Analyzing the top portals' financial results

/Over the past month, a number of the biggest real estate portals around the world have released financial results: Zillow Group, REA Group, Domain, News Corp, Scout24 Group, and Trade Me.

Why it matters: While the results themselves are fairly dry and self-congratulatory, it does give a glimpse into business performance. When viewed as a whole, the results show a number of interesting trends, and give me a chance to highlight the insights behind the numbers, and the numbers behind the story.

Revenue growth comparison

Overall revenue growth sets the foundation for this analysis, and it's quite varied around the world.

The Australian portals are seeing exceptional growth due to the magic of vendor-funded marketing. In the U.S., both Zillow and Realtor.com are starting to slow down, with Zillow investing in adjacent revenue streams. And in Germany, ImmobilienScout24 sees a positive result after a period of relative flatness.

What blows me away, however, is the massive result in Australia. REA Group and Domain recorded huge revenue gains, and nearly all of it from depth products.

The growth strategy isn't rocket science. REA Group generated $100 million in additional revenue by selling bigger photos.

It's worth noting what is driving the revenue growth in each market: more customers, or a higher average revenue per advertiser (ARPA). In the case of REA, Domain, and Trade Me Property, it is all ARPA, which are customers (agents and home sellers) paying more for each listing. However, IS24's revenue growth is entirely driven by an increase in customers and flat ARPA.

In other words, the portals in Australia and New Zealand are fully penetrated but can still raise prices. In Germany, IS24 is struggling to increase revenue per customer, but still managed to sign up more customers over the past six months.

In my latest report, The Future of Real Estate Portals, I introduced the following portal value curve. In essence, it states that product development is becoming more expensive, delivering less value to customers.

The key takeaway is where the revenue growth is coming from: low effort, high value products that promote agents and properties (essentially larger photos displayed more prominently). That's where the big gains are coming from.

The higher-effort products (predictive analytics, lead qualification, etc) aren't a significant contributor to revenue.

Catching the leaders

On a recent call with an investment analyst, we discussed the opportunity for a runner-up portal to overtake the leader. Can Domain take market share from REA in Australia? Can Realtor.com catch up to Zillow in the U.S.?

The evidence suggests that the answer is a resounding no.

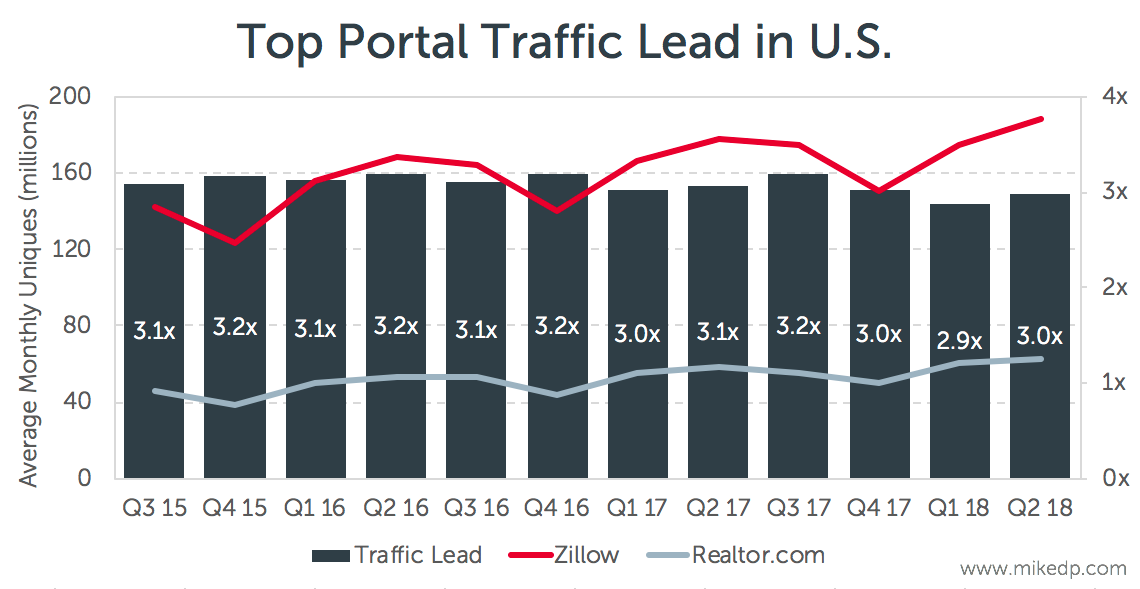

The data from the past two years shows an uncannily steady state between the leading and runner-up portals in both markets.

In the core residential listings business, Domain has remained at 27% the size of leader REA. Both business are growing at the same rate; nothing is changing.

In the U.S., the runner-up portal, Realtor.com, has actually lost a small amount of ground when it comes to growth. Zillow is growing revenues faster.

In the important realm of traffic and consumer eyeballs, Zillow and Realtor.com have remained constant for the past three years. Even with all of the hoopla against Zillow for raising prices in NYC, agent revolts, and increased pressure by Realtor.com, it hasn't meant a thing in terms of overall traffic and revenue numbers.

There's a big difference between a catchy headline and the facts of a situation. Always look for the facts.

Mixed results in adjacent revenue streams

The final area of interest is around portals' expansion into adjacent revenue streams. If you follow my work, you know this topic is of particular interest to me. You may read more of my thoughts, specifically around Zillow, in my analysis of Zillow's Strategic Shift.

The question is no longer whether real estate portals are expanding into adjacent revenue streams, but how they are doing it. There are a variety of strategies at play, with vastly different results.

In Australia, both REA Group and Domain are expanding in different ways. REA bought a mortgage broker in 2017, Smartline, while Domain has launched a trio of new services (mortgage, insurance, and utility switching) via joint ventures. The financial results couldn't be more different.

Both business units are generating decent revenues (more so in the case of Domain, because the overall revenue base is smaller), but only one is profitable. REA's acquisition of an existing business running at scale is returning immediate profits, while Domain remains in the start-up zone of continual (and significant) investments: $27.1 million in FY18.

A deeper look at REA and Domains' mortgage products highlights one final observation. Both are quite similar: well-integrated on the listing pages, a robust loan calculator, and then...

Spot the difference? REA's (top) call to action is a phone number, while Domain's (bottom) call to action is the start of a long online form (without even the first field pre-populated like it was on the calculator -- shame!).

This highlights the importance of consumer psychology in transactions of this magnitude, a topic I recently wrote about in How Psychology is Holding Back Real Estate Tech. REA recognizes the importance of actual human beings in this process, and puts them front and center.

If you have an interest in Zillow's recent acquisition of a mortgage brokerage, look no further than REA Group's Australian acquisition to see how it might play out. Purchased over a year ago, the business is profitable, generating good revenue at good profit margins.

Strategic implications

These latest financial results highlight a few key takeaways:

- Revenue growth is still primarily driven by core premium products that increase exposure for agents and property listings.

- The runner-up portals are staying in the runner-up position. There is no data to suggest they are catching the leaders in their markets (this shouldn't be a surprise).

- Launching into adjacent revenue streams is not a sure thing. Initial investment is very high with no guarantee of success. There are a number of different paths to take, and the initial evidence suggests acquiring existing businesses is the most effective strategy.