Australia's REA Group vs. Domain

/Key points

- Both businesses are growing at the same, strong rate, with all revenue growth coming from depth products.

- Domain has a much more diversified revenue stream, at the expense of profitability.

- Domain is generating 1/4 the listing revenue of REA Group, and is not having a competitive impact.

- Adjacency revenues are small, and in Domain's case, quite expensive.

Australia is home to two leading real estate portals, REA Group and Domain Group. Last month, both businesses released their half-year results.

REA is the clear market leader and one of the biggest and most profitable portals in the world (read more in my Global Real Estate Portal Report). Domain was recently spun-out from Fairfax Media and listed on the Australian stock exchange, and is now able to invest and focus on its core mission.

Growth from depth products

Both REA Group and Domain are growing strong. Their latest financial results show impressive revenue growth in their core residential listing business lines (and for REA, I'm only looking at its Australian business).

Proportionally, both businesses are growing at nearly the same rate (around 19%). This is especially impressive for REA, which is already operating on a large revenue base.

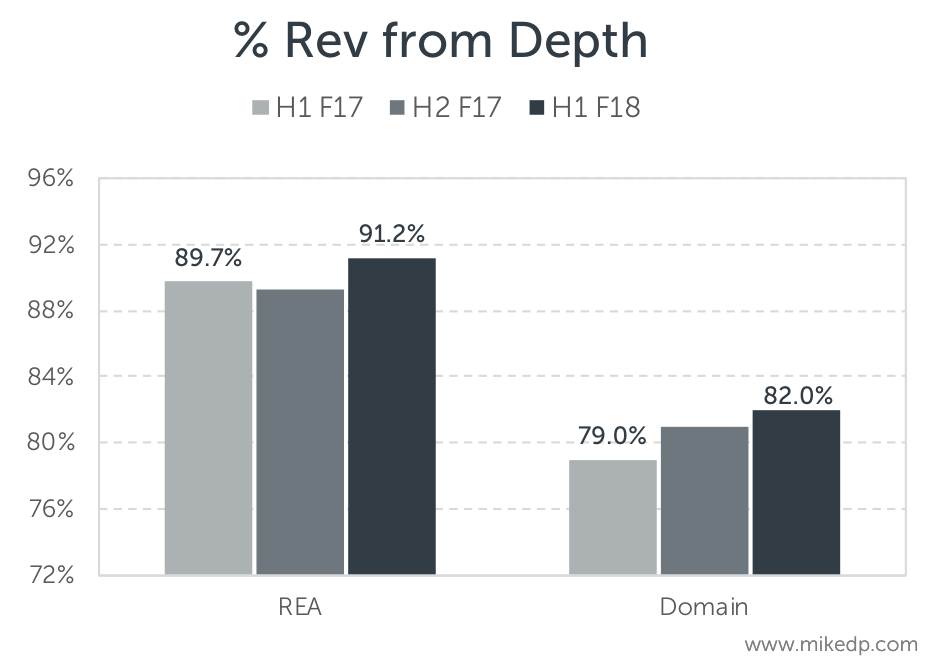

For both businesses, nearly all of this impressive revenue growth is coming from depth products. These are the incremental fees paid by vendors and agents to promote a property listing on the site. $50 million is a big number!

Over time, these depth products are accounting for an increasing percentage of overall revenue (the remainder being subscription fees).

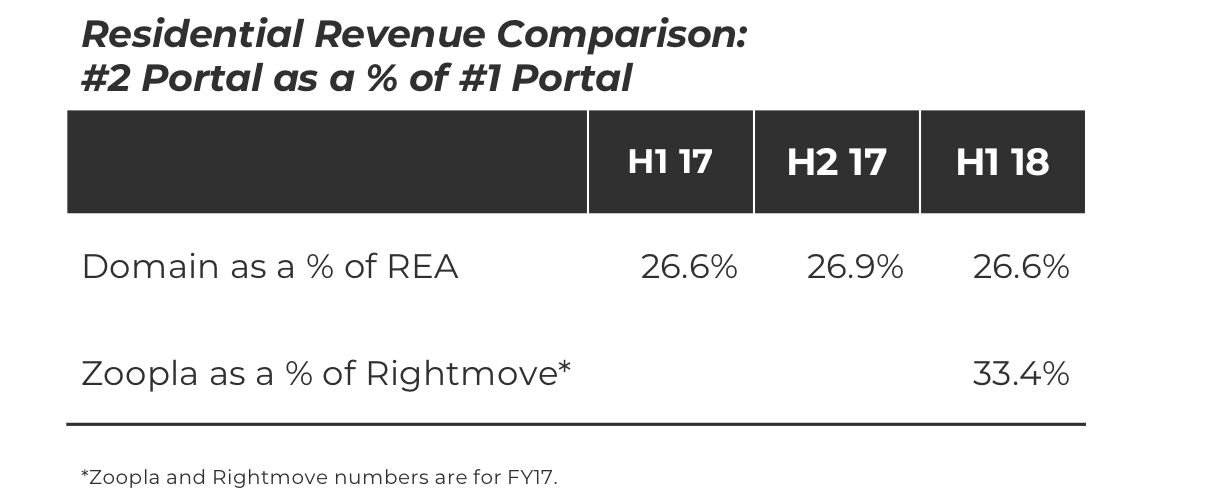

REA is generating about 4x the revenues as Domain in the core residential real estate listing business. I've included Rightmove and Zoopla from the U.K. as an additional data point.

This number isn't changing over time. Both businesses are keeping pace with each other, almost down the the decimal point. In other words, Domain as a strong #2 in the market is not having an adverse impact on REA's ability to grow.

Revenue diversification and profitability

REA Group generates the vast majority of its total revenue from listing fees (depth and subscription), around 84%. Domain, on the other hand, generates only 47% of total revenues from listing fees.

This trend is identical to the U.K. market, where Rightmove, the #1 portal, generates 76% of its revenue from listing fees, compared to 25% for Zoopla, the #2 portal. The #2 players have diversified their revenues in an effort to grow through other avenues.

The market leaders have high profit margins (EBITDA) from the profitable listing business, while the #2 players have lower profit margins from their diversified revenue streams (which tend to be lower margin).

REA's profit margin continues to improve, while Domain's is going down as the business invests in new growth areas. The market leaders are able to continue monetizing their audience without needing to diversify.

Adjacent services

In Australia, both REA Group and Domain have launched adjacent businesses in financial and transaction services. For REA, this represents a small, but profitable, percentage of total revenue.

Domain, on the other hand, is investing heavily in its transaction services business (which includes utility switching, loan, and insurance products -- and the last two are just getting off the ground). It's generating revenue, but is not yet profitable. In other words, it's spending $12.8 million to generate $11.1 million in revenue -- expensive!

While many in the industry talk up the opportunity in adjacency revenues, the evidence suggests a much smaller (and less profitable) opportunity -- and one that is quite expensive to get off the ground.

Strategic implications for Domain

Domain is clearly operating from Zoopla's playbook: to grow, it must diversify. However, their strategies differ. In the U.K., Zoopla fully owns all of its adjacent businessess. However, Domain prefers joint ventures, owning 50% of its comparison business, 60% of its loan business, and 70% of its insurance business.

Domain is effectively starting its loan and insurance businesses from scratch, while Zoopla acquired existing businesses. Starting from scratch is expensive and will take years of investment.

The scope of the adjacency plays also varies. Zoopla generates and monetizes leads through a comparison portal, while Domain is playing a greater role in the transaction. This is a more expensive, more uncertain, but potentially more lucrative opportunity. The key word is potentially.

Domain's foray in adjacencies should not be viewed as a sure thing. While the intent mirrors Zoopla's strategy in the U.K., the execution is materially different, with the result being far from certain.