How Psychology is Holding Back Real Estate Tech

/I was recently on the opening panel at Inman Connect, where the topic was the future of real estate. The conversation centered around the role of technology in the real estate transaction, and the future role of agents (watch the full video).

When I think about the modernization of the industry and technological adoption, my position is that what’s holding us back is psychology, not technology.

It's the psychology, stupid

The big U.S. real estate incumbents can’t stop talking about technology. Each week brings a new announcement about plans for new tech platforms, investments, and initiatives. And while industry gurus love to talk about the impending perfect storm of technology that will revolutionize the industry, I think they’ve got it wrong, and are repeatedly missing a key point.

That key point is human psychology, and the principle is loss aversion. In cognitive psychology and decision theory, loss aversion refers to people's tendency to prefer avoiding losses to acquiring equivalent gains: it is better to not lose $5 than to find $5. (Read more about loss aversion on Wikipedia).

In other words, consumers will prioritise avoiding costly mistakes over making (or saving) more money.

It’s relatively easy for technology to disrupt high-frequency, low-value transactions. The risk (or potential loss) is low, both due to the small value of the transaction and the frequency with which it occurs. Think services like Uber, Airbnb, and Netflix.

On the other end of the spectrum, it is more difficult to disrupt low-frequency, high-value transactions with technology, because the potential loss from a mistake is so much greater. People typically go to specialists to help with these transactions: divorce lawyers, investment bankers, and expert consultants.

A real estate transaction, by comparison, is off the charts: it is ultra low-frequency, ultra high-value. The potential loss that occurs from making a mistake is huge.

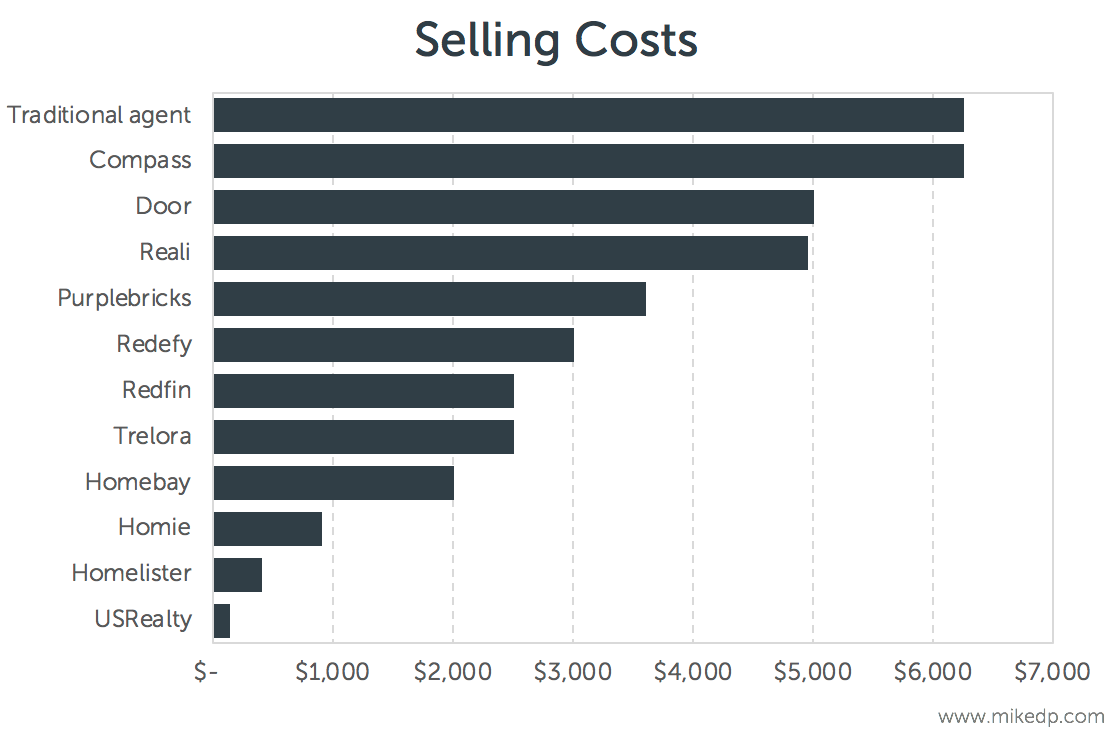

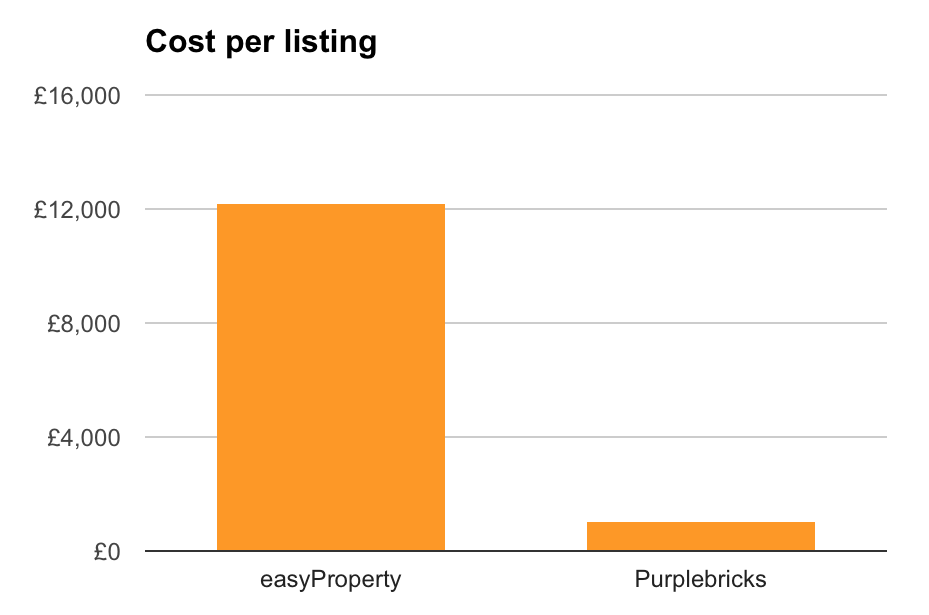

The psychological desire to engage a specialist in these high-value transactions is loss aversion at work. People are willing to pay top dollar to secure a form of insurance on the transaction; someone to hold their hand through the process. Even when cheaper, tech-focused alternatives are available.

It's not technology holding the industry back, it’s psychology. And no software platform, artificial intelligence chatbot, or mobile app is going to change that.

The role of technology

When it comes to real estate, technology has a dual role: making agents more efficient, and providing a better customer experience. It’s not about replacing agents or removing the insurance of having a specialist involved.

This is where the incumbents — with their regular announcements of big technology plays — are at a disadvantage, and the newcomers have the advantage.

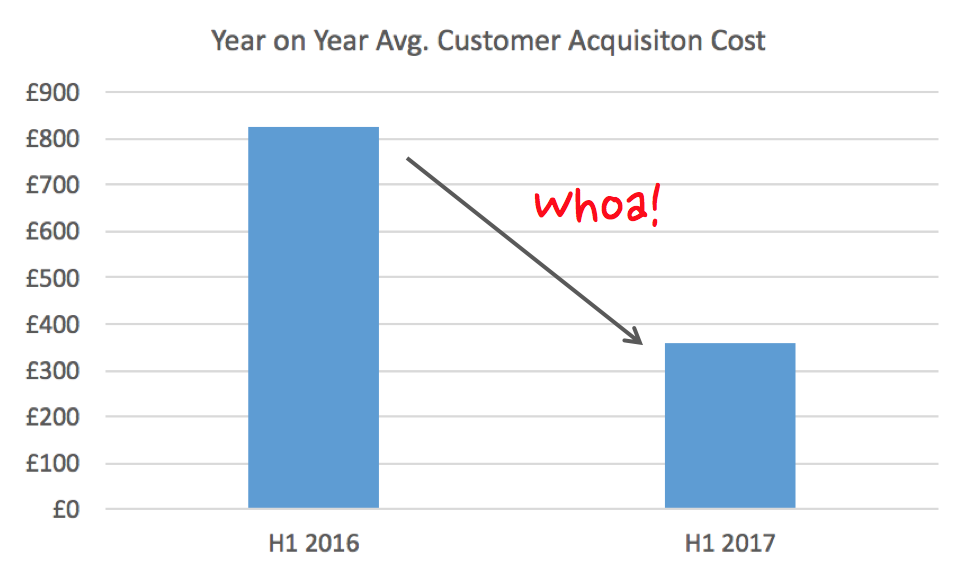

It's the businesses that are built from the ground up around efficiency that have the advantage. More efficient agents means less agents. For a big incumbent to make this change would require an entire retooling of the business, and firing a massive amount of staff and agents. It's too disruptive, and classic innovator's dilemma.

The best way to illustrate this point is agent efficiency: how many deals a typical agent closes each year.

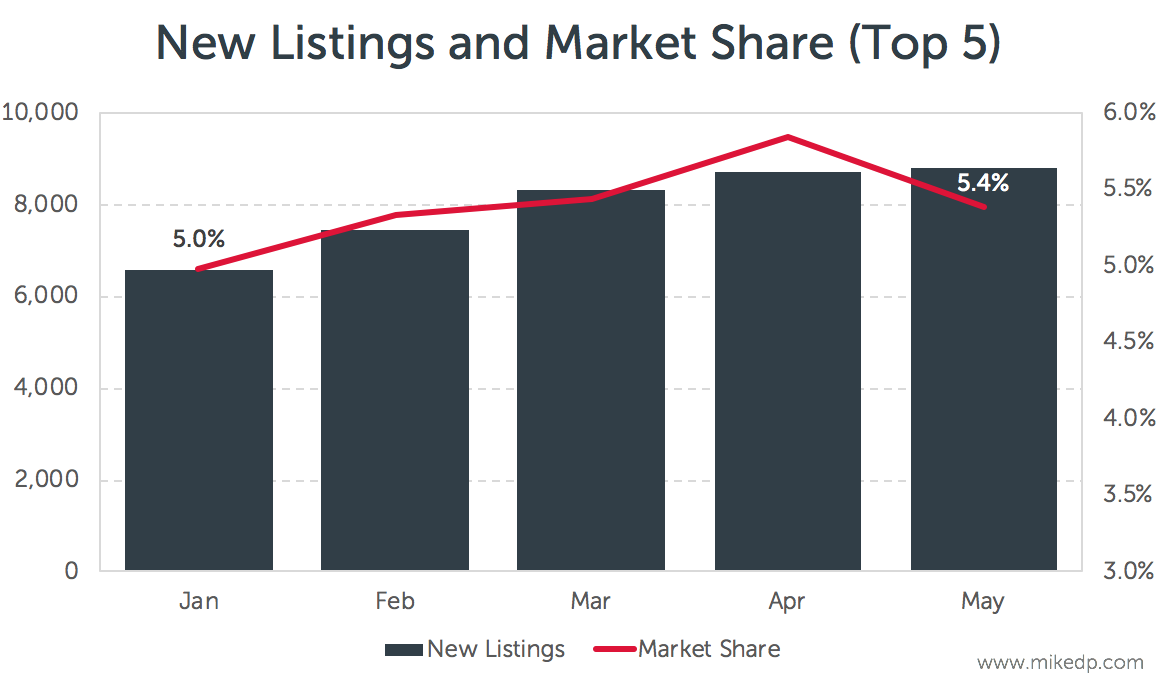

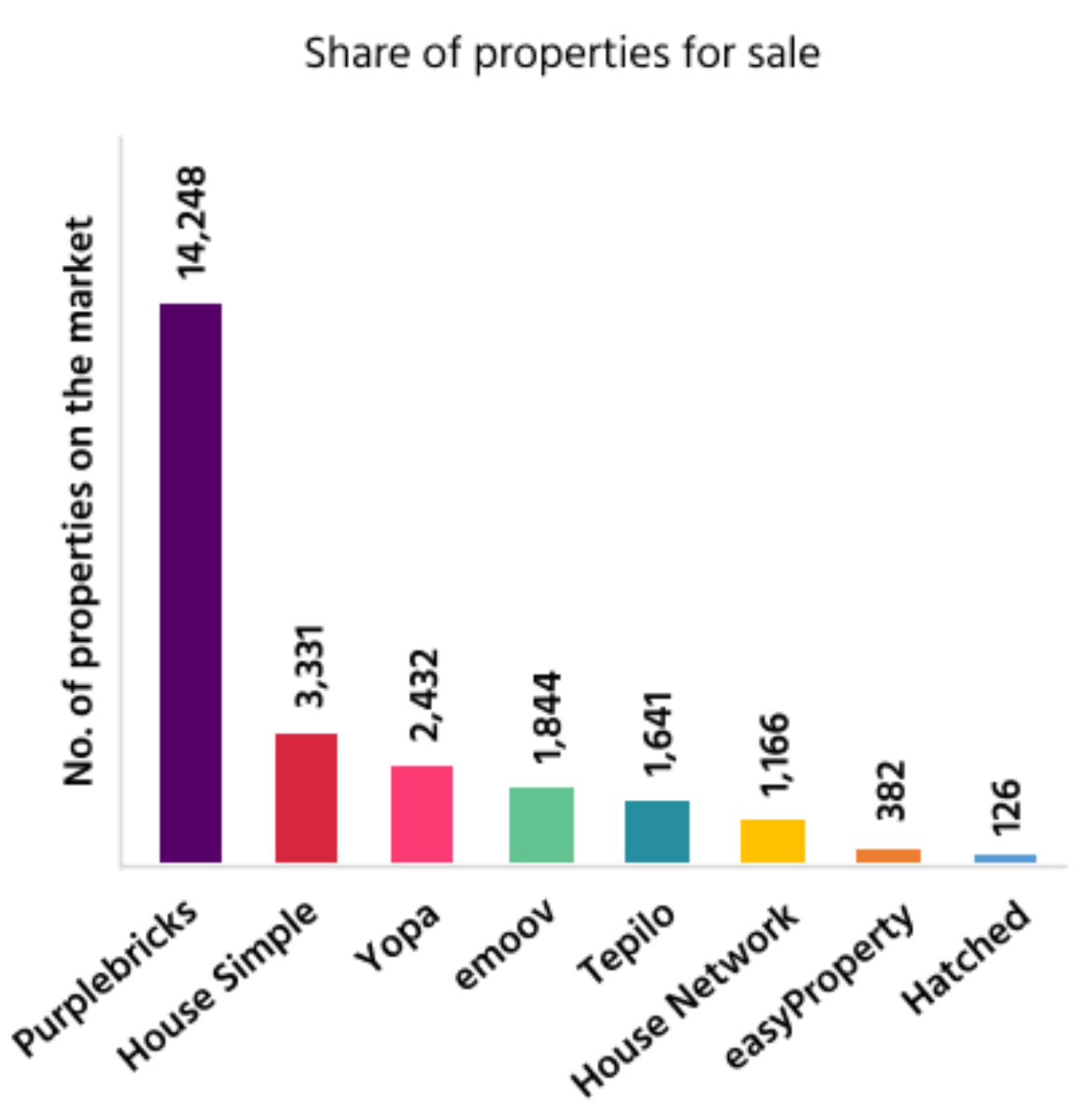

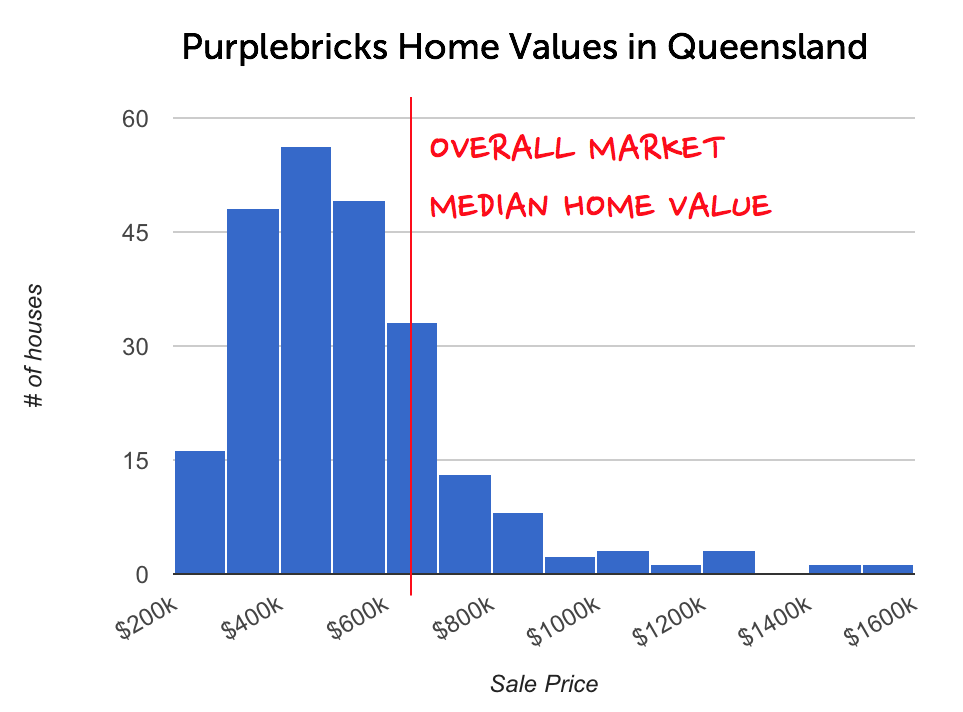

Compass, for all its talk about using technology to make agents more efficient, has yet to demonstrate a significant impact. On the other hand, businesses built from the ground up that utilize technology to improve agent productivity are seeing dramatic gains in efficiency: a 7x improvement at Redfin and a 10x improvement at Purplebricks in the U.K. That's exponential improvement vs. incremental improvement, and is the real eye-opener in the industry.

Strategic implications

Successful new models in real estate understand the key point: smartly combine people and technology. They understand of the role of technology (efficiency and experience), and the role of psychology.

Investors and entrepreneurs assuming that tech will disrupt the real estate industry in the same way it has with low-value, high-frequency transactions are taking a myopic view. It's psychology holding us back, not technology.

If you're interested, be sure to check out the video from the full panel discussion (around 25 minutes) from Inman Connect 2018.