Brokerage Profitability

/A common response to my previous analysis, Agent Compensation at the Top U.S. Brokerages, is that the brokerages paying the most out to agents couldn’t be profitable or sustainable – but, perhaps counterintuitively, the evidence suggests otherwise.

Why it matters: In a shifting market, the low-fee brokerage models are structurally designed to thrive, and are operating much more profitably than legacy brokerages.

To recap, the low-fee models are paying out a significantly higher percentage of their revenue to agents than legacy brokerages.

Those same low-fee brokerages are also profitable or closest to profitability: eXp Realty, United, Real, and Fathom (RealtyONE declined to share this information with me).

The only companies that were profitable in Q1 2023 were eXp Realty and United Real Estate, and the largest legacy brokerages were really unprofitable.

Note: This analysis uses Adjusted EBITDA (think of it as Adjusted Earnings) as the metric of profitability – it allows a company to portray its earnings in the best possible light by backing out expenses like stock-based compensation, one-off legal or restructuring charges, and other non-cash expenses.

To account for variations in brokerage scale, we can look at Adjusted EBITDA per transaction, which yields similarly revealing results.

It’s worth directly comparing the two fastest-growing models of the past five years, Compass and eXp: in Q1 2023, Compass lost $1,900 per transaction, while eXp generated a profit of $130 per transaction – quite the difference.

The outlier is Douglas Elliman, which has a much smaller transaction volume (4,600 in Q1 '23, compared to 36,000 at Compass), so its loss per transaction is much higher than its peers.

The next most common response to this analysis asserts that the low-fee models don’t provide as much support to their agents.

Therefore, while agents are able to “make more money,” they’re on their own and, without brokerage support, are less productive.

Once again, the evidence suggests otherwise.

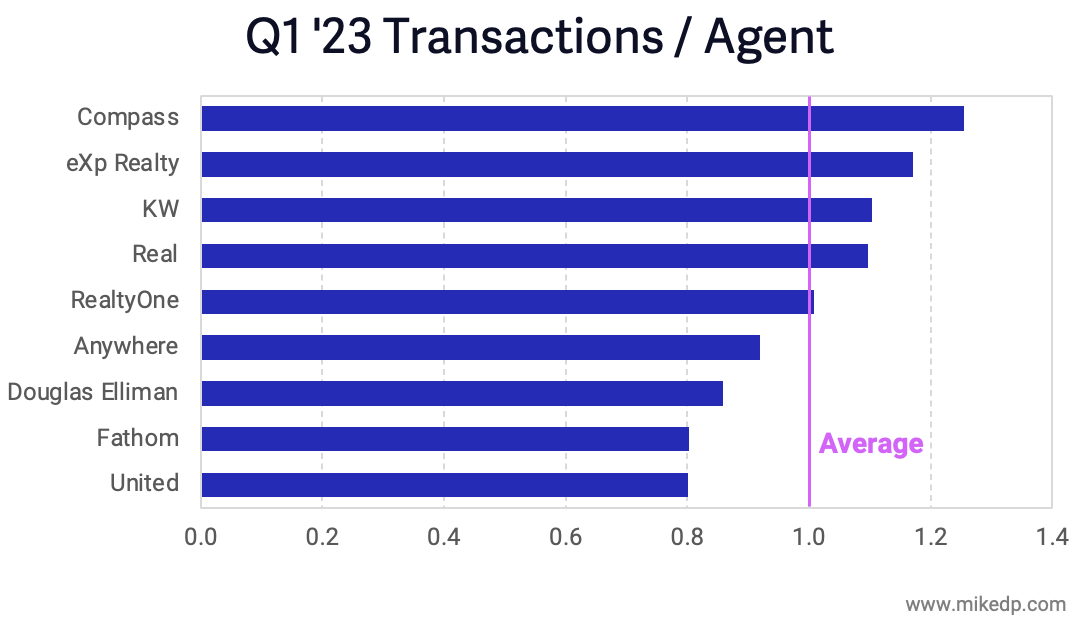

Across the nine brokerages in this analysis, the average production was one transaction per agent in Q1 2023.

The average for the legacy brokerages (Compass, Anywhere, Keller Williams, and Douglas Elliman) was 1.03 transactions per agent, while the average for the low-fee brokerages (eXp, Real, RealtyONE, United, and Fathom) was 0.98 transactions per agent – effectively the same.

In aggregate, agents at low-fee brokerages, with “less support,” were just as productive as agents at the legacy brokerages with “lots of support.”

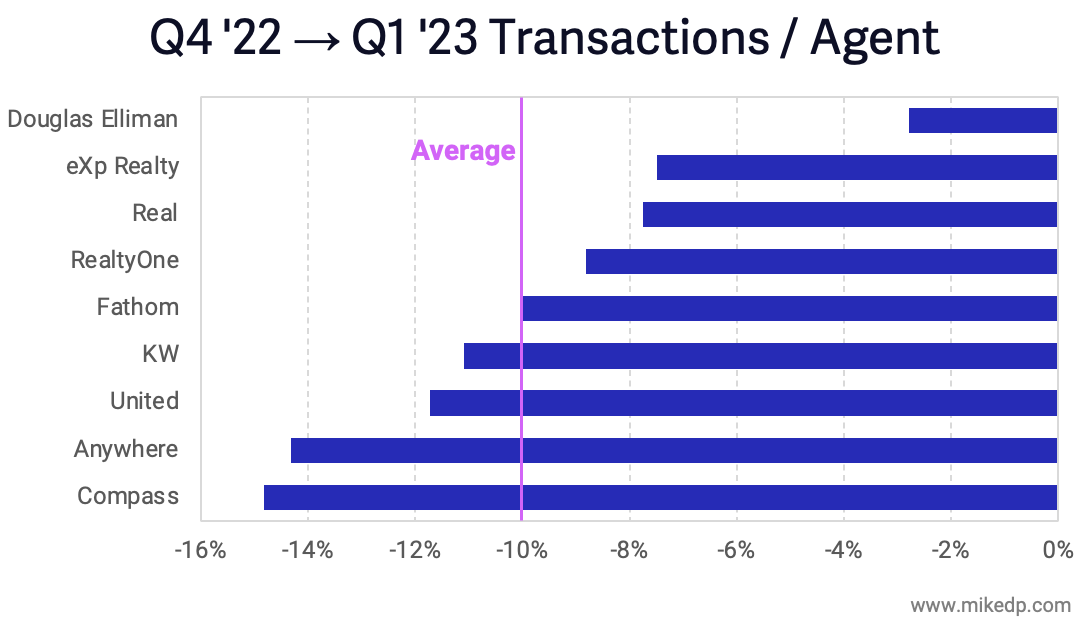

Variability in the number of transactions per agent over time provides further evidence: between Q4 2022 and Q1 2023, the average number of transactions per agent dropped 10 percent across the same nine brokerages.

Four low-fee brokerages (eXp, Real, Fathom, and RealtyONE) were at or below that average – meaning that their agents saw less of a decline in transaction volume than agents at legacy brokerages.

Support or not, agents at low-fee brokerages were more resilient and saw less variability in production during a changing market.

Yes, but: These are averages, and as with all averages, there will be overs, unders, and outliers.

Not all low-fee brokerages and legacy brokerages perform similarly.

Furthermore, inside of each organization, there is significant variability in individual agent performance and compensation.

The bottom line: The dual hypotheses that low-fee brokerages aren’t sustainable, and that their agents are less productive due to less support, are false.

Low-fee brokerages are in fact more profitable than the legacy brokerages, even after paying out a significantly higher proportion of their revenue out to agents.

This is classic Innovator’s Dilemma: while the legacy brokerages are racing to cut costs, the low-fee models – built from the ground up with a lower cost operating model – are taking market share and competing where they can win.