a vendor-funded market (meaning home sellers pay for marketing costs, not agents). So Zillow is again middle of the pack for peers in the remaining markets.

At a macro level and compared to its international peers, there is little to suggest that Zillow can achieve an outsize revenue growth going forward.

Zillow and the U.S. market

To wrap up, there are a few observations that stand out from Zillow’s results and the overall international analysis:

- We can’t use Zillow’s “Adjusted EBITDA” numbers; it doesn’t paint an accurate picture of the business.

- 2017 is the year when Zillow can prove its business model scales. There is very little in the data above to suggest that revenue growth can materially outstrip expense growth.

- Zillow can and will be profitable, but it will be from relatively low margins on a large base. It will be difficult to reach its intended 40% Adjusted EBITDA margins, let alone anything close to that when you include stock-based compensation costs.