Unintended Advantages: iBuying in a World of Social Distancing

/It’s unlikely a global pandemic is what Opendoor and Zillow had in mind when they launched iBuyer businesses. The core benefits of the model -- speed and certainty -- were meant to improve upon a notoriously long and sometimes painful process. But the iBuyer business model is uniquely positioned to thrive in a world of social distancing, where people are putting a premium on the ability to conduct business while limiting direct human contact.

Unintended Advantages

While iBuying launched with specific consumer benefits in mind, it’s becoming evident that the model has several unintended advantages in a world of social distancing. At its core, the model allows consumers to sell and buy homes with limited human interaction -- a fact that had niche appeal in a normal market, but may become more popular in today’s uncertain market.

Today, those advantages include:

No Open Homes: Homeowners have the advantage of selling their homes directly to an iBuyer, without needing to hold open homes with dozens of people walking through their house.

Self-Guided Home Tours: Prospective home buyers can tour homes owned by iBuyers on their own, without an agent present, and outside of a crowded open home.

No In-House Repairs: Selling to an iBuyer removes the necessity of homeowners having external contractors in a house to conduct pre-sale repairs.

Most importantly, selling a home to an iBuyer provides certainty in a time of uncertainty -- and we are definitely in a time of uncertainty. The advantage of selling a home instantly has never been demonstrated in a more dramatic fashion.

Tracking Fee Changes

Since the day Opendoor launched in 2014, people have wondered how the model fares in a down market. One argument in favor of the iBuying model is that in times of uncertainty, consumers would be willing to pay a higher fee for the certainty that an iBuyer provides.

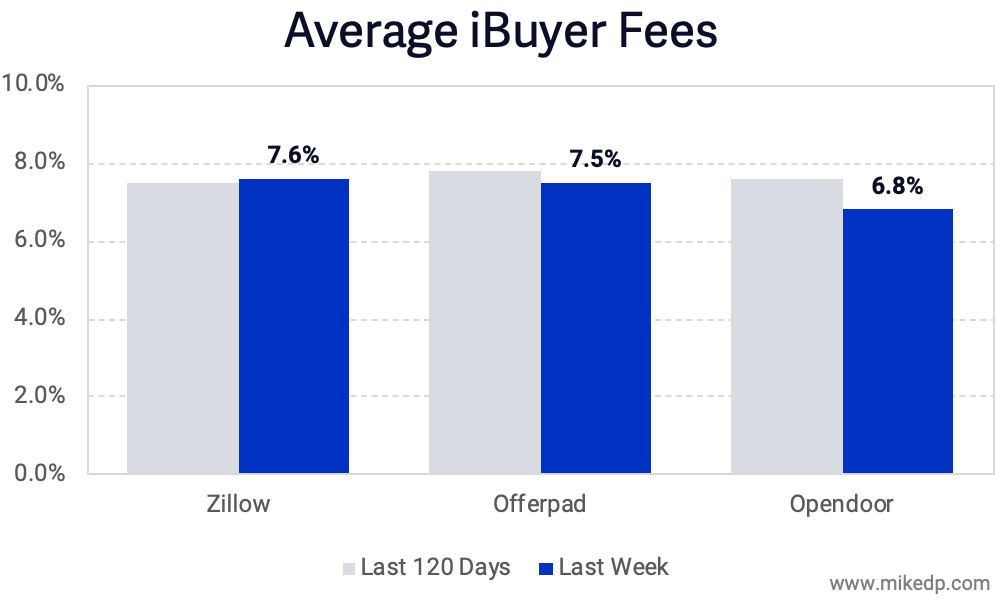

The data is still coming in, but a quick sample of several dozen iBuyer offers from last week (March 9–13) across 14 markets shows no change in the average fee charged to consumers.

It is likely a fee increase will come, to account for the higher risk and uncertainty in the market (iBuyers generally charge a higher fee when there is more market risk). But for the moment, fees remain low, likely in an effort to keep up purchase volumes so as not to exhaust inventory.

Declining Purchase Activity

In the weeks ahead it will be worth paying attention to overall iBuyer volumes.

There are already early signs of a slowdown in the Phoenix market, the birthplace and epicenter of iBuying. Whether driven by inventory shortages, global market uncertainty, or iBuyers mitigating their risk, significantly less homes are being bought each month in Phoenix.

Total iBuyer purchases in Phoenix for February are down 30 percent year-on-year; Zillow in particular is down 63 percent from the same time last year.

Compared to the previous month, January, purchase volumes are down from 368 to 315, or 14 percent. At the same time, iBuyer home inventories are at an all-time low: at current monthly sales rates, Opendoor has two months of inventory and Zillow just one month. The iBuyers are clearing their inventory quickly by selling almost two homes for each home they purchase.

Implications for iBuyers and the Industry

In the months ahead, I would expect iBuyers to react appropriately to a slowing and uncertain market:

Raise fees to account for increased market risk and houses potentially taking longer to sell, driven by less overall consumer demand.

Reduce inventory, by purchasing less homes each month (Phoenix as an example) and continuing to clear existing inventory with appropriate price reductions.

The current state of the market will finally shine a light on how the iBuyer business model reacts to slowing consumer demand. On the one hand, the iBuyer proposition becomes stronger for consumers looking for certainty and to limit direct human interaction. But on the other hand, iBuyers are at-risk in a market slowdown by holding hundreds or thousands of unoccupied homes on their balance sheets.