Online agents consolidate in the U.K.

/Two of the top runner-up online agencies in the U.K., Emoov and Tepilo, recently merged their businesses in an effort to grow market share and more effectively compete with leader Purplebricks.

Why it matters: This is the first major online agency consolidation, a natural result of unsustainable unit economics at low volumes.

Winner take most; followers fight for relevancy

As I've highlighted in the past, the online agency sector in the U.K. is a "winner take most" market. Purplebricks, the leader, has 70%+ market share of the online agent segment.

The online agency business model only works at scale. A key hallmark of the model are low fees combined with centralized and specialized operations that process listings at an exponentially higher rate than traditional agents.

Purplebricks is profitable in the U.K.; the others are not. The unit economics are favorable at scale (thousands of listings per month), but anything less is a money-losing endeavor. Given this, industry consolidation is a natural outcome.

Runner-up spot up for grabs

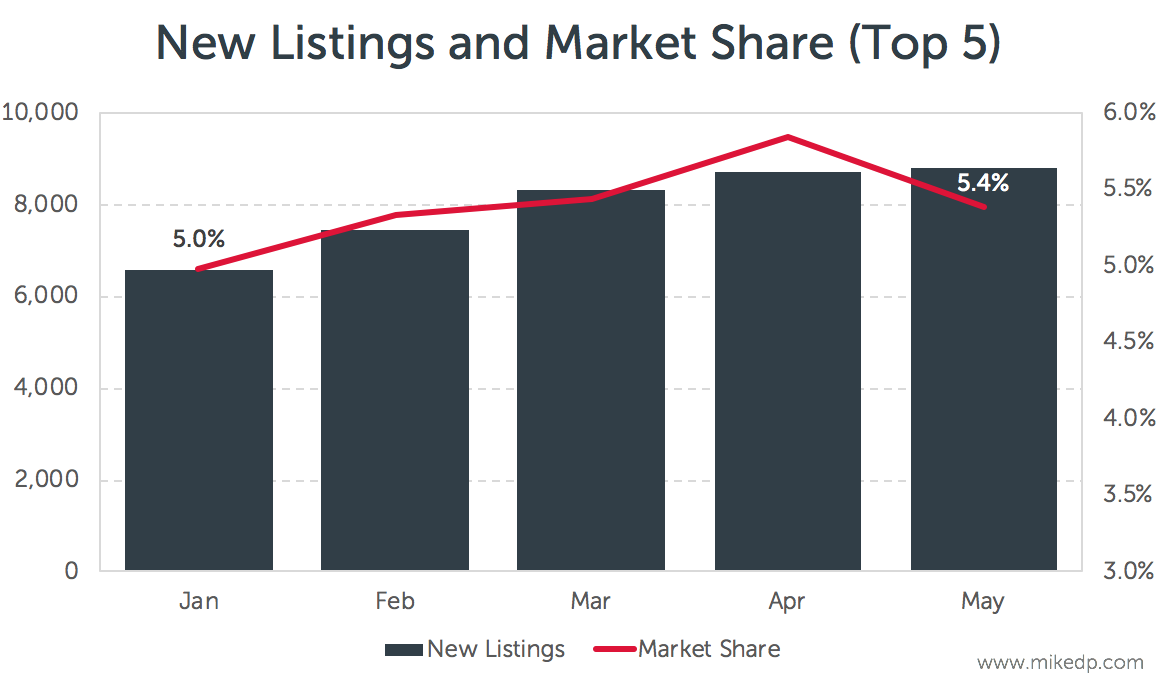

As in my last analysis, using updated new listing data from Rightmove shows two clear trends:

- The #2 spot behind Purplebricks is very much up for grabs. The combined Emoov+Tepilo entity is neck-and-neck with Yopa (in terms of new listings per month).

- Yopa is seeing sustained, strong growth, nearly doubling its business since January.

Purplebricks is still the undisputed leader, with 5.9 times the new listings of Yopa and 7.6 times the new listings of Emoov+Tepilo for the month of May.

It's also worth noting that Yopa is seeing strong growth since its capital raise last year. One can imagine that the business is spending big to acquire new customers, so it is unlikely to be sustainable or profitable. But it is growth nonetheless.

Total market share of the top 5 online agents is down slightly to 5.4 percent (based on new listings) in May. Post-merger, I would expect increased activity from Emoov+Tepilo that grows overall market share.

Strategic implications

This deal raises several important considerations in the online agency space:

- Expect more industry consolidation, and for the slower horses to eventually drop out. The math is simple; the model doesn't work at low volumes.

- Pay now vs. pay later. When considering the relative traction of Purplebricks vs. Yopa, Emoov, and Tepilo, keep in mind that all of the Purplebricks customers are committing to paying upfront; Yopa and the others offer options to defer payment until after a successful sale. In that sense, it's less surprising that Yopa is seeing such strong growth (no risk for new customers).

- Two brands or one? Emoov has announced that it will retain both the Emoov and Tepilo brand. This may not allow the combined entity to realize the full synergy of consolidation, but we'll have to see.