Purplebricks results show promising trends

/Earlier today Purplebricks announced their interim results for the six months ended 31 October 2016. How exciting!

The chart below could effectively be called "scaling." It shows how Purplebricks managed to more than double their revenue during this time period without increasing their fixed and variable costs. While cost of sales increased linearly with revenues (think the payments to their local property experts for securing a listing), their admin expenses and sales and marketing costs stayed the same.

This shows the business model successfully scaling by reaching more customers per advertising dollar.

You can see the equally stunning growth in listings (aka instructions aka someone paying Purplebricks to sell their home) below.

Wow! We're talking more than doubling customers and more than doubling revenues.

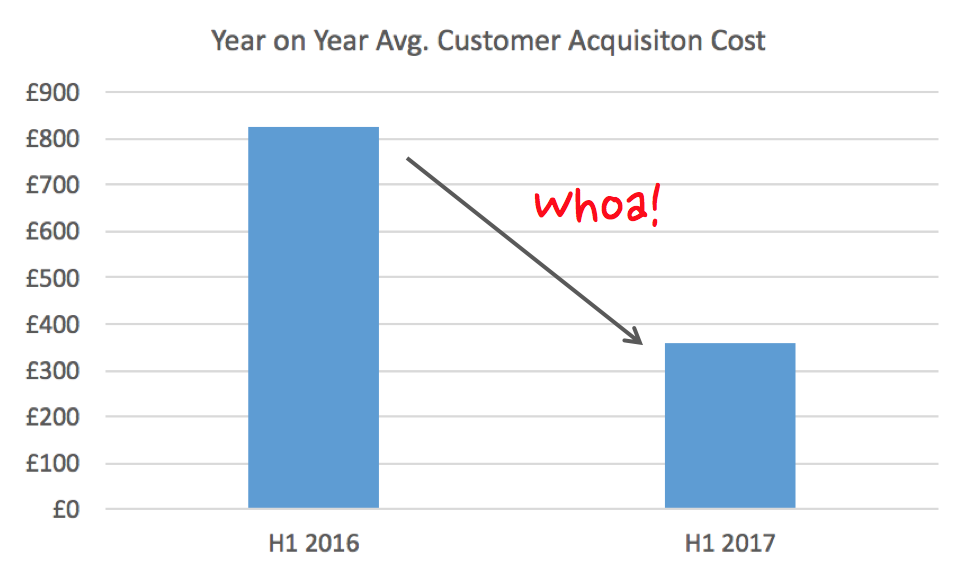

Even more so when you consider the average customer acquisition cost (how much money the business needs to spend to get a new customer). In the same period last year, that number was worryingly close to the fee Purplebricks charged customers (£849 vs. £825), making it impossible to turn a profit.

But wait, look!

Those customer acquisition costs have dropped - significantly - to around £350. That is the most interesting bit of information in this update, given it is a very robust answer to the question, "Can this model make money?"

This interim update is quite remarkable in that it shows further proof the Purplebricks business model works. While initial costs greatly exceeded revenues as the company built scale, what we're seeing now is proper scaling.

There is still the open question of how effective Purplebricks is at selling houses (as opposed to listing them), but I won't wade into that here (here's looking at you, Jefferies). But for now, I'm quite impressed with the results and what it shows for the prospects of not just Purplebricks, but the entire industry.

Note: inexplicably, many of the numbers above are not explicitly mentioned in the results. However, it's easy enough to figure out given the stated revenues, average revenues per customer, and a few assumptions.