What to Expect When You’re Expecting Revenue Growth: Rightmove’s Strategy

/Rightmove’s annual financial results were released on February 28th, revealing a business whose revenue growth has dropped to an all-time low. This analysis focuses on several key charts -- all about growth -- that are absent from Rightmove’s annual report, but are critical to understanding its strategy.

Declining Revenue Growth

Rightmove’s revenue growth in 2019 was the smallest it's ever been -- 8 percent -- the low point in a multi-year decline.

The primary driver of Rightmove’s revenue, representing 72 percent of total, is the core agency listing business. This consists of fees that estate agents pay to list properties for sale on Rightmove. The growth rate of this business has dipped to 4 percent, less than half of last year, and the lowest rate in years.

Rightmove has saturated the U.K. market. Every estate agent that could possibly be a customer generally is. Therefore, the only way to increase revenues in the agency listing business is by raising prices, evidenced by the following chart from Rightmove’s annual report.

The vast majority of Rightmove’s revenue growth -- 84 percent -- came from raising fees. However, Rightmove’s ability to raise prices -- or, as I like to say, to charge customers more money for the same service -- is diminishing. Average revenue per advertiser growth, or ARPA, continues to decline year after year.

Responding to Slowing Growth

Rightmove’s revenue growth is slowing, and investors may have a growing curiosity about the source of future growth.

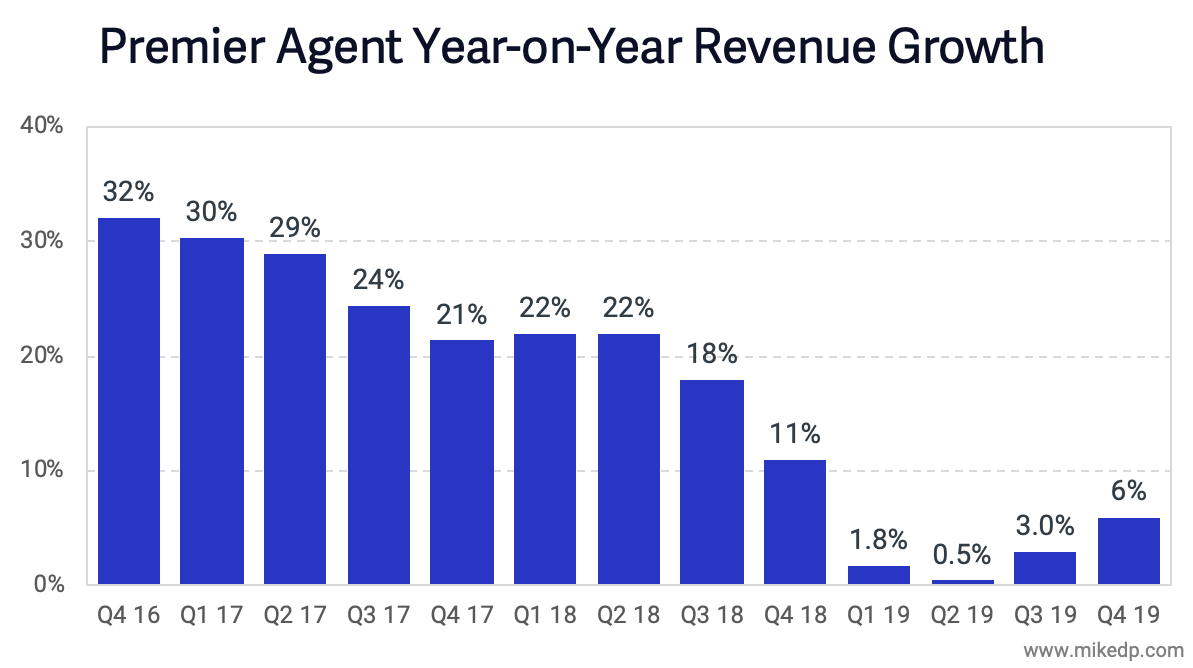

In the U.S., Zillow underwent a similar slowdown in its core lead generation business, the flagship Premier Agent program. During the second half of 2018 and 2019, revenue growth in the business significantly slowed and nearly stopped, illustrated in a chart not too dissimilar from those above.

What does a business do when growth in its primary revenue stream slows? Launch new revenue streams, of course.

In the midst of Zillow’s growth slowdown, it launched several new initiatives: Zillow Offers, its iBuyer business, in mid-2018, a new pricing model, Flex Pricing, in October 2018, and in November 2018 it acquired a mortgage company.

Zillow Offers and Zillow Home Loans offered completely new revenue streams for the business to grow, and Flex Pricing offered its customers a new way to utilize its core service with a different pricing model, and not just higher prices. In the face of growth headwinds, Zillow acted decisively to diversify its business model.

Rightmove's Strategy

Measured by traditional financial metrics, Rightmove is a fantastic business. It is a category leader in the U.K., with an enviable profit margin of 74 percent on revenues of £289 million. But as a public company, it naturally faces pressure to grow -- and that growth has steadily slowed over a number of years.

But even with slowing growth, Rightmove has maintained its commanding traffic lead over rivals (as illustrated in my strategic analysis of real estate portal leadership). Rightmove does not appear to be at risk of losing its market dominance.

What Rightmove is demonstrating -- consistently, year after year -- is a unique strategy in the world of real estate portals. While other portals are vertically integrating, diversifying their services, or getting closer to the real estate transaction, Rightmove maintains a conservative and focused approach.

Time will tell if this approach is sufficient, or if Rightmove will also need to act decisively to diversify its model to satisfy shareholder demands to grow.